It is still a close call as to whether or not the US economy will enter a recession. While we believe that the risks for a mild recession remain, we think slow growth will be the most likely outcome.

As we head towards the end of the year, economists will begin penning their outlooks and suggested portfolio allocations for 2024. It appears there are still two consensus projections for economic growth next year: a soft landing or a recession. To be clear, we are biased to the former over the latter, but there is considerable uncertainty around the outcome.

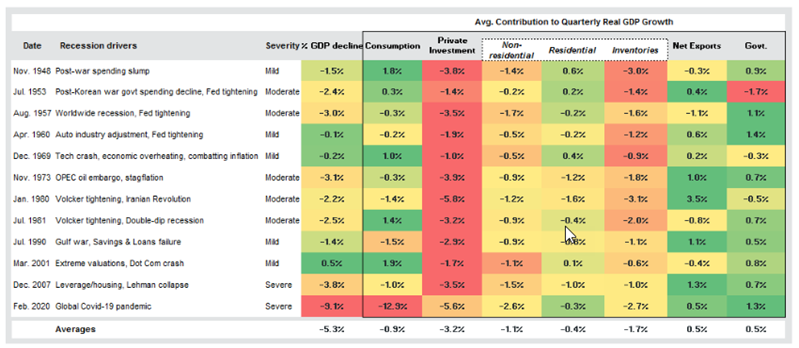

While no two recessions are the same, looking at previous recessions could help inform forecasts for today’s economic outlook. Our recession heatmap provides several interesting takeaways:

- Consumption: While consumption accounts for roughly two thirds of economic activity and typically contracts during recessions, investors may be surprised to see that there have been mild-to-moderate recessions where consumption remained positive.

- Private investment: Capital spending tends to correct materially during recessions, likely driven by the very cyclical nature of inventories and business fixed investment. Housing, on the other hand, tends to be stable with the sector showing modest declines on average.

- Net exports: The US trade balance has often made a positive contribution to growth during recessions. The reason could be because demand for US goods increases relative to US domestic demand when other major economies around the world are stronger than the US economy. However, the US trade deficit tends to worsen when the economy is growing. Therefore, a more likely reason may be that the decline in domestic US demand during a recession curtails imports to a greater degree than exports.

- Government spending: Fiscal support and thereby deficits tend to increase during recessions to offset a weakening economy.

US Recession Heatmap

Looking ahead to 2024, we are cautious on consumption given the potential impact of higher interest rates, depleted savings, higher credit card balances, softening labour markets, and potentially higher gasoline prices on incomes and consumer confidence. That said, consumers have been resilient all year and given consumer balance sheets have been largely catered to low interest rates, absent a significant rise in unemployment, consumption could slow but remain positive.

Within private fixed investment, subsidies and grants via the Inflation Reduction Act, and the CHIPS and Science Act – as well as enthusiasm around generative artificial intelligence – could keep capital spending on equipment and structures and intellectual property rights on solid footing, even under higher interest rates. Residential housing, we believe, may finally stabilise at 7% mortgage rates given a chronic shortage of inventory, incentivising a modest uptick in construction activity. Inventories remain a wild card, but we don’t see signs of an excessive build-up – or boom – in inventories through year-end that would cause a recessionary bust next year.

We suspect net exports won’t materially impact the growth outlook next year but could be net positive for exporters if the dollar declines as the rest of the world recovers while growth in the US slows. Should Congress successfully approve 2024 funding proposals, government spending is likely to continue its trend as a boost to GDP given deficits are expected to rise in the years ahead.

In general, there are several offsetting factors that will impact the economy next year. Suffice to say, it is still a close call on whether the economy will enter a recession or not, but we do believe that while risks of a mild recession remain, slow growth is the most likely outcome.

J.P. Morgan Asset Management’s investment trust offering includes two leading US equity focussed trusts.

More Insights

This is a marketing communication. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are, unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and may be subject to change without reference or notification to you. The value of investments and the income from them may fluctuate in accordance with market conditions and investors may not get back the full amount invested. Past performance and yield are not a reliable indicator of current and future results. There is no guarantee that any forecast made will come to pass. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. This communication is issued in Europe (excluding UK) by JPMorgan Asset Management (Europe) S.à r.l., 6 route de Trèves, L-2633 Senningerberg, Grand Duchy of Luxembourg, R.C.S. Luxembourg B27900, corporate capital EUR 10.000.000. This communication is issued in the UK by JPMorgan Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority. Registered in England No. 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.

09zd231810085331