Optimistic economic outlook creates opportunity

Recent pessimism over the outlook for the UK economy has made its mark on the valuation of the UK equity market, which is trading at roughly a 40% discount to international markets. The smaller and mid-sized companies that the Mercantile Investment Trust focus on are also currently out of favour, with the mid cap FTSE 250 (ex IT) index, which usually trades at a premium to the FTSE 100, currently trading at around a 5% discount. This phenomenon is typically associated with crisis periods, such as 2008, 2016 or the recent pandemic.

For the Mercantile Investment Trust’s portfolio manager, Guy Anderson, these valuations present an opportunity. While the pervasive pessimism on the UK economy stems from the negative impact that high inflation and interest rates have had on real wage growth and consumer confidence, there are signs that things are now starting to turn round. Real wage growth has been increasing for over a year and consumer confidence has rebounded sharply from historical lows. Potential interest rate cuts and inflation continuing to decline could further boost sentiment.

An improving domestic outlook is important for the Mercantile Investment Trust as the portfolio invests primarily in small and mid-sized UK companies, which tend to have much greater exposure to the UK economy than the more international large cap stocks. For example, 50% of revenue from companies in Mercantile’s portfolio is generated in the UK, vs. 25% for companies in the FTSE 100.

Anderson’s optimism is visible in the Mercantile Investment Trust’s gearing, which has steadily increased since 2022 and is now around 15%, the highest level in over a decade.

Investing in a consumer on the move1

The investment team’s expectation of an improving outlook for the UK consumer is reflected in some of the recent changes to the portfolio.

Additions to holdings in two travel and leisure companies has boosted consumer discretionary exposure to the biggest sector overweight. The holding in Jet2, a low-cost leisure airline based in Leeds, has been increased due to the company’s strong competitive position and on expectations that it will benefit from its Airbus fleet (avoiding recent issues at Boeing) and the continuing trend of consumers spending more on services than goods. A more recent addition to the portfolio has been Trainline, a leading train and coach app that is beginning to benefit from increased mobility and access to rail networks in Europe. The company has quickly taken market share in Spain.

With the post-pandemic consumer backdrop continuing to favour services, Mercantile’s managers have reduced some of the portfolio’s exposure to goods retailers, such as Pets at Home. A long-time position in Watches of Switzerland has also been exited, having generated strong returns for many years. The company is facing a new challenge following Rolex’s acquisition of another supplier and we believe it is maintaining growth targets that are too aggressive.

Repositioning in property and financials

A more positive outlook for the UK Consumer and for mortgage rates has led to a focus on companies related to housing and property, which span a range of sectors. For example, portfolio exposure to homebuilders has been increased by adding to a position in Bellway, which had been trading at an extreme discount to book value of roughly 30%-35%, and by taking a position in Vistry.

One of the biggest changes in the portfolio has been the addition of several property companies. The Mercantile Investment Trust had no exposure to real estate as recently as two years ago—a massive underweight position. Mercantile’s managers started adding some stocks last year, and while real estate is still the biggest portfolio underweight, shares are now owned in a variety of real estate investment trusts (REITs), including Tritax Big Box, Shaftsbury and London Metric Property.

Positioning in financials has also been increased to a small overweight from a modest underweight. A new investment has been made in Pollen Street, a private equity investment firm with its own balance sheet portfolio that recently merged with an investment trust. Mercantile has had success in these type of investments for more than a decade. Meanwhile, two non-life insurance companies, Saber Insurance and Direct Line, have been added to the portfolio.

Continued focus on high quality companies

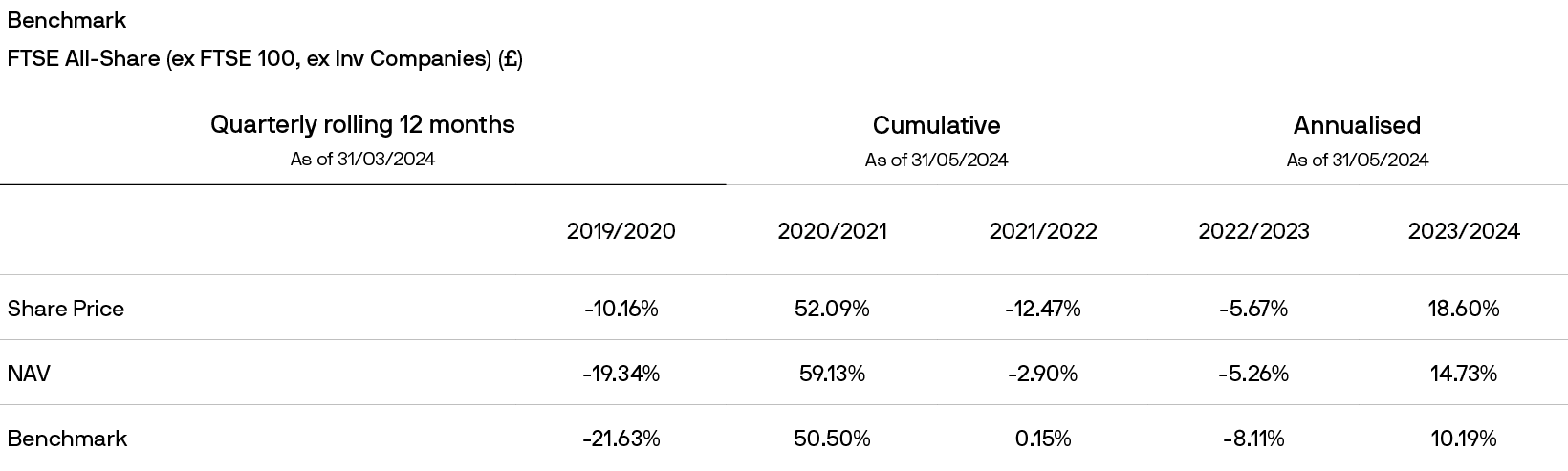

The portfolio’s exposure to specific companies and sectors will continue to evolve with changing economic and market conditions. However, the Mercantile Investment Trust remains focused on investing in high-quality small and mid-sized UK businesses, identified through fundamental, bottom-up analysis—a process that has generated consistent returns ahead of the benchmark over the long term.