With the school year well underway, and Christmas fast approaching, now could be the opportune time for parents to consider their children’s futures and how they can give them the best start in life.

For many, this will include a desire to provide their children with a nest egg to give them a financial head start in life. One of the most tax-effective and simple means of doing this is to open a junior ISA, invested in a suitable investment fund. But which one?

There is, if anything, too much choice. However, parents will have several key requirements, and considering these criteria helps simplify their options. Firstly, they will want the reassurance of investing in a fund that comes with a strong pedigree. The fund will also need a long-term focus, given that the investment will be in place for up to 18 years, and possibly longer, depending on the needs of their child once they turn 18 and gain access the junior ISA. The investment vehicle should also aim to provide strong long-term returns on this money. And the investment vehicle needs to offer high liquidity, to allow the beneficiary to easily withdraw funds to finance gap year adventures, education fees, or a home deposit. It goes without saying that the ongoing management charge needs to be low, especially for such a long-term investment, as high fees paid over many years seriously erode total returns. In sum, the parents need a low stress, steady performer, that will deliver when required.

The Mercantile Investment Trust satisfies all these requirements. The Trust, which invests in the UK’s medium and smaller-sized companies, boasts an impressive pedigree. It has a 140-year history, and with £2.3bn in assets under management1, it is the largest UK equity investment trust. This makes it the flagship investment trust of JPMorgan Asset Management, one of the world’s leading investment managers. As further reassurance, the Mercantile’s managers have a wealth of investment experience, and they have the support of JPMorgan’s large, experienced team of research analysts, including a dedicated team focused on mid and smaller cap stocks, an area of the market that needs careful, firsthand scrutiny, as many companies in this sector are not widely researched by other investors.

The trust adopts the long-term perspective required by an investment that will be in place for up to 18 years, or possibly much longer. The medium and smaller-sized companies it targets have the capacity to grow into larger businesses, but they need time – five to ten years and possibly more - to realise their full potential.

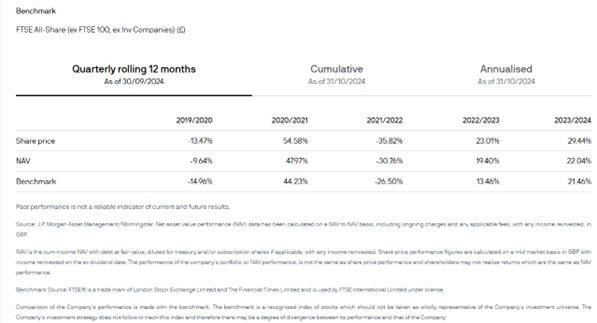

The Mercantile also meets parents’ performance criteria. It has delivered strong gains for its shareholders over the past five years.2 Britain’s medium and smaller companies have, historically, generated higher returns than the UK’s largest companies. This is the case because smaller businesses tend to be innovative, flexible and nimble, and these characteristics help them forge new markets and compete successfully with larger, more hidebound organisations.

In addition to the managers’ skill at identifying tomorrow’s winners, the trust’s performance may also benefit over time from the ability to use gearing, or borrowing money to invest. This can boost performance when the market is rising, or by not being fully invested, provide some downside protection during bouts of market weakness. And of course, the regular dividends paid by the Mercantile can be reinvested tax free in junior ISAs, and this, combined with the benefits of returns which compound over time, can also help grow the pot over the long term.

It is possible for parents to open a junior ISA any time before a child’s 18th birthday, and it is simple to add funds over time via the purchase of more shares. When the child reaches 18, the Mercantile’s size means its shares are highly liquid, and thus easy to access. And if the beneficiary has no immediate need for the funds, the junior ISA will automatically convert to an adult ISA. The trust’s size also provides economies of scale, which it passes on to investors in the form of a very competitive ongoing charge - one of the lowest within its peer group, The Association of Investment Companies (AIC) All UK Companies.3

In all, the Mercantile can be a good choice for parents seeking a fund which will meet their investment requirements, and those of their children, not just today, but more importantly, well into the future. And they can rest easy, knowing their funds are in the care of a team of seasoned professionals with an impressive performance track record.

And now may be an ideal time to start such an investment. Interest rates are on a downward path around the world, and there is great excitement about the potential for the artificial intelligence revolution to transform businesses and boost productivity in many sectors. These factors have provided a significant boost to sentiment in all major equity markets, including in the UK. Yet UK equity valuations are still low, relative to history and compared to other markets, so there are many exciting, attractively valued investment opportunities among the medium and smaller companies targeted by the Mercantile’s managers. This means they are especially well-positioned to continue delivering strong returns and outperformance for their shareholders - young and older - well into the future.

1 The Mercantile Investment Trust website, 19.11.2024

2 The Mercantile Five-Year Performance to 30.09.2024

3 The Association of Investment Companies, 9.10.24. The Mercantile Investment Trust has second lowest ongoing charge of all seven members of the UK All Companies sector.