As global growth continues to slow, dividend investing can be considered defensive and having more income certainty.

In brief

- Asia high dividend equities have outperformed in the second half of this year.

- Robust balance sheets and low debt levels are likely to bode well for Asia dividend stocks amidst slowing macroeconomic conditions. Valuations are also at attractive levels.

- Asian earnings are highly correlated with export growth. Resilient U.S. corporate margins, stabilizing Chinese economic growth will help to support Asian earnings in the near-term. While domestic factors will help cushion a slowdown in U.S. growth.

- High dividend stocks historically provide better risk-adjusted returns.

Asia high dividend equities have outperformed in recent months

A sharp rise in U.S. treasury yields led by the narrative of the Federal Reserve staying higher for longer has put pressure on global equity markets over the past months. Since the end of June 2023, U.S. 10-year Treasury yields has risen more than 112 basis points (bps) and is currently hovering at 4.98%—its highest point since 2007. As a result, equity volatility has risen, with VIX moving from 13.6 to 20.4, and equity performance across most sectors have been broadly negative.

Amidst this rise in equity volatility, high dividend stocks in Asia have been outperforming. While the S&P 500 and MSCI Asia Pacific ex-Japan Index have declined by 4.8% and 3.7% respectively since the end of June, the MSCI Asia Pacific ex-Japan High Dividend Yield index has outperformed, returning 0.2%.

With term premium and technical factors likely to hold U.S. Treasury yields at elevated level, as well as a potential U.S. recession, there are positives for dividend investing in Asia. Firstly, Asia corporates are supported by robust balance sheets and lower debt levels relative to their historical average, which bodes well for dividends in addition to providing a shelter from deteriorating economic conditions. Valuations are also relatively compressed compared to developed markets. Secondly, from a macro perspective, Asian economies are likely to enjoy a healthy growth differential relative to the U.S., and the region’s monetary policy continues to be supportive on a comparative basis.

Robust corporate fundamentals and attractive valuations

As global growth continues to slow, dividend investing can be considered defensive and having more income certainty. Asian corporates are well capitalized and have relatively low debt levels relative to history. While companies within MSCI USA have a cash to debt ratio of 29.9%, MSCI Asia Pacific ex-Japan and MSCI Japan companies have a cash to debt ratio of 62.7% and 39.1% respectively. Adequate cash levels suggest that Asian companies will be able to continue paying dividends even if there is an economic slowdown.

From a valuation perspective, Asian equities are also trading at relatively attractive levels. From a 12-month forward price-to-earnings perspective, most MSCI Asia Pacific ex-Japan regions (except for Korea, Taiwan, Thailand and India) are trading below 15-year average levels. From a price-to-book (P/B) perspective, most regions are trading more than 1 standard deviation below 15-year average levels. Historically, at current P/B levels, Asian equities tend to return positively over the next 12 months.

Earnings expectations have also been adjusted downward significantly since the beginning of year, largely driven by downward revisions to Korea and Taiwan. Earnings revision ratios suggest that downward revisions look to have troughed, and on a relative basis, further downward revisions to Asia earnings seem unlikely compared to the U.S. For high dividend yielding regions such as China, Malaysia, Hong Kong and Singapore, 2023 earnings expectations are still firmly positive.

Supportive macro and policy factors

A recovery in the export and semiconductor cycle may be supportive of Asian equity earnings and dividends. Earnings growth of MSCI Taiwan—accounting for 15% of the MSCI Asia Pacific ex Japan index market capitalization—exhibits a significant degree of correlation with exports and semiconductor billings. While Taiwan exports have been under pressure over the first half of 2023, Taiwan’s export growth recently moved into positive territory in September and new export orders look to have moved past its recent trough. This has been primarily driven by the global artificial intelligence momentum and a still resilient U.S. economy. While there are concerns about a decline in U.S. capital expenditures, the latest from the 3Q U.S. earnings season suggests that U.S. corporate margins are still holding up above historical averages, which could provide a buffer for capital expenditure and demand for Asian exports in the near term.

Further stabilization in China’s economic momentum and deployment of fiscal support to strengthen sentiment should be a boost to Asian equity earnings, as MSCI Asia Pacific ex-Japan has a revenue exposure of around 32% to China.

Asia earnings may also be protected by domestic factors as Asian corporates have a substantial exposure to domestic revenues. MSCI Asia Pacific ex Japan companies derive more than 76% of their revenues domestically. This should help cushion Asian earnings from a slowdown in the U.S. as mentioned previously.

From a policy perspective, while Asia is affected by rising rate concerns, the pass through of higher rates from the U.S. is less prominent compared to the past. In fact, monetary and fiscal policy in the region is marching to a different beat. China is embarking on policy easing to counter growth headwinds, while Japan is likely to maintain its easy monetary policy at least until the beginning of next year.

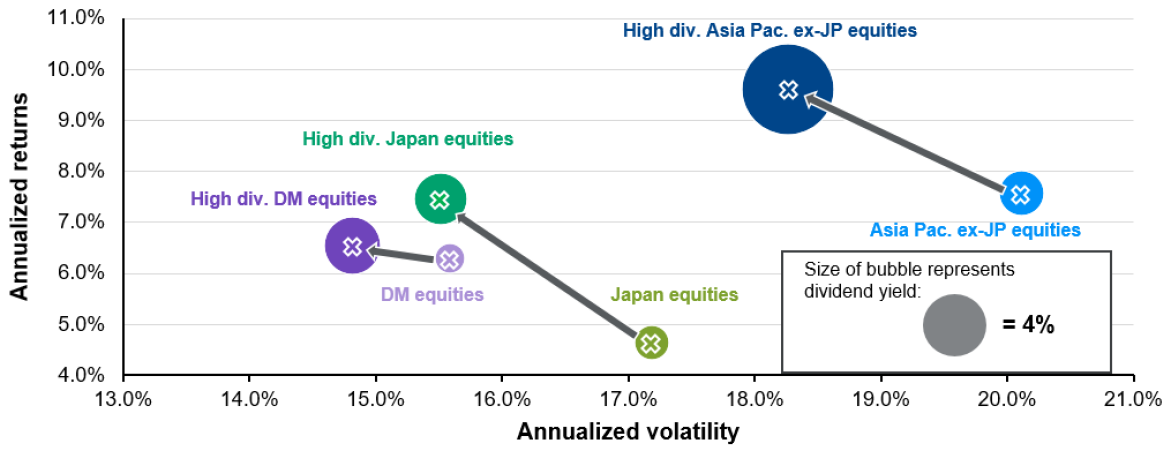

Exhibit 1: Risk return profile of high dividend equities

Based on returns from Jan. 1999

Source: FactSet, J.P. Morgan Asset Management. High div. means high dividend, DM means developed markets, Asia Pac. ex-JP means Asia Pacific ex-Japan.

Guide to the Markets – Asia. Data reflect most recently available as of 30/09/23.

Investment implications

Historically speaking, dividends play a critical role in Asian equity returns. Asia Pacific ex-Japan and Japan dividends contributed to more than 60% and 65% respectively to total returns, compared to 44% in the U.S. from 2000 to the end of September this year. In addition, MSCI Asia Pacific ex-Japan High Dividend index also tends to provide a better risk-adjusted return relative to the broader MSCI Asia Pacific ex-Japan index as shown in Exhibit 1. Given the macroeconomic uncertainties and the likely decline in cash rates over the next 6 to 12 months, it will be increasingly essential to find the complementary pairing of fundamental resilience and stable dividends to preserve and enhance the total return of a portfolio.