There is usually an increase in market volatility leading up to the elections due to uncertainty, but this tends to dissipate once the results are announced.

In brief

- While it is too early to predict the outcome and policy implications, the frontrunners of the presidential race provide some policy precedents to set investor expectations.

- Tax and government spending, foreign trade and regulations are all likely to be investors’ focus on candidates’ policy stance during the campaign period.

- Even though there is some increase in volatility ahead of the votes, the prevailing economic and policy landscape is more important in deciding asset allocation.

We are less than a year away from the 2024 U.S. presidential and congressional elections, which will be held on November 5. Over the next 12 months, the media will likely focus a lot on the campaign and voter polls. However, the actual market implications of the elections may not be as exciting as the media coverage suggests.

What are voters voting for?

In addition to the presidential race, U.S. voters will be voting for all 435 seats in the House of Representatives and 34 out of the 100 Senate seats. Of the 34 Senate seats up for election, 23 are currently held by Democrats and 11 by Republicans.

For the presidential election, the primary season will begin in January to determine the candidates for the Democrat and Republican parties. The primaries will continue until June when the final candidates should be confirmed. U.S. President Joe Biden has already announced that he will run for re-election as a Democrat, with no alternative contender at this stage. Among the Republicans, former U.S. President Donald Trump is currently leading the pack of candidates. However, it is important to note that one year is a significant amount of time in politics, and the situation may change. As of now, we are looking at a potential rematch of the 2020 presidential race. The winning candidate must secure at least 270 of the 538 electoral college votes.

What are the policy implications?

It is too early to assess the policy and market implications since we do not know which candidates will be nominated by the two major parties. However, the current frontrunners have both been in or are currently occupying the White House, so we can consider some policy precedents.

The next president will inherit a large fiscal deficit. The Congressional Budget Office predicts that the fiscal deficit will remain steady at 5%-7% of GDP over the next decade, accompanied by higher borrowing costs. President Biden might advocate for higher taxes but no significant spending cuts. Former President Trump could extend his 2017 tax cuts beyond the scheduled deadline of 2025 and may also support spending cuts. Overall, it is unlikely that we will see a sustainable solution to the fiscal deficit challenge, which could potentially raise market expectations for government bond yields due to ongoing strong supply and potential inflationary effects.

Both candidates are expected to prioritize U.S. interests in trade policy. Former President Trump has suggested a 10% tariff on all imports, while President Biden could introduce more bills to attract manufacturing investment. Trump may also reinstate some policies that are friendly to the fossil fuel industry and have a stronger inclination toward reducing regulations.

Apart from the presidential race, the outcome of the congressional elections can also have significant policy implications. A divided government, where the president and one or both of the chambers come from different parties, is not uncommon and weakens the president's ability to pass major legislation. The size of the majority in the House and Senate is also important. As we have seen in the past year, a narrow majority means that a small number of congress members from the majority party can have an outsized influence on the legislative process. For example, the Democrats' one-seat majority in the Senate allowed opposition from one senator to block President Biden's Inflation Reduction Act. In extreme scenarios, this could increase the risk of the federal government failing to raise the debt ceiling in a timely manner or to pass necessary spending plans to boost the economy when needed.

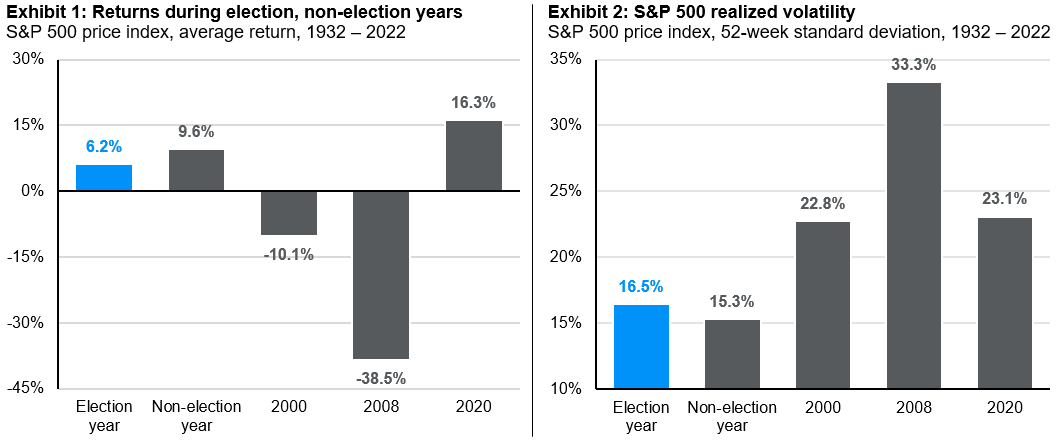

Source: Standard & Poor’s, FactSet, J.P. Morgan Asset Management. Election years are presidential election years.

Data are as of October 31, 2023.

What should investors do?

Although there is plenty of research on the historical market reactions to different government configurations or different years of a presidency, its ability to forecast future market performance is limited.

Ultimately, the prevailing macroeconomic conditions, monetary and fiscal policy stances, and corporate fundamentals have a much greater impact on asset returns. While historical data indicates that returns are typically lower and volatility is higher during election years, this trend was distorted by events such as the tech sell-off in 2000, the 2008 global financial crisis, and the wild market swings of the 2020 COVID-19 pandemic. There is usually an increase in market volatility leading up to the elections due to uncertainty, but this tends to dissipate once the results are announced.

In summary, investors should pay attention to the election process and outcome, but their investment decisions should not be solely driven by this process.