The Weekly Brief

21-10-2024

Thought of the week

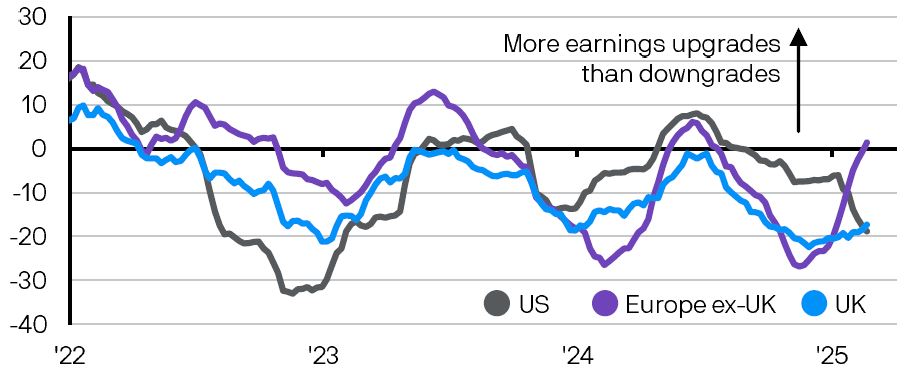

Third quarter earnings season is picking up pace, with nearly 40% of the S&P 500 reporting this week. Results have been somewhat mixed so far. Early reports from the banking sector were generally well received, before weaker numbers from a bellwether stock in the semiconductor industry dampened sentiment across the broader tech sector. With analysts having steadily revised down their expectations since the start of July, the current estimate of around 4% earnings growth for the S&P 500 compared to the same quarter of 2023 appears relatively undemanding. More significant, however, will be the extent to which profit growth continues to broaden out across sectors. After two years where a handful of megacap tech stocks have done a lot of the heavy lifting, further signs that earnings are becoming more evenly distributed could support a rotation beneath the index level.

We are entering the busiest week of third quarter earnings season

%, S&P 500 reporting earnings by market cap

More Insights

0903c02a81fb9234