Dividend equities may play an important role in portfolios as investors navigate a more challenging market environment marked by slowing growth, higher interest rates, and elevated geopolitical risks.

The case for global dividend equities

As we enter a more challenging market environment marked by stickier inflation, higher-for-longer interest rates, elevated equity valuations and rising geopolitical risks, dividend equities could play an important role in portfolios.

1. Relatively attractive valuations

The rally over the past year has been concentrated among low or no dividend yielding companies, leading to a dispersion in valuations between companies that pay dividends and those that do not or pay very little. A broadening market could help narrow the spread, working to the benefit of dividend equities. Even among mega cap tech companies, some are beginning to initiate dividends and focus on cash generation as their business models mature, expanding the investable universe for those seeking equity income opportunities.

2. Peak interest rates tend to present a constructive backdrop for global dividend stocks

As the current monetary policy tightening cycle draws to a close, global dividend stocks may present an attractive opportunity. Looking back at the last four rate hike cycles, global dividend stocks recorded relatively robust performance in the 12 months after the last Federal Reserve (Fed) interest rate hike with a tighter dispersion of returns versus other equity sectors.

3. Defensive assets to ride out uncertainty

The resilience of this asset class can be ascribed to its higher quality characteristics. While not the only metric to assess quality, a long track record of healthy dividend payouts is typically a useful barometer of stronger company fundamentals as well as a signal of a commitment to shareholder value.

The search for higher quality opportunities that are attractively valued could be in favour as investors navigate a more challenging and uncertain macro backdrop. Stickier-than-expected inflation could keep interest rates higher for longer and over time, this could stall economic growth and present challenges for valuations and earnings. Combining both “quality” and “value”, global dividend equities may present a useful option to ride out an environment of higher real rates and slowing economic growth.

4. Dividend growth momentum remains robust

Global dividend growth has proven to be more resilient than global earnings, recording an annual increase of 6% in 2023 versus -2% for global earnings1. Low dividend payout ratios coupled with relatively robust earnings may continue to support dividend growth momentum as many companies have yet to revise their dividend policies after cutting pay-outs significantly during the height of the COVID-19 crisis. We would need to observe a material weakening in earnings before dividends could come under pressure, in our view.

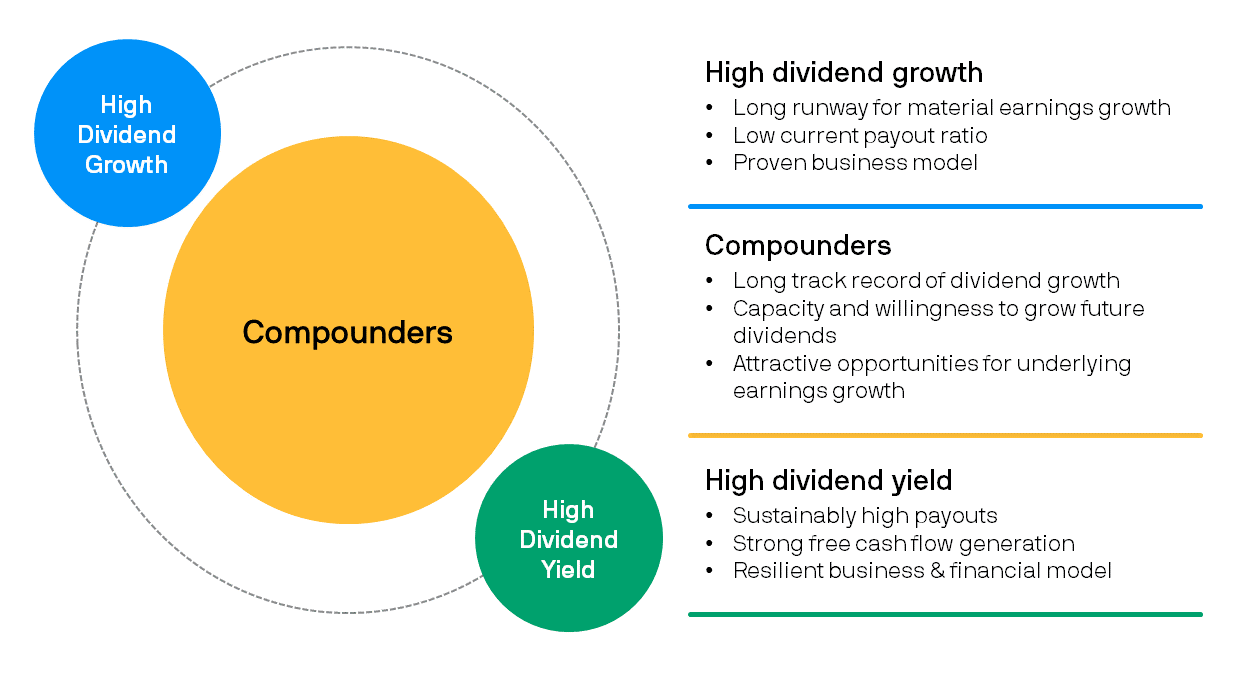

Active and selective: Finding the sweet spot among dividend yielders, growers and compounders

Still, not all dividend stocks are created equal and the challenge is separating the wheat from the chaff. We tend to observe a structural overvaluation of equities that either exhibit higher current dividend yields or faster near-term dividend growth, driven ostensibly by investor short-termism, or a general focus on short-term results at the expense of longer-term outcomes. In our view, seeking out opportunities that combine attractive dividend yield with sustainable dividend growth – also known as “compounders” – can be useful to construct a robust and durable portfolio of dividend equities.

Source: J.P. Morgan Asset Management. For illustrative purposes only.

To that end, the JPMorgan Global Dividend Fund invests across the yield spectrum with an emphasis on underappreciated companies that exhibit a relatively attractive blend of dividend yield and dividend growth. These compounders have historically recorded consistent returns within the fund’s investable universe2. This is balanced by smaller allocations to companies with higher dividend growth and higher dividend yield, allowing the Fund to access a broader range of industries and business models.

Underpinned by an investment philosophy that has been in place for over three decades which prioritises dividend quality and sustainable dividend growth, the JPMorgan Global Dividend Fund capitalises a well-resourced, global research platform to seek out high conviction ideas. Through this rigorous investment process, the Fund strives to achieve higher dividend yield, faster dividend growth and fewer dividend cuts versus its benchmark, in addition to driving competitive long-term performance.