In brief

- Negative currency returns have weighed on most Asian equity returns year-to-date when measured in consistent U.S. dollar (USD) terms, with Japan taking the largest hit, while China and India remain unscathed.

- Central banks in Asia appear resolute in mitigating the impact of further currency depreciation through foreign exchange (FX) intervention, suggesting the worst of the currency drag should be behind us.

- Despite the currency drag, overall equity returns have remained positive across most Asian markets, supported by multiple expansion and earnings.

- Investors should take an active approach towards Asian equities in mitigating currency risks.

Where is the U.S. dollar headed from here?

Markets are pricing the U.S. Federal Reserve (Fed) to hold rates higher-for-longer and for other major developed markets’ central banks to start to ease policy rates sooner, supporting the U.S. dollar. If upcoming U.S. economic data continues pointing to a similar moderation in economic activity and inflation, the earliest the Fed can cut is September. Such optimism could be premature given the underlying components of inflation remain relatively sticky and financial conditions have eased considerably. Financial conditions are tracking at levels below those seen in early 2022, placing less urgency on the Fed to ease. In the near term, while the U.S. dollar strength has likely run out of steam, it could remain supported till the end of the year, from both a carry advantage and economic growth perspective.

U.S. exceptionalism in economic growth and equity performance has been a supporting pillar behind the U.S. dollar strength, but this is showing preliminary signs of fading. With the recent miss on real gross domestic product, softer retail sales data, and slowing payroll growth, the U.S. economic surprise index has fallen sharply into negative territory in May. This comes at a time when growth in China surprised to the upside, and Europe’s growth momentum has turned a corner. While the sustainability of the ex-U.S. recoveries remain uncertain, a narrowing growth differential between the U.S. and the rest of the world could potentially trigger a pullback in the U.S. dollar, albeit on a gradual basis.

From a carry perspective, the U.S. dollar currently yields more than 40% of currencies globally. Moreover, the European Central Bank, Bank of England and Bank of Canada are all likely cutting before the Fed, culminating in a further narrowing of yield differentials between the U.S. and other developed markets. However, once the Fed embarks on its monetary policy easing cycle, the U.S. dollar is likely to weaken. Given the high yield the U.S. dollar is starting with, a first rate cut likely won’t bring down the U.S. dollar significantly right away. It will take time for the U.S. dollar carry advantage to wear off.

Beyond carry and growth, higher-for-longer long-term interest rates (due to factors such as elevated federal debt), election uncertainties, potential trade conflicts, and geopolitical developments could all further add to U.S. dollar volatility.

Slow and steady moving Asian central banks

The decade-high interest rate differential between the U.S. and Asia has resulted in capital outflows from Asian markets and manifested as a weakening of domestic currencies vis-à-vis the U.S. dollar. Since the start of the year, some Asian currencies have fallen to multi-year lows against the U.S. dollar. Notably, the Taiwanese dollar and Korean Won depreciated by 5.1% and 4.7%, respectively, year-to-date.

Markets are likely to continue to reprice the higher-for-longer backdrop, and Asian asset performance and financial conditions could be faced with continued headwinds. This would be accompanied by ongoing local currency depreciation and a higher bar for monetary policy easing for Asian central banks. That said, monetary authorities could avail policy tools such as FX intervention with their ample reserves, or keep front-end rates elevated relative to policy rates. However, the policy freedom for central banks is at times, constrained particularly if external conditions remain challenging. For example, a relatively low net FX reserves buffer could impede the central bank’s ability to defend the currency. In some cases, central banks may have to resort to hiking policy rates as was the case in April in Indonesia, highlighting Bank Indonesia’s priority for Rupiah stability. That said, the gradual decline in the U.S. dollar over the medium term will make room for Asian central banks to cut the benchmark rates.

What does this mean for Asian equities?

Currency risks are often at the top of the mind for U.S. dollar investors investing into Asia. Investors were once again reminded of this pain recently, with MSCI Japan generating attractive returns of 18.05% year-to-date in local currency terms. However, returns were glaringly lower at 6.33% in U.S. dollar terms. In theory, a weaker local currency could boost export competitiveness and support corporate earnings. However, local currency depreciation has weighed on Asian equity earnings in part due to the impact on input costs, offsetting the extent of revenues that has been sourced domestically.

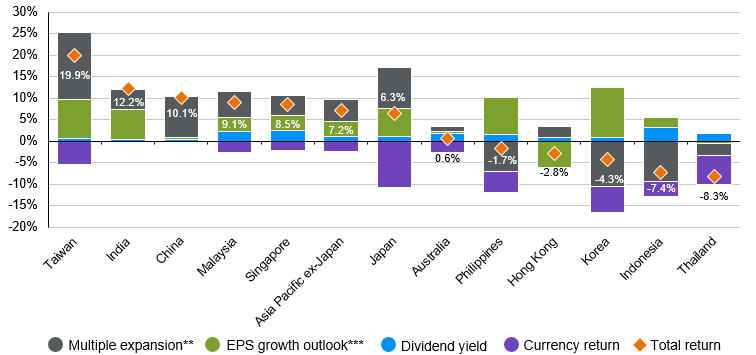

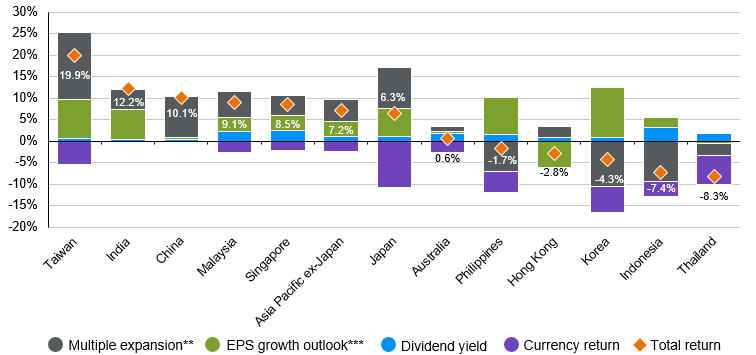

As shown in Exhibit 1, indeed, negative currency returns have derailed U.S. dollar returns for most Asian markets year-to-date, with Japan being the most impacted, while China and India were relatively unscathed. However, the good news is, multiple expansion and improvement in earnings per share across Asian markets have generally been able to cushion total returns so far, given recovery in exports and domestic activity, improved earnings guidance and other country-specific factors. These effects relating to companies’ growth potential and profitability generally outweigh the temporary impact from currencies, and the future potential for further improvements in these components driven by cyclical and structural factors deserve investors’ attention and continue to be a strong case for investing in Asia.

Exhibit 1: Sources of global equity returns year-to-date*

Total return, USD

Source: FactSet, MSCI, J.P. Morgan Asset Management. *All return values are MSCI Gross Index (official) data. **Multiple expansion is based on the forward price-to-earnings ratio. ***Earnings per share (EPS) growth outlook is based on next 12-month aggregate (NTMA) earnings estimates. Data reflect most recently available as of 27/05/24.

Investment implications

The stronger U.S. dollar and tightening in external monetary conditions have made the jobs of central bankers in Asia more challenging as they pursue financial stability. While a weaker currency might help export performance and foreign earnings, it also increases input costs for manufacturers reliant on imported inputs, which in turn diminishes earnings. While some Asian currencies have underperformed this year, tides are turning with the easing in U.S. growth momentum and inflation pressures, which effectively open the door to monetary policy easing by the Fed later this year. Moreover, central banks in Asia appear resolute in mitigating the impact of depreciation through FX intervention and policy rate adjustments. Thus, the worst of the currency drag should be behind us.

Also, it is worth noting that despite the negative currency returns, total equity returns have remained positive across most Asian markets in U.S. dollar terms, with Indonesia, Korea, the Philippines, and Thailand as exceptions. Valuation re-ratings could continue to support returns in the coming months. In Taiwan, robust earnings growth expectations at 21.1% year-over-year in 2024 could provide an additional tailwind. In the longer run, structural trends such as favorable demographic dividends and artificial intelligence demand could provide further support to the earnings outlook.

Nonetheless, investors should take an active approach in mitigating currency risks through understanding the sensitivities of equity markets & sectors to U.S. rates and currency movement. For example, sectors such as information technology and communication services tend to demonstrate higher sensitivity to U.S. rates. Moreover, more domestically-oriented equity markets tend to be better insulated from currency volatility for investors who would not want to take on excessive currency risks.

09tc242805074045