From the mixed economic readings, we still see some opportunities in Chinese stocks, but remain cautious on risk factors.

In brief

- China real gross domestic product (GDP) was up 5.3% year-over-year (y/y) and 1.6% quarter-over-quarter in 1Q 2024, reflecting sustained recovery in activities.

- It is noteworthy that the recovery is biased on the supply sides with stronger growth in manufacturing sectors, while challenges remain in consumer sentiment and real estate market.

- Escalation in policy supports is expected to support domestic consumption and property sector.

- We still see some opportunities in China stocks, but remain cautious on risk factors.

Latest economic data showed some signs of marginal improvement in Chinese economic activities. Real GDP growth rate increased to 5.3% y/y in 1Q24 from 5.2% y/y in 4Q23, beating market expectation of 4.9% y/y. However, quarterly and monthly indicators suggest an imbalanced recovery biasing towards the supply side, with sustained improvement in manufacturing output and investment. On the other hand, challenges remain on the demand side due to weakness in consumer confidence and the real estate sector, pointing to the need for continuous policy support.

Continuous recovery with a bias toward supply side

The Chinese National Bureau of Statistics (NBS) reported y/y real GDP growth of 5.3% in 1Q24. In comparison to the previous quarter, real GDP was up 1.6%, reflecting sustained recovery in overall economic activity. Among sectors, value added by the secondary industry increased by 6.0% y/y, highlighting a strong growth of 7.5% y/y in high-tech sectors. Service sectors accounted for 59% of China’s nominal GDP in 1Q24, while the growth rate slid slightly to 5.0% y/y from 5.3% y/y one quarter ago.

Similar to GDP readings, monthly economic indicators are also pointing to a stronger momentum on the supply side. Industrial production increased by 4.5% y/y in March, featuring booming outputs in automobile (9.4% y/y) and technology products (10.6% y/y). This trend signifies China’s efforts to upgrade its economic structure and break away from the over-reliance on real estate sector. In addition, strong exports of these products might partially offset the headwinds from weak domestic demand and contribute to the overall economic growth.

Driven by the strong output, fixed asset investment in manufacturing sectors continued improving (Jan-Mar 2024: 9.9% y/y). Meanwhile, infrastructure investment remained a supportive factor (Jan-Mar 2024: 6.5% y/y). As a result, the growth rate of aggregate fixed asset investment improved to 4.5% y/y during the first three months, and to 4.8% y/y in the month of March, according to our estimation.

Challenges remain on demand side

Despite the strong momentum in the manufacturing sector, weakness in consumer confidence and the real estate sector remain major challenges. Household confidence in employment and income stayed at around the historical bottom according to the NBS survey, which dragged retail sales in March. After consumer demand was largely released during Lunar New Year holidays, growth in retail sales seems unsustainable without substantial improvement in household income. As a result, growth of retail sales slowed down to 3.1% y/y in March from the previous reading of 5.5% y/y.

The cautious sentiment also affected households' financial decisions. Household savings increased by 11.8% or CNY 15.3trillion during the past 12 months, while outstanding mortgage loans continued sliding after a 1.6% or CNY 621billion net decrease was recorded in 2023. Against this backdrop, developers are subject to mounting pressures from slowing property sales and lower sales prices. The weakness in property market in return affected household consumption via wealth effect and local governments through less fiscal revenue from land sales.

Further policy support on demand side being expected

Solid recovery on supply side may continue in the upcoming quarters, but headwinds are emerging, which requires further policy support on the demand side. As consumption growth dipped, excess capacity may limit the upside on the supply side. Meanwhile, potential tension with trade partners is on the rise when Chinese manufacturers are gaining higher global market share.

As a result, further supportive policies on the demand side are expected. To boost domestic consumption, the Chinese central government recently introduced financial support to trade-in for consumer goods, including household appliances and automobiles. Local governments are gradually announcing and implementing details for subsidies, and this policy will have some positive impact in the second quarter.

In the property sector, regulators are coordinating to provide financial support to prevent large developers from defaulting. It is expected that the People's Bank of China may have further cuts to the required reserve ratio and lending rates, in order to stabilize market demand.

Investment implications

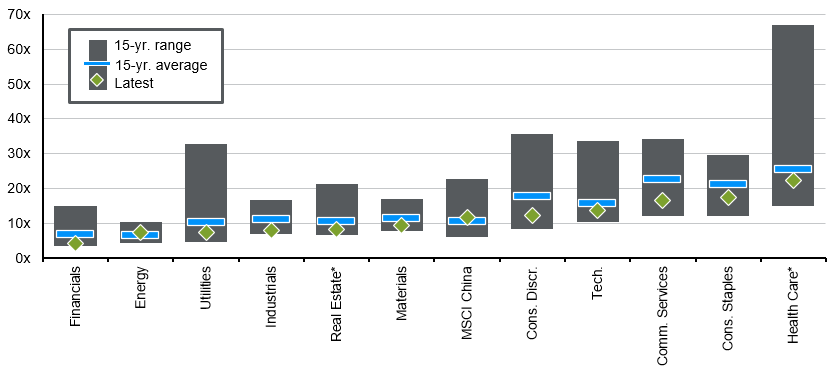

From the mixed economic readings, we still see some opportunities in Chinese stocks, but remain cautious on risk factors. In particular, earnings revision remains negative, and it may take a few more months to digest the downward revision. Recent intervention from national funds was helpful in stabilizing investor sentiment, while the overall valuation of Chinese stocks remains attractive (Exhibit 1). In some new-economy sectors such as lithium battery and solar power, earnings expectations are improving after several years of price wars and overcapacity reduction.

Exhibit 1: MSCI China price-to-earnings

Forward P/E ratios

Source: FactSet, MSCI, J.P. Morgan Asset Management. Tech refers to Technology; Cons. Staples refers to Consumer Staples; Comm. Services refers to Communication Services; Cons. Discr. refers to Consumer Discretionary. Consensus estimates used are calendar year estimates from FactSet. Past performance is not a reliable indicator of current and future results. *Data for the forward price-to-earnings ratio in the real estate and health care sectors begin from 30/09/16 and 30/06/09, respectively. Data reflect most recently available as of March 31, 2024.

Last week, China's State Council published nine guidelines to strengthen regulation and promote high quality development of the capital market. The most significant terms from these guidelines are to improve corporate governance and ensure higher dividend payouts to investors. These plans will likely enhance the earnings outlook, thereby attracting long-term investors to the market, especially with more investors paying attention to this space, on the back of Japan’s ongoing improvement on corporate governance and Korea’s recent corporate value-up program announcement.

Given the attractive valuations, low expectations on policy stimulus and light positioning, China markets can continue to trend higher if the economic momentum stabilizes and sustains.