Source globally. Seek quality.

Unlock more from equities

Despite the many challenges in 2025, the S&P 500 index still notched multiple all-time highs. While uncertainty remains elevated, earnings beat, fiscal stimulus and rate cuts may keep US stocks attractive. However, active management will be crucial to navigate the changing outlook and tap into quality opportunities amid elevated valuations.

US stock market resilience was in full view in 2025, with the S&P 500 index sidestepping concerns, including tariffs, geopolitical tensions and a slowing economy, to notch multiple record highs. In the first seven months of 2025, the S&P 500 rose 7.8%, with the index surpassing the peak set before “Liberation Day,” when the Trump administration announced sweeping tariffs1. In the year ending 31.07.2025, the index recorded 15 all-time highs, accounting for 10.4% of the total number of trading days, 10 of which occurred in July alone1.

In the face of market peaks, investors who stayed on the sidelines may be regretting the missed opportunity, while others may question if the rally can be sustained or if a significant pullback is in the cards.

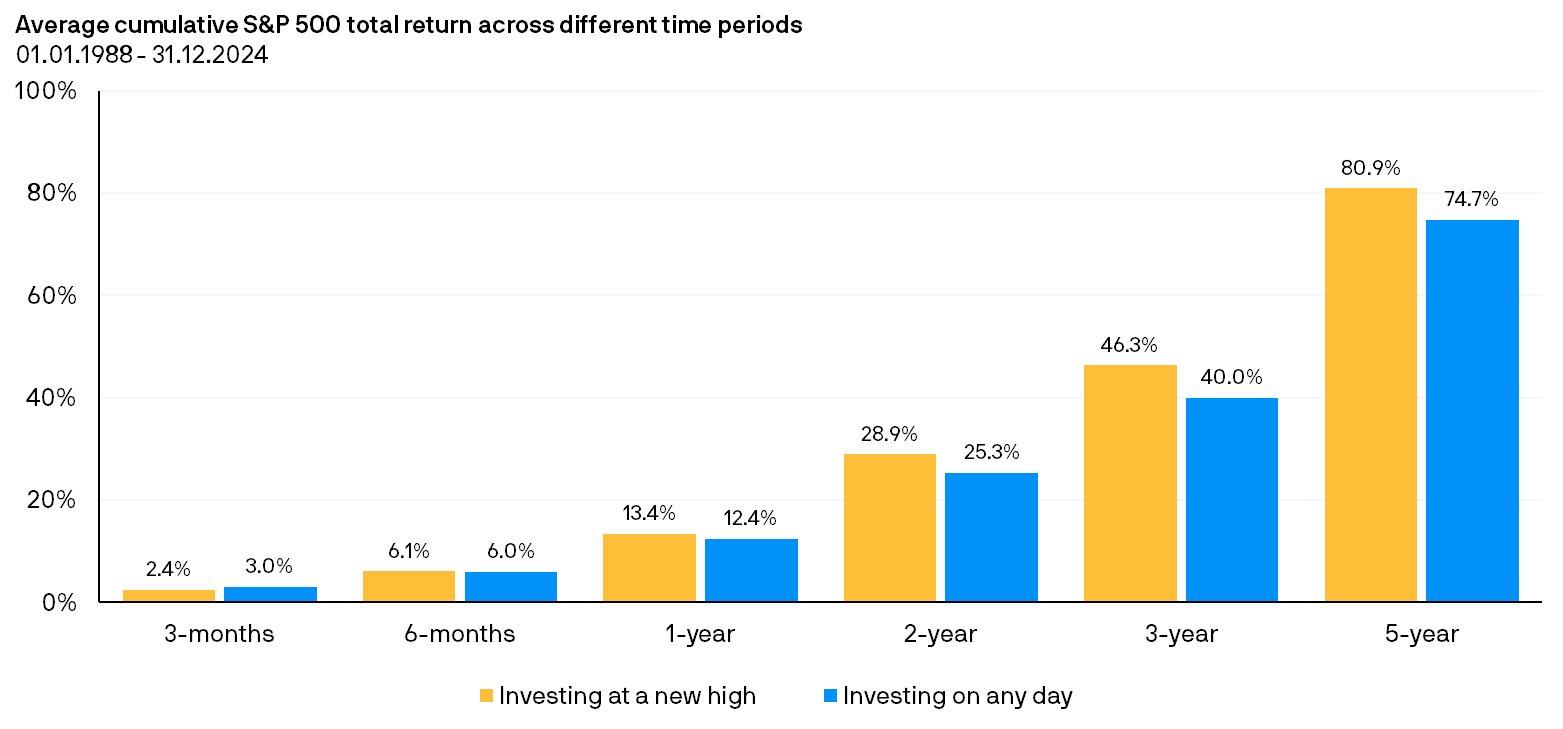

From the outset, all-time highs or market peaks may not present meaningful information as it relates to the optimal timing of investments. As illustrated below, there is no significant difference between investing at all-time highs and investing on any given day.

Indeed, historical data seem to challenge conventional wisdom that has typically persuaded investors to avoid investing in US stocks at record highs. Over the long run, there may be no apparent advantage or disadvantage from investing at all-time highs versus any other time.

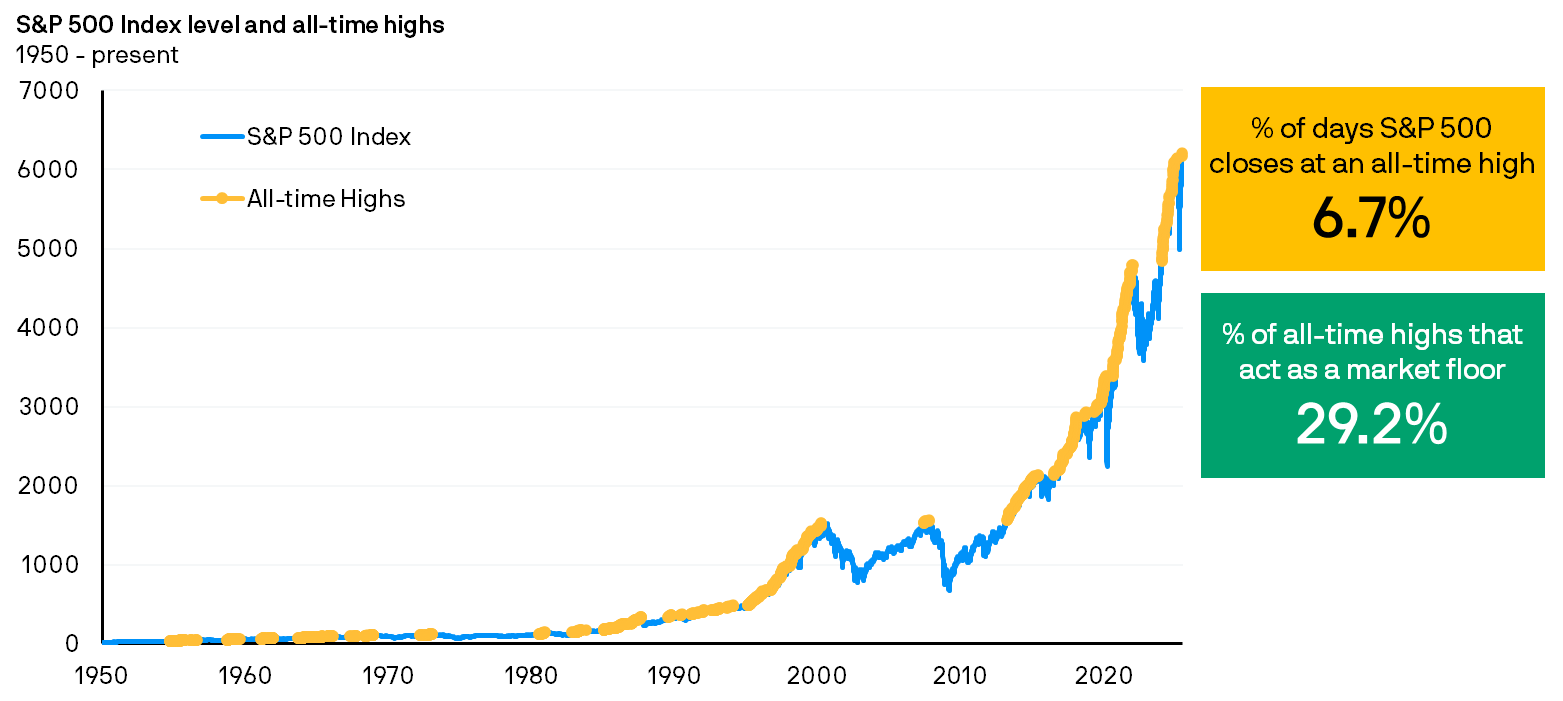

Furthermore, all-time highs are not a ceiling, in the sense that they do not necessarily portend a potentially significant correction later. Put differently, stocks may still rise after hitting record highs. As illustrated below, since 1950 to June 2025, the S&P 500 index had recorded all-time highs in about 6.7% of trading days, and around 29.2% of these peaks had turned into new market “floors,” becoming a launchpad for the future growth of the index.

Taken together, these observations suggest that all-time highs are an imperfect signal or barometer for the optimal timing of one’s market entry. More generally, it implies that the level of the index alone may not present much useful information about the ideal timing of investments or asset allocation. In which case, it would be more prudent to assess other factors such as earnings and valuations that tend to significantly drive market performance.

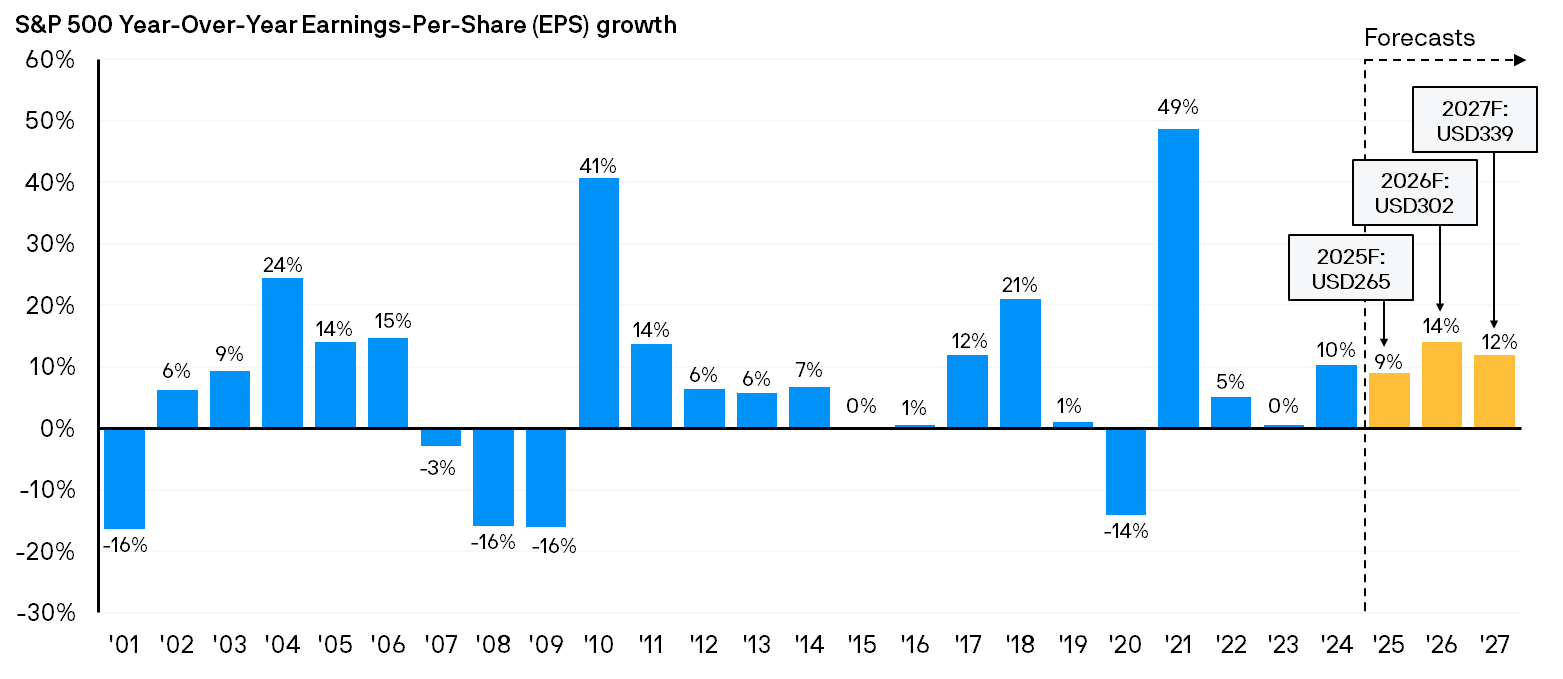

So far, earnings continue to paint a relatively resilient picture for US equities. Of the S&P 500 companies that reported second quarter earnings, 81% and 79% had exceeded earnings and revenue estimates respectively2. While this was after consensus estimates were cut post the “Liberation Day” tariffs, the magnitude of positive earnings and revenue surprises were still above the past 10-year averages2.

This trend is expected to continue. As illustrated below, the 2025 consensus analyst projections for year-on-year earnings-per-share (EPS) growth for the S&P 500 index stands at 9.0%, exceeding the past two-decade average of 7.6%3. Analysts are also pencilling in double digit growth in 2026 and 2027, with earnings projected to broaden thereby narrowing the gap between the 10 largest companies and the remaining 490 names within the index4. In addition, year-to-date (as of 31.07.2025) sector performance has extended well beyond mega-cap tech names, with industrials, utilities and financials posting meaningful gains5.

Nevertheless, with price-to-earnings valuations of the S&P 500 index close to its past 15-year peaks6, active stock selection remains crucial to seek exposure to attractively valued or mispriced opportunities in the US market.

Looking forward, the macro backdrop continues to remain uncertain. As it stands, the true impacts of tariffs on the economy and profit margins are yet unclear. Volatility is likely par for the course with sentiment swinging between optimism about artificial intelligence (AI) and concerns about tariffs. Relatively elevated valuations also implies a narrower margin for error, with short-term pullbacks likely should policy risks emerge or if earnings miss expectations.

Yet, against this backdrop, it is still important for long-term investors to keep a few potential tailwinds in perspective:

Ultimately, these tailwinds do not impact all sectors and companies equally. Bottom-up stock selection remains crucial to ensure exposure to sectors and companies poised to benefit from these constructive factors and/or demonstrate resilience to potential policy and macroeconomic pressures.

Furthermore, elevated market concentration and stretched valuations suggest the need to rebalance exposure between value and growth investment styles, as well as across sectors, to counterbalance these risks.

With greater performance dispersion observed across and within sectors, an active and selective approach may help investors potentially gain exposure to high-quality and attractively valued companies that exhibit resilient demand, healthier margins and are better positioned to adapt to the post-tariff environment.