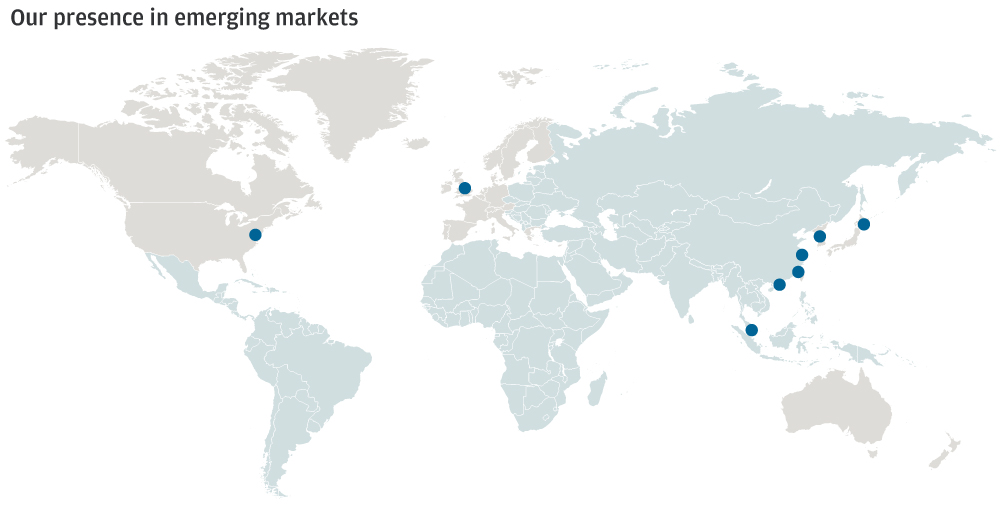

Our emerging market equity and debt investment processes are powered by local knowledge. Our products, developed over a long history of emerging markets investing, are designed to meet a wide range of investor needs.

Share in the emerging market revival

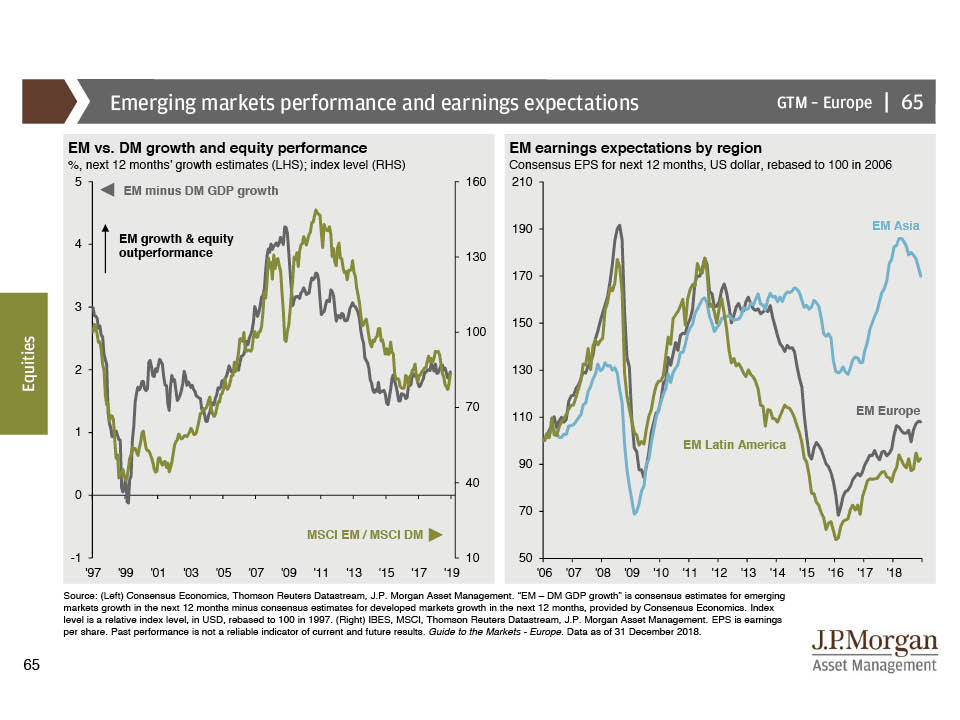

After a period of slower growth, emerging markets appear to have turned a corner. Overseas trade and investment are driving a broad economic recovery, and strengthening consumer demand is also starting to provide a boost.

Many countries have reduced their dependence on commodity exports, with the largest sector in the MSCI Emerging Markets Index now information technology - reflecting innovation at local companies and rapid adoption of new technologies around the globe.

The improving economic backdrop is evident in rising expectations for company earnings, particularly in emerging Asia, but in other regions too. And investors have already begun to participate in the reversal of fortunes, with both emerging market equities and debt outperforming their developed market counterparts over the past year.

Tap into local insights

At J.P. Morgan Asset Management, we are pioneers in emerging market investing. We have managed emerging market equity funds since 1971 - 15 years before the asset class got its name - and debt since 1995.

We believe opportunities in emerging markets are best exploited through local knowledge. Only an experienced manager with real depth and breadth of research coverage has the ability to identify the companies offering the best long-term growth potential, and the debt issuers with the strongest credit quality.