The UK market has been out of favour over the past few years, but Georgina Brittain, co-portfolio manager of JPMorgan UK Small Cap Growth & Income plc (JUGI) updates on the Trust’s performance, and Simon French, UK Economist of broker Panmure Gordon argues that the UK economy is in better shape than generally thought and is set to improve.

Times may have been pretty bleak for the UK market in general, and small companies in particular, but for the JPMorgan UK Small Cap Growth & Income investment trust (JUGI) management team there has been plenty to cheer about recently.

For a start, the merger between the JPM Mid Cap Investment Trust and JPM UK Smaller Companies Investment Trust finally completed at the end of February. The result, renamed JUGI, is more liquid and lower cost with over £500 million under management1, while its enhanced dividend policy promises a 4% yield from total returns, enhancing its appeal for income investors with a nose for growth.

Moreover, although the market has struggled, numerous individual companies within this dynamic, but deeply unloved, part of the market have produced outstanding returns – and as stock pickers, the JUGI team have a powerful nose for those opportunities.

Smaller companies can produce eye-watering returns

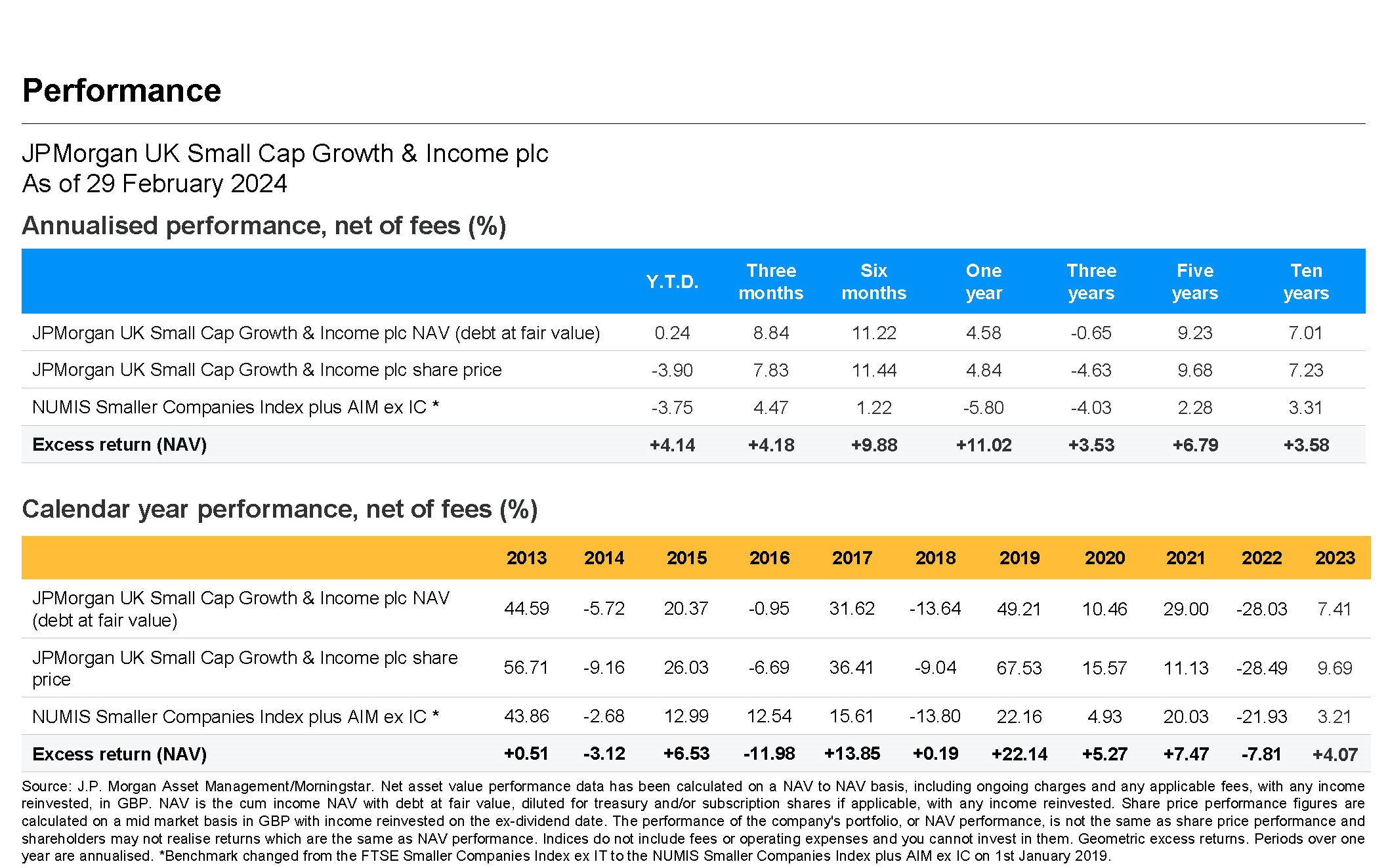

JUGI’s excess NAV return of 11% over the 12 months to end February, against the benchmark index (Numis Small Companies plus Aim)2, speaks for itself. But this is no flash in the pan: the trust has produced top-quartile performance over all time periods.

As co-manager Georgina Brittain points out: “Over the past five years the UK has been out of favors, yet the fund has made almost 10% a year on average. That’s in the bad times – and the good times will return in due course.”3

She stresses the ability of the strongest small companies in the portfolio to produce eye-watering returns even against this backdrop. Over the 12 months to end February, eight of the 10 top performers grew by more than 30%, while the highest performer, Ashtead Technologies, returned 129%4.

UK economy is improving, and fast

There is growing evidence that the good times could be on their way sooner rather than later, too. Simon French, UK Economist at JUGI’s broker Panmure Gordon, points to several macroeconomic indicators that give cause for optimism regarding the UK economy – the key bellwether for small businesses.

First, real incomes are growing again, with February’s CPI inflation down to 3.4% from 4% in January, and nominal incomes now rising by around 5-6%.5

“The Office for Budget Responsibility’s November 2023 forecast was for the steady decline of real purchasing power through 2024/25, but actually since Q4 2023 we have seen strong disinflation, especially for the price of gas, which is feeding through to wider food and services prices,” explains French.

Secondly, after decoupling from wider global trends in 2023, UK inflation is no longer far adrift from the rest of the G7, with the spread between the two at its lowest level for two years. Recoupling with broader inflationary trends will help boost investor confidence, French says.

However, he anticipates that the Bank of England will want to see the seasonally adjusted data for April in order to gauge how persistent inflationary pressures might be, before making any changes to interest rates. “We’re expecting rates to ease in August,” he adds.

Thirdly, household balance sheets are historically strong as households have ‘de-geared’ their debt over the past 15 years. As French observes: “At the time of the financial crisis in 2008, UK households were burdened with net debt of around £650 billion, but now they’re more or less debt neutral.”6

In fact, people’s focus on debt reduction rather than consumption is one reason why the UK economy has grown so sluggishly, given that household spending underpins around 60% of UK GDP. However, looking forward, French sees those healthy balance sheets as a positive for the resilience of UK consumer spending.

Conditions right for a dramatic upturn in performance

So is the time coming for small company performance to roar again? Apart from the macroeconomic drivers, Brittain highlights a number of reasons why she and the team believe the conditions are right for a dramatic upturn in performance.

“Valuations are the start and the end of outperformance, and they are now at extremely low levels, especially in regard to free cash flow (FCF) yields [which show free cash flow as a proportion of share price and indicate a company’s capacity to reduce its debt, pay dividends and facilitate growth],” she says.

To put that into context, a 4% FCF yield is typically considered to indicate decent value; the benchmark index is on 5% at present, while JUGI’s portfolio sits on more than 7%. “These are not normal numbers – small companies are still very, very undervalued,” she adds.

Additionally, small companies themselves are currently “the only buyers in town” for small-cap shares, carrying out regular buybacks on these rock-bottom valuations. “But when outflows stop and other buyers come back in, we do expect the market to move,” says Brittain.

Merger activity is already picking up within UK plc, with two or three deals a week, focusing particularly on the small companies’ space where bargains are most obviously in evidence. JUGI participated in just one takeover in 2023 but has already seen a couple this year with another in the pipeline, and here too Brittain anticipates busier times ahead.

Patience remains the name of the game, but JUGI is strongly positioned to produce a sustained and full-throttle roar as sentiment improves for the UK smaller companies’ market.