Managing short-duration renminbi exposures needs an active approach

Understanding China’s fixed income market

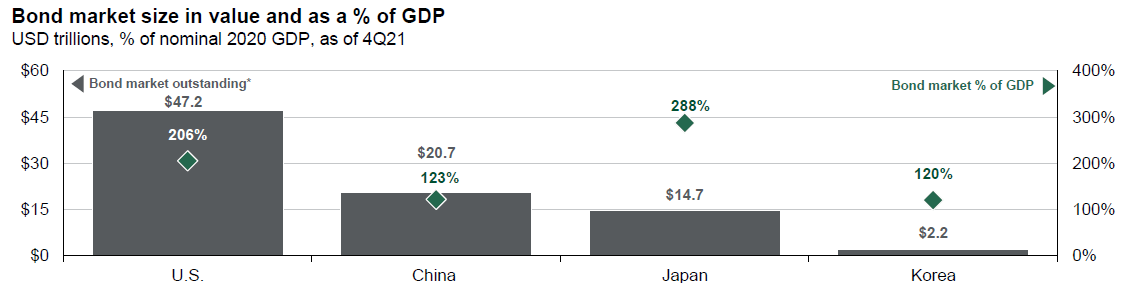

China currently has the world’s second largest bond market (see Fig 1). As many parts of the world are tightening, or about to tighten, their monetary policy, we are seeing a distinct monetary and policy cycles in China. Further stimulus measures by Chinese government are likely in order to reach the 5.5% growth target in 2022. In addition, China fixed income has low correlation with the global fixed income. Meanwhile, RMB has remained relatively stable during recent market volatility, likely due to China’s sizable account surplus.

Despite the significant market size and a relatively resilient currency, China bonds are often under-represented in global portfolios. As Chinese bonds continue to go global, more investors are likely to consider including them.

Fig 1. Debt and bond markets by country

Source: J.P. Morgan Asset Management Guide to China, data as of 31 January 2022. Provided to illustrate macro trends, not to be construed as offer, research or investment advice.

The role of ETFs

ETF strategies present a powerful portfolio construction tool for investors. Today, we are seeing advanced strategies (such as smart beta fixed income, multi-factor strategic beta, ultra-short income, liquidity alternatives and etc.) enabling the build of ETF portfolios with a level of sophistication and diversification* that could not have been envisaged even just five or ten years ago.

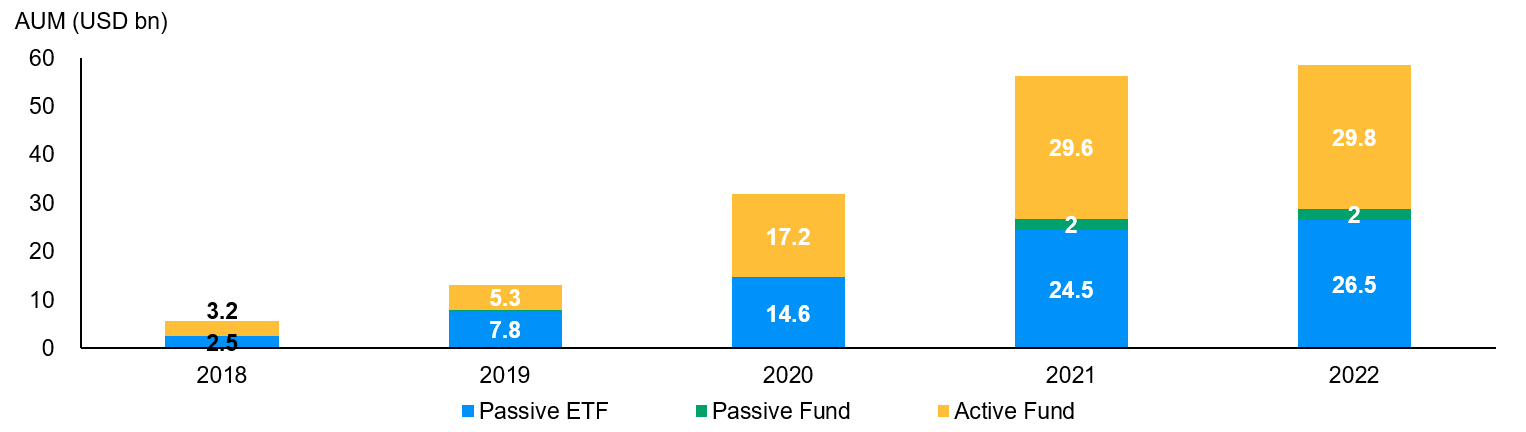

Currently, China fixed income solutions available in the market are dominated by mutual funds and passive ETF strategies which experience fast growth (see Fig 2). Indeed, active ETF strategies have several roles to play in navigating China fixed income market.

Fig 2. Growth of relevant Morningstar Europe, Asia and Africa (EAA) China fixed income and money market categories

Source: Morningstar Direct, including all funds and ETFs in the following Morningstar Categories: EAA China Bond; EAA RMB Bond – Onshore and EAA Money Market with either ‘China’ and / or ‘RMB’ in name; data as of 31 January 2022. Provided to illustrate macro trends, not to be construed as offer, research or investment advice.

Above all, active ETF strategies help target specific outcomes. For example, driven by fundamental bond selection, an active ETF strategy can help provide access to excess returns above a chosen index.

Moreover, active ETF strategies enable more thoughtful allocation. For example, traditional fixed income benchmarks tend to give larger weightings to issuers with higher outstanding debts. An active ETF strategy can assess the creditworthiness of individual issuers and make reasonable deviations from those traditional benchmarks.

Last but not least, active ETF strategies have the ability to rebalance portfolios outside of the systematic rebalancing dates used in passive indices. This flexibility provides more resilience in reacting to unexpected market events.

Employing an active approach

Demand for ETF strategies has grown rapidly in Asia in recent years. This growth is now being further boosted by the development of more sophisticated smart beta and active strategies. When employing an active ETF strategy to navigate China’s fixed income market, it is important to consider whether the solution has the following:

- The ability to deliver current income while seeking to maintain low volatility of principal

- A dynamic allocation between CNY and CNH to access a diversified range of instruments and issuers

- A good understanding of and resources to navigate China’s fixed income market, such as dedicated China’s strategists and credit analysts

- A disciplined, robust, repeatable and risk-controlled investment process

At J.P. Morgan Asset Management, we are focused on innovation in the China fixed income market, seeking to deliver unique solutions that are thoughtful around topics like short-duration renminbi exposures. Our Global Liquidity business manages USD 911 AUM , including a suite of well-received ultra-short duration ETF strategies. The investment team also possess a strong understanding of China’s credit market through a long-term collaboration with our joint venture there.

By leveraging the skills and expertise of our global liquidity investment team, our ETF strategies combine robust investing, independent insights and liquidity management to seek income opportunities in the China fixed income.

1 Source: J.P. Morgan Asset Management, data as of 31 December 2021.

* Diversification does not guarantee investment returns and does not eliminate the risk of loss.

09yi221803071010