Week in review

- China manufacturing PMI at 50.3, slightly above consensus

- U.S. November ISM manufacturing PMI at 48.4, services PMI at 52.1

- U.S. November ADP private payrolls missed expectations, at 146K

Week ahead

- China CPI

- U.S. CPI

- ECB rate announcement

Thought of the week

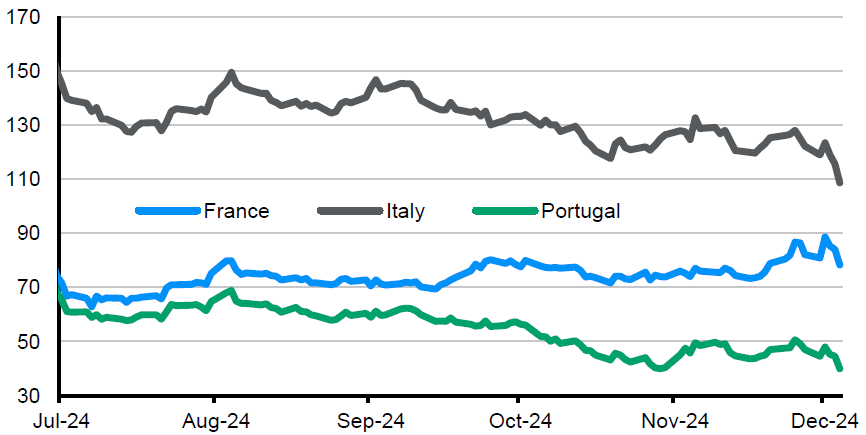

The French National Assembly passed a no-confidence vote against Prime Minister (PM) Barnier, forcing him and his ministers to resign, as he tried to push through parliament a controversial budget to rein in France’s 6.4% budget deficit. Breaking the political gridlock will be challenging for the next PM, but a “Special Law” will likely be approved to keep the government running. The politically uncertainty hits on investors’ confidence in French assets and the euro. Some rating agencies have lowered their outlooks on France’s credit rating, and French spreads have increased over the last months. The good news is there is limited contagion for now to other peripheral fixed income markets, as Italian and Portuguese spreads have been stable. However, this speaks to the broader fiscal challenges and political gridlocks several European economies are facing, including Germany. Heading into 2025, it will be increasingly key for European governments to balance growth and fiscal consolidation amidst manufacturing weakness, tariff risks, potentially more military spending needs.

10Y government bond spreads against German bunds

Basis points

Source: Bloomberg, J.P. Morgan Asset Management. Data reflect most recently available as of 06/12/24.

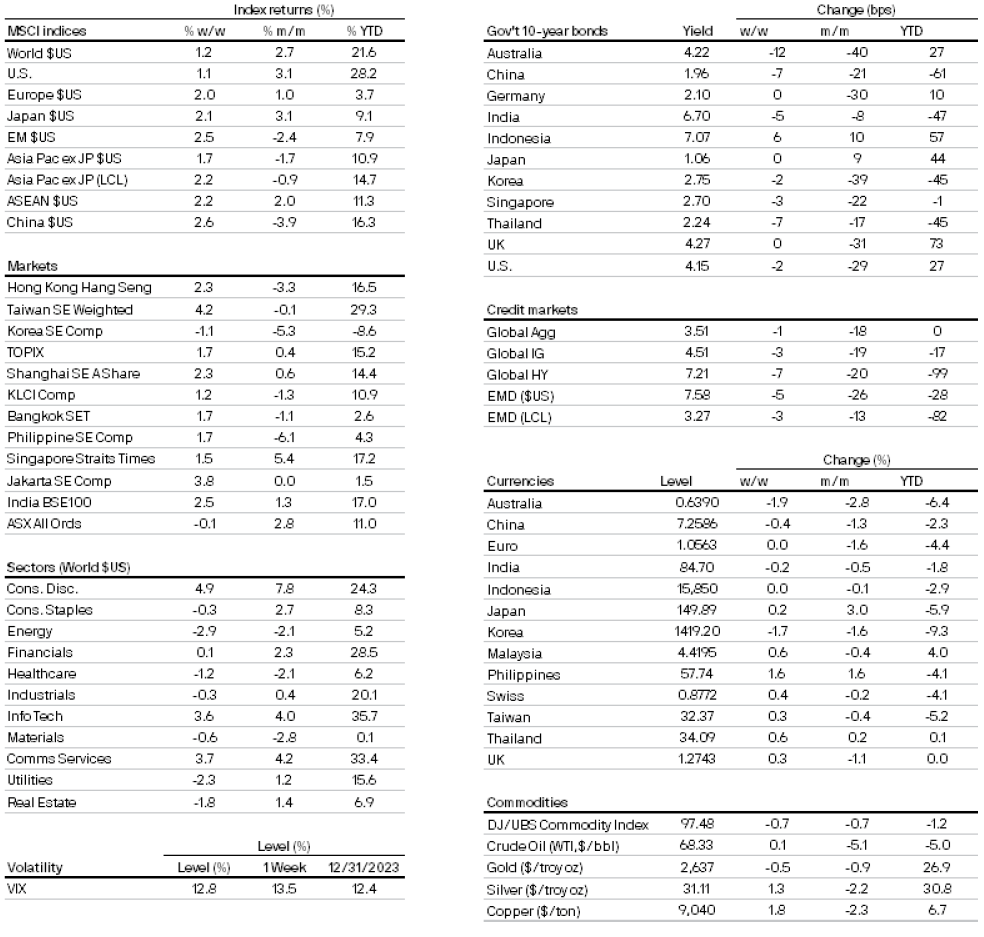

Market data

0903c02a82467a72

All returns in local currency unless stated otherwise.

Currencies’ return are based on foreign currencies per U.S. dollar. An appreciation of the foreign currency against the U.S. dollar would be positive and a depreciation of the foreign currency against the U.S. dollar would be negative.