It is unlikely that the recent rise in commodity prices will change the fact that central banks are nearing the end of their rate hike cycle.

In brief

- Recent rally in oil prices have been driven by supply factors such as the production and export cut extensions by OPEC+ and Russia and a decline in U.S. inventory.

- Rise in food prices mostly concern Asian economies given adverse domestic weather conditions.

- Near-term trajectory in metal prices is determined by China’s economic momentum.

- Although short-term rise in commodity prices may weight on company profit margins and capital expenditure plans, the long-term inflation trajectory is unlikely to change.

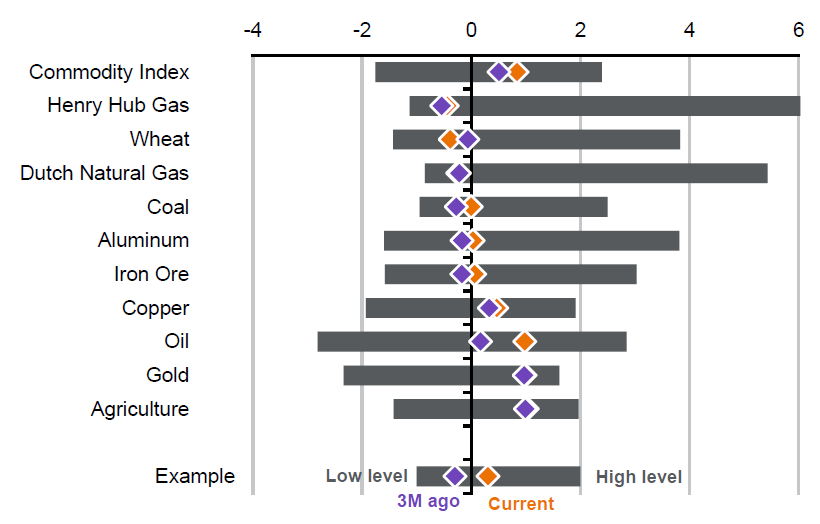

Various economic forces have been at work in the commodities markets as some pockets have rallied while other segments have pulled back over the past couple of months (Exhibit 1).

Exhibit 1: Commodity prices

Commodity price z-scores for the past five years, USD per unit

Source: Bloomberg Finance L.P., FactSet, J.P. Morgan Asset Management.

Guide to the Markets – Asia. Data reflect most recently available as of 18/09/23.

Gauging the direction of commodity markets may offer some foresight into the inflation and monetary policy direction at a time when central bank policy is at forefront of investor’s minds. Fluctuations in commodity prices will also have a spillover effect on pricing power and profit margins, and as result affect the direction of economic growth via capital expenditures—as highlighted in our previous paper.

What has been driving the recent surge in oil prices?

Oil prices have rallied significantly over the past couple of months, with West Texas Intermediate rising more than 26% and Brent crude rallying more than 23% over the past three months. The key driver of the oil rally has been the production and exports restraints from the Organization of the Petroleum Exporting Countries+ (OPEC+) group and Russia, with Saudi Arabia extending its 1 million barrels per day production cuts and Russia extending its 300 thousand barrels per day export cuts through to the end of 2023. This squeeze in supply has been further exacerbated by the decline in the U.S. Strategic Petroleum Reserve from over 650 million barrels in July of 2020 to less than 350 million barrels, as well as continued lack of U.S. refining capacity as hot weather curtailed refinery output over the summer.

From a demand perspective, the dynamics have been more balanced. While the U.S. economy continues to be robust, the demand pull on prices have largely been offset by economic fragility in Europe and China.

Food inflation more of a concern in Asia

In the agriculture market, there has been much focus on the impact of adverse weather and El Nino’s (the unusual warming of surface waters in the eastern Pacific Ocean) effect on food prices, however this impact has not been synchronized across global food prices. For example, wheat, which is consumed overwhelmingly by Western economies such as the EU, Australia and U.S., has seen prices decline by close to 20% over the past 3 months. On the other hand, rice, consumed mostly by Asian economies, has gained by more than 25% over the past three months.

The surge in rice prices has been primarily due to droughts linked to the El Nino effect as rice is a water intensive harvest. While global rice stockpiles are plentiful at 174 million metric tons, 80% of this stockpile is held by China and India. As a result, the rice export ban announced by India—the world’s largest rice exporter—has led to a surge in global rice prices. This increase in rice price has been further accelerated as the amount of land under rice cultivation in Thailand—the world’s second largest rice exporter—has decreased by 14.5% in August compared to the same month last year.

Metal prices driven by China in the near term

In contrast, metal prices have been mixed as result of underwhelming economic activity in China being balanced out by optimism surrounding the deployment of policy easing measures. China is the world’s largest consumer of base metals such as copper, aluminum, and zinc, and is the largest buyer of iron ore, which is a key material in steel used for construction. Therefore, headwinds to construction and manufacturing in China due to low business confidence and property market concerns will continue to limit the pick-up in metal prices. Yet, prices are unlikely to fall materially due to continued incremental policy easing measures to the property sector.

What does this mean for inflation and central banks?

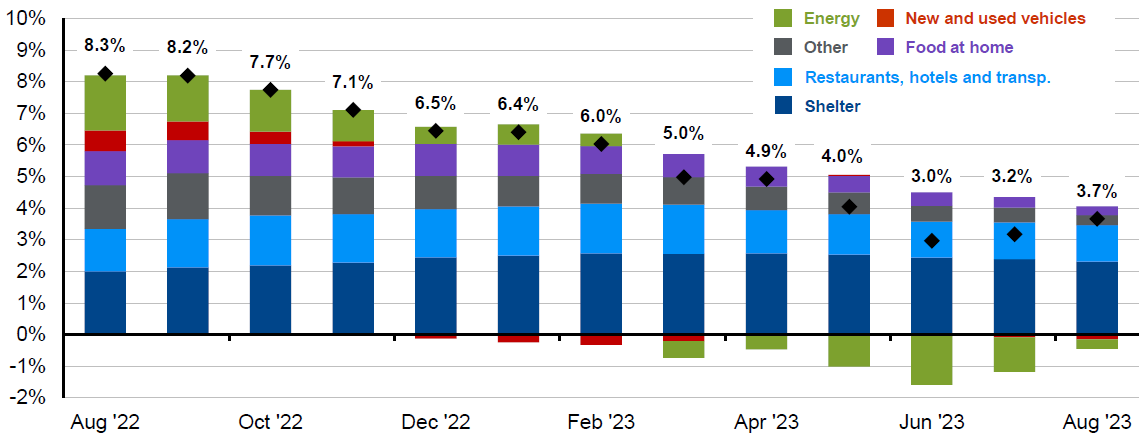

The recent U.S. August inflation print showcased reasons to be optimistic about inflation continuing to soften, yet a further slowdown in headline Consumer Price Index (CPI) was stalled by the recent surge in energy prices. Although the Federal Reserve is arguably more fixated on core inflation as well as the state of the labor market when it comes to its rate decisions, fluctuations in commodity prices will undoubtedly have a say in the trajectory of the Federal Fund rate over rest of 2023 and into 2024. Our base case remains that inflationary pressures across developed markets should cool further in the coming months as energy and food prices play a smaller role in the overall inflation picture in developed markets. Rather, the decline in service prices and shelter costs will likely help to cool inflation further (Exhibit 2) as these components account for bigger portion of the CPI basket.

Exhibit 2: Contributors to U.S. headline inflation

Contribution to y/y change in CPI, NSA

Source: FactSet, J.P. Morgan Asset Management.

Guide to the Markets – U.S. Data reflect most recently available as of 18/09/23.

In emerging markets, higher commodity prices will likely have conflicting implications for policy as it raises inflation while depresses growth. Many southeast and south Asian economies have a higher CPI weight on food and energy. Hence a spike in energy prices would have a more substantial impact on their inflation, prompting their central banks to be more cautious on rate cuts. However, we expect Asian central banks to focus more on the growth risks in the current juncture, overlooking temporary rises in inflation and continue to remain on hold or cut, especially with the Federal Reserve approaching the end of the hiking cycle.

What does this mean for profit margins and growth?

For companies, a surge in input costs will imply further headwinds in maintaining profit margins. So far, corporate margins have held up, but a further surge in input costs may challenge companies’ top line revenue growth, at a time when increased costs from wage and higher financing costs combined with a potential decline in consumer spending may act to compress margins. As capital expenditure tends to lag corporate profits, companies may have to cut capital expenditure and spending if there is a material deterioration in profit margins. This could contribute to a decline in private investments and therefore overall economic growth.

Nonetheless, it’s unlikely that the recent rise in commodity prices will change the fact that central banks are nearing the end of their rate hike cycle, and as such should inflation moderate throughout 2024, we expect global central banks to have the capacity to offer policy support to mitigate any sharp deceleration in growth.