The end of the rate hiking cycle could lead to higher equities and a rally in bond markets as yields fall.

0.61%

The Japanese 10-year bond yield reached its highest level since 2014

In brief

- The U.S. Fed and ECB hiked rates as expected but both central banks have become much more data dependent. Meanwhile, the BoJ is very gradually starting to tighten policy.

- The higher for longer narrative means that yield has been rising rather than falling, something we expect to reverse.

- The equity market is taking a favorable view of what could be the end of the rate hiking cycle, however, confirmation that a recession can be avoided is needed to see a cyclical rally.

The latest round of central banks’ meetings resulted in most following the script with further rate hikes from the European Central Bank (ECB) and the U.S. Federal Reserve (Fed) but a looser commitment on what to expect at upcoming September meetings. Meanwhile, there are signs of life at the Bank of Japan (BoJ) which embarked on “pre-emptive” tightening and adjustments to yield curve control policy (YCC).

The Fed rolls out data dependence

The tone of the press conference softened the edges of what was a largely unchanged official statement. With over 500 basis points of tightening behind them, falling inflation and an economy that is bending rather than breaking, the Fed will be mindful of just how much further they need to push on rates to meet their objectives given they are no longer behind the curve.

Market pricing remains close to the Fed’s message, with the market reflecting an 80% probability that rates are unchanged come September. However, the two inflation figures and employment data released between now and the September meeting will have a decisive role in determining whether the Fed hikes again. The June dot plot signals two rate hikes in 2H 2023. While there are clear signs that inflation pressures in the U.S. are fading, the Fed will be focused on how fast it is falling rather than simply the rate of inflation. Better growth may slow the pace of deflation or limits how far it broadens out leading the Fed to hike again.

The ECB is a “definite maybe” for a September rate hike

The optionality on further hikes was reflected in the ECB’s July meeting, with the rate outlook summarized as “definitely maybe”. The ECB faces a tougher challenge as it sets policy for markets experiencing a range of growth and inflation dynamics. For example, in Germany, headline inflation was 6.4% year-over-year (y/y) in June, meanwhile in Spain, inflation is 1.9% y/y and within the ECB’s target.

For the ECB to remain on hold at its next meeting, their forecasts for inflation would need to be closer to the 2% medium-term inflation target. This would likely require a downward revision to economic growth forecasts based on a steady stream of softer economic data.

While both the ECB and Fed have a bias to tighten further, their data dependent nature means the outlook for upcoming meetings is finely balanced. Neither institution is likely to relent on the “official” tightening bias given it may fuel a further easing in financial conditions. What is more important for markets is the scope for rate cuts in 2024. In our view, the Fed is likely to move ahead of the ECB and many other developed market central banks.

Beginning of the end at the Bank of Japan

The BoJ is slowly moving in the other direction, taking cautious steps towards tighter. The target band for YCC remains at +/- 0.5% on the 10-year Japan Government Bond (JGB) yield, but new flexibility means the BoJ may let the yield rise to 1.0% if needed.

The higher rates of inflation and wage growth validate an adjustment to the YCC policy. Japan’s core consumer price index inflation was 4.0% y/y in June, solidly above the BoJ’s 2% inflation target. The spring wage negotiations resulted in wage growth at its highest level since the early 1990s.

The BoJ is the last central bank to maintain a negative policy rate and the BoJ is aware of the risk that come with normalizing a decade of ultra-loose monetary policy. Sharply higher yields would impact the sustainability of Japan’s very high government debt, the profits of its own bloated balance sheet (approximately 130% of GDP) and broader market disruption caused by a sharp sell-off in Japanese government bonds.

While we expect the BoJ to let the yield on 10-year JGBs drift towards the 1.0% cap, the BoJ will be cautious ensuring inflation and wage growth are concrete enough to warrant more forceful tightening.

Investment implications

Source: Bloomberg L.P., FactSet, MSCI, Standard & Poor’s, U.S. Federal Reserve, J.P. Morgan Asset Management.

Past performance is not indicative of future results.

Guide to the Markets – Australia. Data as of 30 June 2023.

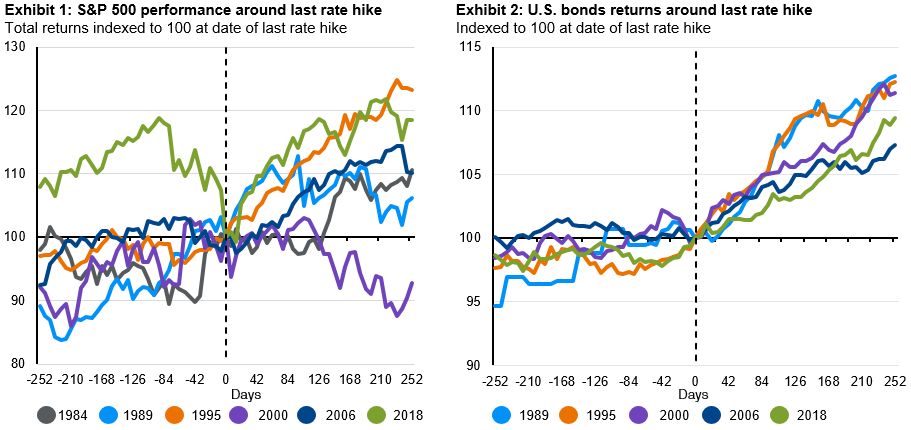

The end of the rate hiking cycle could lead to higher equities and a rally in bond markets as yields fall (Exhibits 1 and 2).

Historically, the end of the Fed’s rate hiking cycle has led to a rising U.S. equity market, but the path is not consistent over cycles. With recession risks remaining elevated and the uncertainty around further rate hikes, the rotation into cyclical lagging parts of the equity market could be limited.

Falling inflation and end of rate hikes are positives for bonds. The risk-adjusted return of quality fixed income assets looks favorable when compared to equity markets given the higher yields today. But with an inverted yield curve, adding duration in line with core benchmarks may be a prudent approach.