How is China dealing with the latest COVID-19 developments?

China has been closely sticking to its zero COVID-19 policy and the recent spread of the Delta variant since last July triggered various rounds of mass testing, contact tracing and tighter mobility restrictions. As of September 1, there are currently 11 mid- to high-risk areas (which can be a street, a community district, a block or a village that have confirmed cases) in six provinces.

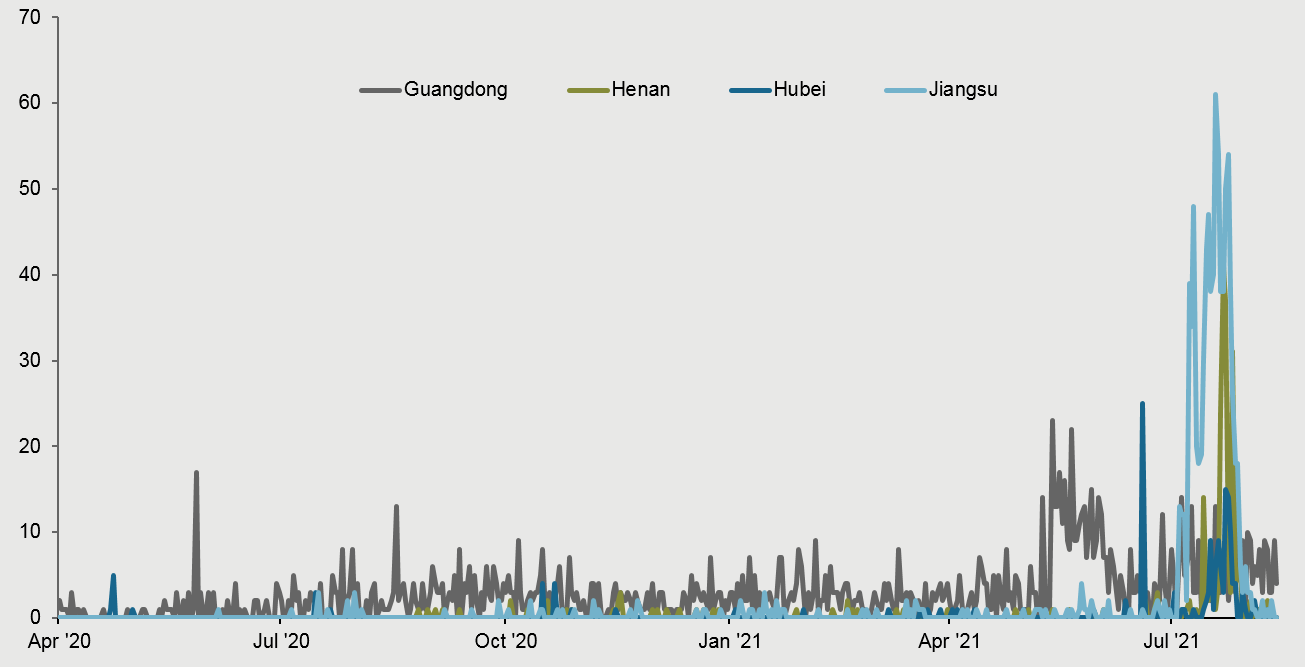

While the government only implemented targeted shutdowns in some mid- to high-risk areas, local governments introduced much broader travel restrictions, limiting both inter-city as well as inter-provincial travel. The swift, strict and timely policy responses have helped to lower the number of daily new domestic cases from the peak of 143 on August 9 to zero cases by September 1.

The recent resurgence of COVID-19 cases has also triggered the acceleration in vaccination, with daily vaccination doses rising from 11.7 million on July 15 to 25.6 million on August 10, helped by the start of the vaccination rollout to teenagers aged 12-17. Ever since China rolled out the vaccinations, about 1.9 billion doses have been administered in China.

As the outbreak of the Delta variant in China appears to have subsided, some lockdowns are starting to be removed or relaxed. However, strict restrictions remain in place in many tourist sites and recreation venues. It is also unlikely that inter-provincial travel will be eased in the near term if there are still mid- to high-risk areas.

The lingering COVID-19-related restrictions and uncertainty will probably weigh on consumption and sentiment, especially services activities. In the month of July, retail sales slowed notably to 8.5% year-over-year (from 12.1% previously). This may have been further magnified by the heavy rains and floods in some areas (most notably the Henan province).

Looking ahead, we expect fiscal policy to do more of the heavy lifting in supporting growth for the rest of this year, especially as government bond issuance is running below this year’s quota and can be stepped up. This could help underpin a modest rebound in infrastructure investment.

Monetary policy has shifted to a neutral stance after some modest tightening in the first half. However, this position could shift if growth momentum eases further. We believe that Chinese officials will utilize both fiscal and monetary policies to stabilize the near-term growth outlook, thereby creating room for measures to address longer-term economic and market reforms.

The recent resurgence of COVID-19 cases in certain provinces led to tighter mobility restrictions

EXHIBIT 1: RESURGENCE OF COVID-19 CASES IN GUANGDONG, HENAN AND HUBEI AND JIANGSU SINCE MID-JULY

CASES

Source: National Health Commission, J.P. Morgan Asset Management.

Data reflect most recently available as of 01/09/21.

Investment Implication

Other than the evolving regulatory landscape, the pandemic continues to be the most important factor influencing the Chinese economy and investment backdrop in the next 12 months.

The latest resurgence and the implementation of strict lockdowns point to Chinese government’s determination in pursuing the zero COVID-19 strategy. China’s National Health Commission also made a clear statement that it can beat the virus by sticking with this strategy. This implies potentially a more volatile growth outlook within China as economic activities may act as the shock absorber to prevent any resurgence in infections.

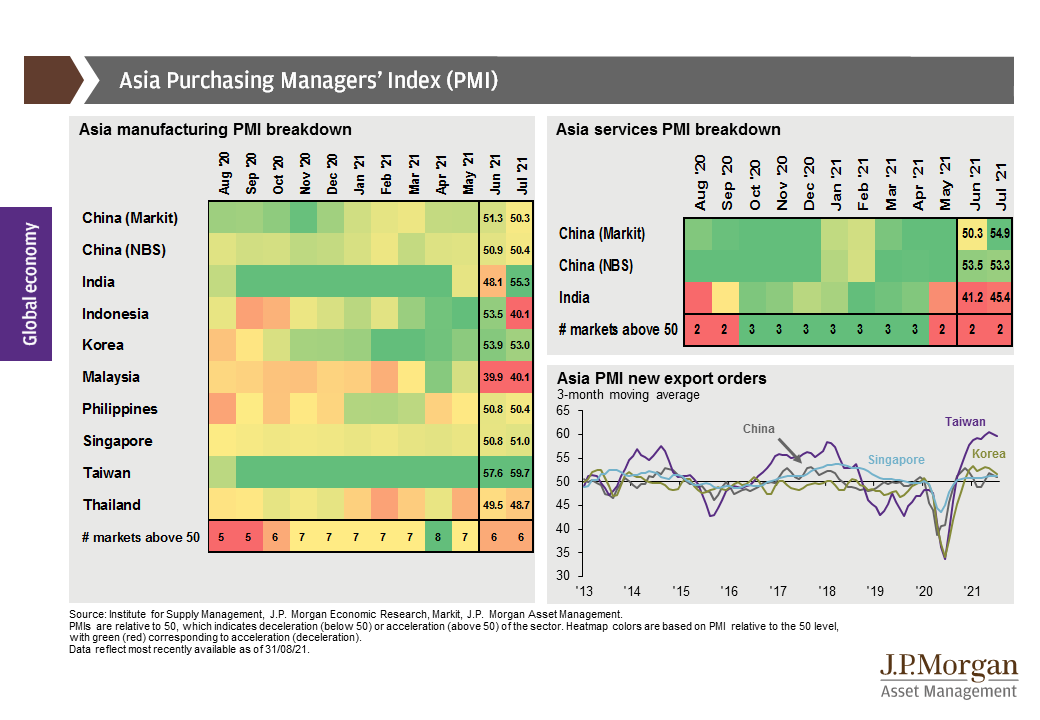

Increasingly, more Asian governments are discussing their reopening conditions and whether they will continue to pursue a zero COVID-19 strategy or learn to live with the virus like some of the developed economies.

Some of the economies of the Association of Southeast Asian Nations (ASEAN), where tourism and business travel play an important role, are actively reviewing their existing public health policies. Based on the trade-off between infection resurgence and economic recovery, we expect more governments to fine-tune their reopening policies and may allow a certain amount of daily infection cases within the system, as long as the vaccination program is in progress. This may benefit sectors such as airlines, transport infrastructure, hotels, restaurants and leisure. This could also have knock-on effects on consumer and business confidence, leading to continuing normalization in economic activities and improving corporate earnings within ASEAN.

Within China, given the economic cost and difficulty in eradicating COVID-19 within the community, especially as more Asian governments start to reopen their economies, we believe that Chinese policymakers may also evaluate their zero-tolerance strategy in the near term.

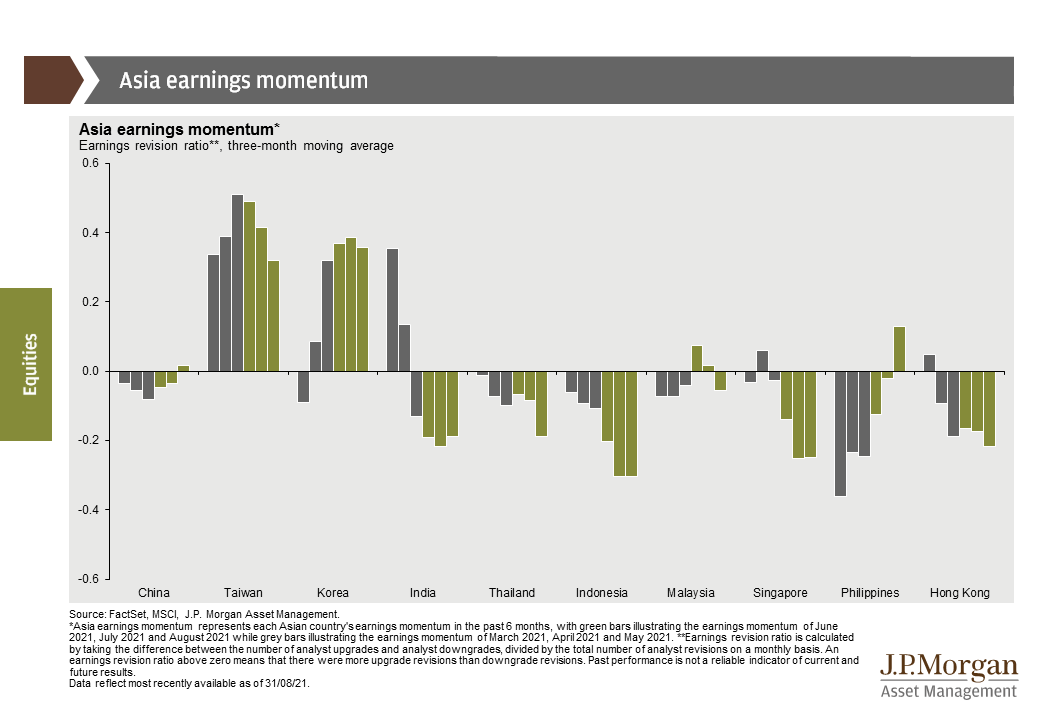

As the number of local infection cases continues to decline, we expect this latest wave of COVID-19 spread will likely be contained relatively soon. However, still-tight mobility restrictions and cautious consumer sentiment will probably linger, thereby hindering consumption recovery in the next few months. Furthermore, the broad-based slowdown in July activity data and the ongoing supply side bottleneck, as well as the regulatory changes will continue to pose downward pressures on growth.

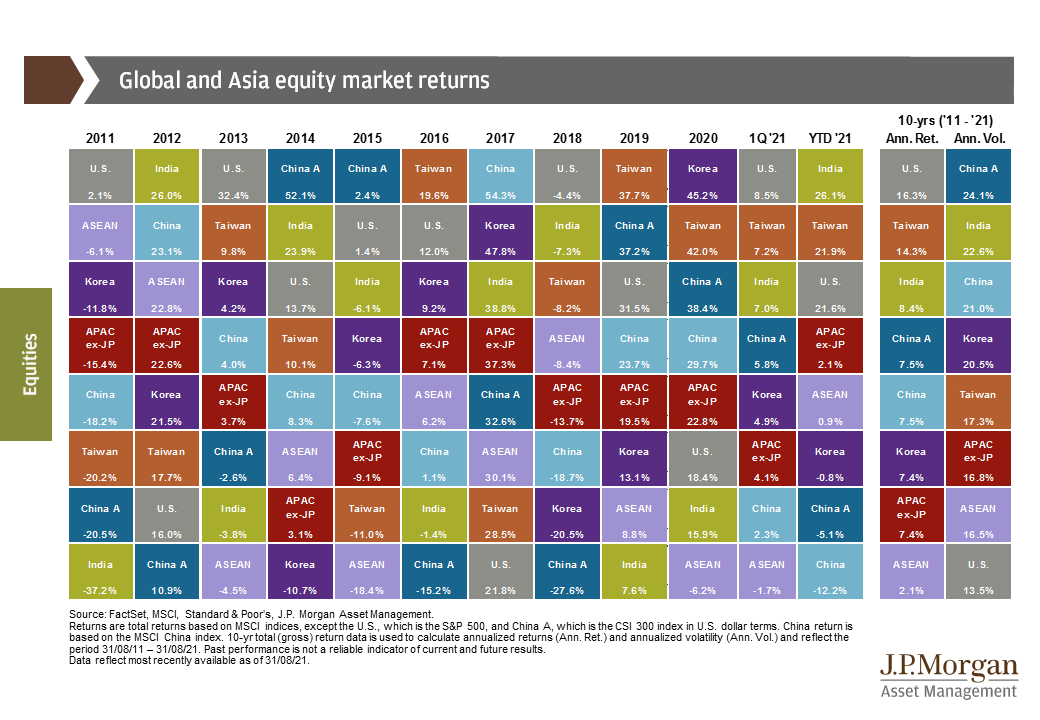

The loss of momentum in the economic recovery simply strengthens policymakers’ case to act in a timely manner to stabilize growth. Fiscal policy will likely be taking the front seat, while monetary easing will probably remain targeted. However, any signs of a more sustained policy easing could provide support to Chinese equities. We retain our long-term positive stance on Chinese equities, with a focus on structural growth areas such as technology, health care and domestic consumption. The policy adjustment will also be supportive of infrastructure investment, including the construction, materials and industrials sectors.

0903c02a829b6918