Income and growth without compromise with a European heart

May 2024

This is a marketing communication

The market backdrop for Europe continues to improve, despite investor attention remaining on the US and its “Magnificent Seven”. With discounts against the US at near-record levels, is now the time to invest in Europe? In this article, portfolio managers of JPMorgan European Growth & Income plc, Alexander Fitzalan Howard and Timothy Lewis, reveal the reasons they believe Europe presents an investment opportunity not to be missed.

While the US market’s robust performance has dominated headlines over the past six months or so, driven by a handful of tech mega stocks, canny long-term investors have had an eye to the strong recovery taking place in European markets.

What makes the current situation particularly interesting is the fact that although European stocks have performed so competitively, they remain deeply out of favour, sitting at near-record discounts to their US counterparts.

Europe’s Magnificent Seven: Tech and Beyond

“However, investors do finally seem to have realised that there is a world beyond the US’s Magnificent Seven tech-dominated leaders,” observes JEGI co-manager Alexander Fitzalan Howard.

He makes the important point that the constituents of European markets have changed dramatically over the past couple of decades. The region’s largest businesses are no longer drawn from worthy but dull sectors such as telecoms and energy, but from more dynamic, forward-focused industries including technology, healthcare and luxury brands.

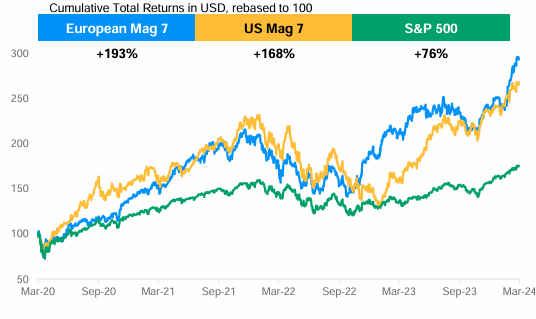

Indeed, over the four years since the start of Covid in March 2020, Europe’s own Magnificent Seven leading companies have soundly beaten their US peers, producing total cumulative returns of a meaty 193% against the US’s 168%¹.

Fitzalan Howard argues that while many investors are keen for a piece of cutting-edge tech action, they have other options beyond the big US names. “If you want exposure to AI, you don’t have to buy Nvidia like everybody else,” he says.

“Why not consider ASML, which makes the tools needed to make the advanced chips, or Schneider Electric, which does the power management, crucial for AI data centres?” Europe provides rich pickings for investors looking for high-quality, growth-oriented, profitable companies - and unlike the US, they are still very attractively priced.

An improving macro outlook for Europe

For the JEGI managers, there are several respects in which Europe is well-placed in macroeconomic terms for a powerful bounce-back in due course.

First, says Fitzalan Howard, Eurozone inflation has been falling steadily in recent months and now stands at a very manageable 2.4%². In contrast, US inflation is proving stickier than anticipated, and the US Federal Reserve is not now expected to cut interest rates before late 2024.

“It therefore looks as though the ECB will cut rates first, which should be bullish for European equities,” he adds.

At the same time, the outlook for growth in the Eurozone is improving. On the consumer front, real wages growth has turned positive, driving an upturn in consumer confidence.

Nonetheless - and in contrast to the US, where savings levels have been falling for the past three years – people in Europe are still adding to their savings. “That means there’ll be plenty of firepower when sentiment improves.”

As far as manufacturing is concerned, the inventory correction that took place in the aftermath of the pandemic has run its course, and businesses are once again seeing growth in new orders. The Eurozone Purchasing Managers Index (PMI) is climbing once again as confidence picks up, and is predicted to “go above 50 in the summer”.

This augurs well for broader business performance too. “Historically, where the PMIs go, earnings revisions tend to follow - so the outlook for European earnings is starting to get better,” Fitzalan Howard explains.

Finally, despite the improving climate, European markets are sitting at extreme discounts to the US. The MSCI Europe index is trading at around 35% below the MSCI US, compared with a long-term average of around -15%³, with huge discounts in evidence across the range of investment indicators, from price-to-earnings and price-to-book ratios to dividend yield.

“As the outlook brightens, investors are likely to recognise the extraordinary good value available here,” comments Fitzalan Howard. Falling inflation, rate cuts and earnings pick-ups will also help to revive deeply unloved parts of the market, with the likes of cyclicals, banks and small cap businesses all feeling the benefit, he adds.

JEGI: Disciplined stock selection reaps rewards

For investors keen to take advantage of the current wealth of opportunity among European stocks, JEGI provides a robust route into this rich but under-appreciated market.

Co-manager Timothy Lewis points to the combination of rigorous quantitative research and deep, stock-specific fundamental analysis that goes into the building and maintenance of JEGI’s portfolio – a reflection of the breadth of JPMorgan’s resources.

That approach has self-evidently paid off. The Trust has consistently outperformed the benchmark, MSCI Europe ex UK index, producing strong absolute returns while limiting volatility – and has achieved this over short and long-term time periods, in both growth and value-dominated market environments, and when markets are falling as well as when they’re rising⁴.

The aim, says Lewis, is to keep JEGI’s portfolio inherently well-diversified, but with a focus firmly on “long-term global structural growth trends where European companies are well-placed to benefit”.

These themes include health and wellbeing, with holdings such as pioneering weight-loss drug manufacturer Novo Nordisk and L’Oreal, a leader in skincare products with pharmaceutical ingredients; the transition to a low-carbon world, through the likes of electric cable manufacturer Prysmian; and interest rate normalisation, via bank stocks such as the highly profitable Unicredit.

As the macro backdrop improves, the wealth of well-run companies with positive momentum at historically low prices undoubtedly makes this an exciting time for the JEGI team – and an outstanding opportunity for investors.