Navigating China’s credit landscape with a future-proofing perspective

An under-represented market

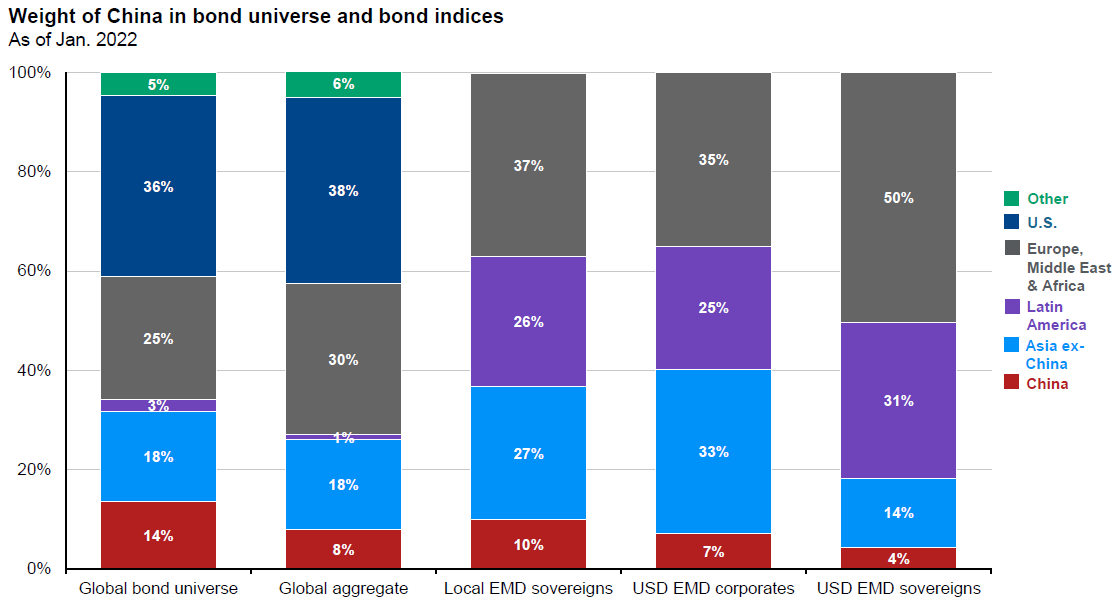

China’s bond market has grown significantly over the past several years and is now the world’s second largest with a market size of USD 20.7 trillion1. However, China fixed income remains vastly under-represented in global indices relative to the size of its bond market and economy (see Fig 1). This is likely due to low coverage by the international rating agencies and perceived low liquidity in the individual bonds. Despite often untapped by global investors, interest towards the China’s onshore credit market is emerging.

Meanwhile, China bonds’ low correlation to traditional developed market bonds presents investors a good source of diversification*. Furthermore, in our opinion, opportunities for seeking yield supported by the relatively high yield potential as a result of China’s easing monetary policy makes it a relatively attractive asset class in a low interest rate world. For global investors seeking diversification* and attractive yields, China bonds are an increasingly accessible choice on the back of its evolving index inclusion.

Fig 1. Bond index weightings to China

Source: J.P. Morgan Asset Management Guide to China, data as of 31 January 2022. Provided to illustrate macro trends, not to be construed as offer, research or investment advice.

When considering investing in China fixed income and selecting strategies to express investment views, a number of factors should be taken into consideration. Firstly, how to track global fixed income benchmarks. Secondly, how to use China fixed income to generate alpha in investment portfolios. Last but not least, how to use China fixed income in the search for yield, in what is effectively a low yielding environment globally.

The role of ETFs

As one of the important portfolio construction tools, ETF strategies continue to gather momentum globally across all asset classes. This trend is like to continue and gather pace as ETF providers bring more thoughtful solutions to the broader market.

In particular, as access to liquidity becomes increasingly important to investors, bond ETF strategies can help increasing or decreasing exposures without buying or selling individual bonds.

For global investors looking to diversify their portfolios and seize China’s fixed income opportunities, ETF strategies can be one of the asset classes presenting that avenue. Currently, majority of passive China fixed income ETF strategies available in the market only invest in treasuries, and treasuries account for less than half of the entire China fixed income market.

Seeking liquid, beta exposures

When seeking liquid, beta exposures to China’s vast fixed income universe, it is important to consider whether the solution has the following:

- The ability to seek both onshore rates and liquid credit markets

- The capability to target the future state of inclusion, by maintaining dynamic exposures to corporate bonds as China fixed income market evolves

- The partnership with a reliable index provider to enable innovation and customization when developing benchmarks

A future-proofing perspective

At J.P. Morgan Asset Management, we are focused on innovation in the China fixed income market, seeking to deliver future-proofed solutions that are thoughtful around topics like China corporate credit. Our Global Fixed Income investment team has a long track record combining strong quantitative research and investment when managing systematic fixed income strategies.

By leveraging the skills and expertise of our global fixed income investment team, our ETF strategies harness the opportunities in China’s longer-duration aggregate bond market to build risk-adjusted portfolios as we help our clients to stay ahead.

1 Source: J.P. Morgan Asset Management Guide to China, data as of 31 January 2022

* Diversification does not guarantee investment returns and does not eliminate the risk of loss.

09oh222103135707