With the prospects of weaker growth in the U.S. economy, does it still make sense to switch to corporate bonds with lower credit ratings?

8.5%

U.S. high yield corporate bond yield to worst

In brief

- The U.S. economy has been resilient according to recent data, however, corporate spending and the housing market could still come under pressure from persistently higher rates.

- This represents an opportunity to lock in relatively high level of yields in this interest rate cycle.

- Despite the short-term risk of spread widening in U.S. high yield corporate bonds, the current level of yield is attractive for income generation over the upcoming economic cycle.

The U.S. economy has shown considerable resilience despite the aggressive hiking by the Federal Reserve (Fed) since the start of 2022. With the end of the hiking cycle in sight, investors are asking if the U.S. economy can avoid a recession altogether. This has encouraged some investors to shift towards the high yield segment of the U.S. corporate bond market.

There is something for hawks and doves alike

The latest economic data shows the U.S. economy is still operating ‘business as usual’ under a higher interest rate regime. The economy expanded by 2.4% annualized in 2Q 2023, and was the fourth consecutive quarter of growth higher than 2%. Consumption and investment both made solid contribution.

July non-farm payrolls, up 187,000, was softer than expected and the weakest reading since the pandemic recovery, yet unemployment rate fell to 3.5% with steady average hourly earnings growth.

The hawks would argue that all is well with the U.S. economy despite an accumulated 525bps increase in the policy rate since March 2022. Despite higher government bond yields, real yields are still very low due to high inflation. Around 70% of mortgages have locked in low mortgage rate (<4%), and hence rising policy rates have yet to impact on most household spending.

Yet, the doves would argue that some of these buffers against high rates will eventually wear out. Moreover, signals from the corporate sector are less rosy. The ISM manufacturing survey index rebounded modestly from 46.0 in June to 46.4 in July, but is still firmly below the neutral-level of 50. Bank lending standards are also tightening.

Over 80% of S&P 500 companies having reported their 2Q earnings, quarter-on-quarter earnings growth has ground to a halt. All these imply weaker corporate spending could become even more cautious, except for those companies benefiting from the Inflation Reduction Act and the CHIPS Act.

On balance, we expect the U.S. economy to decelerate into the year-end. Corporate spending and the housing market are still more at risk of a sharper slowdown than household spending.

Investment implications

Overall, we expect U.S. Treasury yields to see more downside with gradual decline in inflation and weaker growth momentum in the months ahead. This process could be accelerated if the Fed indicates the end of the hiking cycle is near. Hence, this represents an opportunity to lock in relatively high level of yields in this interest rate cycle.

We have been focusing on government bonds and investment grade corporate debt since the start of the year in anticipation of weaker growth. However, both these segments of the fixed income market have underperformed high yield corporate debt year-to-date given the resilience of the U.S. economy. With the prospects of weaker growth in the U.S. economy, does it still make sense to switch to corporate bonds with lower credit ratings?

The current level of credit spread for high yield corporate bonds, at around 460bps, is tighter than the long term average and consistent with steady economic growth and low corporate default rate. Intuitively, slower growth would bring more concerns over the rise in the default and this would be reflected by a widening of credit spreads, which lead to a drop in bond prices. Recovery rates have also fallen modestly recently. Issuers could see the need to refinance their bonds in 2024-25 as their bonds mature. The potential for the Fed to start cutting rates then could help to smooth the process.

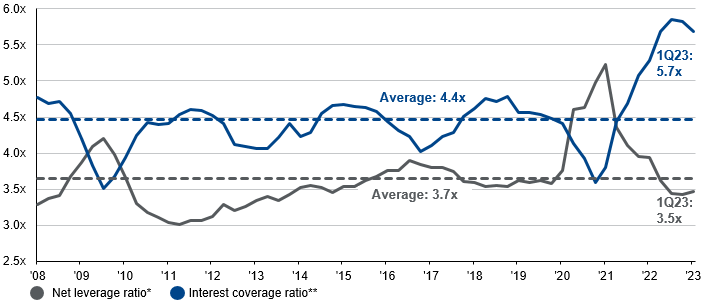

Exhibit 1: U.S. high yield leverage measures

Net leverage* and interest coverage ratio**

Source: J.P. Morgan Economics Research, J.P. Morgan Asset Management. . *Net leverage is net debt divided by adjusted earnings before interest, tax, depreciation and amortization (EBITDA). **Interest coverage ratio is EBITDA over interest expense. Guide to the Markets – Asia. Data reflect most recently available as of 07/08/23.

We still see the risk of spread widening for high yield bonds in the near term in response to softer economic data. However, default risk is likely to be more sector specific and hence active management is key. Moreover, we note that a period of strong earnings performance and companies locking in cheap funding costs before 2022 meant that leverage measures, such as net leverage ratio (net debt divided by earnings) and interest coverage ratio (earnings over interest expense) are in a strong position. This should help companies to weather through the challenges ahead.

For long term investors, the credit spread widening during the economic downturn would be followed by spread tightening when the economy recovers. This implies the negative price impact would recover eventually. While this implies there could be a more attractive yield level to add allocation to high yield in the future, the current yield level at 8.5% is still a decent income flow for investors.