While it may be too early to take advantage of historically attractive small cap valuations, at some point we expect a modest small cap premium to return.

In brief

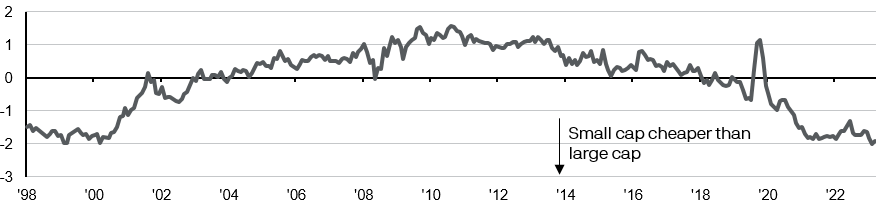

- Smaller firms currently trade at particularly low valuations compared to their larger counterparts.

- Structural challenges partly explain the disappearance of the small cap premium, but cyclical headwinds – such as high interest rates and lingering recession risks – are also to blame.

- These valuations offer an opportunity for longer-term active investors: as cyclical headwinds fade, smaller firms have the potential to outperform, thus reinstating a modest small cap premium.

Before the Covid pandemic, small cap stocks often proved a good choice for investors able to take on more risk to potentially enhance their portfolio returns. The asset class had provided long-run excess returns over large caps for several decades, which left small caps trading at higher valuations than corresponding large cap indices. A greater prospect for mergers and acquisitions, lower liquidity, and an inherently bigger growth potential were commonly cited reasons for this small cap valuation premium.

However, after an extended period of underperformance, the global small cap premium has disappeared. The MSCI World Small Cap Index now trades on a forward price-to-earnings (P/E) ratio of 15x, well below the MSCI World’s 16.9x valuation (and vs. a long-run median of 17.7x).

Exhibit 1: S&P 600 vs. S&P 500 valuations*

Z-score based on relative forward P/E ratio (# of std. dev. over / under average)

Source: FactSet, S&P Global, J.P. Morgan Asset Management.

Data reflects most recently available as of 12/12/23.

Part of the reason the small cap premium has disappeared is cyclical. On average, small cap stocks are more geared to the economic cycle and more financially levered than larger firms. In a late cycle environment with lingering recession risks and elevated interest rates, smaller firms thus look less attractive.

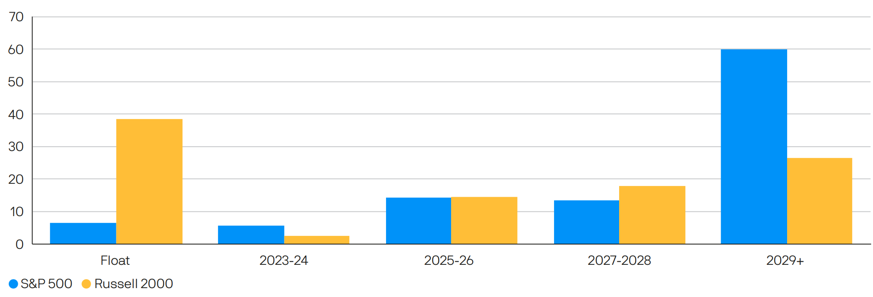

In particular, small caps are more vulnerable to recent interest rate rises – the largest increases in several decades. Smaller firms’ debt is more likely to be floating rate, and their fixed rate debt has a shorter average maturity, implying larger upcoming refinancing needs. For example, 38% of Russell 2000 debt (excluding financial firms) is floating rate, vs. an equivalent 7% for the S&P 500.

Exhibit 2: Outstanding debt maturity by year

Ex. Financials, % of total USD-denominated debt outstanding

Source: Bloomberg, Russell, S&P Global, J.P. Morgan Asset Management. Past performance is not a reliable indicator of current and future results. Data as of 30/11/23.

Structural challenges have also brought down the small cap premium. Today, large amounts of private equity and venture capital compete with public markets to provide equity financing for smaller companies. Increasing numbers of promising businesses are deciding to stay private or postpone public listings, deterred by increasing regulation in public markets. Smaller firms are also more frequently taken private today than in the past. This introduces a negative selection bias into small cap indices.

Over the past decade, small cap indices have measurably declined in quality. Before the financial crisis, unprofitable firms averaged a 27% share of the Russell 2000; today, that figure is 45%. Thus, investors are probably justified in demanding a higher risk premium for smaller cap stocks than in the past, which is reflected in their lower valuations.

As well as a decline in quality, the sector mix of small cap indices shows that many higher-growth, more traditionally innovative industries are underrepresented. In the MSCI World Small Cap Index, the technology and communications sectors are weighted twelve and four percentage points lower than in the MSCI World. By contrast, industrials (20%) and real estate (8%) feature heavily. As a result, revenue growth across large and small cap indices has converged. Average US small cap revenue growth has not exceeded large cap revenue growth from 2010 to date.

Given these structural challenges, we would not expect the small cap valuation premium to return to the circa 50% seen on average over the last 20 years.

Nonetheless, as cyclical headwinds fade small cap stocks could rerate from currently depressed valuations. Buying small caps during recessions has historically been a winning strategy, as the likelihood of central bank rate cuts and prospects of an economic recovery boost smaller firms over their larger counterparts. Over the three years following the start of a recession, the Russell 2000 has outperformed the S&P 500 by an average of 22 percentage points.

Thus, while it may be too early to take advantage of historically attractive small cap valuations, at some point we expect a modest small cap premium to return. Our base case for 2024 expects a deceleration in economic growth in developed markets. This scenario would present an opportunity for investors in the smaller cap segments of equity markets – although given the larger quality dispersion of small cap indices, an active approach is likely prudent.