Capture returns beyond public markets

Alternative asset classes, such as private equity, private credit and real assets, can help to diversify traditional balanced equity/bond portfolios against a broader range of economic and market risks, and provide opportunities for enhanced long-term returns from active management.

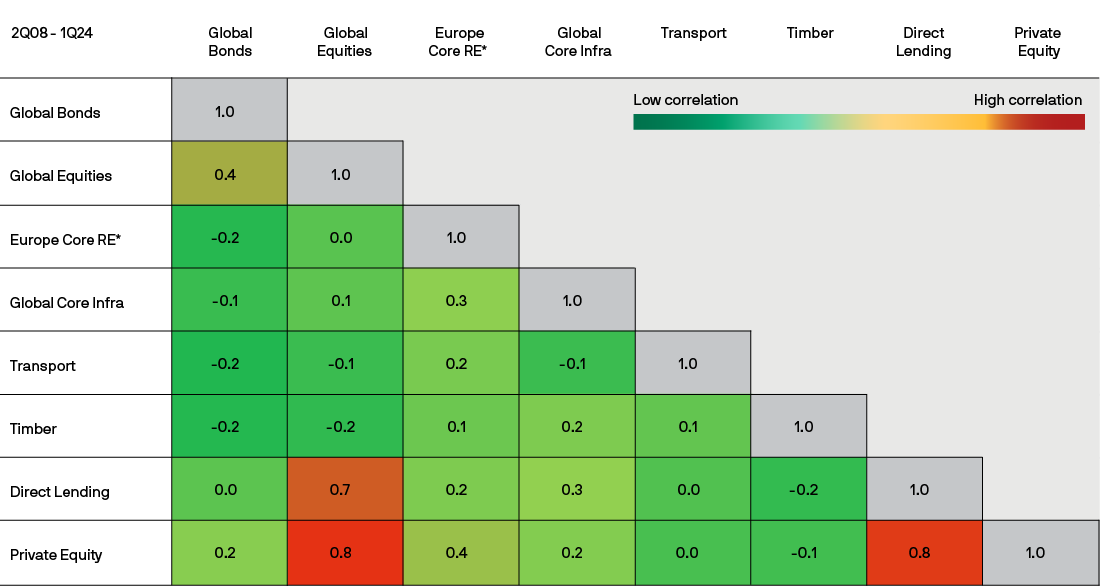

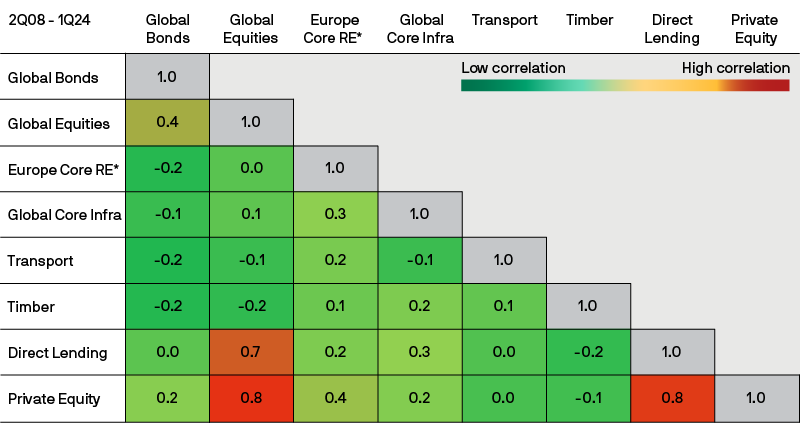

Public and private market correlations - Quarterly returns

Many alternative assets, such as real estate, transport, infrastructure and timberland, can enhance diversification in portfolios through their ability to provide non-correlated or negatively correlated returns with public markets. Other private assets, such as private equity and direct lending, can provide compelling opportunities for return enhancement.

Source: Bloomberg, Burgiss, Cliffwater, MSCI, NCREIF, PivotalPath, J.P. Morgan Asset Management. *Europe Core RE includes continental Europe. Private Equity and Venture Capital are time-weighted returns from Burgiss. RE: real estate. Global equities: MSCI AC World Index. Global Bonds: Bloomberg Global Aggregate Index. U.S. Core Real Estate: NCREIF Property Index – Open End Diversified Core Equity component. Europe Core Real Estate: MSCI Global Property Fund Index – Continental Europe. Asia Pacific (APAC) Core Real Estate: MSCI Global Property Fund Index – Asia-Pacific. Global infrastructure (Infra.): MSCI Global Private Infrastructure Asset Index. U.S. Direct Lending: Cliffwater Direct Lending Index. Timber: NCREIF Timberland Property Index (U.S.). Hedge fund indices are from PivotalPath. Transport returns are derived from a J.P. Morgan Asset Management index. All correlation coefficients are calculated based on quarterly total return data for the period indicated. Returns are denominated in USD. Past performance is not a reliable indicator of current and future results. Data are based on availability as of August 31, 2025.

More is better in alternatives

Whether clients have a conservative, balanced or aggressive risk profile, adding a multi-alternatives allocation to an existing portfolio of stocks and bonds can help to diversify risk and enhance returns over time.

Forecasts are not a reliable indicator of future performance. For discussion purpose only. Source: J.P. Morgan Asset Management, as of September 2025. Expected returns and expected volatilities are based on 2026 LTCMA asset class assumptions in EUR, net of management fees, and represents median manager performance. Equities and bonds are based on global equities and euro aggregate bonds respectively.

Diversification does not guarantee positive returns and does not eliminate the risk of loss.

Access the potential of a diversified, global multi-assets portfolio

JPMorgan ELTIFs – Multi-Alternatives Fund captures the diverse investment opportunities offered by private markets within the European Long-Term Investment Fund (ELTIF) wrapper. The fund provides your clients with access to new sources of return and can help to boost the resilience of portfolios across market cycles.

Fund materials

1 Time Weighted Return (TWR) eliminates the effects of additional capital that’s added to the portfolio, as well as any withdrawals from the portfolio, over the stated time period. These targets are the investment manager’s internal guidelines only to achieve the fund’s investment objectives and policies as stated in the prospectus. The targets are net of fees and subject to change. There is no guarantee that these targets will be met.

2 Source: J. P. Morgan, as of 30 June, 2025. AUM figures are representative of assets managed by the J.P. Morgan Private Markets and J.P. Morgan Global Alternative Solutions groups.

Materials to share with your clients

JPMorgan ELTIFs – Multi-Alternatives Fund brings the extensive multi-alternatives expertise, multi-layered risk management and research-driven investment approach of one of the world’s leading alternatives managers to your clients’ portfolios.