Fund and investment trust charges

Entry Charge

This is the maximum that might be taken out of your money before it is invested in the Fund. For example if you invested £100 and an entry charge at 3% was applied, it means that £97 of your money would be used to buy shares in a fund. This covers the costs of setting up your investment.

Exit Charge

There are no exit charges for any of the J.P. Morgan OEIC funds.

Performance Fees (Funds)

There are currently no performance fees charged on most of the J.P. Morgan OEIC funds. Please check the fees section of the individual fund page for more information on performance fee charges.

Service charges

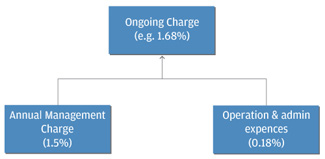

Ongoing Charges (Funds)

This is based on last year's expenses (excluding performance fees). It covers all aspects of operating the fund during the year, including fees paid for investment management, administration and the independent oversight functions. Where the fund invests in other funds, the figure includes the impact of the changes made in those other funds.

J.P. Morgan fund example

Ongoing charge collected by J.P. Morgan

Ongoing Charges (Investment Trusts)

Ongoing charges are the management fee and all other operating expenses, excluding interest charges on any borrowing and any performance fee payable expressed as a percentage of the average daily net assets during the year. All figures are for the previous financial year. The management fee is calculated on the market capitalisation of the company. The ongoing charges percentage can therefore be lower than the management fee rate if the company historically trades at a discount as the net assets will be higher than the market capitalisation.

Transaction Costs

Funds incur transaction costs, made up of stockbroker commissions and transfer taxes, as a necessary part of buying and selling a fund's underlying investments in order to achieve the investment objective.

A significant proportion of these transaction costs are recovered directly from investors joining or leaving a fund. This is known as a dilution adjustment and further information is contained in the Dilution Adjustment section of the Prospectus.

The transactions costs figures detailed in the table are the average of the previous three financial years as a percentage of the Net Asset Value of each fund. For funds with less than a three year record (i.e. have been launched in the last three years and therefore do not have three years of financial accounts) the figures will reflect either the average of the last two financial years or the most recent financial year depending on the launch date of the fund.

In the case of shares, transaction costs are paid by a fund on each transaction. In addition, there is a dealing spread between the buying and selling prices of the underlying investments. Unlike shares, other types of investments (such as bonds, money market investments, derivatives) have no separate identifiable transaction costs; these costs form part of the dealing spread. Dealing spreads vary considerably depending on the transaction value and market sentiment.

Comparing transaction costs for a range of funds may give a false impression of the relative cost of investing in them for the following reasons:

- Transaction costs do not necessarily reduce returns. The net impact of dealing is the combination of the effectiveness of the manager's investment decisions in improving returns and the associated costs of investment.

- Historic transaction costs are not an effective indicator of the future impact on performance.

- Transaction costs for buying and selling investments due to other investors joining or leaving a fund may be recovered from those investors (dilution adjustment). Transaction costs vary from country to country.

- Transaction costs vary depending on the types of investments in which a fund invests.

- As the manager's investment decisions are not predictable, transaction costs are also not predictable.