U.S. President Trump's order to investigate other markets' trade practices sheds light on his administration's trade and foreign policy approach. The likelihood of permanent tariffs has increased due to the potentially widespread nature of reciprocal tariffs and operational difficulties of calculating product-level tariff rates and holding negotiations with each market.

In brief

Tariff news continue to unsettle markets, with stocks vulnerable to tariffs underperforming the S&P 500 by 6% since the U.S. election day1. Last week, U.S. President Trump introduced the "Fair and Reciprocal Plan" to address practices deemed unfair by his administration. This plan aims to equalize tariff rates and increase tariffs in response to non-tariff barriers, like value added taxes (VATs), government subsidies, regulations and legal actions against U.S. companies. Equalizing tariff rates may have a significant impact on certain markets and industries. Furthermore, targeting non-tariff barriers is complex and could cause significant economic disruption. With negotiations possible before the April 1st deadline, the future of these tariffs remains uncertain and could unevenly affect markets.

Here are the markets most at risk:

- European Union (EU): The EU accounts for 17% of U.S. imports, the largest of any trading bloc and had a trade surplus of USD 175billion with the U.S. in 2023. While the U.S. and EU have similar average tariff rates of 3.4% and 4.1% on each other’s imports, respectively, disparities arise at the product level. For example, the EU imposes a 10% tariff on U.S. autos, whereas the U.S. applies a 2.5% tariff on European autos. A contentious issue is the EU's VAT, which the White House now considers a tariff. In short, VATs are consumption taxes paid by producers at each stage in the supply chain and by consumers at the time of sale. European companies can usually reclaim the VATs paid on their business-related purchases, with the consumer-paid VATs going to the government. The Trump administration argues that this gives European companies an unfair advantage, especially due to the size of VATs in Europe, which average 20%, significantly higher than the average U.S. sales tax of 6.6%. If the U.S. retaliates against VATs, reciprocal tariffs could exceed 20%, presenting significant downside to the EU’s already fragile economy.

- Emerging Markets: Tariffs are common in emerging markets to protect nascent industries. India and Brazil have average tariff rates of 11.5% and 7.4%, respectively, on all imports. India, which had a USD 43billion trade surplus with the U.S. in 2023, has begun reducing tariffs on certain products to ease tensions. Brazil, which maintains a slight trade deficit with the U.S., may face less targeting, though high tariffs on products like U.S. autos and ethanol are still pain points.

U.S. President Trump's order to investigate other markets' trade practices sheds light on his administration's trade and foreign policy approach. The likelihood of permanent tariffs has increased due to the potentially widespread nature of reciprocal tariffs and operational difficulties of calculating product-level tariff rates and holding negotiations with each market. Currency depreciation can help offset the tariffs, as seen in 2018-2019, and U.S. President Trump's focus on the stock market as a success barometer could limit negative impacts; however, uncertainty may harm business sentiment. For investors, staying diversified and being mindful of vulnerable industries and companies is critical.

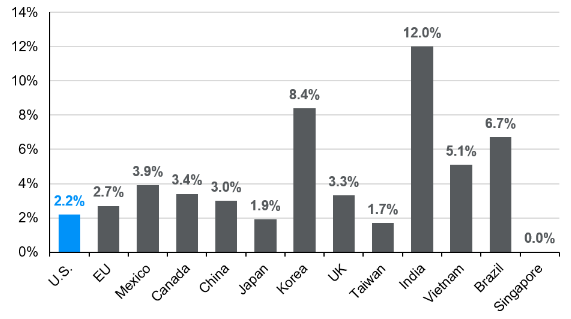

Many markets could face increased tariffs

Most favored market trade-weighted average duties, all imported goods, 2023

Source: WTO, J.P. Morgan Asset Management. Markets shown represent the 12 largest U.S. trading partners by volume.

1 Stocks identified as vulnerable to tariffs are represented by the J.P. Morgan U.S. Global Tariffs Index.