Over the past few weeks, on-shore CNY interest rates have rebounded sharply higher from the cycle lows of early May. SHIBOR, Treasury bond and financial policy bank bonds yields all jumped across the curve, while credit spreads surged upwards. The combination of a central bank policy pivot, better economic data and market technical factors contrived to end China’s bond bull market – but is the upward momentum sustainable, and what are the implications for investors?

Swift Intervention:

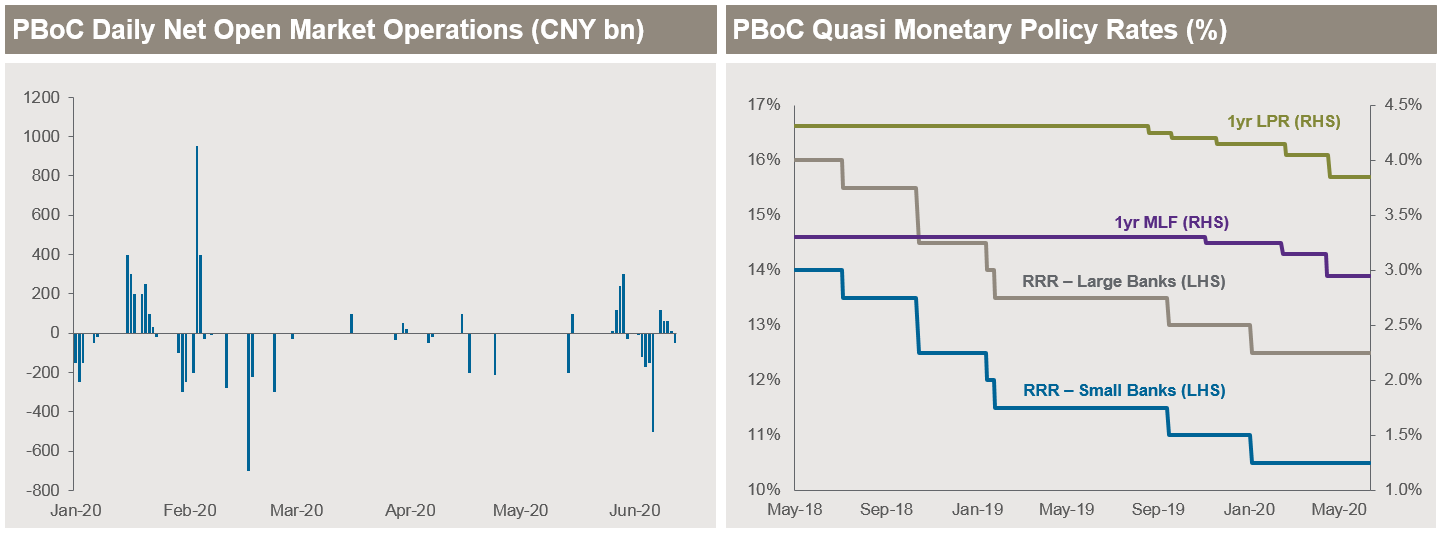

As financial markets reopened following Chinese New Year holiday, the Peoples Bank of China (PBoC) focused on minimizing the economic fallout from the Covid-19 outbreak (Figure 1). The central bank injected a record amount of liquidity via open market operations (OMO), cut the Reserve Requirement Ratio (RRR) and key quasi-monetary policy rates including the Medium Term Lending Facility (MLF) and the Loan Prime Rate (LPR).

Figure 1: The PBoC used monetary policy to support market stability

Source: Bloomberg, as at 14th June 2020

The PBoC also reduced the 7-day repo rate and trimmed the interest on excess reserves (IOER) for the first time since 2008. All these actions plus the plunge in first quarter GDP by 9.8%q/q raised expectations of additional rate cuts – and by mid-April market driven interest rates hit new multi-year lows.

The PBoC Pivot:

However, China’s apparent success in containing the Covid-19 outbreak and restarting the economy was soon reflected in economic data, which showed signs of normalization as large parts of the economy emerged from quarantine. Exports recovered faster than expected, policy driven sectors accelerated, and the PBoC’s new targeted lending tools supported a revival of small and medium enterprises.

In his annual policy address at the delayed National People’s Congress (NPC), Premier Li mentioned stability over forty times, compared with zero mentions of growth. The economic uncertainties triggered by the pandemic have threatened the government’s “six guarantees” including employment and basic livelihood, forcing a reappraisal of growth and stimulus plans. For the first time in over two decades, the authorities did not announce an official 2020 growth target. This reduced pressure on the Ministry of Finance and the PBoC to deliver further fiscal and monetary policy stimulus.

Instead, the Ministry of Finance made several formal announcements, encouraging market participants to focus on downside debt risks. Meanwhile, the PBoC surprised the market by leaving the MLF and LPR rates unchanged in May and June, and dramatically scaled back OMO - reducing the amount of liquidity in the banking system from excessive to merely ample.

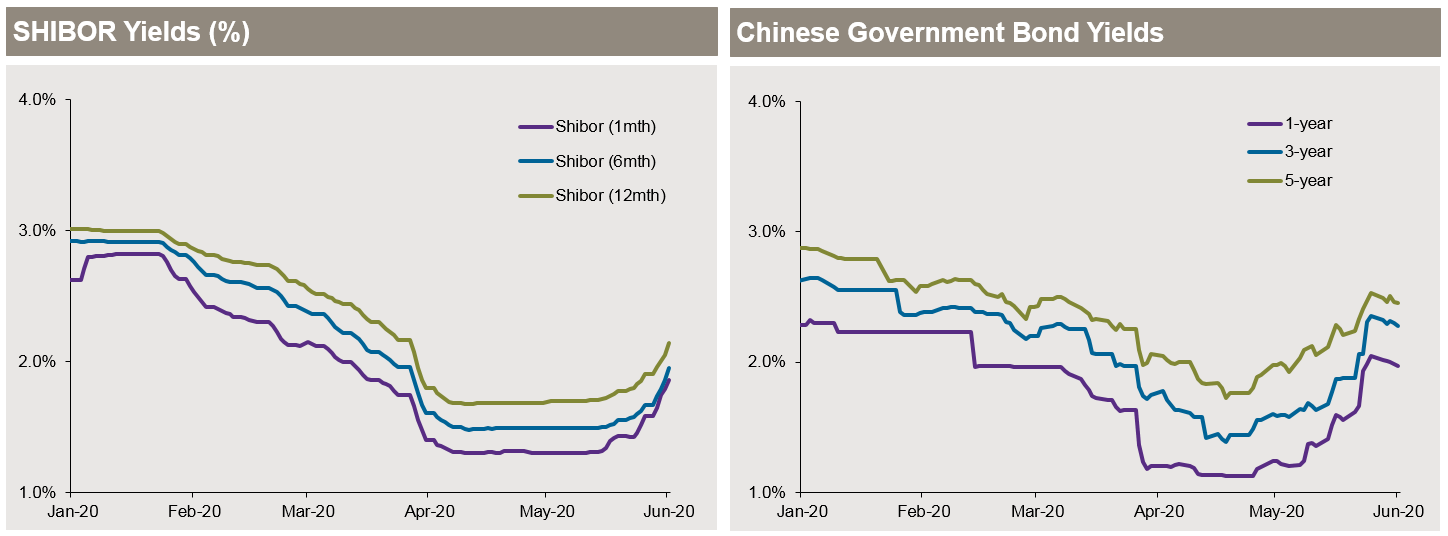

These factors plus technical dynamics including tax payments and sizeable local government bond issuance helped push yields (Figure 2) to two-month highs, ending China’s bond bull market, as investors unwound expectations of further PBoC monetary policy easing.

Figure 2: SHIBOR and government bond yields have rebounded sharply

Source: Bloomberg, as at 14th June 2020

The PBoC also hopes that standardizing the date for MLF (15th of each month) and LPR (20th of each month) combined with formalized notification of OMO (9-9.20am each day) will help reduce market volatility and improve forward guidance.

Investor Implications:

Rapidly declining yields in the first quarter triggered large flows into riskier investments including structured deposits, asset management products and short duration bond funds. Subsequently, as expectations of further monetary policy stimulus faded, market yields have increased, generating capital losses, fears of a spike in bond defaults and an investment retrenchment.

Despite the nascent recovery, economic activity remains well below potential and exposed to risks of a second Covid-19 wave – potentially necessitating additional central bank monetary easing. A recent virus outbreak in Beijing has already prompted the State Council to reiterate the need to maintain ample liquidity (possibly signaling further RRR cuts) and encouraged the PBoC to ease its 14-day repo rate. Fortunately, the PBoC still has capacity to cut rates further or inject additional liquidity if necessary – principally via quasi-monetary policy tools - but a significant policy reversal remains unlikely in the near term.