A ballast with higher income

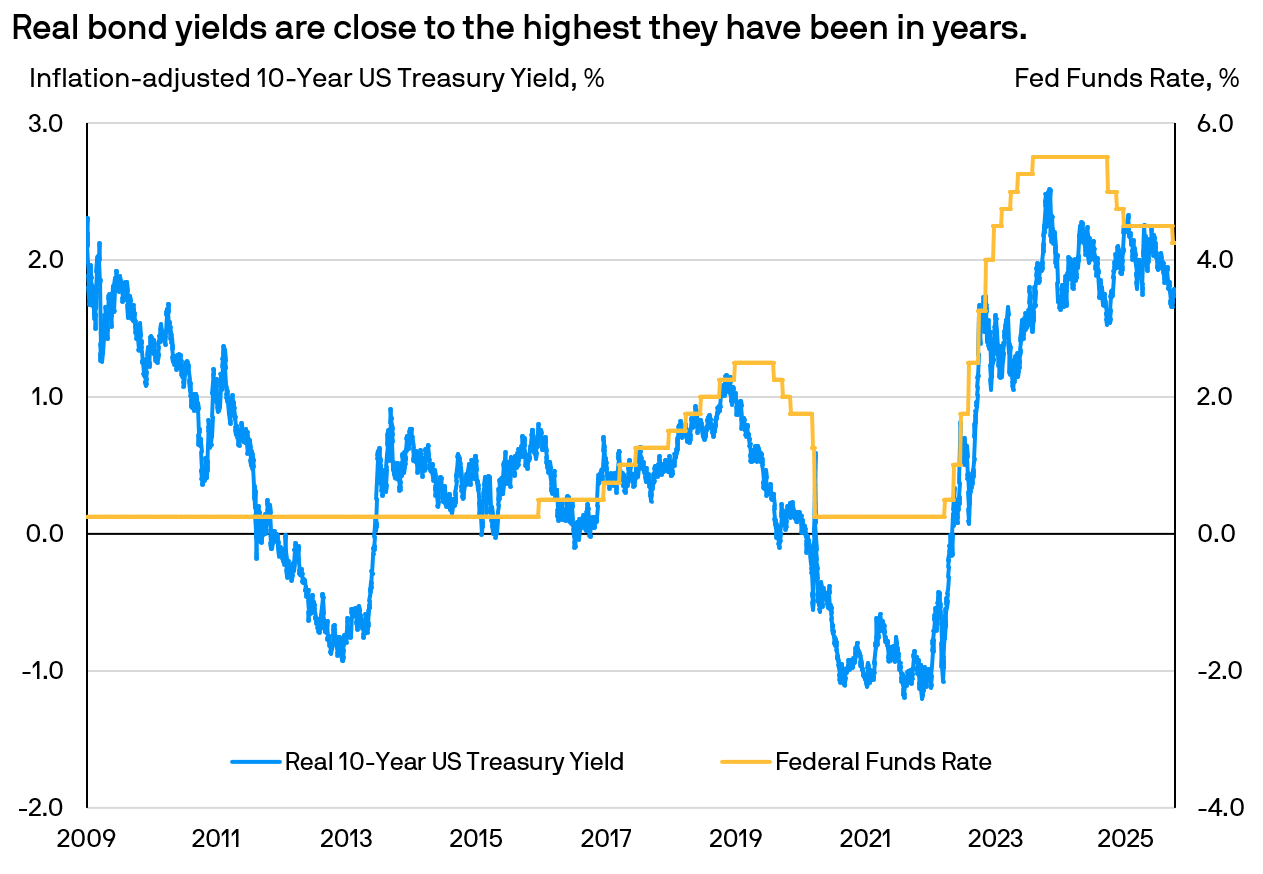

To say that bonds have regained relevance in portfolios would be to state the obvious. As the chart on the right shows, current inflation-adjusted yield on the 10-Year US Treasury continues to hover within the highest range in over a decade, following an extended period of low or even negative real yields.

This steep climb can be traced back to the Federal Reserve’s rapid rate hike cycle in 2022-2023, aimed at quelling inflationary pressure. Three years on, nominal yields continue to offset expected inflation, with real yields firmly back in positive territory. As such, the asset class continues to maintain its relevance as an income-generating ballast for portfolios.

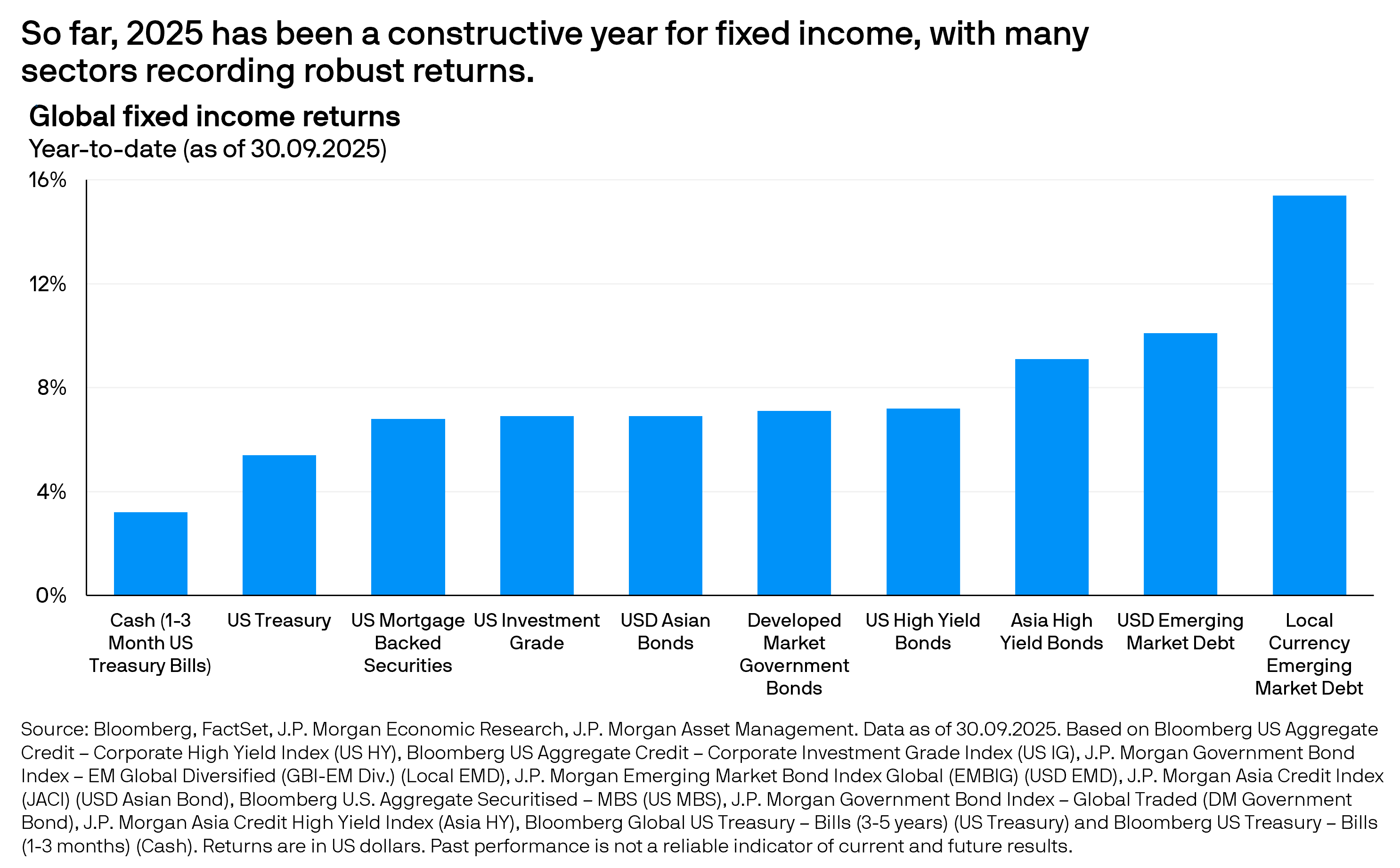

Looking ahead, we believe the fixed income investing landscape remains constructive for several reasons.

1. Yields across multiple bond sectors continue to trade meaningfully above the past 15-year median, presenting attractive opportunities for income generation.

2. Global central banks have shifted into an easing mode, as inflation pressure recedes and growth momentum moderates. Falling rates may enhance the potential for capital gains.

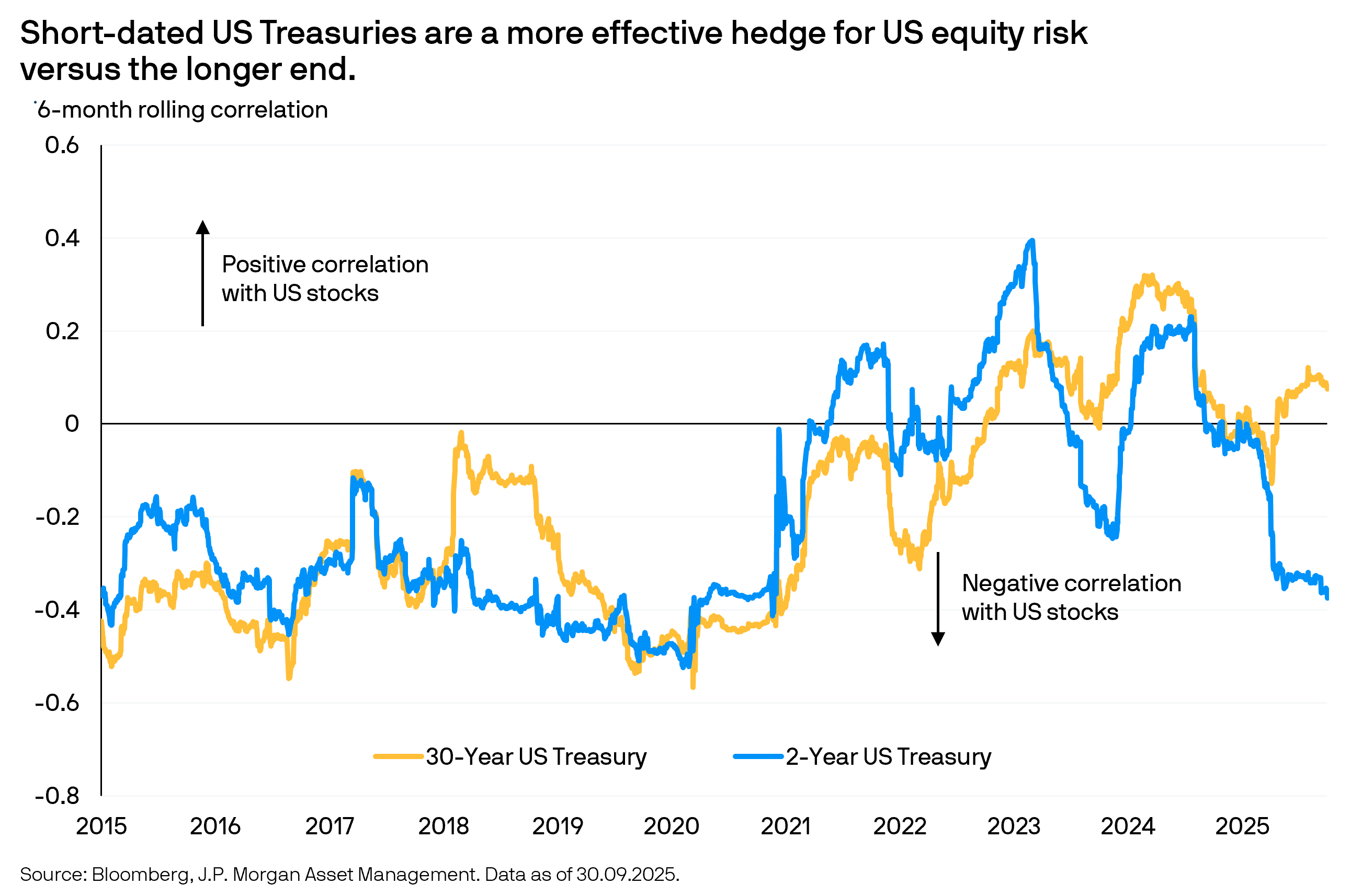

3. Stock-bond correlations have turned negative, particularly as it relates to the shorter-end of the yield curve. This suggests that short duration1 bonds can fulfil its role as a potential ballast for portfolios should downside risks to growth intensify.

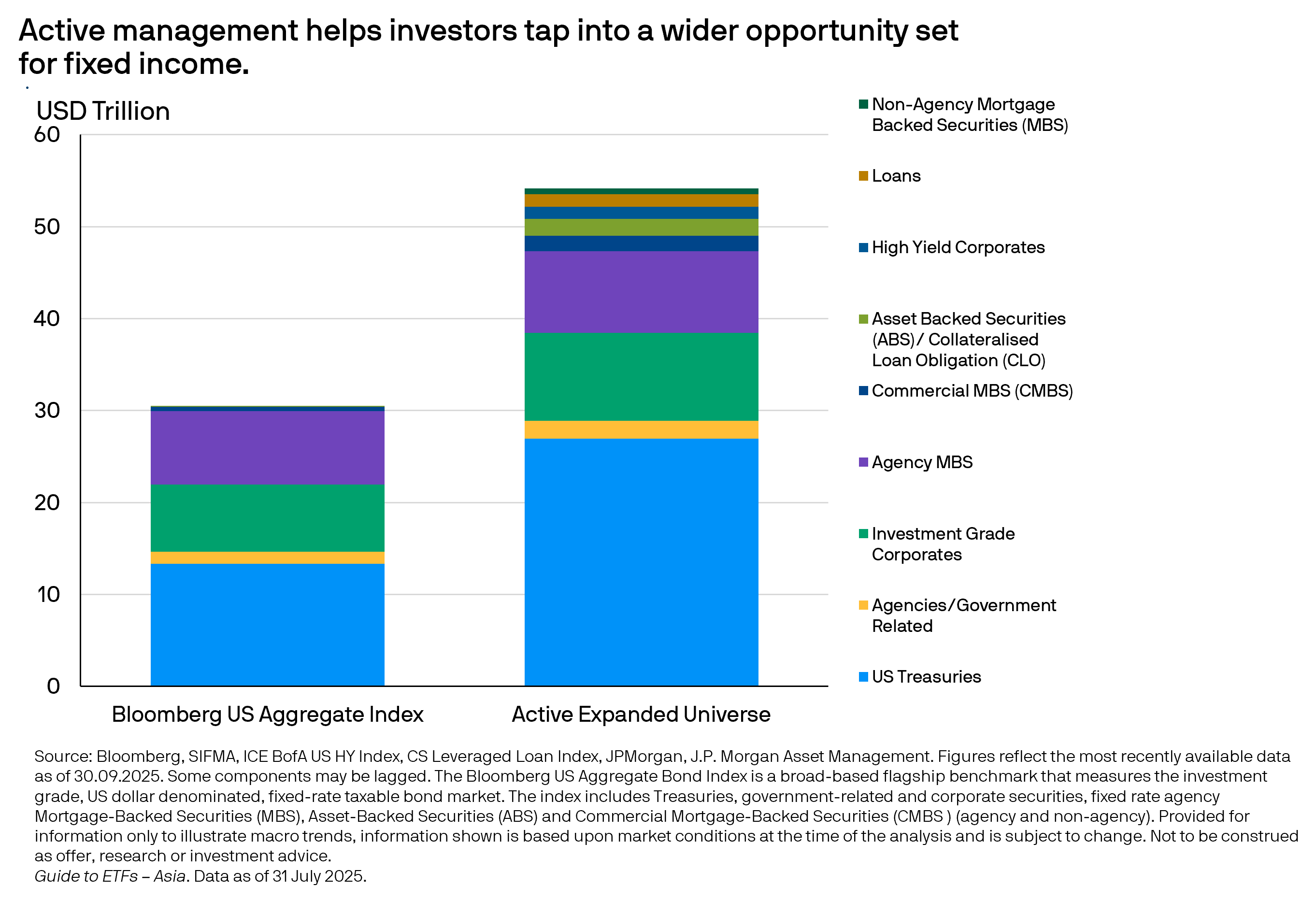

Nevertheless, staying active and flexible will be crucial to harness income opportunities across multiple sectors while dynamically managing credit and duration risks amid a fast changing and uncertain macro environment.

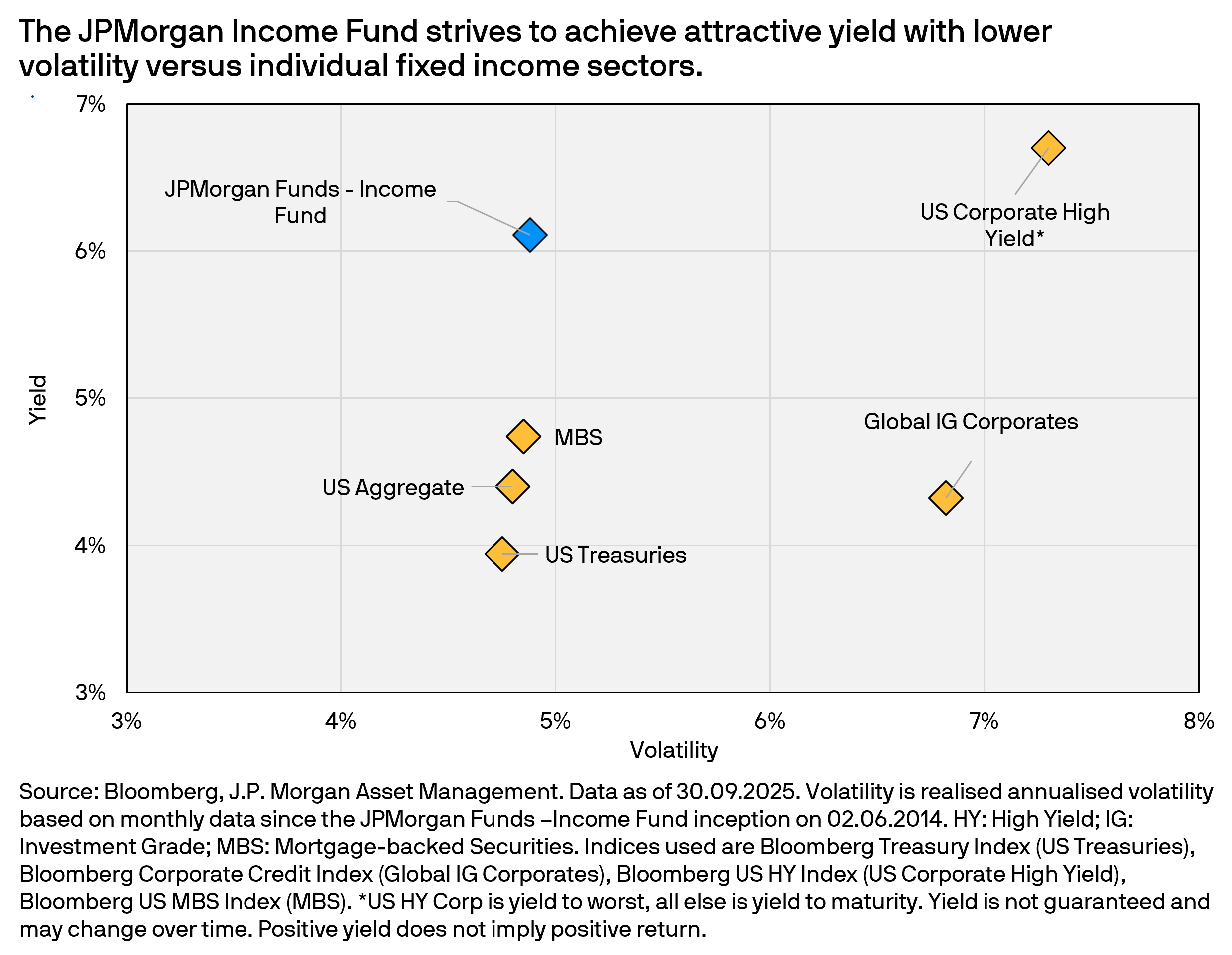

For over a decade, the JPMorgan Funds – Income Fund has successfully navigated multiple economic and political cycles, while recording robust returns, attractive income and lower volatility versus global investment grade bonds. Its long track record of actively managing duration exposure may prove valuable in navigating potential downside growth risks and inflation surprises in the current market environment.