Upgrade portfolio yield with investment grade

We explore the impacts of COVID-19 from a Fixed Income insurance perspective and discusses balancing liquidity and downgrade risks

Bryan Wallace

Gilles Drukier

Years of low interest rates have already challenged insurance portfolio returns. Now, the global COVID-19 coronavirus outbreak has thrown economies and financial markets into turmoil, presenting more challenges. While insurance portfolio managers will need to increase their focus on liquidity and downgrade risks, some interesting opportunities in riskier assets such as investment grade fixed income have also arisen.

A volatile time of high, lows and lockdowns

A lot has happened over the past six weeks: we have gone from all-time lows to near-cyclical highs in credit spreads, government bond yields hit all-time lows and over three billion people worldwide have been in lockdown. The key question now for insurance companies is whether this provides an opportunity to increase investments to riskier assets at seemingly more attractive valuations. As with everything the answer is nuanced, but we highlight below some areas which we believe have become attractive.

Towards the end of January 2020, the average spread over government bonds of investment grade corporate bonds was at a low point of 99 basis points (bps), the S&P 500 Index of US equities was close to 3,300 and the 10-year US Treasury bond was yielding above 1.60%.

The COVID-19 pandemic triggered unprecedented volatility: the spread of investment grade over government bonds reached a high of 373bps, the S&P 500 hit a low of 2237 and the 10-year US Treasury bond yield sank to 0.54%. The selling of risk assets was prompted by record outflows from investment grade credit funds, amplified by de-risking from leveraged investors to meet margin calls.

At this stage, liquidity was very poor and fixed income markets were partially broken. Market participants with urgent liquidity needs (for instance, to meet margin calls) had no other option than to sell high-quality, short-dated government and corporate bonds, pushing spreads wider and also flattening credit curves, as short-end bonds bore the brunt of the selling.

In that respect, de-risking became a costly and lengthy exercise and we mainly saw insurance companies stop reinvesting coupons and making redemptions to maintain an additional liquidity buffer.

Most governments and central banks in developed markets intervened by boosting liquidity in an attempt to normalise fixed income markets. The European Central Bank (ECB) initially miscommunicated the extent to which it would support.

European sovereign spreads, namely for Italian bonds, which led to a large scale sell-off; this prompted the ECB to announce a EUR 750 billion bond purchase programme which has helped to underpin borrowing costs for the region’s weaker economies. The Bank of England implemented a GBP 200 billion bond purchase programme (a similar programme post the Brexit vote was GBP 60 billion).

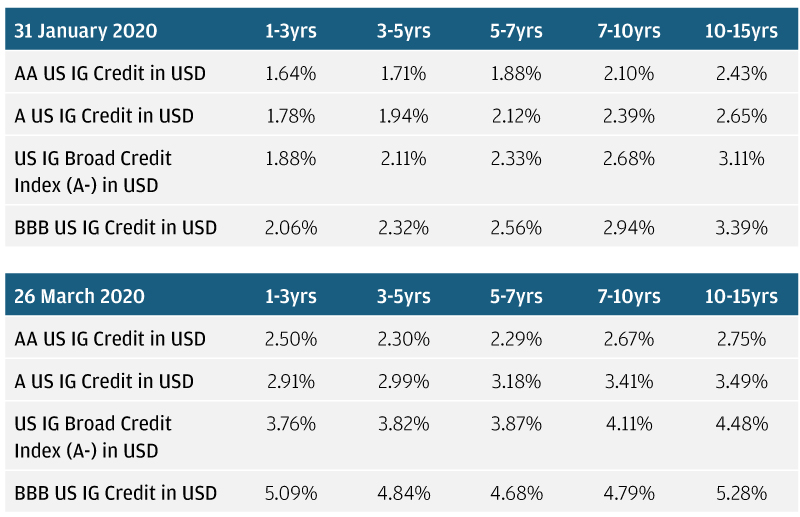

Initially the US market lacked a similar corporate bond buying programme to the one that helped to contain spreads in Europe. As a result the US corporate bond market underperformed Europe by 120bps, but this dynamic changed when the US Federal Reserve (Fed) surprised investors by announcing a corporate purchase programme. The primary and secondary Corporate Credit Facility would purchase securities out to five years in maturity to help improve front-end liquidity and reduce pressure on spreads. As a result of this announcement, we saw a mild improvement in liquidity when US corporate investment grade spreads on 26 March 2020 closed 80bps tighter than the widest print. On that day, the S&P 500 rebounded to 2580 and the 10-year Treasury was trading at a 0.60% yield.

At the same time, a lot of corporates looked to secure additional funding in the absence of a liquid commercial paper market leading to an unprecedented level of new issuance with more than USD 200 billion in March 2020 (versus a monthly average of USD 75 billion). Some high-quality issuers have been coming to the market at wider than usual levels; for instance, Disney issued a 10-year senior bond at a spread of 270bps.

Balancing liquidity and downgrade risk with investment opportunities

These levels are clearly attractive versus historical levels and we have started to see institutional investors, such as sovereign wealth funds and insurance companies, cautiously dipping their toes in the market despite the recessionary outlook.

While liquidity is paramount for retail funds, insurance company asset managers also need to adopt a conservative approach to cash management in the in the current environment to meet increased levels of claims in the property and casualty business and higher-than-usual redemptions on the life insurance side.

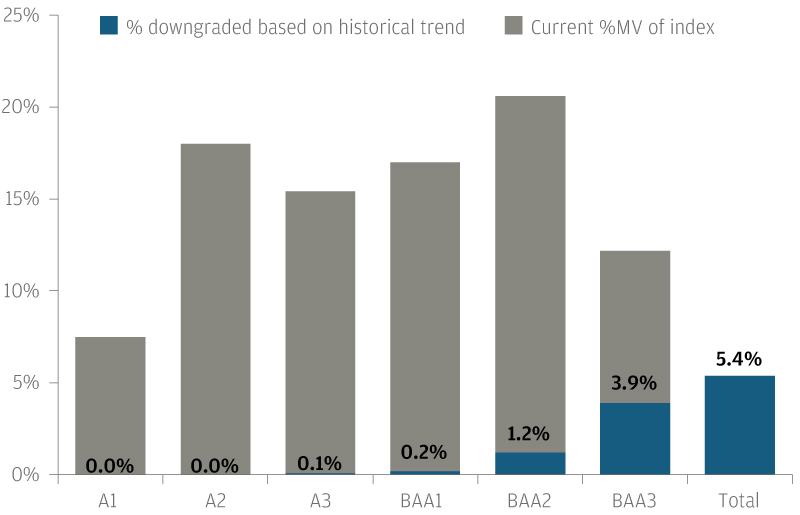

Downgrade risk will also become more critical than previously as rating agencies have reacted quickly and aggressively to challenging financial and economic conditions. We have already seen weakened investment grade issuers being downgraded and we expect roughly a further 0.5% (USD 260 billion) of the US investment grade market to be downgraded to high yield in 2020, which would represent a 25% increase in size of the high yield market (Exhibit 1).

Downgrades are likely to increase based on historical trends and recent actions from rating agencies

Exhibit 1: Percentage of corporate downgrades expected by rating category based on historical trend and the current percentage of market value of the index

Source: J.P. Morgan Asset Management, as at 11 March 2020. Barclays, average amount of US investment grade calculated as transitioned to high yield based on historical averages as a proportion of a given rating category. For example 51% of BBB- downgraded to high yield in 2002, and then re-weighted to current market characteristics (e.g. 12.2% of current index is BBB-) to determine the percentage notional that could fall into high yield during a credit bear market should it occur today.

Some sectors are likely to be particularly affected:

- Autos is witnessing a severe drop in demand in the immediate term coupled with supply chain issues, which further accentuate the sector’s problems. The demand destruction is likely to continue for some time as consumer spending power diminishes as a result of higher rates of unemployment. Sector fundamentals had already been deteriorating as manufacturers increased spending on electrification, autonomous driving and more stringent emission regulations.

- Transportation, most notably the airline sector, is being severely impacted by the mandatory travel restrictions implemented globally, with many airlines now grounding their entire fleets. The US government’s USD 2 trillion stimulus package is likely to ward off bankruptcy at least in the near term but the situation for the sector remains critical.

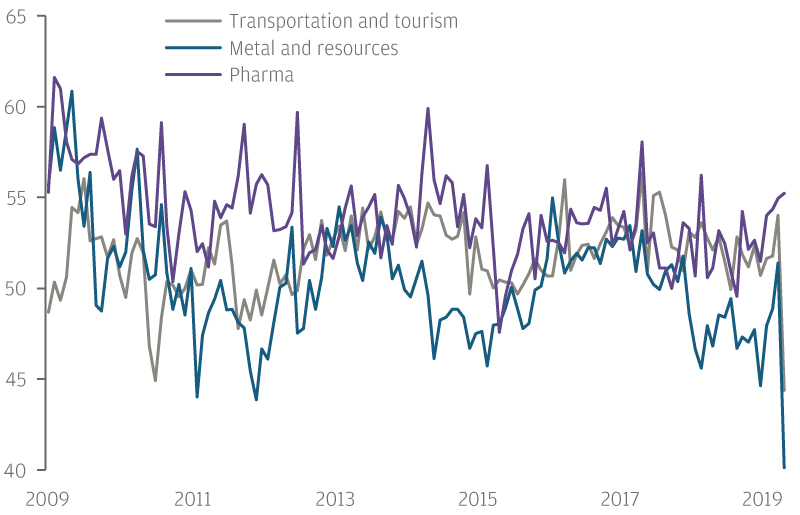

- Energy is suffering from severe supply- and demand-side shocks. The supply-side shock is emanating from a Saudi–Russian oil price war, which has pushed oil to a 17-year low of USD 20 per barrel. The demand side is being impacted by the pandemic-induced global lockdowns, with estimates suggesting consumption has dropped by 26 million barrels per day, leading to a global oil surplus (Exhibit 2).

Sectors related to transportation and energy may be most negatively impacted

Exhibit 2: Purchasing managers’ indices, select sectors

Source: J.P. Morgan Chase & Co., J.P. Morgan Asset Management. As at 29 February 2020.

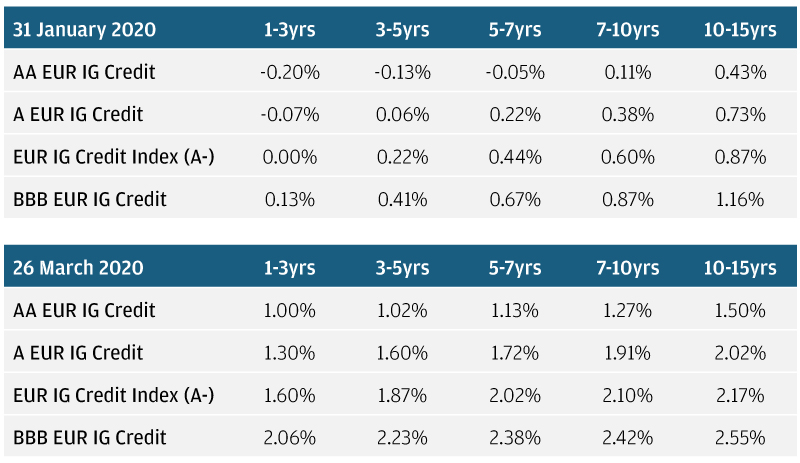

Nevertheless, for insurance companies with a slightly longer investment horizon, and that have suffered over the past couple of years from very low rates, the markets currently offer some interesting entry points. A few areas of the investment grade space stand out to us as particularly attractive:

- EUR investment grade corporate credit (A- average rating): over the period, yields went from close to 0.30% to roughly 2.00%

Source: J.P. Morgan Asset Management, Bloomberg and ICE Bank of America Merrill Lynch

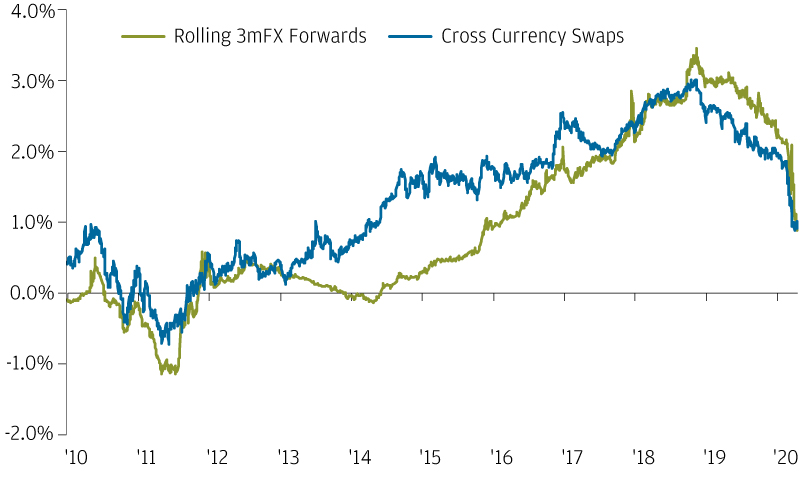

With the reduction of the cost of hedging USD into EUR, US IG Credit also offers great opportunities

Source: J.P. Morgan Asset Management, Bloomberg.

- Short-dated US investment grade corporate credit (A- average rating) hedged into EUR: yields increased from roughly 0.10% to 2.50% (hedged with swaps)

- Long-dated US investment grade corporate credit (A- average rating) hedged into EUR: yields rose from approximately 1.50% to 3.25% (hedged with swaps)

Source: J.P. Morgan Asset Management, Bloomberg and ICE Bank of America Merrill Lynch. EUR hedged yield levels will depend on hedging strategy

- US taxable municipal bonds hedged (AA- average rating) into EUR: yields went from about 1.75% to 3.00% (hedged with swaps)

As these yield changes clearly indicate, some value has been created in pockets of the investment grade market. However, it is crucial to run issuer-specific fundamental analysis to understand the long-term effect of the pandemic on issuers’ balance sheets.

PS: On the 9 April, the US Federal Reserve announced a USD 750bn Primary and Secondary Corporate Credit Facility with the ability to buy 5yrs of less IG Corporate Credit Bonds including those downgraded to High Yield (no less than BB-/Ba3) after the 22 March. In parallel, OPEC agreed to cut its production by 9.7m barrels per day in May and June, 7.8m barrels in 2H20 and 5.9m barrels in 2021. On that day, the average spread over government bonds of investment grade corporate bonds was at 247 basis points (bps), the S&P 500 Index of US equities was close to 2790 and the 10-year US Treasury bond was yielding above 0.72%.

0903c02a8288495a