Environmental, social and governance (ESG) factors are increasingly used alongside traditional financial metrics to gain a better understanding of the risks linked to the sustainability of any investment. There are many ways in which these factors can be incorporated into an investment process, depending on how investors want to align their financial objectives with their values. A notable development we’ve seen most recently is an evolution from investors simply focusing on mitigating ESG risks and employing exclusionary frameworks, to also considering the potential opportunities ESG investing can offer and aligning portfolios accordingly.

What is ESG?

Why are investors paying more attention to ESG factors?

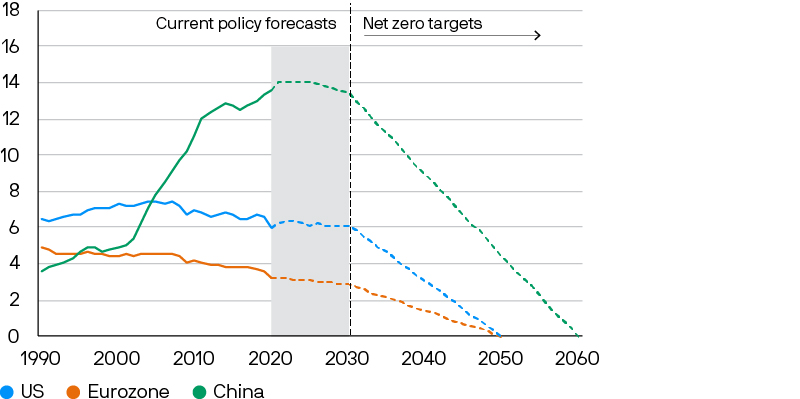

Government policy is the first driver. On the environment, for example, the Paris Agreement has created significant momentum behind tackling climate change since it was signed in 2016, with the goal of limiting global warming to well below 2 degrees Celsius compared to pre-industrial levels. More than 70 countries and regions – representing over 75% of global greenhouse gas (GHG) emissions – have now set ambitious targets to slash emissions over the coming decades, yet progress remains limited so far (see Exhibit 1).

Exhibit 1: Greenhouse gas emission targets

Billion tonnes / year, CO2 equivalent

Source: Climate Action Tracker, J.P. Morgan Asset Management. Current policy forecast is the September 2021 forecast provided by Climate Action Tracker for the US and EU, and the May 2022 forecast for China. CO2 equivalent tonnes standardise emissions to allow for comparison between gases. One equivalent tonne has the same warming effect as one tonne of CO2 over 100 years. Guide to the Markets - UK. Data as of 30 June 2022.

Significant policy changes will be required to get the climate trajectory back on track, both in the form of “carrots”, such as new spending on climate-friendly projects, and “sticks”, which include new taxes and regulations. In response, we’ve seen the creation of several private sector initiatives to align with the goals of the Paris Agreement, such as the Net Zero Asset Managers Initiative (NZAMI) and the Net Zero Asset Owners Alliance (NZAOA). Through setting targets and requirements for signatories, such as setting interim net-zero portfolio targets, these initiatives aim to translate the science into concrete actions and facilitate the transition across the investment landscape.

Major changes to the global energy mix are a key pillar of climate ambitions. Renewables make up less than 10% of the energy mix today, but estimates from the BP Energy Outlook 2020 suggest that they will need to increase to around 60% over the next 30 years if net zero targets are to be reached. This shift may pose major challenges for industries that are heavily reliant on fossil fuels while also creating opportunities for companies that can facilitate the transition, which highlights the importance of reflecting environmental factors in any investment decision. (We discuss these trends in more detail in “Achieving net zero: The path to a carbon-neutral world”.)

ESG considerations are also impacting consumer preferences and public attitudes, which in turn are driving corporate action. Consumers are making purchasing decisions with sustainability in mind, and they are voting with their wallets. These changes have ripple effects. Not only are companies under pressure from the bottom up via the way that their customers spend their money, but governments are also under pressure to apply “top down” pressure given increased scrutiny from their electorates. For investors, this creates compelling opportunities to invest in those companies that have responded by incorporating ESG considerations into their operations or those offering products and services that directly address sustainability challenges.

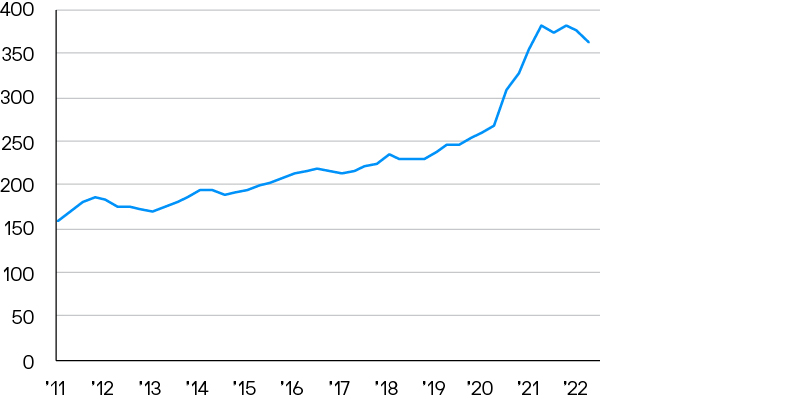

At the same time, social and governance factors are coming to the fore after a decade of lacklustre real wage growth, particularly in low- and middle-income households, and with the Covid-19 pandemic shining a spotlight on the way in which companies treat their workforce. Corporate recognition of the importance of diversity and inclusion within the workforce, for example, has accelerated, as evidenced by the sharp increase in the number of times these terms have been mentioned during earnings calls over the past two years (see Exhibit 2). In the EU, a social taxonomy is under consultation (to complement the existing environmental taxonomy) which will help define more clearly what constitutes a social investment and those activities that contribute to achieving social objectives. Meanwhile, governance standards, such as board diversity and risk management practices, are also receiving much greater scrutiny.

Exhibit 2: Corporate mentions of diversity and inclusion in earnings calls

Number of mentions for MSCI ACWI companies, four-quarter moving average

Source: MSCI, J.P. Morgan Asset Management. Data as of 30 June 2022.

As investors look to better reflect ESG factors within their portfolios, the nature of investment flows is changing, further boosted by regulators raising the bar around disclosures, such as the EU Sustainable Finance Disclosure Regulation (SFDR). Sustainable investment funds in Europe have gone from receiving 15% of net flows in 2017 to more than 100% of net flows in the first half of 2022, according to data from Morningstar. This trend, in itself, could influence valuations over time, with companies that rank highly on ESG metrics benefiting from a lower cost of financing.

How can ESG factors be incorporated into investment decision making?

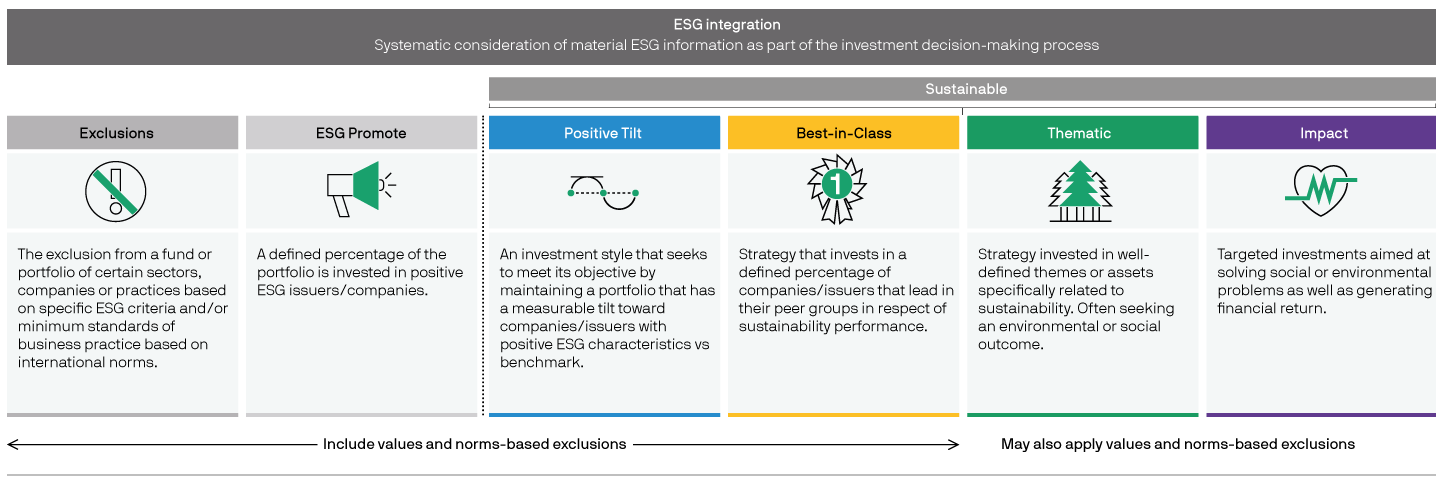

Source: J.P. Morgan Asset Management, as of December 31, 2021.

While the range of strategies on offer continues to evolve, there are several options available for investors looking to place greater weight on sustainable factors.

As a first step, investors increasingly implement exclusions policies across their portfolios to express certain values and views by applying restrictions on the ability of a fund manager to buy assets related to certain industries, such as weapons, tobacco, thermal coal extraction, unconventional oil and gas extraction, alcohol, and adult entertainment. Alternatively, fund managers may be able to invest only in businesses that have signed up to the UN Global Compact on sustainable and socially responsible policies.

ESG integration has also become a foundational component of many strategies across the industry today. ESG integration is the systematic inclusion of financially material ESG factors as additional inputs into investment analysis and decision-making. Assessing ESG factors, such as climate risk, natural resource use, human capital management and business conduct, have increasingly become accepted as important considerations when assessing a company’s long-term prospects alongside more traditional factors, such as product demand.

Building upon this, increasingly, investors are looking to seize the opportunity sustainable factors can offer instead of just focusing on mitigating the risks. They are allocating to dedicated sustainable strategies, which employ a forward-looking approach that aims to deliver long-term sustainable financial returns. Which sustainable path to take will depend on each investor’s own views:

Positive Tilt strategies award a larger allocation within a portfolio to stocks with higher ESG scores. The ratings can be founded upon either qualitative or quantitative scoring systems developed in-house by investment/sustainable investing experts.

Best-in-Class strategies rank companies in the investment universe within their sectors and then select the most sustainable companies within a given sector. This process attempts to reward ESG leaders in an industry, while also avoiding large portfolio skews toward sectors more associated with strong ESG practices or better disclosure.

Thematic/Impact strategies are built to align with specific environmental and/or social objectives, predominantly investing in companies whose products and services address specific themes within these areas.

What is the process for rating an asset based on ESG factors?

With both investors and regulators continuing to apply pressure on companies to disclose ESG-related information, data availability is improving steadily across geographies. Many investors use data providers such as MSCI or Sustainalytics to assess and compare companies through an ESG lens. However, there are limitations to relying solely on external data sources, particularly given the low correlation (0.4611) among individual agencies’ ESG ratings, which exposes the challenges of different rating methodologies.

In an effort to overcome these limitations, we have created our own proprietary data-driven ESG scores. Taking this approach presents an opportunity to take a more granular look into the underlying drivers of a company’s ESG risks and creates the option to incorporate alternative data sets from a broader range of sources to derive more forward-looking data signals.

Coupling these data insights with those gleaned from fundamental research can help investors form a more holistic view of the ESG risks and opportunities within each company that they look at. Active engagement with company management is another powerful tool that can both influence corporate behaviour and ensure that ESG ratings accurately reflect day-to-day practices.

Summary

Environmental, social and governance factors are becoming a higher priority for governments, regulators and savers alike. Investors have a range of strategies they can deploy, ranging from ESG integration, whereby ESG factors are considered alongside traditional metrics in the investment process, to impact investing, in which a specific sustainable outcome is at the heart of the investment process. At a minimum, understanding how ESG-related preferences and policies are changing is necessary to mitigate investment risk. However, savers are, increasingly, seeking more than financial returns—they also want to be a force for change.

1 Correlation between MSCI and Sustainalytics ESG scores for MSCI ACWI; data as of May 2022.