A summary of the latest trends in the markets (December 2024)

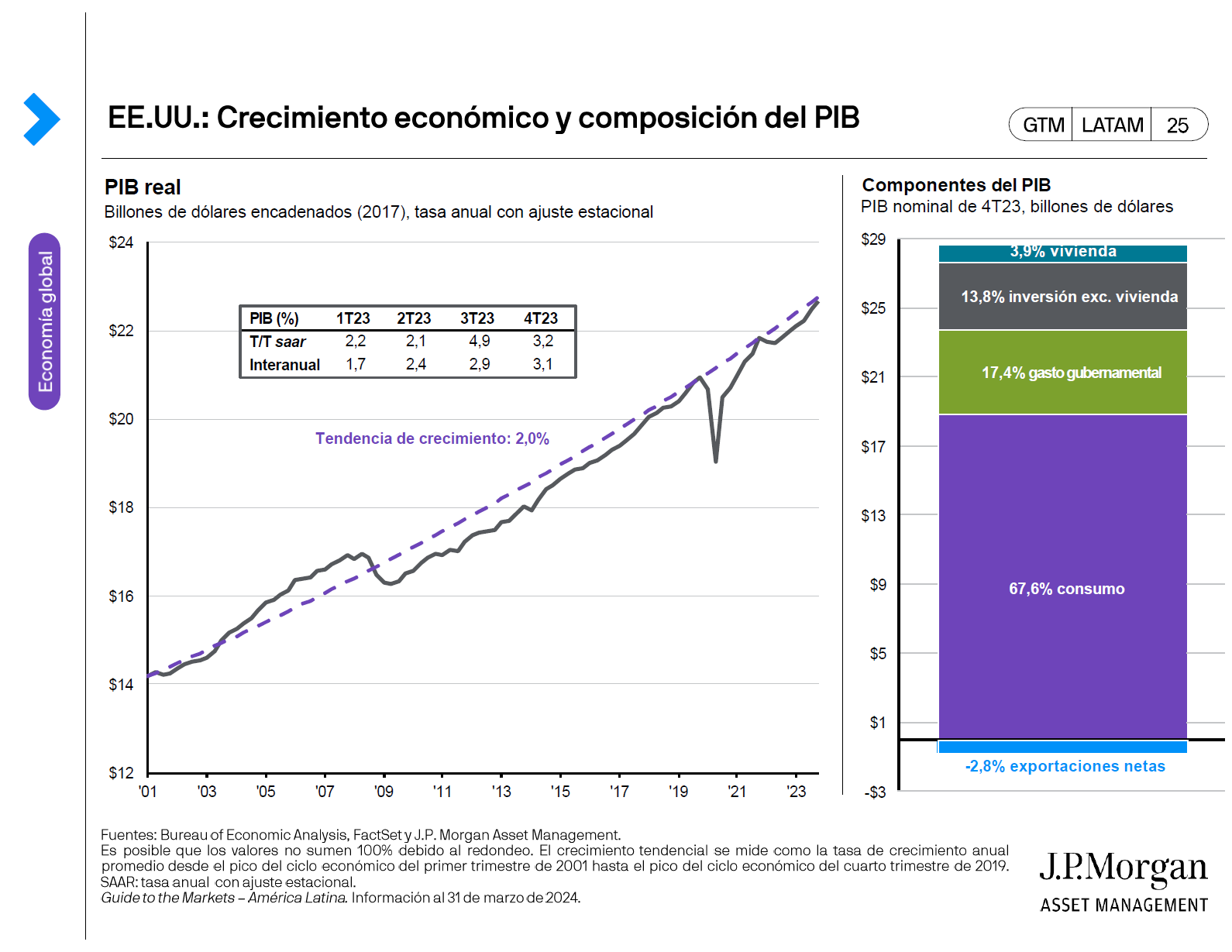

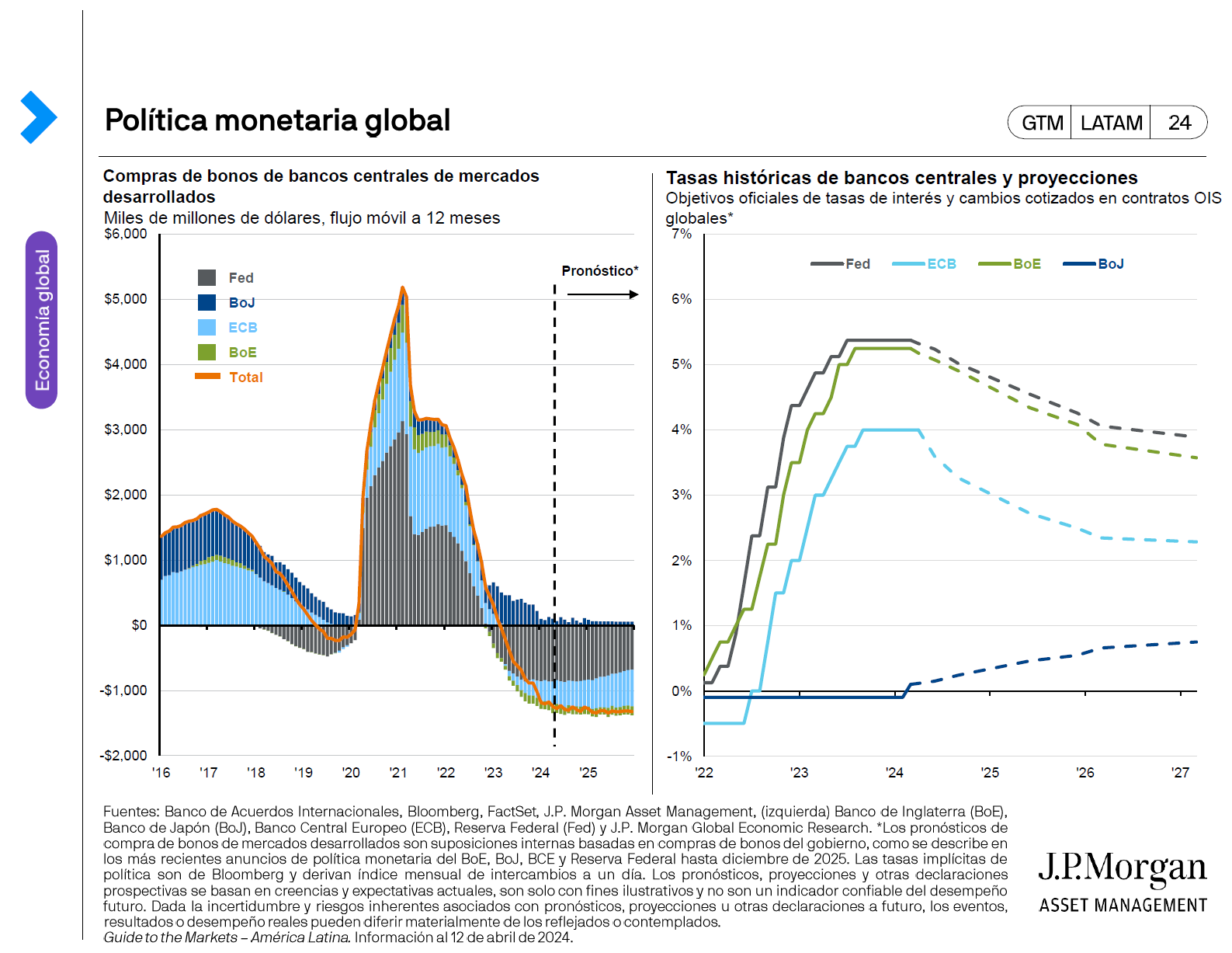

The U.S. economy continues to be the top performer, with robust growth and consumption of 2.8% and 3.5% q/q saar, respectively. The October jobs report showed a disappointing 12,000 jobs being added, but this was impacted by strikes and weather events. Recent revisions to labor market data also show that the nonfarm payrolls figures continue to overstate employment growth. However, this likely means that productivity growth is playing a bigger role. The Federal Reserve will likely cut rates by 25bps again in December, but its cycle may be cut short due to inflationary pressures from tariffs and other potential policy changes.

China’s economy continued to lose momentum in November. Exports increased a robust 12.7% y/y, compared to 2.4% the month prior, likely due to companies trying to build inventories before tariffs are potentially implemented. Imports, which measure domestic demand, fell 2.3% y/y, after rising 0.3% last month. Additionally, retail sales and industrial production data were mixed.

In developed markets ex-U.S., economic conditions remain unstable, particularly in the Eurozone. Eurozone PMIs weakened again to 48.1 in November, with significant weakness in France. In Japan, real wages grew a robust 2.1% y/y in September, while inflation grew 2.3% y/y in October; if its economic metrics can stay at these levels, the Bank of Japan will likely feel comfortable raising rates again this year or in 2025.

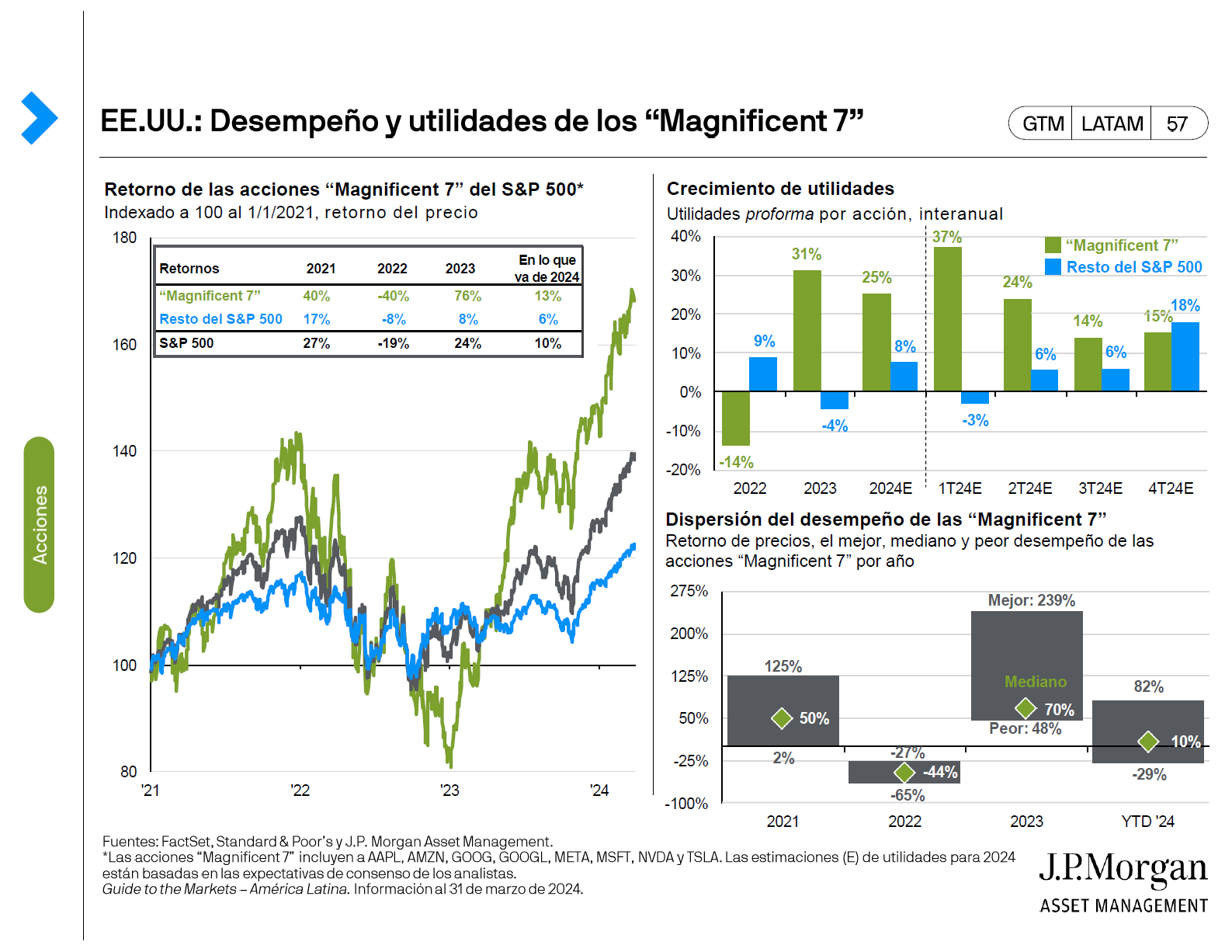

U.S. equity markets reached new heights in November, with the S&P 500 surpassing the 6,000 mark. Equities rallied due to President-elect Trump’s plans for deregulation and corporate tax cuts. While most sectors did well during the month, cyclical sectors did better, particularly Financials, small-cap equities, and Industrials. However, some sectors, like those exposed to government contracts (Defense, Healthcare) had worse performance due to expectations for government spending cuts. For bonds, 10-year Treasury yields increased the day after the election but finished the month 10 basis points lower, as some cabinet member nominations brought some relief that the upcoming government may be mindful of fiscal constraints. The dollar strengthened a solid 1.7% against the currencies of its major trading partners.

Perhaps the biggest uncertainty going into the next year is U.S. trade and immigration policy. President-elect Trump announced a variety of tariff plans along the campaign trail, including 10-20% universal tariffs and up to 60% tariffs on Chinese imports. More recently, he announced that he would apply a 25% tariff on Canada and Mexico and add an additional tariff on China of 10%. For immigration, he announced that mass deportations could take place. These policies could have significant implications for labor supply, inflation, and growth.

Amid rising volatility due to policy uncertainty, investors may want to consider increasing exposure to alternative assets. Since 1990, a portfolio comprising 30% alternative investments, 40% equities, and 30% bonds has demonstrated 2% lower volatility and higher returns compared to a traditional 60/40 portfolio. Additionally, lower rates should lead to higher multiples and more exit activity for private equity and reduce pressure on the real estate market.

Looking ahead, the election results bring a lot of policy uncertainty, and markets are likely to see more volatility. Despite this, investors should continue to focus on opportunities, such as better performance for other sectors outside the Mag 7 (especially for indirect beneficiaries of the AI trend, like utility companies), slightly lower rates, and normalization in private equity exit activity. Sticking to one’s investment plan, which includes rebalancing and making adjustments based on goals, remains the best long-term strategy.

Snapshot of the economic and market update for the fourth quarter of 2024

For important information, please refer to the homepage.

This content is intended for qualified investors and is part of the educational material available for download through this page. We recommend reading the document for complete access to the information and its respective disclaimers.