Are opportunities emerging in Chinese stocks after the recent sell-off?

Since July, policy measures have been intensively introduced to push for the transition to high-quality and sustainable development. Chinese internet giants are particularly under pressure in various fields, such as anti-trust investigations, data security, labor law execution, corporate tax increases and online gaming regulation. Meanwhile, the off-school tutoring sector was hit severely by a new round of education reform. Finally on August 17, a comprehensive policy framework to promote “common prosperity” was published, which further exacerbated investors’ concerns about uncertainties in the economy and financial market.

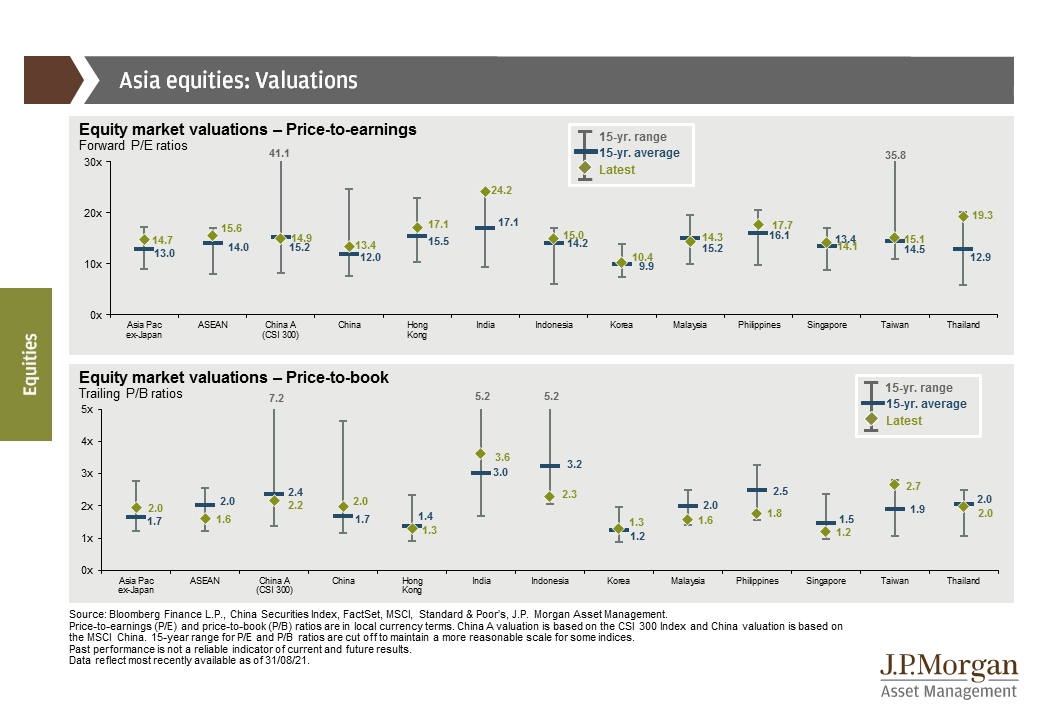

These changes were beyond investors’ expectations, and the associated uncertainties influenced investors’ sentiment in both onshore and offshore market. On August 20, the MSCI China Index (USD) closed 20.7% lower from the June 30 level. In response, Chinese regulators actively communicated with the market to reassure investors. Such actions, coupled with the depressed valuation after the market correction, helped stabilize the market, and major indices rebounded sharply both onshore and offshore on August 24.

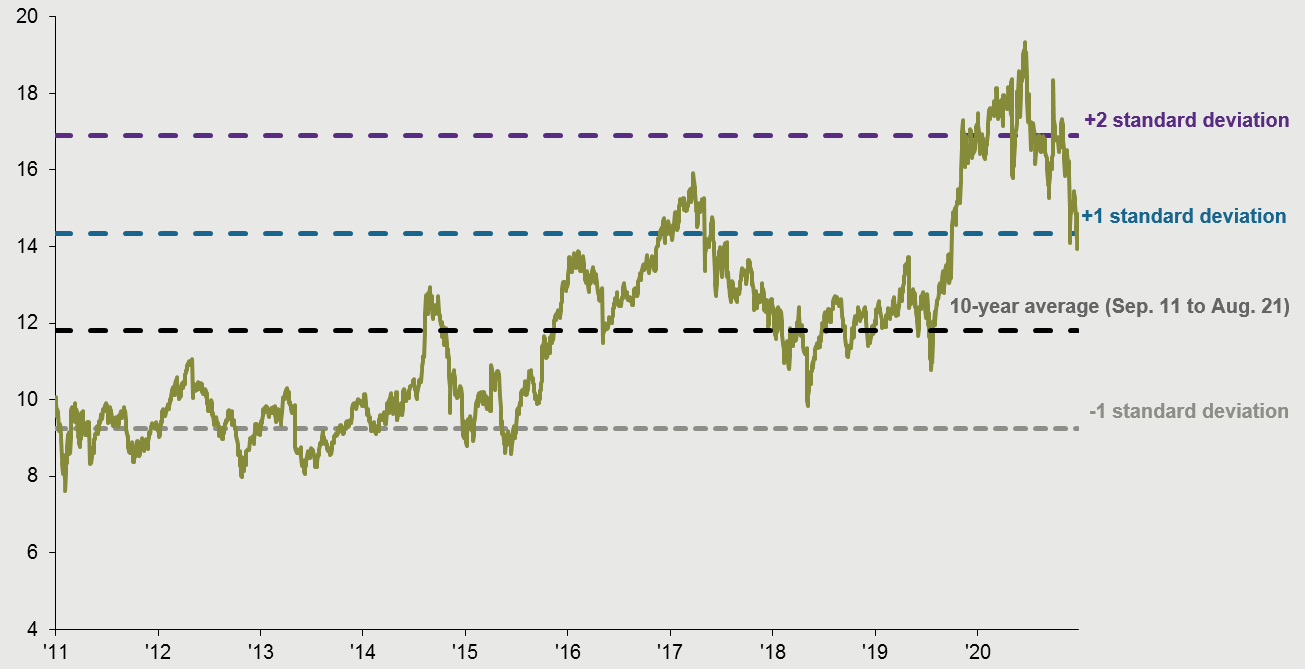

After the sell-off, the forward price-to-earnings ratio of the MSCI China Index declined to a level of around 14, or one standard deviation above the 10-year average after the sell-off. For global investors, opportunities for long-term investment seem to be emerging at this valuation level. However, we might need to have closer scrutiny of the policy trend and be selective in portfolio management.

First of all, the recent policy changes might only be the start instead of the end for a long-term transition. After claiming the victory of eliminating absolute poverty in February, top policymakers are devoting greater efforts to achieve a more balanced and sustainable development.

Consequently, regulatory reforms are still in the cards for some of the “new economy” industries where Chinese authorities see the need to achieve better social outcomes, such as youth protection and appropriate social benefit coverage for workers, or improving the competitive environment by allowing smaller players to compete with industry leaders.

In the past, those “new economy” sectors benefited from elevated valuations given the expectation for high growth in revenue and profit. Under the new circumstances, investors might have to incorporate a higher risk premium or require more downside protection in their valuation models.

On the other hand, investors should also recognize that some regulatory changes are not market negatives. For example, ambitions in self-sufficiency in semiconductor manufacturing and software development or achieving greenhouse gas reduction targets mean certain industries stand to benefit from policy tailwinds in the medium to long term.

China stock valuation has declined to a more reasonable range after recent market correction

EXHIBIT 1: Forward price-to-earnings ratio of MSCI China Index

Source: Bloomberg, MSCI, J.P. Morgan Asset Management.

Data reflect most recently available as of 24/08/21.

Investment Implication

Despite the elevated market volatility, we still believe China remains an integral part of any investor’s portfolio, both in equities and fixed income. It is still essential for investors to remain invested in China, while flexibility and selectivity are more important than ever.

In the near term, the changing policy framework brings disturbances to investors’ valuation models, particularly for those sectors affected by the changing regulatory landscape. Therefore, we remain cautious on the earnings growth forecast of internet giants until there is a clear signal of the establishment of a stable regulatory regime.

On the other hand, technology continues to play a critical role in the country’s economic development. There are smaller policy uncertainties for high-tech manufacturing sectors when Chinese authorities are pursuing self-sufficiency in semiconductors, software, new energy, etc.

For the near future, China’s economic policy might change from neutral to a more supportive stance, which could buffer some shocks from the reforms. There might be marginal improvement in liquidity conditions for the rest of this year, which means further policy tailwinds for the manufacturing sectors. Meanwhile, after a prolonged correction, the consumer sector might also benefit from policy easing and the restoration of sentiment.

0903c02a829b6918