ETF foundations

Exchange traded funds (ETFs) are pooled funds that are as easy to trade as stocks. Historically, ETFs have been most commonly used to track equity indices, but they are increasingly being used with other asset classes, such as fixed income and alternatives, and with active investment strategies as well as passive.

ETFs offer the same all-in-one diversification benefits as traditional mutual funds, while also allowing investors to trade in a single transaction, and in real time during market hours, while having full visibility on the fund's underlying holdings. Powered by these benefits, ETFs have transformed global investment industry since they were first introduced back in the 1990s.

Here are the key features that make ETFs stand out from other funds.

Cost

In general, the cost-efficient ETF structure is synonymous with low fees, and low trading and execution costs. To understand why, we have to look at the ETF structure, whereby the supply of an ETF’s shares is closely controlled by two types of specialist investor: market makers, who can buy and sell ETF shares at specified prices at all times in the secondary market; and authorised participants (APs), who are allowed to create or redeem ETF shares in the primary market.

ETFs costs are lower because the process to create or redeem ETF shares is highly efficient. If an ETF suffers a redemption, or receives inflows, it may not need to trade its underlying securities if an AP or market maker is able to find a willing buyer or seller for the ETF shares in the secondary market. APs may not therefore need to create or redeem shares which avoids trading in the underlying securities every time they receive a buy or sell order for an ETF.

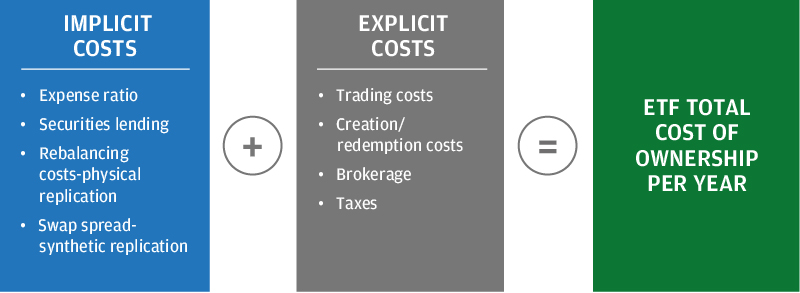

However, while this low fee structure is attractive, ETF investors also need to evaluate other costs incurred for holding the fund. These costs include such factors as transaction costs related to portfolio rebalancing, and any costs associated with securities lending, for example. Investors will also need to account for the cost of purchasing and exiting the fund. These charges include brokerage fees, and creation and redemption costs.

Total investment cost

Source: J.P. Morgan Asset Management; for illustrative purposes only.

Transparency

An UCITS ETF is required to publish its holdings on a daily basis, and these records are free for anyone to view. An ETF investor can therefore see exactly which assets their ETF owns at any point in time on a daily basis, and how those holdings have changed over time. These details are freely available for J.P. Morgan Asset Management ETFs via our website.

This level of transparency can help ensure portfolio managers are accountable for their decisions, and can also help investors keep track of their portfolios so that they stay close to their stated objective at all times.

Liquidity

Shares in an ETF are priced throughout the trading day, and can therefore be bought and sold at a current market price at any time, so long as the exchange that the ETF is listed on is open. Pricing aims to be as fair as possible and is therefore efficient, with APs able to use arbitrage to ensure ETFs prices generally stay close to fair value. The price will usually be at a small premium or discount to the ETF’s underlying net asset value. Importantly, ETF pricing reflects real-time market conditions. Investors can get a view on the value of their investment through the trading day thanks to the publication of an intraday indicative price, or iNAV, which is refreshed every 15 seconds. ETF price will stay as close as possible to the fair value iNAV.

The intraday pricing and liquidity offered by an ETF provides major benefits, including price discovery and the ability to get immediate market exposure at a known price. Enhanced ETF liquidity may also may be of value to investors who need to trade frequently. It allows investors to track their portfolio performance in real time through the trading day and make changes, at a known price and generally with quick execution, rather than wait until the next day, as is the case with traditional mutual funds.

Accessibility

As ETFs are traded on regulated stock exchanges, anyone can buy or sell an ETF through their broker. In most cases there is no minimum purchase size, special requirement or barrier to entry.

Thanks to an ETF’s intraday liquidity, it is also possible for sophisticated investors to use ETFs to build complex investment strategies. For example, an investor can short an ETF, buy an ETF on margin, or write options on an ETF. This level of flexibility gives sophisticated investors the ability to hedge their holdings, increase their market exposure or even enact sophisticated options strategies.

What types of ETFs are available?

The most popular ETFs have been those tracking indices, which seek to match the portfolio holdings and performance of broad market benchmarks. Index-tracking ETFs offer an easy, cost efficient way for investors to add market beta. The indices that these funds track are usually market cap weighted, which means the ETF’s portfolio will be biased towards the largest companies or most indebted bond issuers.

As market conditions and investor needs have changed over time, ETF providers have responded with new smart beta, thematic and active ETF strategies.

Smart beta funds aim to track the performance of custom-built indices that have been designed to enhance the return potential of market cap weighted portfolios by distributing risk more evenly across regions, sectors and stocks.

Active ETFs are managed by professional portfolio managers, who pick only those securities that they consider to be the most attractive in order to target a specific outcome—such as to generate an income, outperform a benchmark or reduce risk.

How can ETFs be used in a portfolio?

The wide variety and versatility of ETFs allow them to play a number of different roles in an investor’s portfolio, including:

- Portfolio construction

- Cash Equitization

- Access to new assets

- Hedging

- Liquidity management

- Variety/precision

At the core, the ability of passive ETFs to mirror broad stock and bond indices at low cost make them excellent portfolio “building blocks” to enhance diversification. However, smart beta and active ETFs are also increasingly being used as core building blocks, as well as helping to fill portfolio gaps, help realign an unbalanced portfolio or provide access to otherwise hard-to-reach markets.

Investors are also using ETFs to reduce costs. And because ETFs can be traded quickly and easily throughout the day, they’re effective vehicles for moving in and out of markets as new opportunities and risks arise.

ETFs could make a compelling addition to any diversified investment portfolio.