During the press conference, Chairman Powell emphasized balance with regards to rate cuts given risks to employment are to the downside while risks to inflation are to the upside.

Following a nine-month hiatus, the Federal Open Market Committee (FOMC) delivered in line with expectations and voted to reduce the Federal funds rate target range by 0.25% to 4.00%-4.25%. Newly appointed governor, Stephen Miran dissented in favor of a larger half-point cut.

Adjustments to the statement language were uncontroversial. It noted economic activity had moderated in the first half of the year; job gains have slowed alongside a small increase in the unemployment rate, though stated downside risks to employment have risen. Inflation was still described as elevated but added language that it has moved up.

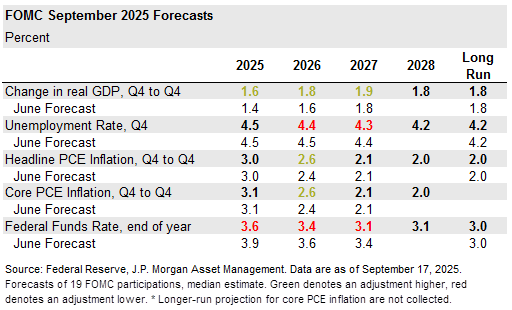

Turning to the Summary of Economic Projections, outside of more rate cuts, refreshed forecasts were largely unchanged relative to the June meeting:

- Growth was nudged higher by 0.2% to 1.6% and 1.8% for 2025 and 2026, respectively.

- The unemployment rate was unchanged at 4.5% in 2025 and revised lower to 4.4% in 2026.

- Both headline and core PCE forecasts held at 3.0% and 3.1% for 2025. Next year saw a slight bump by 0.2% for both to 2.6%, perhaps acknowledging the lagged pass-through effects of increased tariff rates.

- The median interest rate outlook signal two further cuts this year, likely delivered at the final two meetings, and maintained its projection for just one rate cut in 2026 bringing policy rates to 3.25-3.50% by the end of next year.

During the press conference, Chairman Powell emphasized balance with regards to rate cuts given risks to employment are to the downside while risks to inflation are to the upside. He explicitly stated todays cut was a “risk management” ease. In other words, softer labor markets allow the Federal Reserve (Fed) to focus more squarely on employment without abandoning vigilance on inflation.

Chair Powell quite succinctly stated current policy is assessed by looking through the windshield versus the rearview. Indeed, it is now clear that while labor markets have cooled more materially than initially anticipated, going forward weakening labor supply should limit a material rise in the unemployment rate while inflation pressures remain emphasizing a balanced approach. The Chair also fielded several politically charged questions centered around Federal Reserve independence and was unsurprisingly dismissive.

Market reaction was mixed; bond yields were initially unchanged and edged higher over the course of Powell’s press conference. Rate sensitive equities like small caps bounced while broad markets were pressured lower.

For investors, it now appears the Fed will cut rates for the remainder of this year, lowering the attractiveness of cash yields. Moreover, equities have tended to do well while the Fed cuts rates and the economy avoid recession, and short- to intermediate term yields continue to screen attractive relative to recent history. Therefore, investors should remain well diversified across high quality bonds, reasonably priced stocks, international assets and alternative assets.