Quarterly Perspectives 4Q 2024

Arthur Jiang

J.P. Morgan Asset Management is pleased to present the latest edition of Quarterly Perspectives. This piece explores key themes from our Guide to the Markets, providing timely economic and investment insights.

Politics. Policies. Portfolios.

Overview

- The U.S. economy is cooling, moving from “hot” to “warm,” and the Federal Reserve (Fed) is shifting its policy priority from taming inflation to safeguarding the job market. As such, a gradual rate cut cycle is likely in the quarters ahead. The U.S. presidential election in November could focus market attention on policy options, especially on taxes and trade.

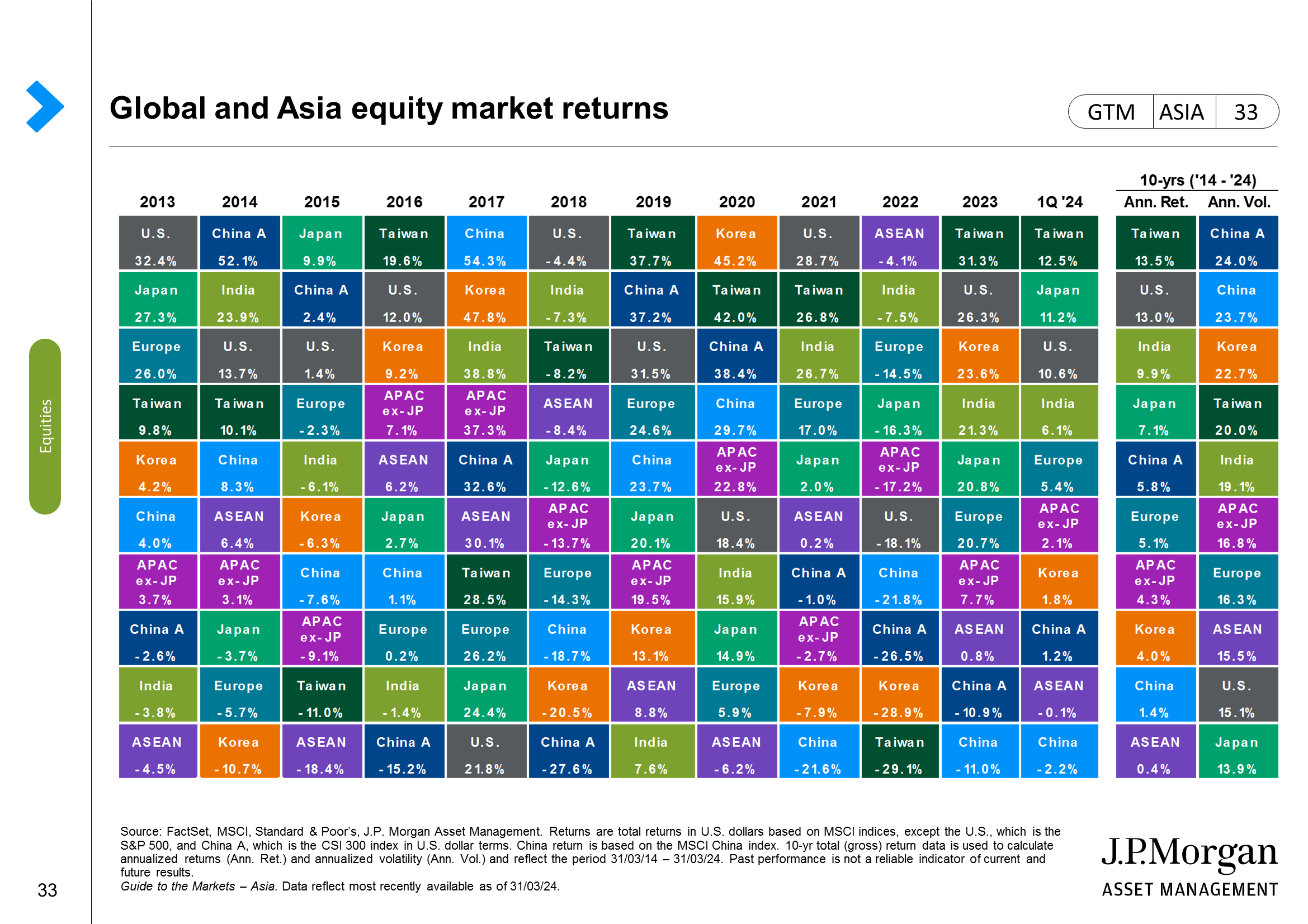

- Lower policy rates and an economic soft landing in the U.S. have historically facilitated a stock-bond portfolio outperforming cash1. International diversification continues to be a critical way to manage risks while tapping into opportunities.

- Investors should look to broaden their sector allocation in U.S. equities into quality companies and those that are less correlated with the economic cycle. Even though government bonds have already reflected some of the anticipated rate cuts ahead, we believe they can provide income above inflation and a hedge against a worse-than-expected downturn.

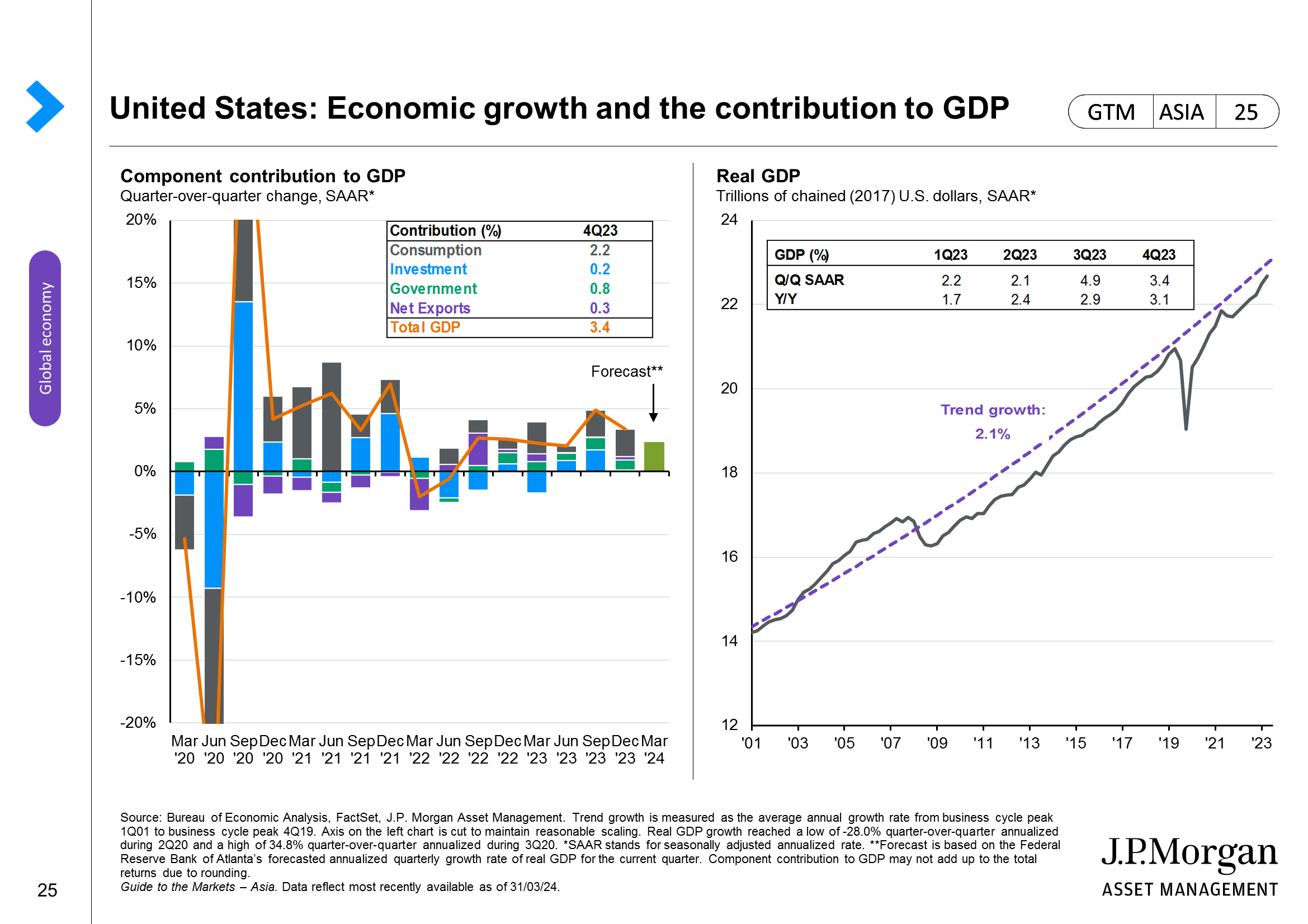

U.S. economic growth: From “hot” to “warm”

- The U.S. economy is cooling, shifting from “hot” to “warm.” High interest rates and a lack of fresh fiscal stimulus amid the elections season are putting a gentle brake on growth. Consumers, especially those in the lower-income group, are becoming more price-sensitive as their balance sheets swing from excess savings during the pandemic era to debt accumulation.

- The job market is showing signs of slowing, albeit from a high level, as reflected by recent job openings data. The rise in the unemployment rate is partly due to rising labor participation.

- Meanwhile, inflation is also showing more convincing signs of slowing, especially in shelter costs, which constitute one-third of the overall consumer price index. However, medical care and transportation services remain relatively persistent in propping up services inflation. Core goods prices have been falling since the start of 2024, and it is worth noting whether the recent U.S. dollar (USD) depreciation could prompt a modest rebound in imported inflation.

U.S. elections: Different pledges, similar outcomes

- The U.S. presidential election is likely to be a close race between Vice President Kamala Harris and former President Donald Trump. This could raise the possibility of a divided government where the two major political parties, the Democratic Party alongside the Republican Party, could split control of the presidency and Congress. In this scenario, it could be more difficult to pass legislation on taxes, spending and regulations.

- Despite their different campaign pledges, there are similarities between the two presidential candidates. The federal government’s sizable fiscal deficit is likely to remain in place, with rising debt over the medium term. U.S. trade policy is expected to remain focused on domestic manufacturing, especially against imports from China. This would continue to pressure companies, including those from China, to diversify their supply chains to manage risks of tariffs and other trade barriers.

- Historically, market volatility declined following the release of election results. We believe economic and corporate fundamentals will be the more dominant drivers of market returns.

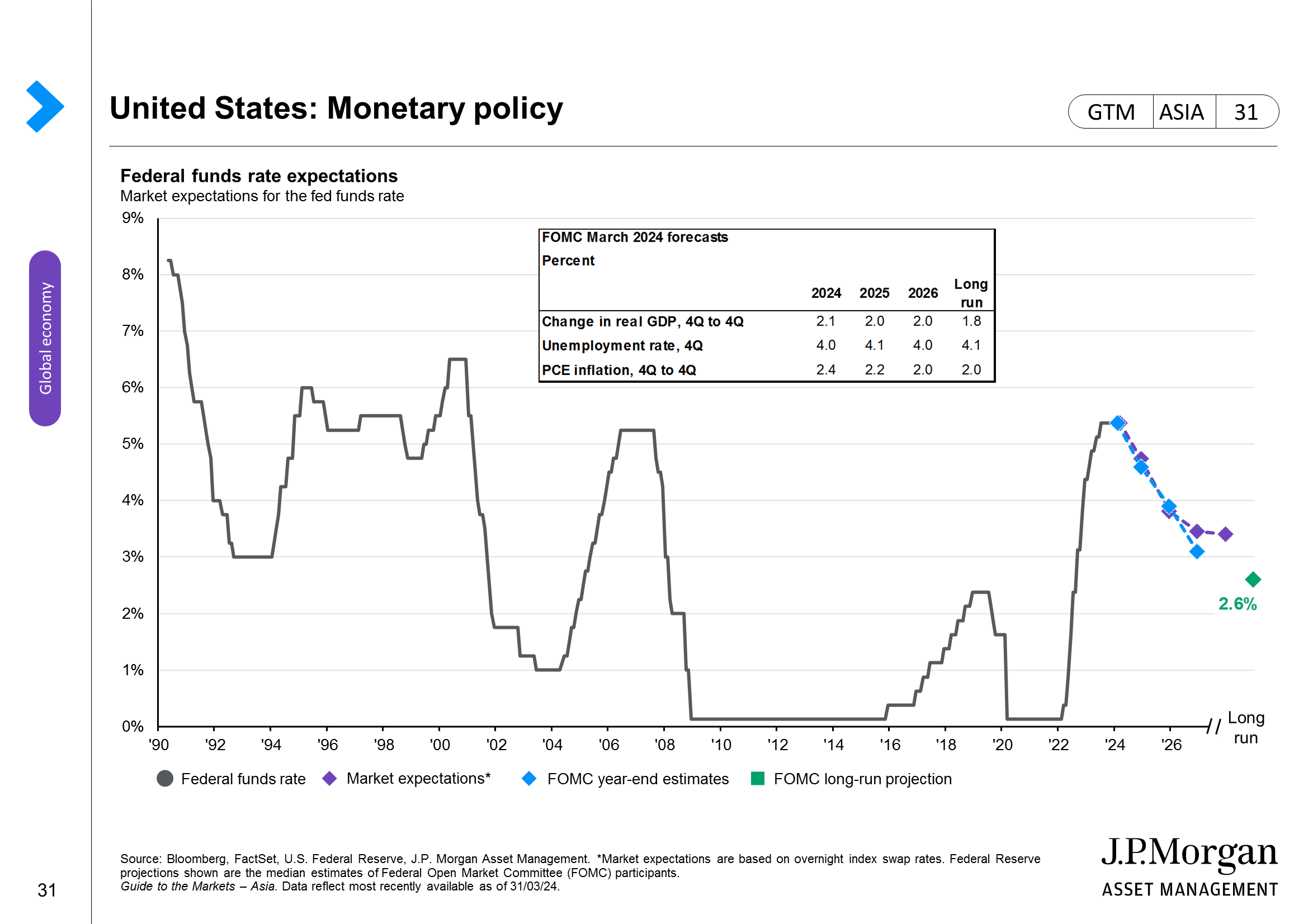

Fed policy: Changing course

- The Fed’s policy focus has shifted to safeguarding the job market as it sees inflation on track toward its 2% target. This is reflected by the 50 basis points (bps) rate cut at the Federal Open Market Committee (FOMC) meeting in September. More importantly, in its updated Summary of Economic Projections, the median of forecasts shows FOMC members expect the policy rate to be cut by 150 bps in end 2025.

- Considering the current economic performance, which is still consistent with a soft landing of the U.S. economy, the Fed can still afford a more patient approach toward bringing the policy rate back to neutral. Of course, the pace and timing of rate cuts could change based on incoming inflation and job numbers. One potential challenge is how the Fed will react to a rebound in inflation brought about by supply-side shocks. This could include disruptions in the global supply chain or trade policies from the new administration that could raise the costs of U.S. imports.

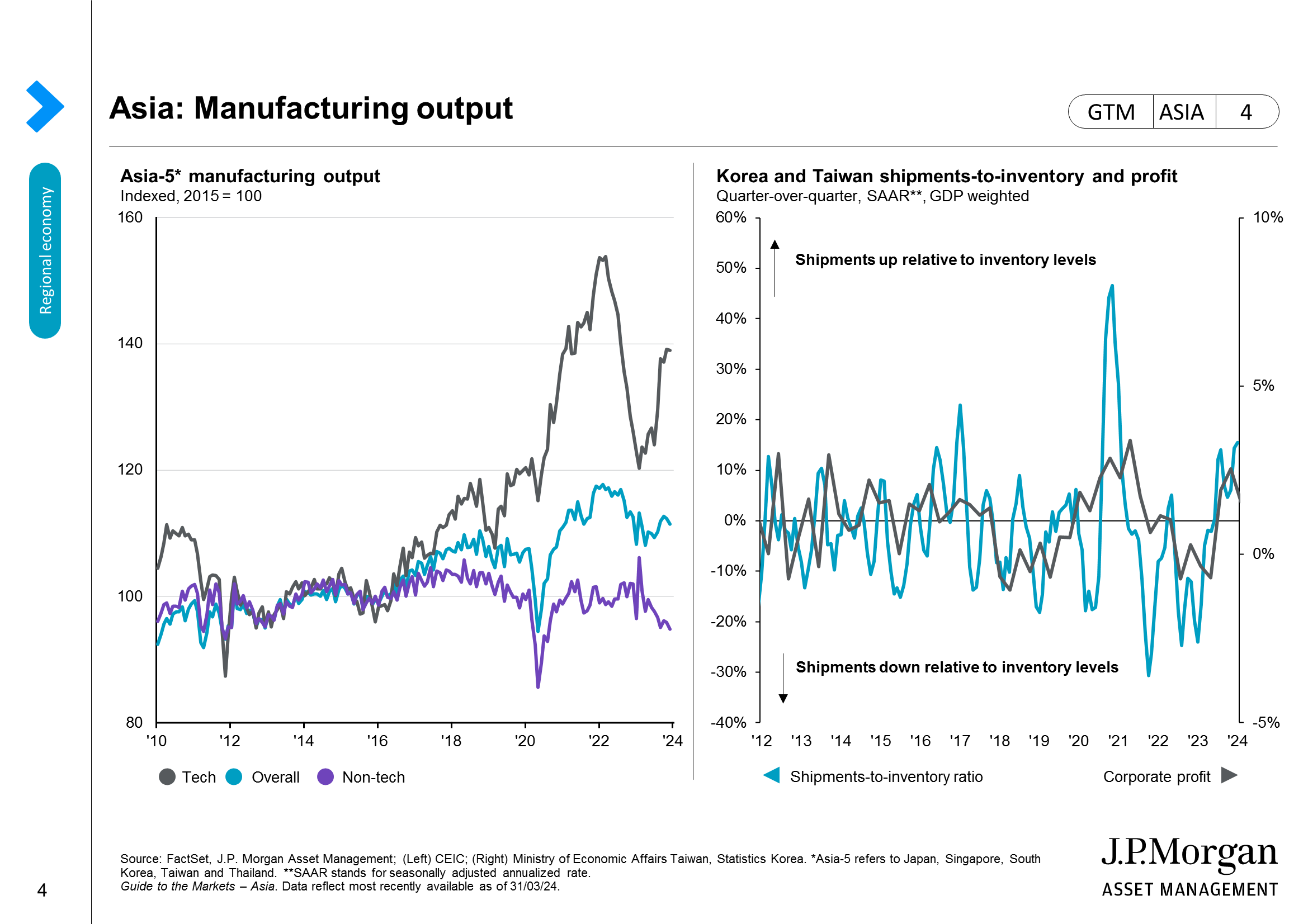

Asian economies: Robust exports

- Despite concerns over the pace of corporate investment relating to generative artificial intelligence (AI), Asia’s technology and semiconductor export momentum remains largely intact. The next signpost would be the demand for consumer electronics with AI processing capabilities, or Edge AI.

- China’s economy continues to see unbalanced growth, with challenges facing the housing market weighing on consumption and corporate investment. Both fiscal and monetary policies need to be more aggressive to facilitate a more sustainable recovery. While exports have experienced some strong recovery in 2024, they face more uncertainties from Western economies considering the recent tariffs on electric vehicles imposed by the U.S., EU and Canada.

- The window for Asian central banks to cut rates is widening. Lower policy rates in the U.S. have helped to weaken the USD. Alongside lower inflation in the region, Asian central banks may start to cut rates in late 2024. That said, the pace and timing of rate cuts would be determined by domestic circumstances.

Risks: Conflicts and supply chain disruptions

- Unexpected turns in growth (recessions) or inflation (price rebound) are probably the most relevant to investors in recent times. On inflation rebounding, it is important to define the trigger given the different policy implications of demand-side or supply-side shocks. The former, which we believe is less likely, could necessitate a return to higher rates.

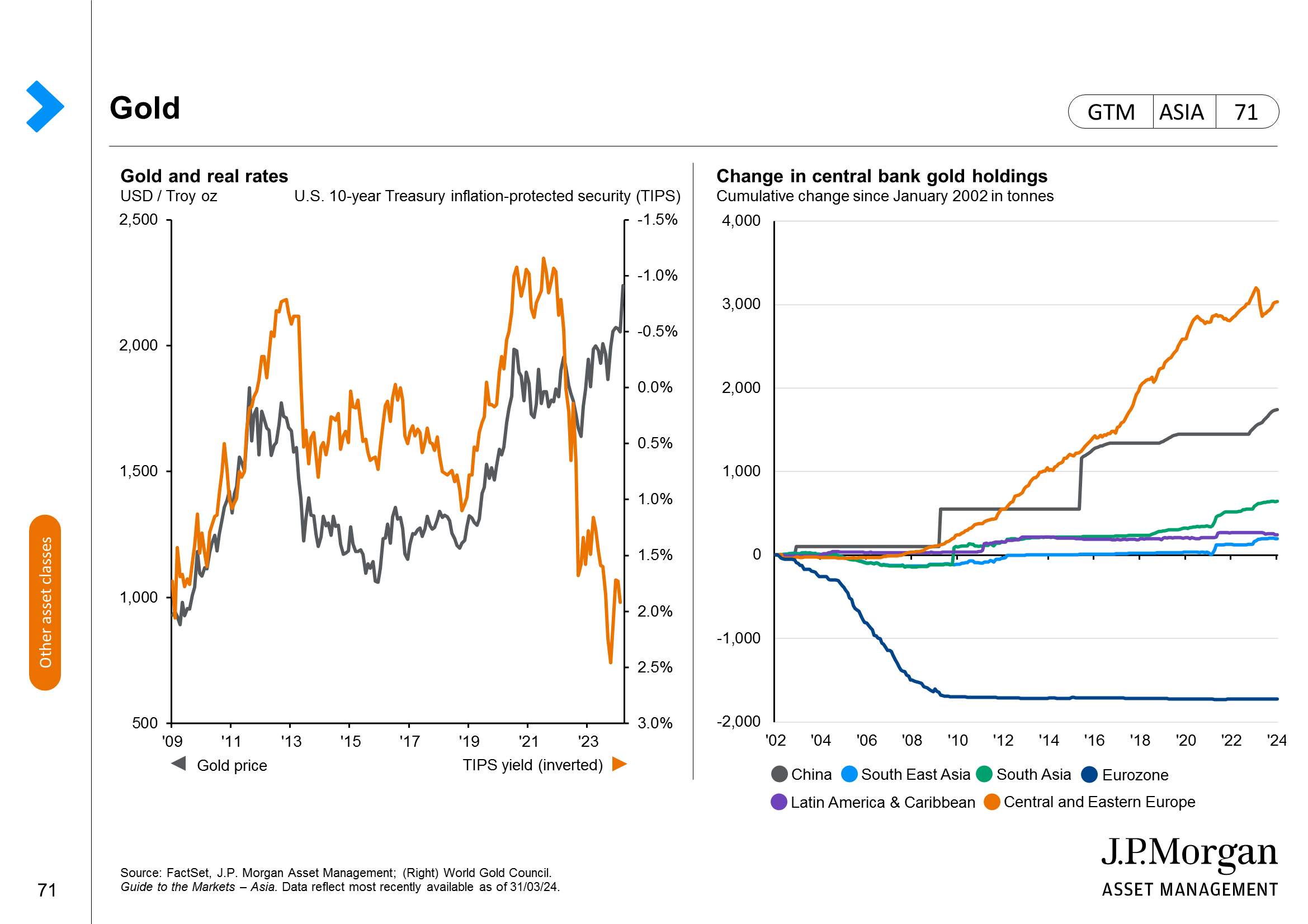

- Geopolitical tension in the Middle East limited freight traffic through the Red Sea and Suez Canal earlier in the year. This could continue with rising tension between Israel and Iran, as well as heightened concerns over energy transportation that goes through the Strait of Hormuz. Ukraine’s military action inside Russian territory also raises the risk of escalation of the conflict in Europe.

- Additionally, the global manufacturing supply chain remains vulnerable to disruptions. China’s export limits of critical minerals used in semiconductors and other technological equipment can also lead to shortages in electronic components. Natural disasters related to climate change are always within sight, even if a solution is difficult to plan for.

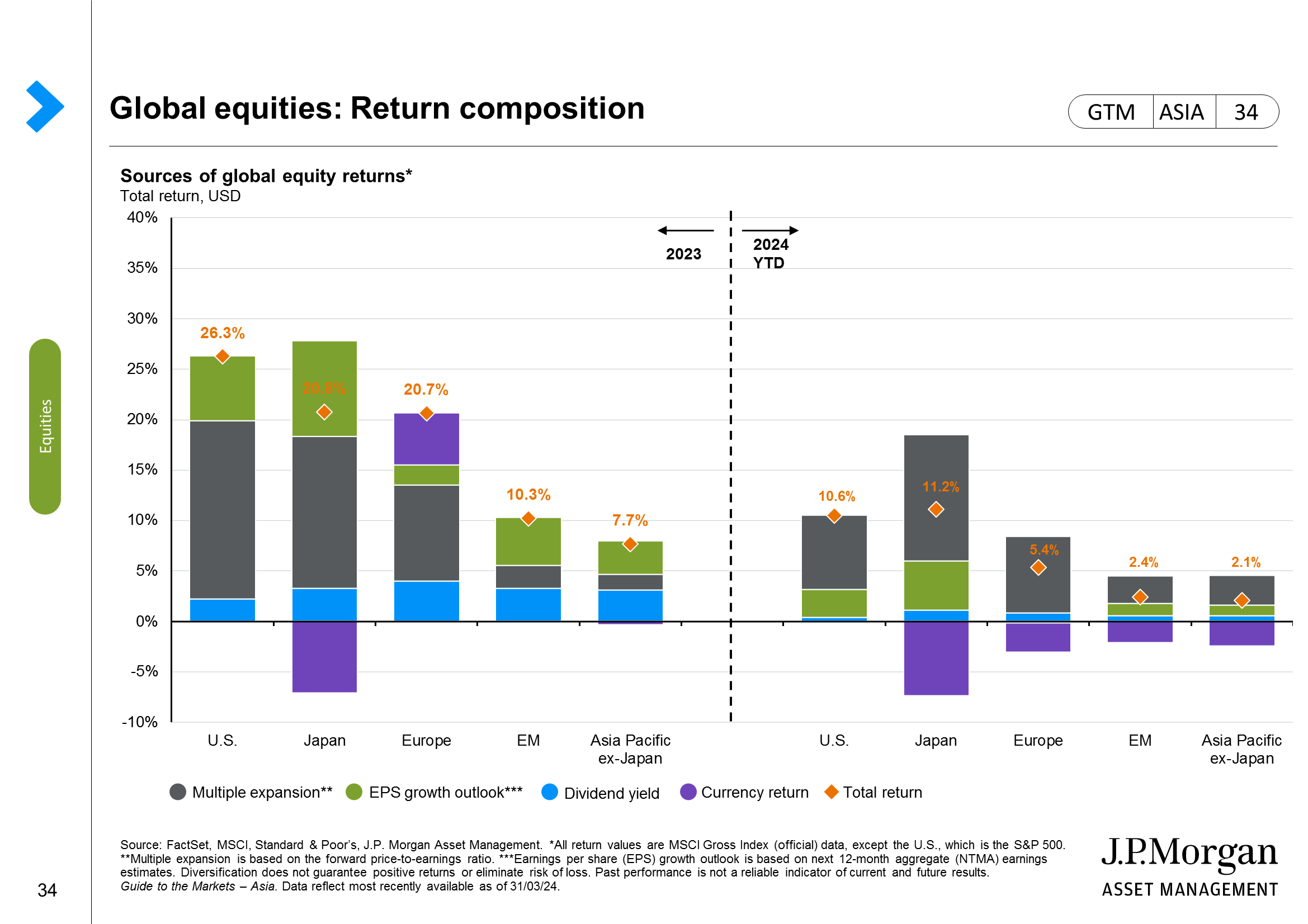

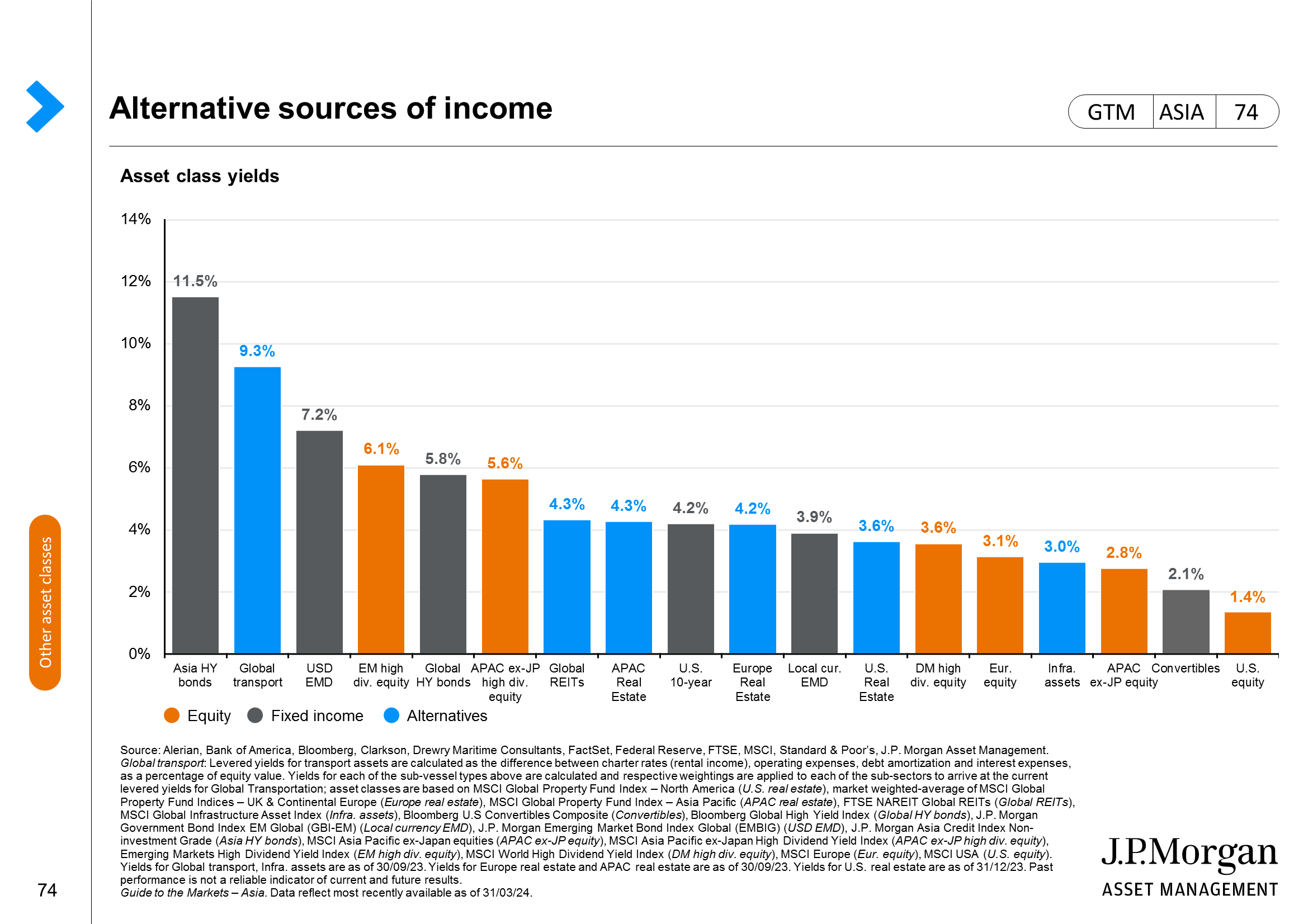

Asset allocation: Rate cuts to boost stocks and bonds

- Our core view of a rate cut amid a U.S. economic soft landing has worked out well so far, with both fixed income and equities outperforming cash1 as the Fed’s intention to ease monetary policy becomes clearer. We continue to see a balanced stock-bond allocation as optimum in portfolio construction.

- Given the prospects of softer growth in the U.S., investors should also consider a plan B, in case the deceleration in growth is worse than expected. This is where government bonds, investment-grade (IG) corporate debt and defensive equities could help balance the goal of generating returns while managing volatility. Some investors may consider cash-equivalent assets to be a good hedge against a recession, but they typically underperform government bonds and IG corporate debt as falling yields could provide potential additional returns from higher bond prices.

U.S. equities: Rising tides lifting more boats

- We continue to see value in U.S. equities both in the short term and the long term. In the short term, a broadening of corporate earnings can help some of the laggards catch up to the mega-cap technology companies. In fact, so far in 3Q 2024, health care, utilities, real estate and consumer staples have outperformed information technology and communication services. This trend reflects the more defensive nature of investor appetite and is broadly consistent with the historical trend of sector performance following the start of the rate-cut cycle.

- In the longer run, technology and growth are still expected to lead. U.S. technology companies have deployed their capital to engage in research and development as well as building capacity to grow. Hence, an economic slowdown could lead to a correction in these growth sectors. Yet, these corrections have historically been an optimal time to build a position in these long-term growth drivers.

Fixed income: Time to focus on quality again

- Government bonds play two important roles in portfolio construction. First, we believe they are an important source of income contributing to total return. Government bond yields in most developed and Asian economies have remained above inflation, which means investing in government bonds can help that part of the portfolio keep up with inflation. Second, rate cuts by central banks should cap the upside for bond yields, and hence limit the downside potential for bond prices. Moreover, even if the government bond markets have already priced in central bank rate cuts in the months ahead, government bonds can still provide additional support if economic performance turns out to be worse than expected.

- Additionally, a growing number of central banks in both developed economies and emerging markets are starting their rate-cut cycle, thus providing a wide opportunity set for bond investors to choose from.

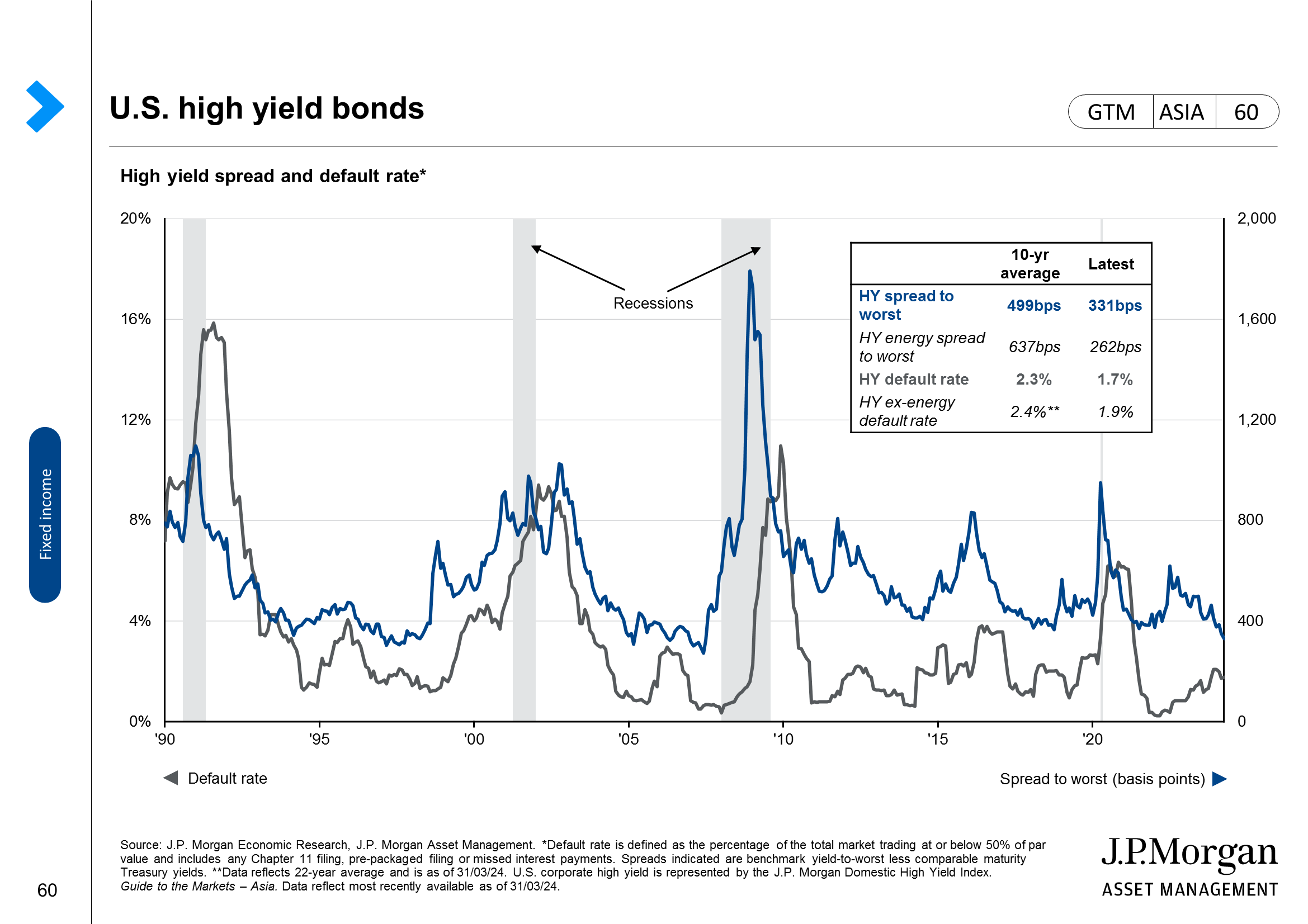

- High-quality fixed income, such as IG corporate debt, can play a similar role while potentially providing higher yields than government bonds. For high-yield, non-IG corporate bonds, their price stability is dependent on the economy not falling into a sharp recession, which could accelerate corporate defaults.

The USD: Let gravity do its work

- The USD index has dropped by 4.5% since its recent high in late June. This is driven by the prospects of lower interest rates in the U.S., alongside some long-standing factors that would have forced the USD lower. These include overvaluation of the greenback and persistent and sizable current account and fiscal deficits of the U.S. economy.

- Still, a number of conditions could further weaken the USD. The global economy would need to avoid a sharp recession or financial stress, otherwise, the USD would act as a safe-haven currency and appreciate once again on the back of demand. U.S. economic growth would need to decelerate broadly in line with other developed economies, rather than the growth exceptionalism that we have seen since the end of the pandemic.

- A weaker USD has historically benefited international assets, including emerging market (EM) and Asian fixed income and equities. Even though stronger Asian currencies could undermine export competitiveness for the region’s exporters, many companies with high technology content, such as semiconductors, are typically less impacted. A weaker USD also allows Asian and EM central banks more flexibility in cutting rates, thus supporting their fixed income markets.

1 Cash is proxied by U.S. short-term treasuries.

NEXT STEPS Please contact your J.P. Morgan representative to learn more about the Market Insights program. |