A summary of the latest trends in the markets (December 2025)

November saw subdued returns for global markets. Developed market equities rose just 0.3%, while global bonds returned 0.2%. Defensive sectors outperformed, reversing the trend seen since May, as technology and cyclical stocks lagged.

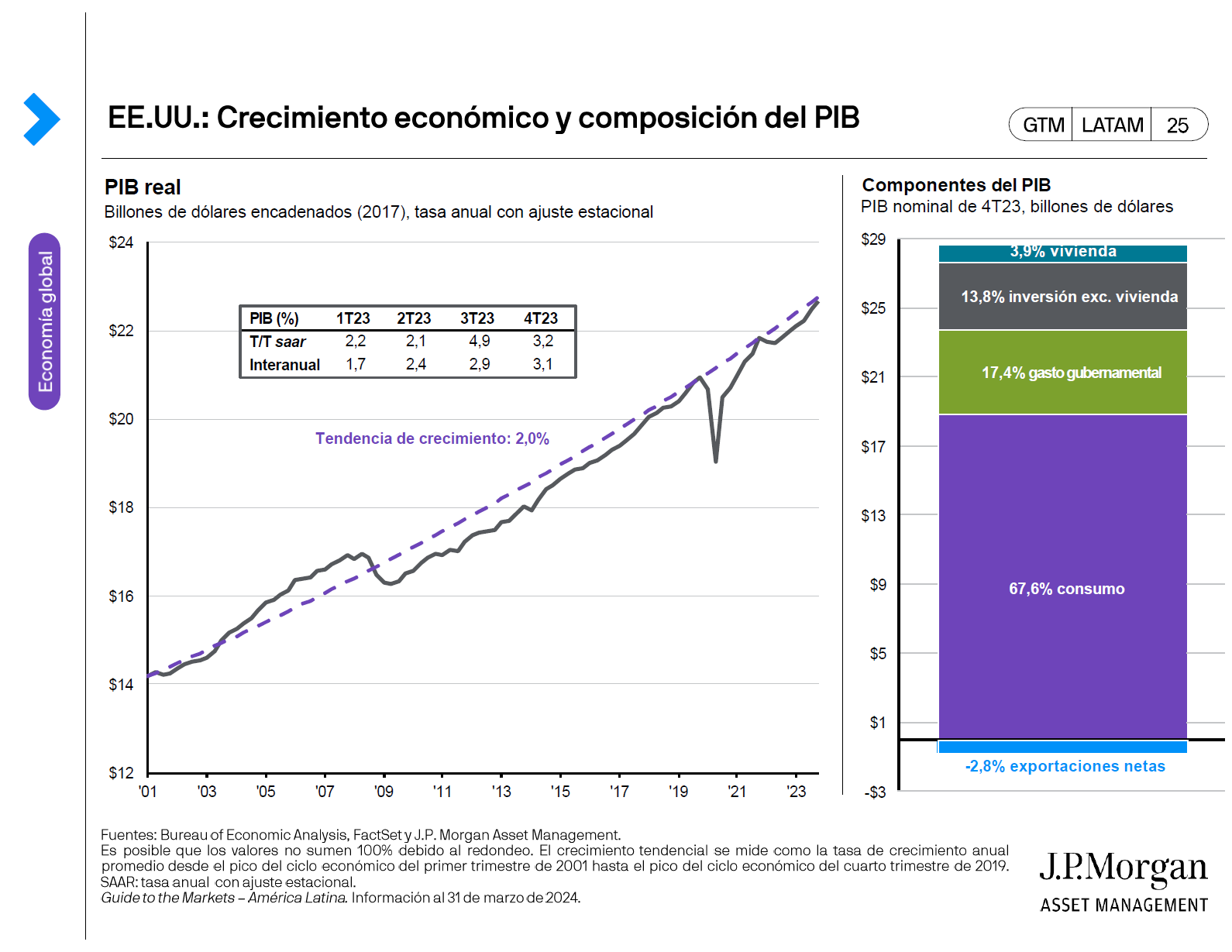

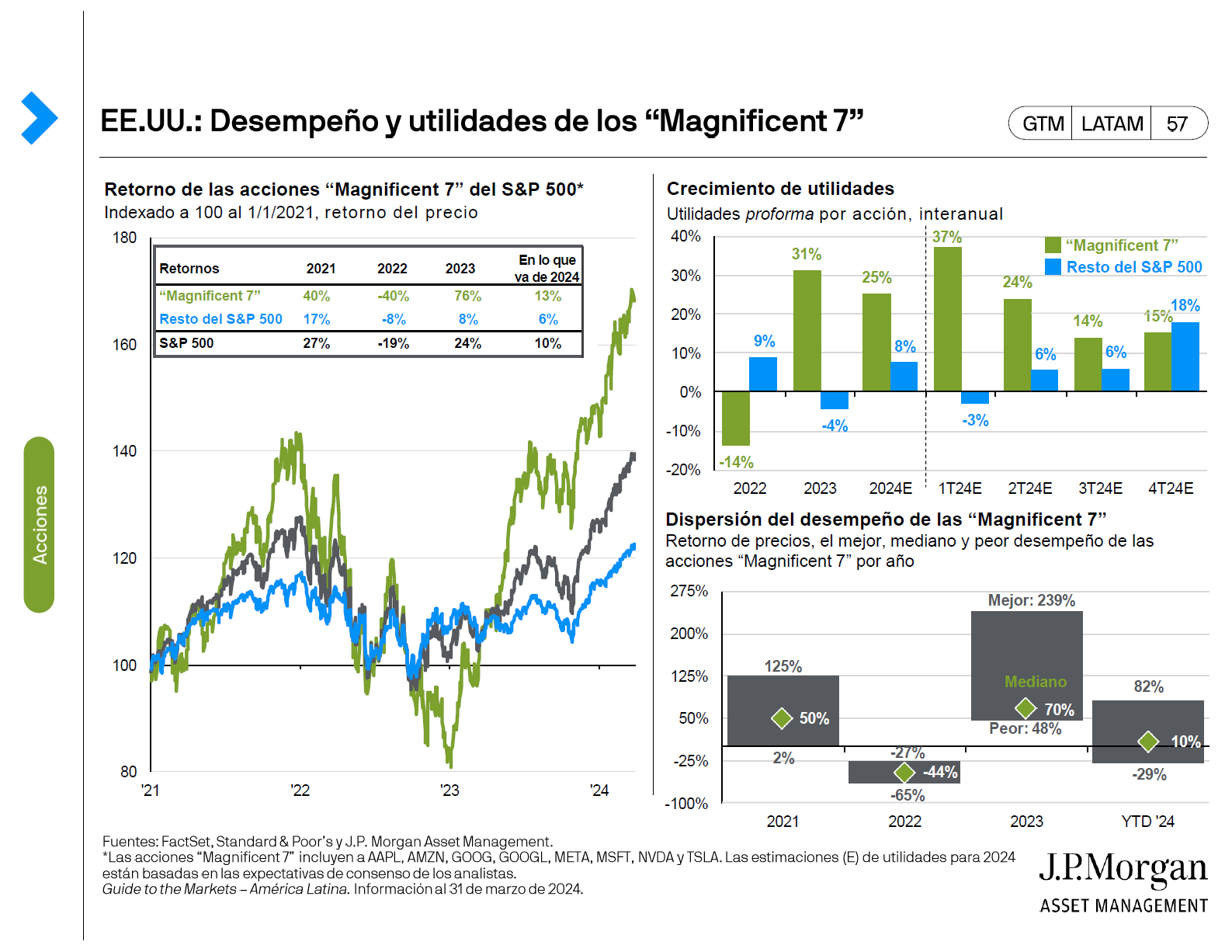

In the U.S., the longest government shutdown in history, lasting 43 days, ended mid-month, but market sentiment remained cautious due to ambiguous data and uncertainty about monetary policy. The September jobs report was finally released and showed 119k jobs being added, well above expectations of 51k. However, the unemployment rate rose to 4.4%, the highest level in more than three years. The current mix of labor market indicators shows that slack continues to gradually build. For U.S. equities, despite a robust earnings season—81% of S&P 500 companies beat estimates and EPS growth reached 13%—they rose just 0.3% during November. The “Magnificent 7” saw 2025 EPS growth expectations rise to 22%, but high valuations and doubts about future growth limited further gains. As the AI bubble debate continues, investors should remain invested but ensure proper exposure to asset classes outside U.S. equities.

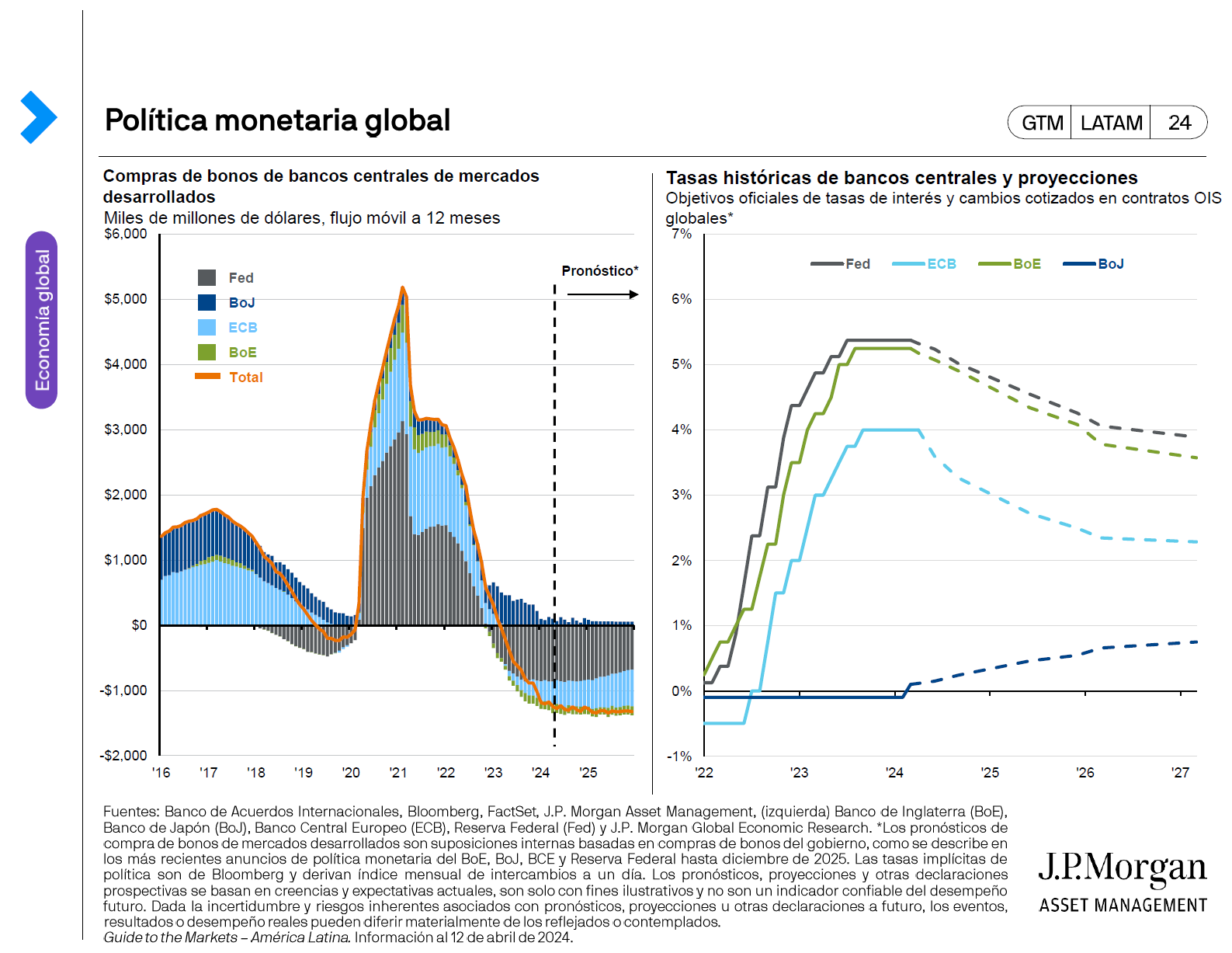

European equities ex UK outperformed the U.S. (+1.3%), supported by financials and technology, while autos lagged. Europe was helped by strong earnings expectations for 2026 and lower tech concentration. In Japan, significant rate volatility caused jitters in the market. Doubts grew about how long expansionary fiscal policy, supported by loose monetary policy from the BoJ, could be maintained. The depreciating yen adds to the inflationary risks in the Japanese economy, with the October CPI rising 3% y/y. This caused government bond yields to rise, making Japanese long government bonds one of the worst performers during the month, down 4.2%. It has also led to renewed concerns about another carry trade unwind, similar to the August 2024 episode.

On the trade front, tensions have eased, and the Trump administration is showing more willingness to lower some tariffs due to affordability concerns. The Supreme Court heard the first oral arguments in early November challenging the president’s authority to impose tariffs under the International Emergency Economic Powers Act. While a final decision may take time, the administration is likely to use other legal provisions, such as Sections 122, 232, and 301, to implement temporary or sector-specific tariffs. Investors should expect ongoing uncertainty around tariff levels and inflationary pressures into next year.

Looking ahead, November’s rotation from growth and technology to defensive sectors underscores the importance of diversification. Regional diversification proved beneficial, with European and Japanese equities outperforming the U.S. and emerging markets. High-quality bonds remain crucial for portfolio risk management, especially if AI-driven equity gains prove unsustainable.

For important information, please refer to the homepage.

This content is intended for qualified investors and is part of the educational material available for download through this page. We recommend reading the document for complete access to the information and its respective disclaimers.