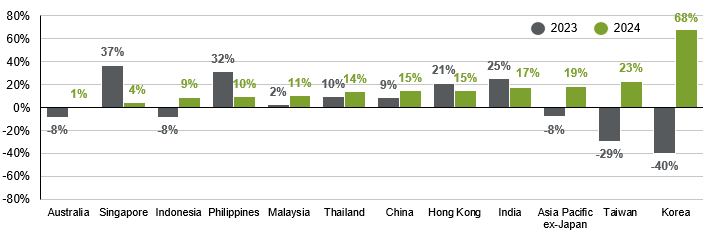

Asia ex-Japan tech sector EPS is expected to decline by 49% in 2023, but rebound by more than 64% in 2024, with the technology hardware and semiconductor industries leading the rebound.

In brief

- In the face of declining pricing power but still elevated wage levels and high borrowing costs, U.S. corporate capital expenditure may be restricted as profit margins come under pressure.

- A material slowdown in corporate investments increases the probability of a recession. This may a create a drag on Asian capital goods exports, despite the recent AI boom.

- That said, long-term domestic demand drivers for Asia tech such as digitization, automation and a growing consumer base lessens the sector’s sensitivity to external demand.

Dodging the bullet so far

Towards the end of 2022, markets thought we were heading into one of the most-anticipated U.S. recessions in 2023. However, nearly 3 quarters later, the U.S. economy is demonstrating exceptional resilience across many economic sectors, causing risk markets to now price in a soft landing. Economists are also pushing recession expectations further and further into 2024, if at all.

If the U.S. falls into a recession, the spillover effects into Asian economies are inevitable, due to weaker export demand, lower commodity prices, sentiment turning risk-off etc. Specifically, one channel worth exploring is how changes to the U.S. capital expenditure (capex) cycle can impact the tech sector in Asia.

Where is U.S. capital expenditure heading?

Why is Capex an essential component to monitor when predicting recession? In every U.S. recession after 1948 (excluding the pandemic recession), the private investment component (residential, non-residential investments and inventories) was the biggest drag in terms of GDP contribution. Looking back at past Federal Reserve’s tightening cycles, only 3 managed to end on a soft landing, and continued increases in corporate capex provided key support for the economy. In high interest rate environments, corporate behavior is an important cushion to limit the spillover effects that monetary tightening can have on household incomes and consumer sentiment.

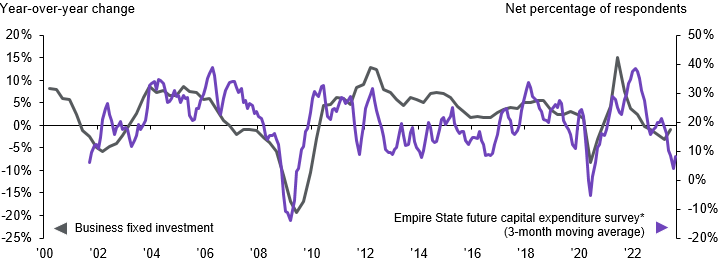

So far, U.S. capex has held up reasonably well despite high borrowing costs. Although we have not yet seen elevated corporate caution and material weakness in capex, we think it is likely just a matter of time. A pullback in capex lags corporate profits, as companies have to see a material deterioration in margins before deciding to cut spending. So far corporate margins have held up, but disinflation will challenge companies’ pricing power and top line revenue growth, at a time when increased costs from wages and higher financing rates may act compress margins. In the alternative scenario where corporates maintain pricing power, keeping prices high, central banks might be pressured to restart hiking, eventually pushing capex down if a policy induced recession ensues. Of course, the impact that high financing costs has on individual sectors and companies will vary, depending on the capital and labor intensity, interest cost management etc. But broadly-speaking, we have seen capex intentions weakening, as shown in Exhibit 1. In the 2Q S&P 500 earnings seasons, we also saw the pace of capex increases slowing, with major Tech companies announcing big capex cuts (e.g. Amazon -27% y/y and Meta -18% y/y).

Exhibit 1: U.S. investments and future capex intentions

Source: Federal Reserve Bank of New York, U.S. Bureau of Economic Analysis, J.P. Morgan Asset Management. *Future capital expenditure intention is the difference between the percentage of businesses looking to increase capital expenditure vs the percentage of businesses looking to decrease capital expenditure over the next 6 months. Guide to the Markets – Asia. Data reflect most recently available as of 04/09/23.

The short term: the potential drag on Asia

A pullback on U.S. corporate capex not only risks pushing the U.S. economy into a recession, but could also disproportionately hurt the exports from Asian economies such as Taiwan, Korea and Japan. These economies have a higher sensitivity to U.S. investments due to their reliance on exports of capital goods, such as machinery, vehicles, and electronics.

Specifically, semiconductor manufacturers in Asia, which garnered considerable interest recently, will likely struggle with a few short term headwinds. On the supply side, rapid capacity expansion after the post-pandemic supply shortage has caused an inventory build-up and the correction is taking longer than expected, thus limiting price growth. Turning to demand, apart from a potential U.S. demand slowdown, the stalled recovery in China, a major consumer electronics market, has created an unwanted headwind.

The long term: AI, digitalization and demographics

There are trends we are watching out for, that could provide support to U.S. capex and Asia tech demand, especially on the longer term.

On U.S. capex, since the 2008 Financial Crisis, companies have been spending more of their operating cashflow on share buybacks, and less on capex, as compared to pre-2008, resulting in sluggish growth in manufacturing capacity and ageing private nonresidential fixed assets in the U.S. The last decade of underinvestment could push companies to keep spending despite macro uncertainties. On the other hand, elevated labor costs may incentivize companies to invest more in automation to raise labor productivity, just as AI technology is making significant advancements. In fact, 2Q23 labor productivity in the U.S. beat expectations at 3.7% annual growth, the biggest rise since 2020. If this trend sustains, it could cushion the economy against a slowdown in consumption or investments, or in other words, paving the way for a soft landing.

There are also domestic and secular trends which are supportive of Asia tech demand.

Firstly, digitalization, the rising prominence of AI, and the proliferation of computing intensive processes across industries will continue to drive the demand for semiconductors and tech products within the region. This secular trend will be a tailwind for Asian tech exports as Asian economies account for more than 50% of the world’s semiconductor shipments and more than 66% of the world’s computer exports. Although geopolitical concerns may hasten the reallocation of supply chains out of Asia, the pace of reallocation will vary across the tech sector. While lower-end tech and chip production are more flexible and susceptible to re-allocation pressures, higher-end value added semiconductor production facilities will be more sticky given higher fixed costs and more complex production lines.

Secondly, the growing number of middle-income households and increased penetration of internet usage in the region will also bolster the demand for Asian tech products. According to a study by the Brooking Institutions, in 2020, 2 billion Asians were members of the middle class, and that number is set to increase 75% to 3.5 billion by 2030 – meaning two in three member of the middle class will be from Asia. At the same time, internet penetration and mobile phone usage in many parts of Asia continues to lag behind developed markets. For example, according to the World Bank, in 2021, only around 72% and 46% of the Chinese and Indian population had access to the internet compared to 92% and 87% in the United States and the European Union. The latest Asia Pacific Mobile Economy report by GSMA estimates that the number of mobile phone subscribers will rise from 400 million currently to around 2.1 billion by 2030 as a consequence of an increase affordability of 5G and rapid network infrastructure expansion in the region. This results in mobile penetration in the Asia Pacific region reaching 70% by 2030. The simultaneous expansion in spending power of the Asian population and the increased connectiveness of the population to the digital platform means there is going to be a robust demand for tech products, services, and related infrastructure over the next couple of years.

Investment Implications

Given the economic interlinkage of Asian economies to the global capex cycle, its unsurprising to find that the earnings of Asian companies are highly correlated with capex cycle in the U.S. Therefore, with the potential slowdown in capex, Asian equity earnings may be hit a lull in the short term. Third quarter earnings transcripts suggest that most Asian companies are relatively cautious on the recovery in tech and demand. In particular, the demand for smartphones, personal computers and non-AI servers appear to quite sluggish. While there are small signs of the semiconductor cycle bottoming out, the pace of improvement has been quite slow. with a recovery likely to playout in the latter half of 2024. The development in AI is a major long-term tailwind, but AI-related chip demand, accounts for a small portion of current revenues (e.g. 6% of Taiwan’s largest foundry chipmaker’s total revenue, and projected to reach the low teens in 2027, see link). Thus, AI opportunities might not be able to offset the slowdown in demand for electronics.

Exhibit 2: Earnings growth by market

Earnings per share, year-over-year change, consensus estimates

Source: FactSet, MSCI, J.P. Morgan Asset Management. Consensus estimates used are calendar year estimates from FactSet. Equity indices used are the respective MSCI indices. (Past performance is not a reliable indicator of current and future results. Guide to the Markets – Asia. Data reflect most recently available as of 05/09/23.

This is reflected in earnings estimates. Asia ex-Japan tech sector earnings per share (EPS) is expected to decline by 49% in 2023, but rebound by more than 64% in 2024, with the technology hardware and semiconductor industries leading the rebound. 2024 EPS growth estimates for South Korea and Taiwan lead the way (Exhibit 2), expected to rise more than 68% and 23% respectively.

In the longer run, the AI-related trends, and the growing consumer base in Asia will continue to form the crux of demand for Asia tech.

094t230509072443