Assessing the outlook for the pound as the Brexit deadline approaches

2020/05/01

GFICC Investors

In Brief

- Key decisions on the Brexit process must be made in the next few months.

- There are risks to the pound from a greater structural impairment if there is a “hard” Brexit at the end of 2020.

- Underlying vulnerabilities in the pound have been exposed by the Covid-19 shock, and a sustained recovery is likely to require stability in broader financial markets.

- While we have not perceived the pound as being as cheap as many think, we do note the recent improvement in the UK’s trade position.

Structural vulnerabilities undermine the pound

Our long standing view on the pound has been that it is not as cheap as widely perceived despite the fall related to Brexit. This view is based on our analysis of trends in the UK balance of payments data, which since 2016 have failed to show the type of improvement that would typically be associated with an economic rebalancing catalysed by a cheap currency. We have also noted previously (https://am.jpmorgan.com/us/en/ asset-management/institutional/insights/portfolio-insights/currency/what-would-a- conservative-government-mean-for-sterling/) that the structure of the UK’s external position makes the pound quite vulnerable to financial market sentiment because of the UK’s reliance on short-term external funding.1

The enormous global impact of the Covid-19 outbreak has averted investors’ focus from many of the typical shorter-term drivers of currency markets, such as interest rate spreads and relative economic growth rates. The impact of the virus on the UK economy, and the coordinated fiscal and monetary policy response, have been broadly comparable to other advanced economies in order of magnitude, though it will be several months before we have enough reliable data so say for sure. It also appears that the trajectory of infection rates is somewhat similar across the western advanced economies.

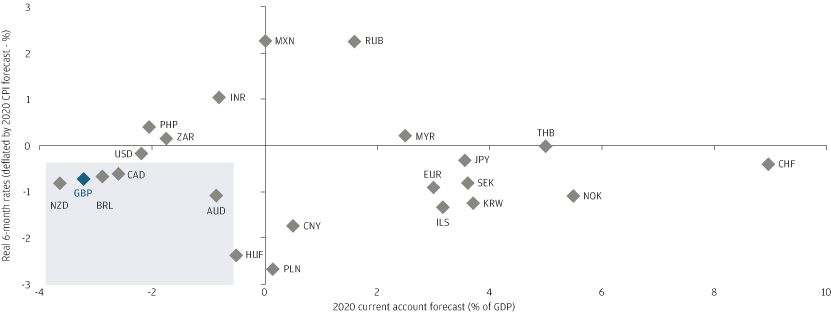

Nevertheless, so far in 2020 the pound has fallen against other reserve currencies, which is something we attribute to the UK’s structural vulnerability that comes from running a large current account deficit in an environment where funding flows have dried up (Exhibit 1). We believe broad stability in global financial markets is likely to be a necessary, but not a sufficient, condition for a recovery in the pound.

Unfavourable currency fundamentals leave the pound exposed to risk sentiment

EXHIBIT 1: CURRENT ACCOUNT VS REAL RATES

Source: Bloomberg; data as of April 2020.

Brexit back in focus

Over recent months, less attention has naturally been paid to Brexit developments; however, a key deadline is approaching at the end of June. In the transition period currently scheduled to finish at the end of 2020, a future trade agreement will need to be reached or the UK would revert to trading with the European Union (EU) on World Trade Organisation terms—a scenario that would confirm the worst fears of the currency markets from last year.

The Withdrawal Agreement allows for a one-time extension of the transition period, for a maximum of two years, which must be agreed by 1 July 2020. It is worth noting that the Conservative Party manifesto stated the intention to end the transition period in 2020, a stance that has been reiterated by the government in recent weeks. The UK faces a critical decision that is complicated by the disruption caused by Covid-19. Guidance from the EU suggests that only limited progress has been made on future trading arrangements following the April meeting round.

It is also the case that significant UK government resources have been diverted to focus on issues related to the Covid-19 outbreak, which we would have anticipated to have been focused on Brexit. We believe the stark choice faced by the UK will become a key focus of currency markets over the next few months, and that the risks are skewed towards further near- term weakness in the pound.

Better news on trade

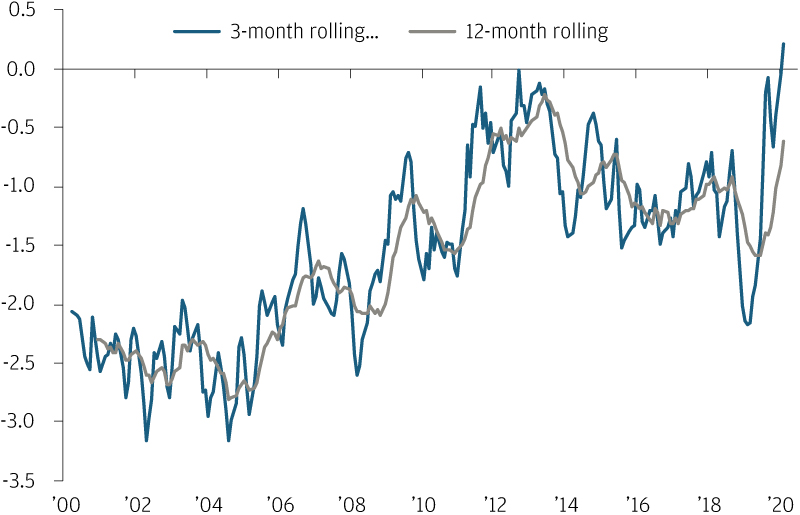

We do note one small area for optimism, with recent data suggesting the long overdue improvement in the UK trade balance may finally be gaining some traction (Exhibit 2). The better trade data is welcome evidence that the pound may have reached low enough levels to prompt some rebalancing of the UK economy, though we would expect any significant further deterioration in trading relationships with the EU, such as a hard exit at the end of this year, to shift the equilibrium level of the pound lower still.

Some evidence of economic rebalancing in the UK

EXHIBIT 2: UK TRADE BALANCE EX ERRATICS AS % GDP

Source: Bloomberg; data as of April 2020.

It is also too early to say what impact the Covid-19 outbreak and lockdowns will have on the UK trade position. It is possible that some rebalancing could occur through weaker consumption in the UK, though there are many potential offsets. If the improvement in UK trade can be sustained through a conclusion of the Brexit process and through the post-virus reopening of economies, there may finally be an opportunity for long-term currency investors to benefit from an appreciation in the pound.

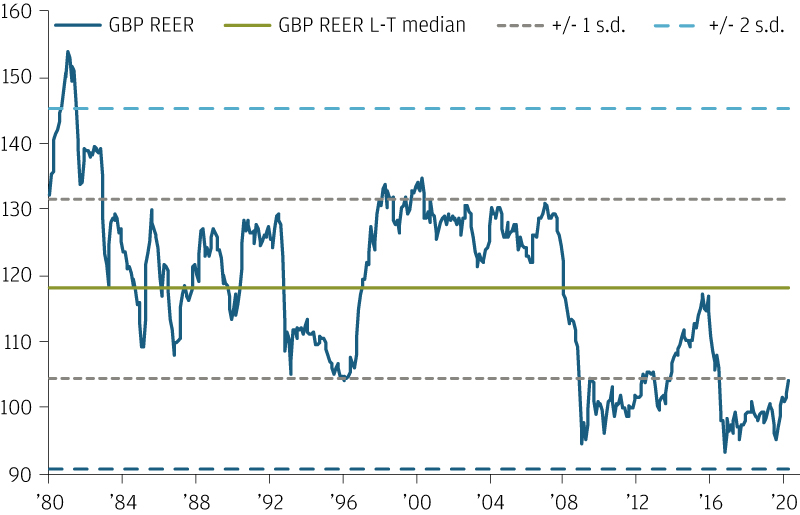

The pound appears very cheap in a purchasing power parity framework

EXHIBIT 3: GBP REAL EFFECTIVE EXCHANGE RATE VS LONG TERM MEDIAN

Source: Bloomberg; data as of April 2020.

Currency Management

Since our first segregated currency overlay mandate funded in 1989, J.P Morgan Currency Group has grown to manage a total of USD342 billion (as of 31 March 2020) in bespoke currency strategies. Our clients include governments, pension funds, insurance clients and fund providers. Based in London, the team consists of 18 people dedicated exclusively to currency management with an average of over 15 years of investment experience.

We offer a range of hedging solutions for managing currency risk as well as a tailored optimal hedge ratio analysis:

- Passive currency hedging serves to reduce the currency volatility from underlying international assets. It is a simple, low cost solution designed to achieve the correct balance between minimising tracking error, effectively controlling transaction costs and efficiently managing cash flows.

- Dynamic “intelligent” currency hedging aims to reduce currency volatility from the underlying international assets and add long-term value over the strategic benchmark. A proprietary valuation framework is used to assess whether a currency looks cheap or expensive relative to the base currency and the hedging strategy is adjusted accordingly.

- Active “alpha” currency overlay offers passive currency hedging, if required, combined with an active investment process to deliver excess returns relative to the currency benchmark. Our approach is to build a global currency portfolio combining the output of fundamental models and incorporating the qualitative views of our strategy team.

1 For more on our thoughts on the pound, see https://am.jpmorgan.com/us/en/asset-management/institutional/ insights/portfolio-insights/currency/what-would-a-conservative-government-mean-for-sterling/

0903c02a828af922