Invest in the heart of America – the case for US smaller companies, part 1

Investing in smaller companies has historically generated higher long-term returns than in larger companies. This “size premium” has been shown to exist in several important academic studies over the years, which have examined decades of financial market data1.

Smaller company outperformance doesn’t come in a straight line, however. There have been long periods in the past in which they have underperformed larger companies, including in the US in recent years. In this article, the first in a two part series, we look at the reasons why smaller companies tend to outperform in the long run, with specific reference to the attractively deep and diverse US small cap market and the opportunity that likely lies ahead for the JPMorgan US Smaller Companies Investment Trust plc.

Unlike large, established companies, smaller companies have a longer runway of growth ahead of them. From a smaller starting size, they can expand faster and for longer than larger companies, which have typically already experienced the higher growth phase of their life cycle.

The mathematics here are simple – it is easier for a smaller company with a market capitalisation of, say, $5bn to deliver $500m of additional annual sales for a growth rate of 10%, than it is for a company with a market capitalisation of $500bn to produce the same rate of growth. The larger company in this example, would need to find $50bn of additional sales to deliver 10% growth. This is not an impossible task, but it is clearly a more challenging prospect for a large business to sustain high rates of growth than it is for a smaller company.

In addition to their growth advantage, smaller companies are typically less well researched than large caps, which leads to the prospect of greater valuation anomalies. With limited analyst coverage, the attractions of smaller company stocks sometimes go unnoticed by the wider market, allowing experienced investors to uncover undervalued opportunities before they are widely recognised. This less efficient pricing environment we believe makes small caps a fertile landscape for active managers and positions them for substantial potential returns over the long term.

Why US small caps?

For a long time, the United States has possessed a very attractive small cap sector, in large part because of its dynamic culture of innovation and growth. US companies are born into a corporate environment that values entrepreneurship and creativity. The successes of the past have allowed it to build a supportive business ecosystem that is adept at providing the ingredients that smaller companies need to fulfil their long-term potential. These smaller companies are, in a sense, the beating heart of American economic progress, representing the country’s drive and adaptability, and playing a key role in its long-term economic success.

Furthermore, US smaller companies tend to be more focused on domestic markets, making them less vulnerable to international trade tensions, currency fluctuations and broader global economic headwinds. This domestic orientation means they are well-placed to benefit from momentum within the US economy and other structural shifts, such as recent initiatives aimed at bringing manufacturing back to the US. Programs like the CHIPS Act and federal spending on infrastructure are directing billions into US-based industries, creating a supportive backdrop for smaller American companies involved in sectors such as technology, manufacturing and logistics.

Why the JPMorgan US Smaller Companies Investment Trust?

Investing in small caps is a specialised field in which experience is key. The team behind the JPMorgan US Smaller Companies Trust (JUSC) brings a rare depth of expertise to this area. J.P. Morgan has long been acknowledged as a leader in US equity markets, benefiting from decades of experience and a global research infrastructure that allows it to identify and access trends and opportunities across industries. This broader expertise in US equities provides a strong foundation on which the dedicated JUSC team builds its focused small cap strategy.

The JUSC investment team itself, led by Don San Jose, has a well-honed ability to identify and capitalise on the market inefficiencies that are so abundant in the US smaller company universe. San Jose has led the portfolio since 2008, and he is supported by co-managers Dan Percella and Jonathan Brachle. With an average of 22 years of industry experience (including an average 19 years with J.P. Morgan), the team is highly skilled in conducting detailed, bottom-up research.

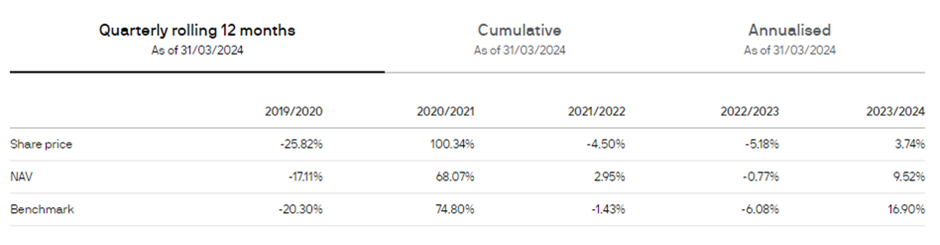

The team’s investment approach is disciplined and quality-focused, centring on companies with sustainable business models and strong fundamentals. By following a robust and disciplined investment process, the team has developed a proven track record for identifying high-quality businesses with excellent long-term growth potential and backing them for long-term success, as the performance data well demonstrates.

With considerable experience in this specialist area of investing, Don San Jose and his team are very confident about the opportunity that lies ahead for investors looking to invest in the heart of America. In part two of this series, we will look at the reasons why investment trusts represent a highly suitable vehicle for investing in US smaller companies and why their prospects may be especially favourable in the current environment. Plus, we’ll explain why Trump’s victory in the US Presidential election could further enhance the appeal of US smaller companies.