Week in review

- U.S. GDP in 1Q24 grew 1.6% SAAR, weakest since 2Q22

- South Korea GDP expanded 1.4% q/q in Q1, beating expectations

- Japan core CPI rose 1.6% y/y in April, lower than consensus

Week ahead

- China manufacturing PMI

- Japan unemployment rate, consumer sentiment, manufacturing PMI

- U.S. FOMC meeting, jobs data, ISM services

Thought of the week

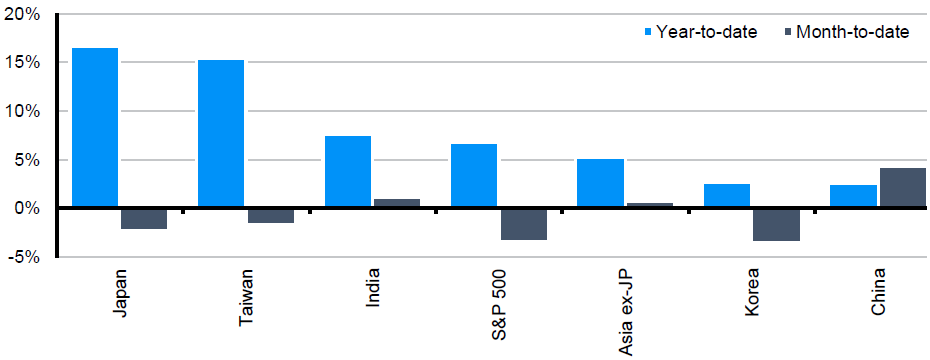

On the back of macro shifts in the U.S. – delayed rate cut expectations, higher 10-year Treasury yields (up 70bps YTD), stronger U.S. dollar (up 4% YTD), higher oil prices (Brent crude up 14% YTD), it is worth taking stock of Asian equity market performances so far. MSCI Asia ex-JP rallied 12.7% from a January low to the peak in early April, before correcting 4.6% mid-month, and then rebounding back to close to the peak at the time of writing. The various macro shifts in the U.S. are generally negatives for Asian countries, but with varying degrees of sensitivities. For example, higher real rates tend to hurt Taiwan and Korea more, given larger weight in tech, which will experience valuation adjustments. However, these markets are also positively correlated with U.S. economic activity, which has been stronger than expected, helping to offset some of the impact from rates. Taking currency as another example, a stronger U.S. dollar tends to hurt China, Hong Kong, Thailand, Korea, but domestically-focused markets such as India and Indonesia showed less sensitivity to such currency movements. In general, Asian markets have showed resilience in April despite the hawkish macro shifts and weak S&P 500 performance. Looking ahead, economic growth in Asia remains favorable and Asian central banks are poised to start cutting, albeit starting later and at a slower pace than previously expected.

Asian equity market performances relative to S&P 500

MSCI total returns in local currency

Source: FactSet, J.P. Morgan Asset Management. Data reflect most recently available as of 25/04/24.

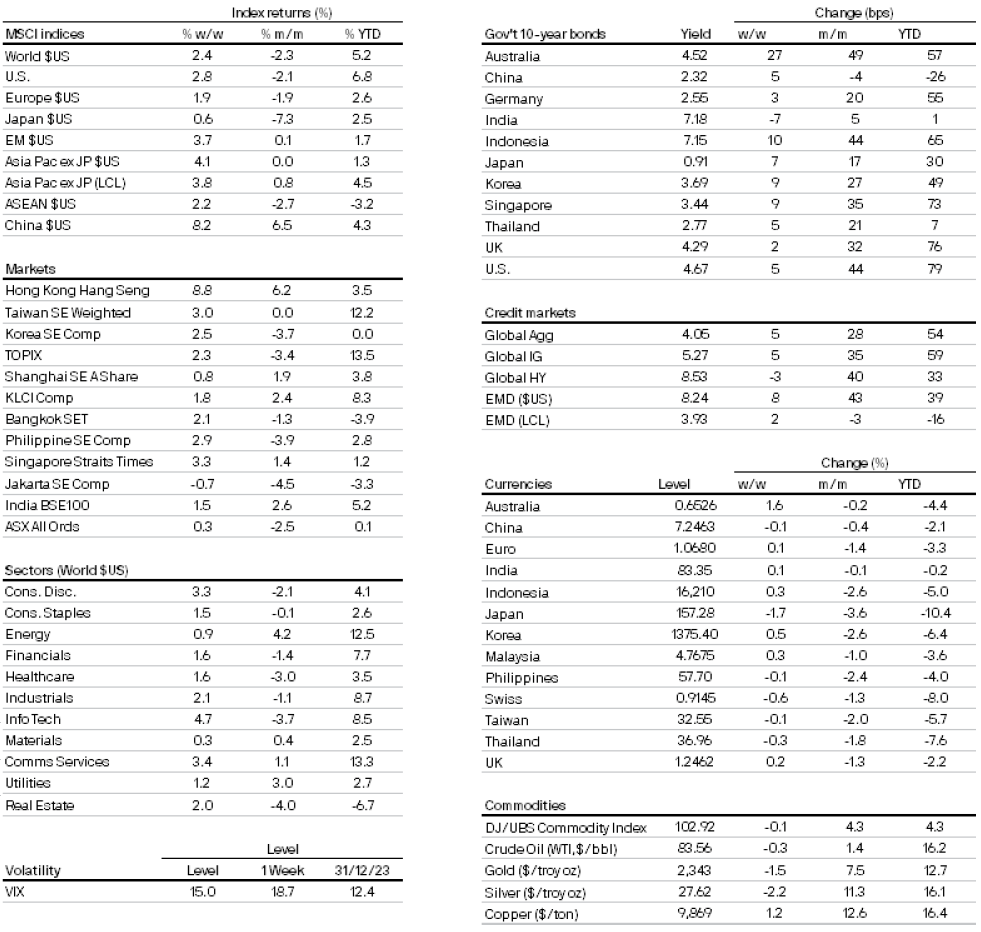

Market data

0903c02a82467a72

All returns in local currency unless stated otherwise.

Currencies’ return are based on foreign currencies per U.S. dollar. An appreciation of the foreign currency against the U.S. dollar would be positive and a depreciation of the foreign currency against the U.S. dollar would be negative.