Week in review

- U.S. retail sales slowed to 0.2% m/m

- China YTD industrial profits slowed to 1.9% y/y

- BoK kept policy rates at 2.50%

Week ahead

- Fed interest rate decision

- RBA interest rate decision

- Japan average cash earnings

Thought of the week

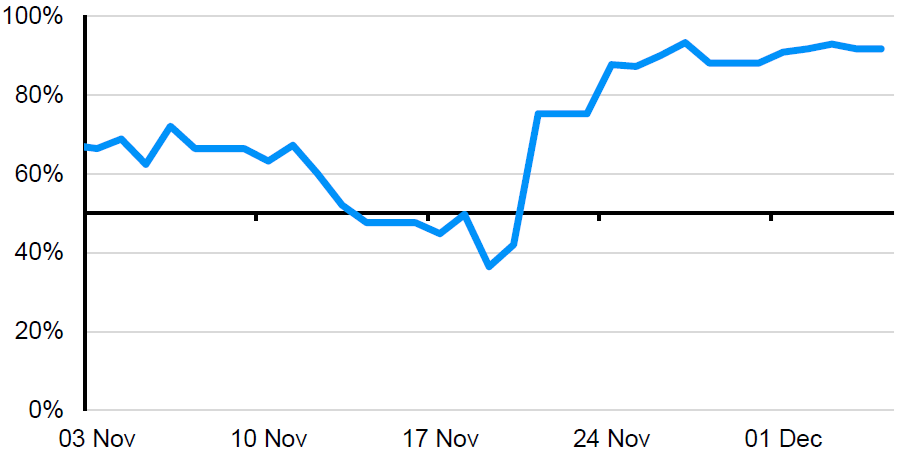

The Federal Reserve will meet this week to set monetary policy. But as the recent government shutdown has meant November’s non-farm payroll data was not available last week, markets have had to rely on alternative indicators to gauge the state of the labour market. However, these have provided limited insight – the ADP report tracked lower with 32k job losses and the Challenger report indicated a 71k announced job cuts in November, but these have contrasted with last week’s drop in initial jobless claims and continuing claims data, which points to resilience in the labour market. And although the series of dovish comments from Fed officials last month led markets to sharply increase the odds of a December rate cut, from 36% to 93%, the decisions this week, and especially the guidance on interest rate trajectory and economic projections, remains far from certain.

Implied probability of a December rate cut

OIS markets

Source: Bloomberg, J.P. Morgan Asset Management. Data reflect most recently available as of 5/12/25.

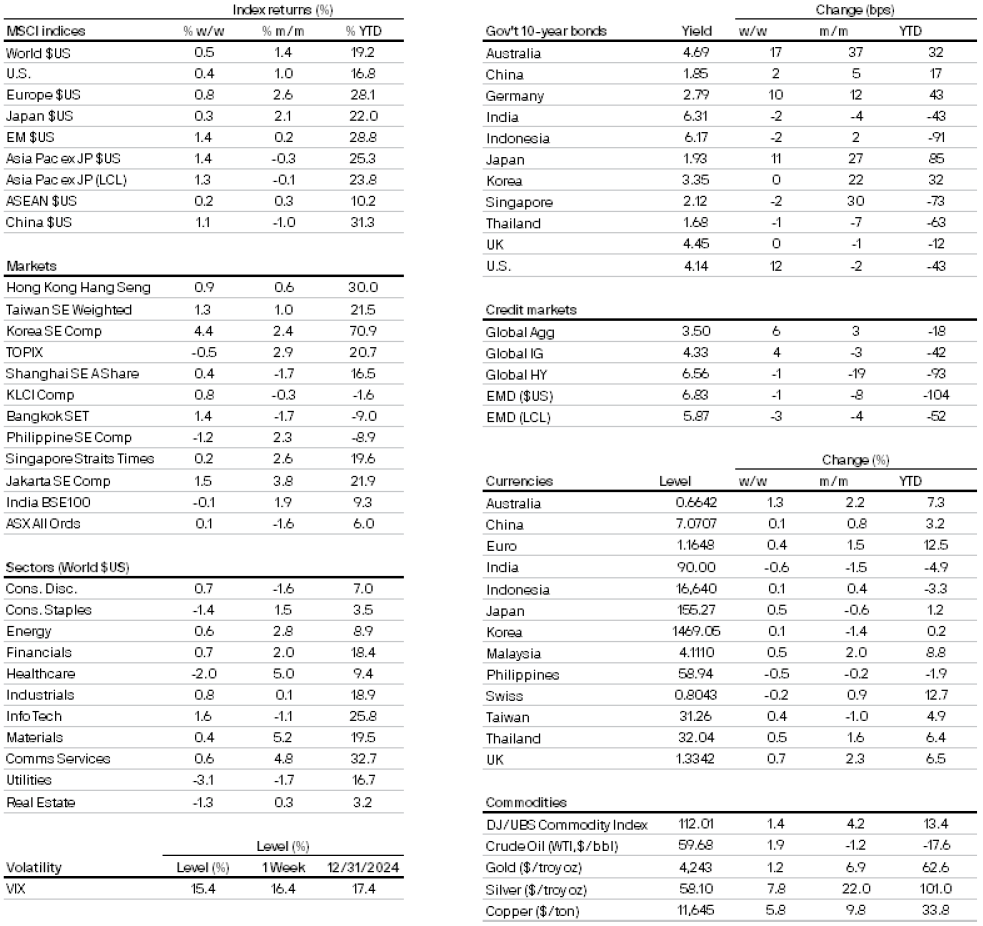

Market data

0903c02a82467a72

All returns in local currency unless stated otherwise.

Currencies’ return are based on foreign currencies per U.S. dollar. An appreciation of the foreign currency against the U.S. dollar would be positive and a depreciation of the foreign currency against the U.S. dollar would be negative.