The preservation of the environment has risen to the top of the agenda for governments, corporations and individuals around the world. There is good reason for this. Key environmental issues, such as climate change, the protection of biodiversity, and water and waste management are among the biggest challenges facing our planet, and a coordinated global approach is required to tackle them.

What we have seen so far is consumers voting with their wallets and avoiding companies with poor environmental records, while governments are introducing legislation that is increasingly pushing for tough cuts to carbon emissions to meet their net zero targets. For investors, this change in policy direction and consumer trends is too large to ignore. The consideration of environmental factors in investment decisions now feels essential to drive long-term returns.

The role of environmental factors in portfolio management

Clearly these changing trends would benefit some companies more than others. Those businesses that are heavy emitters of greenhouse gases, or are not taking their environmental impact seriously, risk ending up on the wrong side of legislation and consumer demand. Integrating environmental risks into investment decisions can help investors filter out those companies who may fall victim.

However, investing with environmental factors in mind is not just about risk reduction. The increasing importance of the preservation of the environment also brings with it many compelling investment opportunities. While some companies will be left behind during the energy transition, there are a number of companies that are actively helping to facilitate the move to a low carbon future. These companies can be found in a range of sectors. For example, electric car manufacturers, or clean energy companies; or sustainable forestry businesses helping to extract carbon from the atmosphere, and technology companies working on artificial carbon extraction initiatives. These companies, and many others, have the potential to be beneficiaries of the significant increase in public and private investment that is needed in the environmental space over the decades to come.

Another reason why investors are attracted to companies and projects that are helping to address environmental issues is the potential to align personal values with investment decisions, as people consider what type of planet they want to leave behind for future generations.

Work to mitigate environmental risk and limit the impact of global warming is well underway. Climate is perhaps the highest profile environmental issue and the Paris Climate Accord, which gained near-unanimous international support, has set targets for global carbon emissions in order to keep the global temperature rise well below 20C this century (compared to pre-industrial levels). However, achieving this goal still requires wide-ranging, large-scale, rapid and systemic transformation of the global economy away from its current dependence on fossil fuels.

According to the International Energy Agency (as at November 2022) the transition to a low-carbon economy will require investments of at least USD 4 trillion to USD 6 trillion a year, of which 20%-28% is expected to come from the financial system.

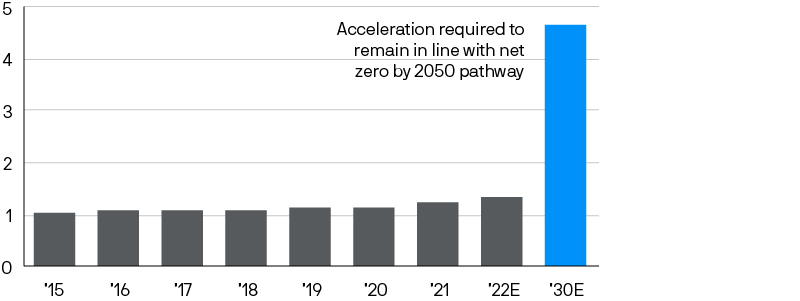

An increase in financial support is needed for the low-carbon transitionGlobal investment in clean energy and energy efficiency, USD trillions

Source: International Energy Agency, J.P. Morgan Asset Management. Data as of 4 November 2022. Forecasts are not a reliable indicator of future results.

Investors’ capital, therefore, plays a crucial part in helping to mitigate not only climate risks, but broader environmental issues.

The investment risks and opportunities presented by climate change, and the response to it, are transformational. We believe that investors simply can no longer afford not to account for environmental factors in their portfolios.

09xf220112102927