It’s been easy for investors to come up with reasons to be negative on European equities. Indeed, over the past 10 years, Europe has been impacted by many global macroeconomic headwinds—the pandemic, the war in Ukraine, rising inflation and interest rates—as well as more specific European challenges, including reducing its reliance on Russian gas, sluggish economic growth and rising populist movements shaking up the political landscape.

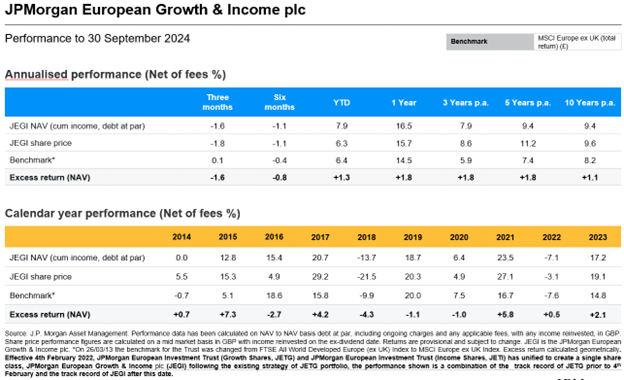

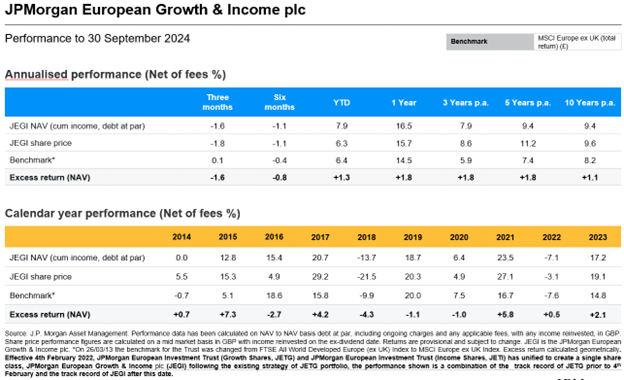

Despite these challenges, over the past 10 years, the NAV of the JPMorgan European Growth & Income plc (JEGI) has increased over 9% per annum—over a full percentage point above the benchmark’s annualised return over 10 years1.

Investors are negative, the data looks more positive

As the US economy and stock market continue to exceed expectations, many investors don’t have the same level of confidence in Europe’s economy or stock markets. Concerns about European macro has become the consensus view, even more so since the US election.

However, a closer look at the data reveals early signs of recovery in Europe. While many industrial businesses remain weak, the European purchasing manufacturers’ index is improving and financial conditions across the eurozone are starting to ease from the tightest levels seen in the past 15 years. The European Central Bank (ECB) has started cutting interest rates, which are expected to normalize back down to 2%.

Importantly, the consumption is finally showing signs of picking up. The strong post-Covid consumer rebound in the US was more muted in Europe because of war in Ukraine, high energy prices and inflation. Consumer confidence and retail sales are now improving and positive wage growth should help sustain the trend. J.P. Morgan Asset Management’s consumer research analysts in the US note that the European consumer is an unexpected area of strength for some of their companies while JEGI’s portfolio managers are seeing signs of improving consumption in consumer-exposed companies in the portfolio.

Do European companies deserve a discount?

Investors often dismiss the persistent valuation discount of the European equity market to the US equity market as structural. The European equity indices have more cyclical and value-type companies that typically trade with lower valuations compared to the S&P 500, which benefits from the higher valuations of technology companies.

However, a closer look at European and global markets shows that the discount persists within sectors and for no discernable reason. Across every single sector, European stocks, on average, trade at wide discount to their global peers. Consider the following pairs of stocks with similar fundamentals, but where the European company trades significantly lower than a comparable global one on 12-month forward earnings: Rolx trades at 28x vs. Thomson Reuters (Canada) at 41x; Novo-Nordisk trades at 29x vs. Eli Lilly (US) at 44x and Michelin trades at 9.5x vs. Bridgestone (Japan) 10x2. Just closing these valuation gaps could support performance of European equities.

Key themes across the portfolio

JEGI’s investment team covers 1300 European companies across the market capitalisation spectrum and looks for businesses that have a combination of quality, value and momentum to construct a portfolio based on individual stock prospects. From this bottom-up stock selection process, four key themes emerge:

- Spending on health and wellbeing is projected to continue increasing, benefiting a wide variety on JEGI’s companies including Danish pharmaceutical company Novo Nordisk, which manufactures the blockbuster diet drug Wegovy; Glanbia, an Irish dairy business; and Italy’s Essilor Luxotica, a high-end eyewear company that is fitting hearing aids into eyeglasses.

- Transitioning to a low-carbon economy is underway in Europe and several portfolio holdings will play important roles. Italy-based Prysmian has a 34%–40% global market2 share of submarine high-voltage cables that are critical to helping the energy grid expand. The company recently made an accretive acquisition in the US and has revised earnings up. Two French companies, Schneider Electric, a global leader in digitising and automating energy management, and Spie2, an energy services company, provide additional exposure to the energy transition theme.

- Interest rate normalisation is expected to continue in Europe. JEGI has high exposure to European banks, with a large position in Unicredit, a well-capitalised bank that pays a large dividend while also buying back shares. The portfolio’s holding in Nordea and ING Group are also well positioned to benefit in an environment where interest rates are around 2.0%–2.5%,3 the most profitable level for European banks.

- Resilient consumers are expected to begin spending again. JEGI has exposure to travel-related companies, such as Irish budget airline Ryanair, and apparel manufacturers with global footprints, including Spain’s Inditex and Germany’s Adidas.

JEGI’s portfolio managers use long-term stock selection and focus on portfolio construction to generate modest returns above the benchmark that can compound over time—and can help limit drawdowns in volatile markets. This time-tested investment approach has generated consistent outperformance across one, three, five and 10 years.

Sources :

1

Past performance is not a reliable indicator for current and future results.

J.P. Morgan Asset Management. Performance and AuM data as at 30 September 2024. Performance data using net asset value per share, cum income, with debt at par value in GBP. Geometric excess returns. Please note Benchmark Indices do not include fees or operating expenses and are not available for actual investment. Benchmark is the FTSE All-Share (ex FTSE 100, ex Investment Companies) Index.

2 J.P. Morgan Asset Management, Bloomberg. Data shown from 31 March 2023 to 30 April 2024.

3 Factset November 2024.