A summary of the latest trends in the markets (Januray 2026)

2025 marked another year of global resilience and strong returns, even amid a policy storm in the US. The S&P 500 is up 13% year-to-date, driven by robust earnings and persistent AI enthusiasm. International equities are outperforming the US by 1,500bps—the largest margin since 1993—buoyed by reforms and a weaker dollar. Global fixed income offered attractive yields amid policy uncertainty. Meanwhile, global fixed income markets offered attractive yields amid policy uncertainty. Beneath the surface, however, the US economy shows increased divergence: affluent households benefit from wealth effects, while middle and lower-income consumers face pressure and rate-sensitive sectors like housing remain soggy. Policy shifts—most notably higher tariffs, a new fiscal package (OBBBA), and reduced immigration—began to reshape the macro landscape, setting the stage for a more complex 2026.

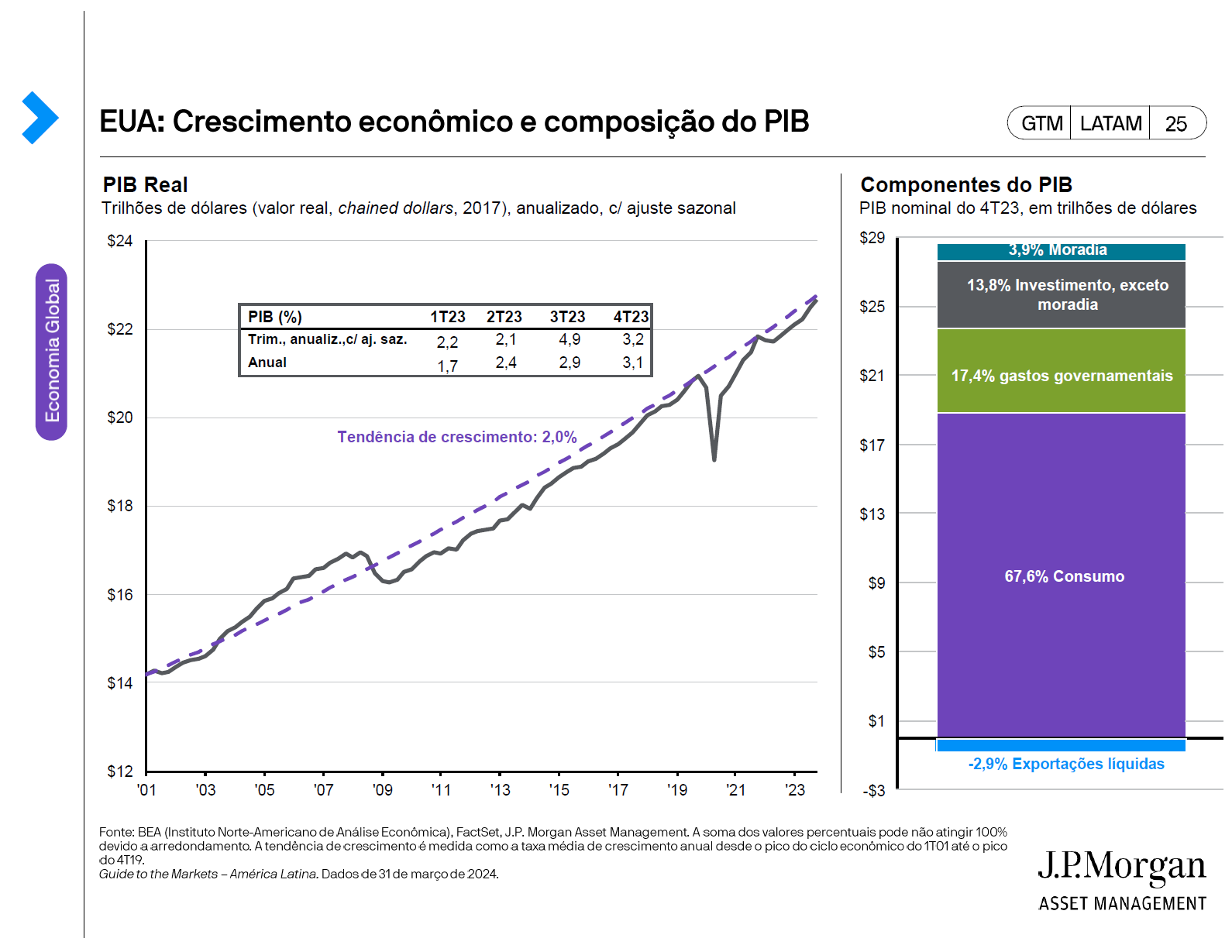

The US economy enters 2026 in a continued K-shaped expansion. After a lowdown in 4Q25, where real GDP growth is expected to decelerate to roughly 1%, with real GDP growth near 1%, the first half of 2026 should see a temporary lift above 3% as the stimulative impact of tax refunds and capex incentives from the OBBBA flows through. This surge is likely to fade, with growth moderating to 1–2% later in the year as stimulus wanes and tariff costs reach consumers. Lower immigration and companies in a “no hire, no fire” state keeps job growth subdued but prevents sharp unemployment increases; the rate should peak at 4.5% in early 2026 before declining. Inflation is expected to rise through mid-year, peaking below 4%, then fall toward 2% by year-end as energy and shelter costs ease. While the baseline forecast is for a “cold, hot, cold again” pattern, the range of alternative scenarios is unusually wide, with policy and market risks—such as Supreme Court rulings on tariffs, further fiscal stimulus, or shifts in AI investment—potentially altering the trajectory. Investors should be prepared for a bumpier ride beneath the surface, even as headline economic indicators appear stable.

Fed policy remains central, with the committee divided between persistent inflation and a softening labor market. Markets expect the Fed to reduce rates 2–3 times through 2026, but the easing path will likely be shallow and patient, as officials weigh risks to both sides of their mandate. Rate volatility may flare up as markets recalibrate expectations, and the Fed’s stance could shift in response to evolving data and political pressures.

Fixed income remains a portfolio anchor in 2026, with the environment favoring income generation and careful curve positioning. With the Fed likely to proceed with a shallow easing cycle (barring a recession), long-term rates should remain range bound and modest curve steepening is expected. The preferred “sweet spot” appears to be in the 2–3 year part of the curve, where investors can balance attractive yields with flexibility should the rate outlook shift. Investors should continue to embrace income, particularly in corporate credit, underpinned by solid corporate and household balance sheets. Active security selection and a preference for quality is paramount to balance macro risks. Global bonds, particularly in developed markets and emerging local currency debt, provide additional diversification against U.S.-specific risks, such as its rising debt levels.

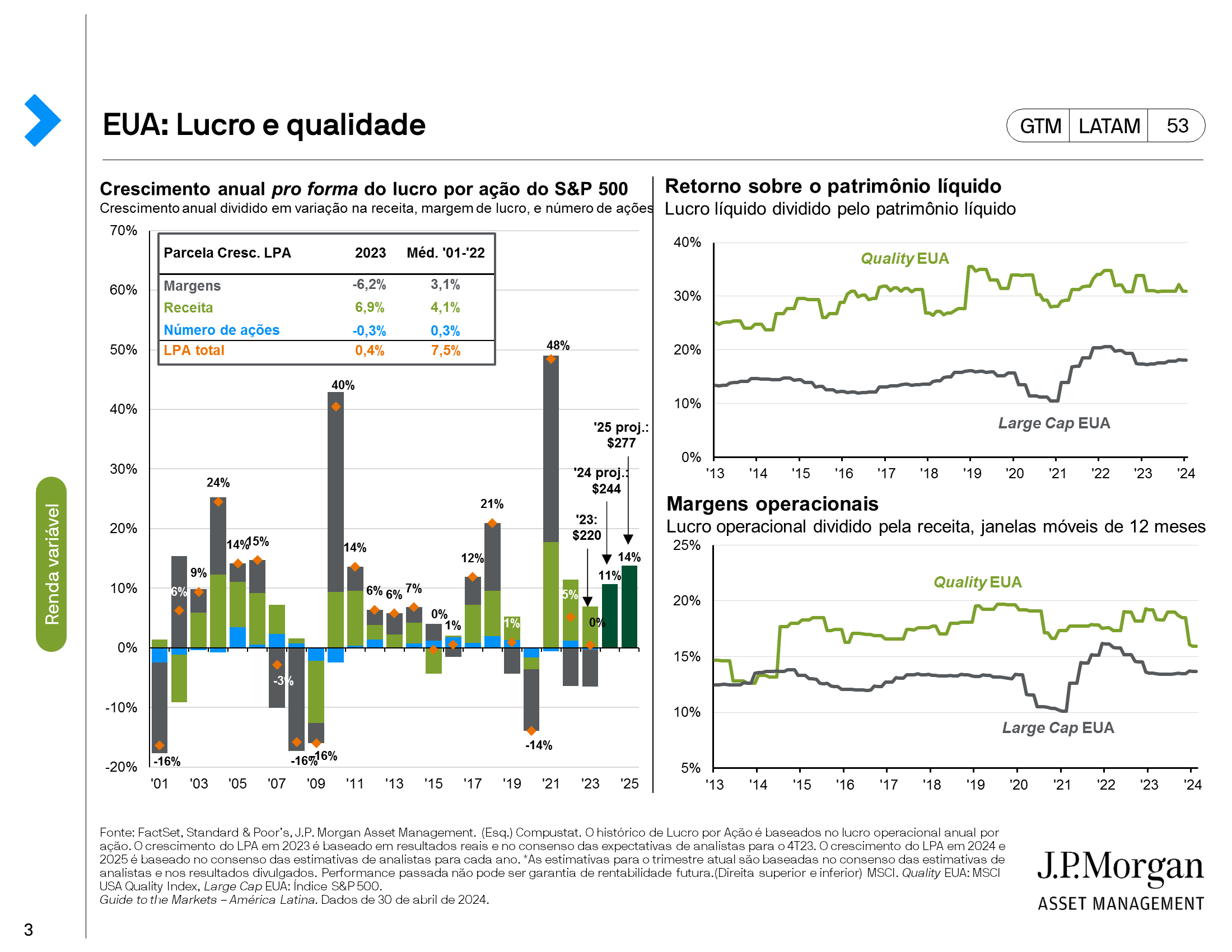

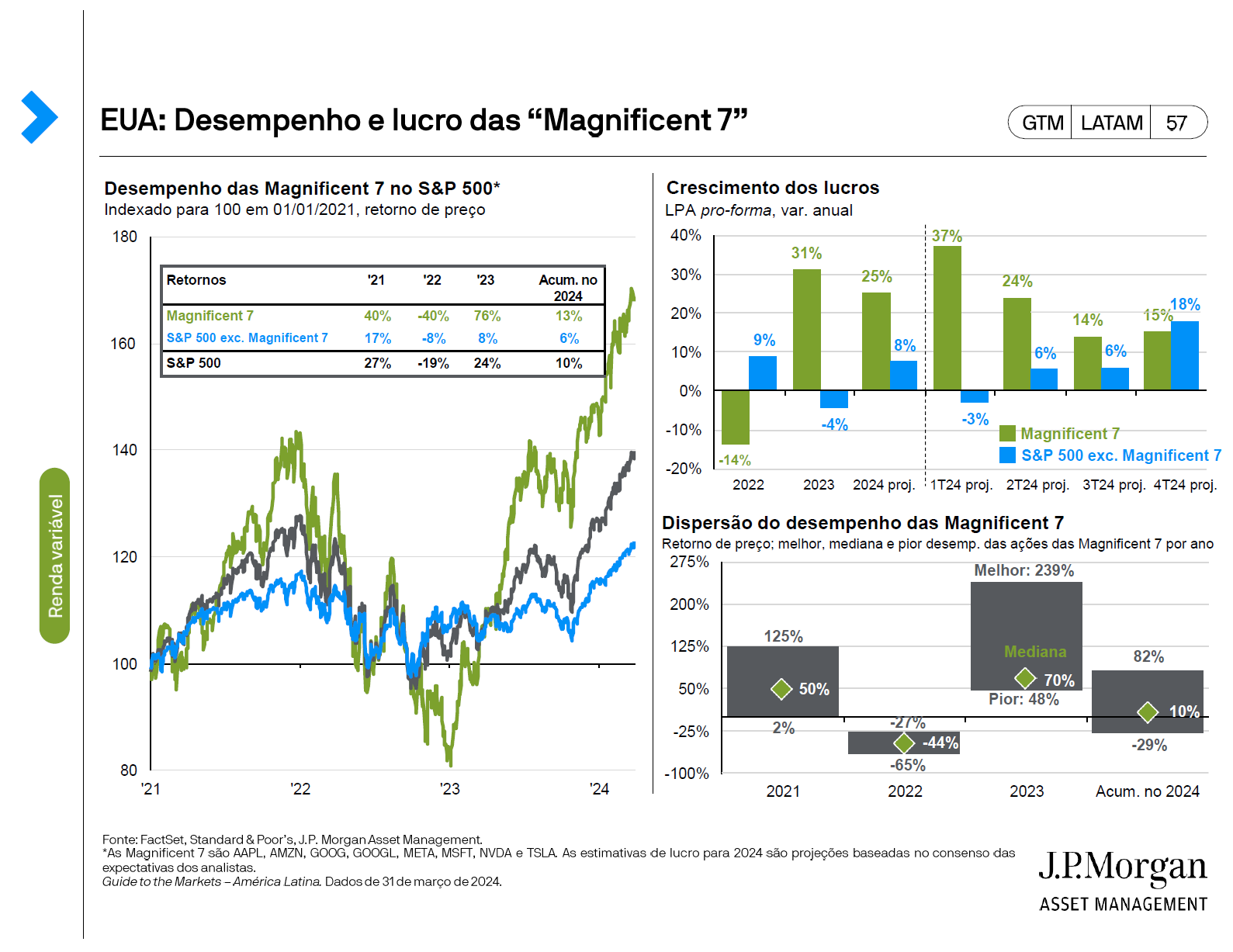

US equities valautions are still expensive, but profit growth is strong, with four quarters of double-digit earnings growth and S&P 500 earnings expected to rise 13% in 2026. The “Magnificent 7” continue to drive returns, though earnings growth is gradually broadening. AI investment is financed by cash-rich firms, with tech sector free cash flow margins near 20%, more than double late 1990s levels, underscoring robust profitability and the capacity to self-fund AI investment. While the sector’s fundamentals are strong, expectations are high and markets remain vulnerable to missteps—be it in adoption rates, supply constraints, or external shocks. The stakes are high and visibility into the ultimate winners remains limited, but this looks less like a bubble and more like the tumultuous beginnings of a structural transition. Selectivity and balance are critical: while growth sectors have obvious appeal, investors should also look to resilient value sectors such as financials, which benefit from deregulation and curve steepening.

International markets have emerged from a long period of underperformance, posting strong returns led by multiple expansion and a weaker US dollar. This has further room to run, as the earnings growth gap with the US is narrowing, with about 10% growth expected outside the US in 2026, as global activity remains resilient and tariff uncertainty fades. Structural themes underpin this outlook: positive nominal growth and the end of negative rates have transformed European and Japanese companies; the AI theme is broadening, supporting tech in Korea, Taiwan, Japan, and emerging markets; fiscal stimulus is accelerating, and shareholder-friendly policies are spreading. International markets also offer dividend yields twice those of the U.S., and valuation discounts remain deep.

The opportunity set for 2026 is broad, but risks are elevated. Portfolios remain offsides after years of U.S. and growth outperformance; now is the time to rebalance toward diversified exposures across equities, fixed income, and alternatives. Maintaining balance, embracing selectivity, and staying attuned to policy and macro risks will be essential.

For important information, please refer to the homepage.

This content is intended for qualified investors and is part of the educational material available for download through this page. We recommend reading the document for complete access to the information and its respective disclaimers.