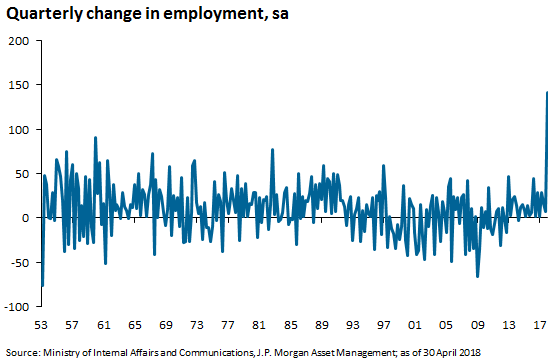

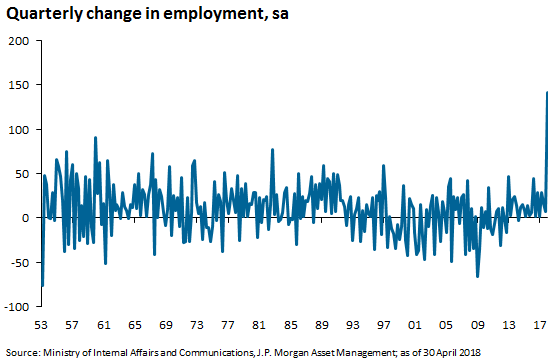

Japan has one of the lowest unemployment rates globally. Business surveys continue to indicate significant labour shortages and the working age population is no longer growing. So how is it possible that the economy added the most number of jobs since records began in Q1?

First some caveats – there are likely some seasonal adjustment issues with this data which may lead to downward revisions going forward. That said, on an unadjusted basis, Japan still added jobs in a quarter that historically sees large falls due to retirements and college students leaving work.

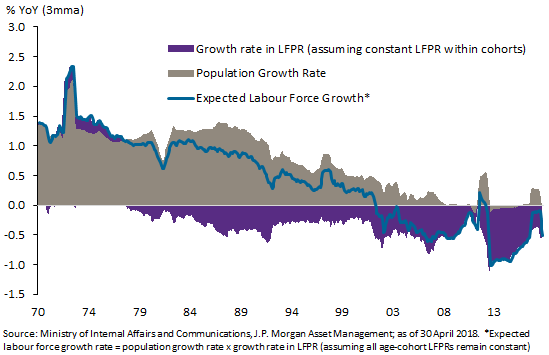

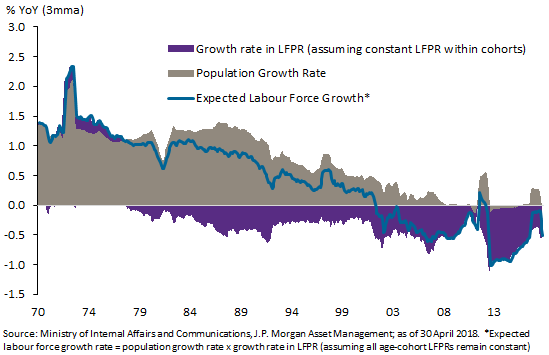

Given the demographics in Japan, the labour force should not be growing at the fastest pace since the 1990s. In fact, it should be shrinking. Labour force growth consists of population growth and the growth in the labour force participation rate (LFPR). Assuming a constant LFPR within age cohorts, a stagnant and aging population should be generating a negative labour force growth rate:

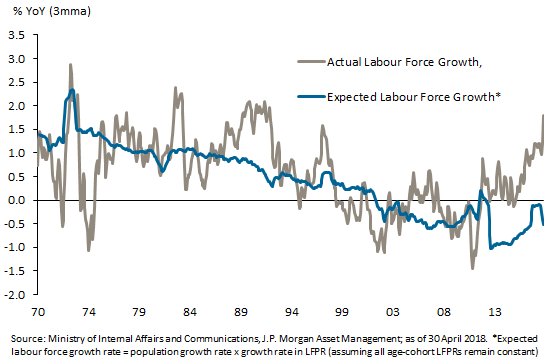

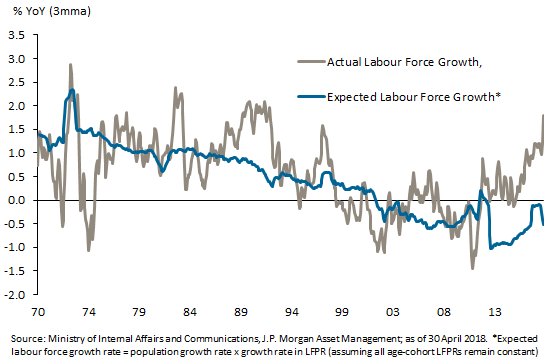

In reality, the labour force is growing just under 2% per year:

So where is the outlet and can other countries follow this same path as they approach full employment?

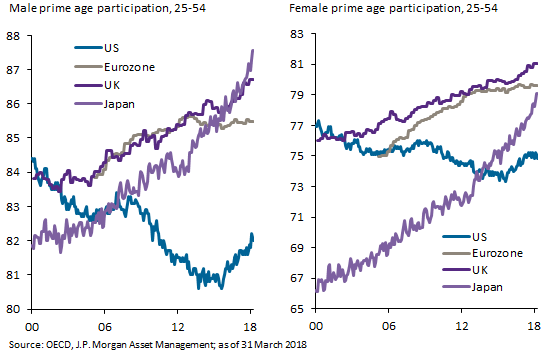

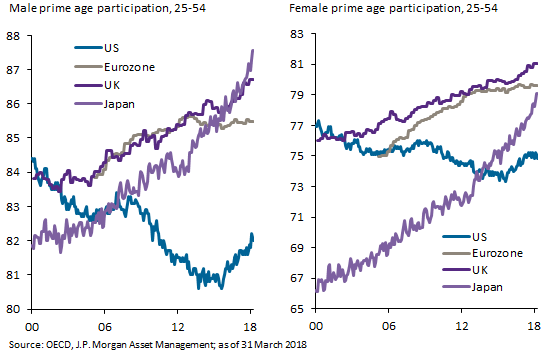

In Japan, there are two key sources of hidden slack. The most obvious and impactful is rising participation rates, especially female participation. The surge in women joining the labour force has been dramatic, especially into part-time employment.

This is a phenomenon that has been ongoing for some time. Whilst there is clearly a limit to this (only 100% of the population can join the labour force), there is no reason it cannot continue for some time yet as the labour market continues to tighten.

A similar trend has been happening to a lesser extent in other DM economies. The US, however, is a different story. Despite the male prime age LFPR rising since its depths in late 2015, this series has been on a structural downtrend for decades whilst female LFPR remains stubbornly flat. The IMF attributes this structural trend down to several factors including large numbers of incarcerations, the opioid crisis and shorter maternity leave. Whilst I do not expect a speedy rebound in a multi-year structural trend, the US may follow in the footsteps of Japan, at least cyclically, as the labour market tightens beyond full employment.

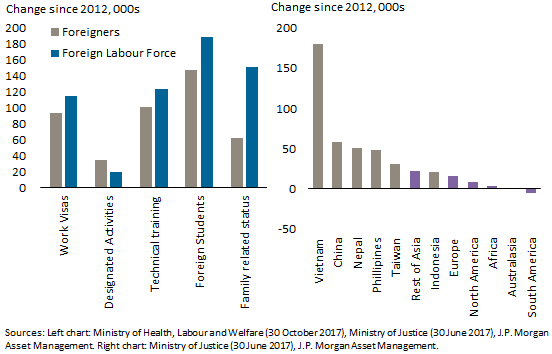

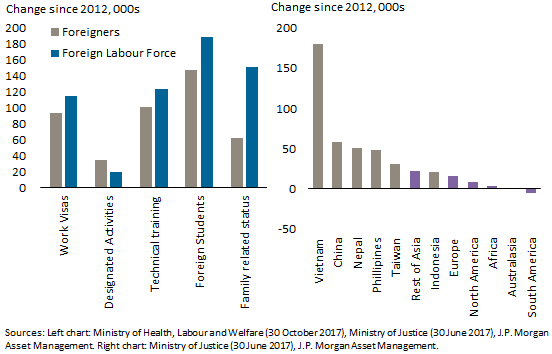

The second and less obvious outlet is immigration. Japan has a very strict immigration policy which only tends to give work visas to highly skilled workers in specific industries. Whilst the share of foreign workers in the labour force remains low (~2%), it has been rising and contributing to employment growth.

As can be seen below, a lot of the rise in foreign workers has come from students and trainees. The former can work up to 28 hours per week whilst the latter can work full-time after a certain amount of training in the first year of their entry. The second graph shows that a lot of these workers are coming from South East Asian countries with a much lower per capita GDP and a higher population growth rate.

Whilst I do not expect there to be an explicit change in immigration policy in Japan, this source of foreign labour is being implicitly allowed, even encouraged, as labour market shortages start to bite. Although this is becoming an important source of hidden slack in Japan, it is unlikely to be as important in the rest of the developed markets where foreign labour shares are much higher.

Overall, Japanese employment should not be growing. However, as the labour market tightens, slack continues to emerge, allowing the economy to continuing growing comfortably above trend.