Building better carbon transition fixed income portfolios

20/07/2022

Carly Segal

Paolo Gazzola

Wei Chu

Bryan Wallace

Introduction

Following the 26th United Nations Climate Change Conference (COP26) in Glasgow in November 2021, member countries enacted further targets to mitigate the worst impacts of climate change, and reiterated the commitment to keeping the global post-industrial temperature rise to 1.5 degrees Celsius (˚C) or below. In conjunction with the commitments made by governments, COP26 also spurred companies across the private sector to align their investments with the net zero transition.

While the implications of these commitments for financial institutions are widespread, a key feature was the creation of the Glasgow Financial Alliance for Net Zero (GFANZ), created in 2021 to bring together financial sector net zero initiatives, including the Net Zero Asset Owner Alliance, the Net Zero Asset Managers Initiative, and the Net Zero Banking Alliance. As a signatory to the Net Zero Asset Managers Initiative, J.P. Morgan Asset Management has committed to achieving net zero in its assets under management by 2050.

These climate commitments have further impacted our clients, as governments, asset owners, investment managers and corporations all increase their focus on reducing carbon dioxide (CO2) emissions. And across the world, fiscal stimulus packages have been tied to green policies, particularly with the goal of achieving net zero emissions. These packages are critical to meeting the Paris Agreement and Glasgow climate targets.

What are net zero portfolios?

Net zero portfolios are an approach to investing in companies and governments that reconciles climate commitments across the financial sector, with the need for a transformation of the global economy, and the development of science-based transition pathways. Actively managing portfolios’ carbon emissions has become essential for asset owners to successfully navigate climate risks, technological disruption and public policy changes, as well as to mitigate the impacts on portfolio performance.

As we outlined in our climate policy thematic article in our 2021 Long-Term Capital Market Assumptions1, we expect policymakers to take significant further actions to achieve this emissions reduction. This policy response will have material consequences for passively managed fixed income portfolios: according to a 2019 study, insurance portfolios with sovereign bond holdings that are most exposed to high-carbon industries could suffer a decline in value of up to 4%.2 Corporate bond portfolios will also feel the impact of climate change policies. The introduction of emissions trading schemes or outright carbon taxes are likely to expose costs previously unaccounted for on an issuer’s balance sheet, which could in turn have material impacts on credit fundamentals and ratings.

From a transition risk standpoint, the increased importance of renewables will cause more assets to become stranded – from old intellectual property, such as combustion engine patents, to physical property, including coal power plants and energy-inefficient real estate. This risk can also be an important driver of value in actively managed fixed income portfolios, where asset-heavy fixed income sectors such as utilities, energy, automotive and basic industry represent a large proportion of corporate bond indices.

Throughout this paper, we leverage the Net Zero Investment Framework outlined by the Institutional Investors Group on Climate Change (IIGCC), of which J.P. Morgan Asset Management is a member. The framework serves as a comprehensive guide to help institutional investors align their portfolios towards net zero3.

We also highlight J.P. Morgan Asset Management’s unique active management approach to carbon transition fixed income portfolio management, which can harvest opportunities while also reducing the risks involved in the transition to a low-carbon world.

How we think about carbon transition portfolios

Our carbon transition framework consists of three stages:

1) Identify and rank companies based on their carbon transition readiness;

2) Construct portfolios utilising forward-looking carbonreduction metrics;

3) Engage with issuers who have yet to put in place appropriate climate policies.

In all three stages, we leverage the depth and expertise of our research platform as well as data from both internal and external sources, all of which is aggregated in our proprietary portfolio management system.

Identify: Ranking companies based on their carbon transition readiness

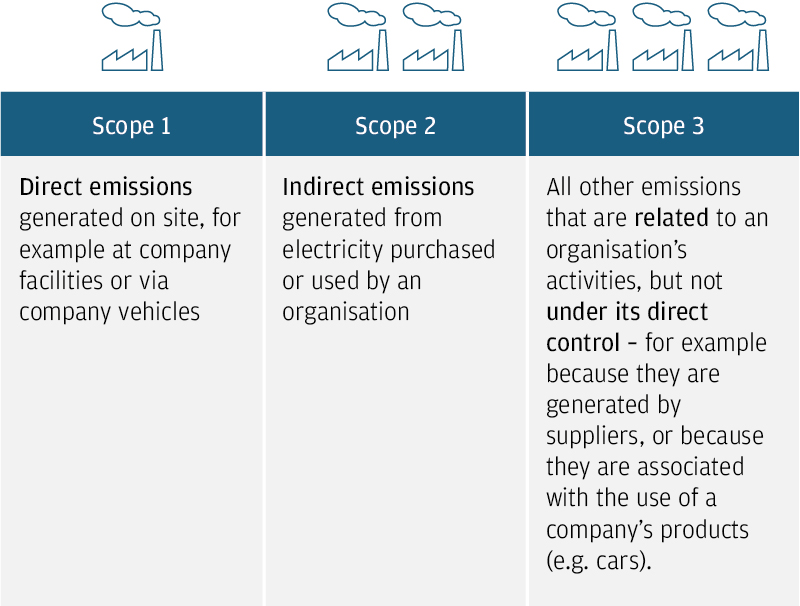

Our framework considers the contribution of a company to global warming through direct emissions (Scope 1) and indirect emissions (Scope 2). We also consider Scope 3 emissions qualitatively, although the relatively low level of consistent reporting across fixed income issuers does not currently allow us to include this metric in the overall CO2 emissions calculation for our bond portfolios (Exhibit 1)

Exhibit 1: Understanding the three scopes for emissions4

Source: J.P. Morgan Asset Management. For illustrative purposes only.

Our preferred metric for fixed income carbon transition portfolios normalises CO2 emissions for each issuer’s revenues, so as to arrive at a carbon intensity metric measured in “tons CO2 equivalent/USDm” (tCO2e/ USDm). This measure is in line with the Task Force on Climate-related Financial Disclosures (TCFD) recommendations.5 That said, there are a number of ways to measure portfolio and issuer level carbon emissions - all of these have drawbacks, so although most carbon-aware investors will have a preferred measure, we should consider other metrics such as absolute emissions and financed emissions throughout the investment and monitoring process. A guide to various carbon exposure metrics can be found here.

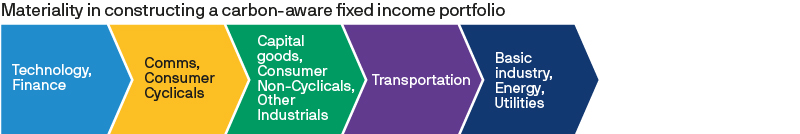

In our 2020 white paper on the integration of environmental, social and governance (ESG) factors into investment decisions6, we evaluated the relative materiality of carbon emissions for each of the sectors in a carbon-transition portfolio. When looking at carbon intensity, we do not apply blanket exclusions to highemitting sectors or companies. Our approach is to engage and allow all sectors and issuers to be part of the solution, as they all play a crucial role within a functioning economy and will be key to a successful low-carbon transition (Exhibit 2).

Exhibit 2: Relative materiality of carbon emissions across fixed income sectors

Source: J.P. Morgan Asset Management.

At the same time, not all current carbon emissions contribute equally to investment risk, and carbon intensity as a metric has numerous limits. Financial institutions, for example, have low Scope 1 and 2 carbon intensities, given the sector’s low carbon footprint. Yet bank lending to high-emitting sectors, such as utilities, has an indirect, multiplier effect on carbon intensity that manifests only in future years.

Similarly, sub-sectors such as auto parts, electrical components and energy-related segments—including drilling, storage and transportation—might feature a high revenue dependence from fossil fuels, while having a relatively low tCO2e/USDm intensity. Therefore, it is important to complement historical carbon intensity with a qualitative overlay and a forward-looking approach.

Forward-looking carbon footprint commitments by companies or governments are ultimately the most important factor in achieving net zero emissions. These can take different forms with varying levels of commitment. Our approach to assessing the strength of a company’s commitment comprises of both quantitative and qualitative factors:

- Quantitative: Relying solely on quantitative data poses challenges regarding availability, transparency and consistency. We use external data validators, such as the Science-Based Targets Initiative (SBTi) and the Transition Pathways Initiative, to identify companies with strict commitments, and the Sustainalytics Controversy Score to flag those situations where a company’s behaviour is at odds with its stated policy. As data and disclosures evolve across governments and companies, so too will the quantitative metrics we are using in our framework.

- Qualitative: The input of our credit analysts is crucial in determining the strength of a company’s forwardlooking targets. It is all the more important in fixed income where data can be more limited, particularly in sectors with lower percentages of publiclylisted companies. In this regard, we employ the full breadth of J.P. Morgan Asset Management’s equity and fixed income research capabilities and tools to augment our coverage and refine our approach. Qualitative factors, such as linkage to management compensation, capex committed and management track-record, are some of the important forwardlooking indicators in our analysis. As we discussed in our 2022 Long-Term Capital Market Assumptions7, fixed income investing does introduce additional complications to incorporating ESG and carbon transition assessments. Our credit and equity research analysts therefore provide crucial insights into companies’ commitments to the transition – we’ve found that particularly for fixed income, a deep understanding of an issuer’s complex funding structure can be a vital input to getting a full picture of a specific issuer’s net zero readiness. Our research analysts are also often the first to catch small nuances between companies’ carbon transition policies, particularly when it comes to identifying “red flags” of issuers that are not taking the net zero transition seriously. Consistent engagement with management is also a crucial part of this evaluation - our research analysts can analyze and influence companies' climate change policies by interacting regularly with C-suite executives of the companies they cover.

Case study: ENEL

- Company overview: One of the largest energy utility companies in Europe, headquartered in Italy.

- Sector: Utilities. Carbon intensity is very material given the sector’s role in supplying power to consumers and industries. Electricity and heat generation for example have accounted for 24% of total GHG emissions in the last decade8.

- Scope 1 and 2 carbon intensity (historical): 3rd quartile in EUR corporates utilities, 4th quartile in GBP corporates utilities.

- Scope 3 emissions: Company discloses and sets explicit Scope 3 targets but disclosure is low and inconsistent across the sector with only 43% of the GBP utilities universe disclosing Scope 3 and only 23% disclosing both upstream and downstream emissions9.

- Forward-looking commitments: “very strong”

– Quantitative: 1.5oC target set and approved by the SBTi.

– Qualitative: Management deeply committed to de-carbonising their operations with all but essential capital expenditure dedicated to renewables, and carbon emission targets well integrated into the company’s strategy.

- Conclusion: Include in carbon transition portfolio due to very strong forward-looking commitment despite historically high carbon intensity linked to the company’s legacy coal business.

The securities above are shown for illustrative purposes only. Their inclusion should not be interpreted as a recommendation to buy or sell.

The combination of the two factors results in a “very strong”, “strong”, “weak” or “very weak” qualification for the forward-looking commitment of a company. This qualification is then used as a key input in order to actively identify bond issuers that add the most value in carbon transition portfolios. We provide a case study example of this framework by looking at a company with a “very strong” forward looking commitment, Enel.

Construct: Building carbon-transition portfolios utilising forward-looking metrics

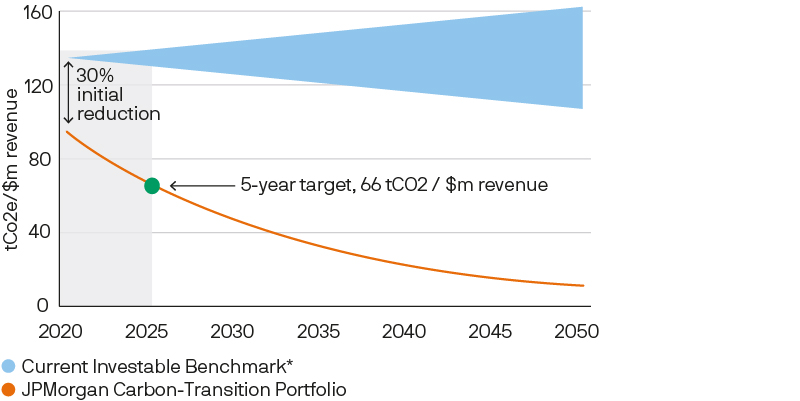

Our carbon-transition portfolios are constructed in three broad stages: 1) Reduce carbon intensity by at least 30% relative to the broad investment universe; 2) Reduce annual carbon intensity by 7% year on year; and 3) Set five-year interim carbon reduction targets.

1. A 30% reduction in portfolio carbon intensity relative to an appropriate broad investment universe. Ideally, this reduction is implemented in the initial portfolio construction process but a more gradual approach can be used for fully-invested “buy and maintain” portfolios with realised gain and loss budgets. This target is consistent with the European Union (EU) Technical Expert Group (TEG) recommendation for EU Climate Transition benchmarks and allows for a broad opportunity set across different issuers. Should the investable universe allow for a 50% reduction (aligned with the EU TEG’s EU Paris-Aligned framework) without reducing diversification, we are able to incorporate this higher reduction target into our investment process.

2. A 7% annual carbon intensity reduction. This goal recognises that two companies with identical footprints today may have completely different strategies in the future. The target allows the portfolio to reach net-zero carbon emissions status by 2050, and is informed by forward-looking carbon intensity indicators, such as the Science-Based Initiative’s five-year de-carbonisation targets and feedback from our research and Investment Stewardship teams. To meet the 7% annual goal, we continually monitor issuers’ carbon emissions data to ensure the portfolio remains on track, while also engaging with companies when necessary. We can also use any allowed turnover budget to decrease carbon intensity, but this should be seen only as a last resort when issuers are not making sufficient progress in their carbon reduction strategies and have not reacted to engagement efforts.

3. Five-year cumulative carbon reduction targets. Typically issuers release carbon emissions data on an annual basis. While monitoring and engaging with issuers on a regular basis is crucial, we set five-year interim targets to measure the cumulative carbon reduction target in the portfolio. This medium-term yardstick allows us to avoid excess turnover and to account for the long-dated nature of many of the carbon-generating assets; for example, power plants may have residual lives well in excess of shorter-term carbon reduction measures. Furthermore, a five-year target smooths out the short-term fluctuations in currency and commodity prices that may otherwise dilute the meaning of the tCO2e/USDm carbon intensity indicator.

The estimated carbon reduction that results from applying our objectives to a portfolio can be seen in Exhibit 3.

Exhibit 3: Estimated carbon reduction in a carbon transition portfolio using our three portfolio construction objectives

Source: J.P. Morgan Asset Management. Scope 1 and 2 carbon emissions considered.

*For illustrative purposes only.

Targets can be further discussed and refined depending on client requirements.

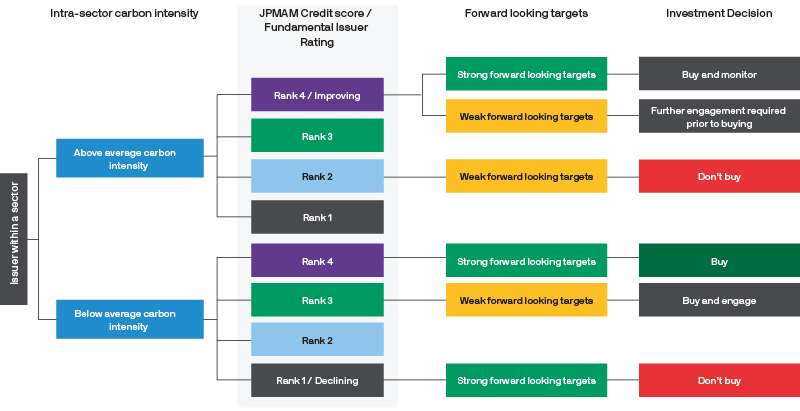

When it comes to issuer selection, we combine fundamental, quantitative and technical (FQT) inputs from our core fixed income investment process, resulting in a credit score of one to four (one: weakest, four: strongest) and a fundamental issuer rating and direction, with the two following key carbon-reduction dimensions:

1. Intra-sector current carbon intensity. Our approach is non-exclusionary, in that we do not restrict entire sectors based on their carbon intensity. We therefore consider each issuer’s carbon intensity relative to the carbon intensity of its respective sector – above or below average – with percentiles used to indicate where an issuer is placed within its sector.

2. Forward-looking carbon policy targets. As discussed in the previous section, we use quantitative and qualitative inputs to identify whether a company or government’s forward-looking commitments are strong or weak. This component of the portfolio construction process is arguably the most important, particularly for a buy-and-maintain strategy, as a portfolio of companies with strong forward-looking commitments should, in theory, align to net zero by 2050 through an organic reduction in carbon intensity in each issuer’s operations. We have also made significant firm-wide investments, in particular through our Sustainable Investing team, to dissect the various sources of forward-looking carbon data, as we build out even more comprehensive in-house capabilities to analyse the viability of company, sector, and portfolio level transition pathways.

The result is a rigorous framework for making investment decisions which is shown in Exhibit 4.

Exhibit 4: Our global fixed income investment platform is leveraged to build carbon-transition portfolios

Source: J. P. Morgan Asset Management. For illustrative purposes only. The above decision tree is not exhaustive and should serve to show examples of different potential decisions.

The bond-by-bond selection process allows us to go beyond an issuer’s carbon intensity and additionally take into account specific features that are embedded in the bond covenants. This selection process can help insurance and pension funds achieve carbon-transition goals. We consider three types of securities in our carbon-transition portfolio construction process:

- Green bonds: The proceeds of these bonds are aimed at financing specific carbon-reduction projects, while benefiting from the creditworthiness of the issuer’s entire balance sheet. For example, a high-polluting power company may not be investable, according to the issuer selection framework described above, but a green bond issued by the same company, and aimed at financing renewable power generating projects, could be a viable proposition. We evaluate each green bond based on its own quantifiable carbon-reduction characteristics, as well as its adherence to the Green Bond Principles framework10, among other things. We are also exploring ways of quantifying the emissions avoided thanks to the use of green bonds at a portfolio level.

- Sustainability-linked bonds: These securities are issued for general corporate purposes, so they lack the environmental specificity of green bonds. On the other hand, they feature environmental goals in their covenant structure. For example, failure to achieve a certain renewable power generation capacity, such as 50% of the company’s overall capacity by 2030, can result in financial penalties, such as a coupon step-up. In this respect, and from a de-carbonisation standpoint, sustainability-linked bonds are of higher quality relative to other issues by the same company.

- Transition bonds: An emerging type of financing used in sectors that are hard to de-carbonise (for example, mining, steel, cement and shipping). Transition bonds or transition finance aims to fund investments that are not yet low or zero-emission but have a short-term role to play in de-carbonising an activity or supporting an issuer in its transition to net zero targets. So far issuance of transition bonds has been fairly limited. Specific guidance on required disclosures for issuers looking to use transition finance was issued by the International Capital Market Association (ICMA) in December 2020.11

Engage: Establish a dialogue with issuers that have yet to put in place appropriate climate policies

Engagement with issuers is one of the key pillars of our ESG-integrated investment process, and it plays an integral role in ensuring portfolios can achieve the specific carbon transition targets.

The J.P. Morgan Asset Management Investment Stewardship team drives firm-wide engagement strategy, working in conjunction with fixed income and equity research analysts who are on the ground analysing and interacting with the companies and governments that the firm invests in on behalf of clients. More about our investment stewardship philosophy and our engagement activities in 2021 can be found in our Investment Stewardship Report.

As fixed income investment managers, we lend money to companies on behalf of our clients, and aim to deliver strong risk-adjusted returns. We expect the issuers we invest in to conduct business in a sustainable manner, demonstrating high standards in every aspect of their operations. We believe that issuers’ climate-related risks and practices are drivers of long-term performance, particularly in sectors vulnerable to physical or financial threats stemming from climate change. Therefore, we take carbon transition issues into consideration, alongside other market risk factors, in analysing the securities that we can invest in on behalf of our clients. We consider the analysis of carbon transition issues to be a key aspect of our fiduciary responsibility and a fundamental component of our risk management process.

Despite the many resources at our disposal, bond investors do not have voting rights, unlike our equity counterparts. However, bond issuers are highly dependent on investors for access to capital, so we do have leverage to positively influence their business practices through active engagement. Our fixed income platform has over 65 dedicated career research analysts, giving us the scope to conduct this rigorous engagement, pressing company management and government officials on topical issues and encouraging them to adopt best practices. Although we own different parts of the capital structure, our climate-related goals are the same as our equity colleagues. We therefore partner with our equity counterparts to ensure a consistent approach to engagement with companies. In addition to the work done by our product research teams, we also leverage the resources of the Investment Stewardship team discussed above, which set firm-wide targets for engagement.

Some of the key areas of engagement related to carbon transition are:

- Current carbon emissions. Scope 3 emissions are currently not considered in our quantitative carbon intensity targets, as only about 55% of the companies in our investable universe12 disclose this metric. By actively engaging with different bond issuers we are aiming to increase Scope 3 reporting coverage, further refining our analytical framework.

- Forward-looking carbon emissions targets. The Science-Based Targets Initiative issuer coverage is relatively low, with only 15%- 20% of the companies reporting their adherence to less than 2°C global warming scenarios. J.P. Morgan Asset Management’s global credit research capabilities and ESG-integrated investment approach alleviate this issue by providing a qualitative insight into a given company’s future plans for carbon reduction. Through engagement with companies we aim to achieve a much higher percentage of companies committing to global warming targets in the next five years and we encourage companies to comply with the Science-Based Targets Initiative.

- Sectors with higher emissions. We aim to have a minimum of 70% of high emitting sectors (eg. basic industry, energy, and utilities) invested in issuers that are currently aligned with net zero, committed to aligning, or are issuers we are engaging in order to elicit credible net zero plans.

Challenges & considerations

Issues around data coverage, quality and transparency continue to be the biggest obstacles we face throughout the net zero portfolio management process. Although the industry and its partners in the scientific community have made significant strides in outlining theoretical frameworks for net zero investing, the reality is that reporting on emissions and net zero planning is nowhere near standardised.

Our investment universe consists primarily of global investment grade fixed income. However, we see large disparities in the quality of current and forwardlooking carbon data from regional and sectoral perspectives. For example, the United States is a key source of necessary future carbon emissions reductions, but reporting on corporate net zero plans is not standardized, whereas it is already the norm for European issuers. Further challenges come into play in the emerging markets, where state ownership of issuers is commonplace, and capital markets are less established – these are factors that introduce further complexity into the setting of net zero targets and emissions reduction plans.

Keeping all of these challenges in mind, while aiming to gather as much high quality data about issuers’ forward-looking carbon targets is crucial. There are no silver bullets when it comes to net zero planning indicators, but we can continue to work with issuers and other stakeholders in the industry to improve disclosure and commit to externally recognised, science-based plans for the low carbon transition.

Conclusion

Climate change poses material risks and opportunities to all asset owners, and in particular, to insurance company and pension fund balance sheets. Our carbon reduction framework aims to reduce the climaterelated financial risks faced by our clients. Our portfolio construction framework leverages J.P. Morgan Asset Management’s proprietary analytical resources, global research platform and Investment Stewardship team to deliver buy-and-maintain carbon transition portfolios tailored to the specific needs of our clients.

Integrating carbon transition into the investment process does not need to come at the expense of higher financial risks or lower returns. Future technological advancements and regulatory developments will require insurers and pension funds to become “carbon transition ready”, presenting opportunities to diversify risk and enhance more sustainable profitability.

1 Wu, J., Siegert, C., Aguirre, N., Juyvns, V., Lintern, T., Mandel, B. “Weighing the investment implications of climate change policy,” J.P. Morgan Asset Management 2021 Long-Term Capital Market Assumptions.

2 Battiston, S., Jakubik, P., Monasterolo, I., Riahi, K. and van Ruijven, B. “Climate risk assessment of sovereign bonds’ portfolio of European insurers,” European Insurance and Occupational Pension Authority (EIOPA) Financial Stability Report (December 2019).

3 IIGCC, “Paris Aligned Investment Initiative: Net Zero Investment Framework for Consultation” (August 2020).

4 In the late 1990s, the Greenhouse Gas Protocol was established to set accounting standards to measure and manage greenhouse gas (GHG) emissions and encourage companies to report on their emissions via a corporate responsibility report. The GHG Protocol defined three key “scopes” for categorising emissions.

5 Task Force on Climate-related Financial Disclosures, “Final Report: Recommendations of the Task Force on Climate-related Financial Disclosures,” (2017): pp. 42–44.

6 Building stronger portfolios: ESG integration – Investment led, expert driven”, J.P. Morgan Asset Management (July 2020).

7 Source: JP Morgan Asset Management “2022 Long Term Capital Market Assumptions” (8 November 2021).

8 Source: United Nations Environment Programme “Emissions Gap Report” (9 December 2020). https://www.unenvironment.org/emissionsgapreport-2020

9 Source: MSCI and Bloomberg Barclays GBP corporate universe (30 September 2020)

10 “The Green Bond Principles, established by the ICMA, are voluntary process guidelines that recommend transparency and disclosure, and that promote integrity in the development of the Green Bond Market”.

11 Climate Transition Finance Handbook, December 2020.

12 Based on the Bloomberg Barclays Global Corporate universe.

09gn220507101712