Introducing JEPI, JEPQ and JEPG

Meet Hamilton Reiner,

the expert behind JPMorgan’s options-based ETFs.

Curious how he pioneered delivering higher income and lower volatility for investors? Read the article to uncover his approach and insights!

Enhance your portfolio with our active income ETFs

Get active with an award-winning ETF manager

Best ETF Manager

AsianInvestor Asset Management Awards 2024, 20256

Learn more about Equity Premium Income

Discover JEPI, JEPQ and JEPG

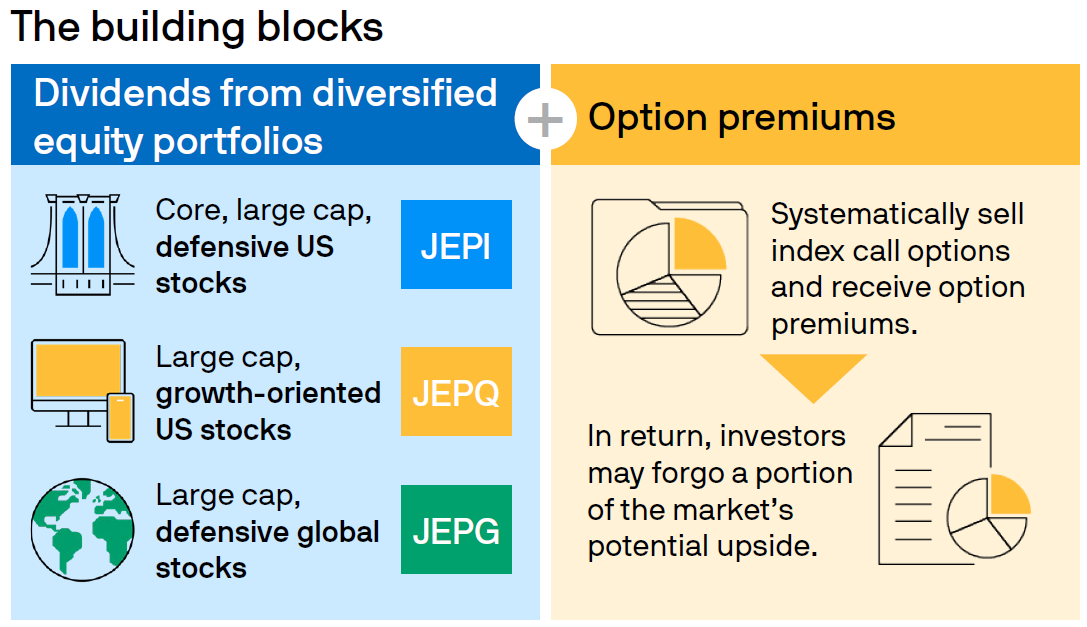

Download our brochure to learn more about active ETFs, the building blocks of the Equity Premium Income strategy, and our three solutions – JEPI, JEPQ and JEPG. Explore the roles they can play in portfolios to enhance income potential and harness the market upside.

Equity Premium Income explained. Watch now!

Delve deeper into our Equity Premium Income solutions through a series of informative and insightful videos.