After a few false dawns this year, Fed rate cuts are imminent, with the discussion now shifting to how quickly rates will come down. How should investors be positioned ahead of the first cut?

In brief

- U.S. Federal Reserve rate cuts are imminent, with the discussion now shifting to how quickly rates will come down. How should investors be positioned ahead of the first cut?

- One of the biggest risks for investors in a falling rate environment is reinvestment risk. Looking at “soft” versus “hard landings” is key when thinking about risk levels and duration.

- Historically, asset class performance has varied depending on why rates are moving lower: risk assets typically perform well during “soft landings” and suffer during “hard landings.”

Over the past month, it has become clear that inflation is no longer the only risk on the Federal Reserve’s radar

“The time has come” was a memorable phrase from U.S. Federal Reserve (Fed) Chair Jerome Powell’s speech at the Jackson Hole Symposium at the end of August. After a few false dawns this year, Fed rate cuts are imminent, with the discussion now shifting to how quickly rates will come down. How should investors be positioned ahead of the first cut? Historically, asset class performance has varied depending on why rates are moving lower: risk assets typically perform well during “soft landings” and suffer during “hard landings.” In both scenarios, cash has consistently underperformed core fixed income, highlighting the growing opportunity cost of not being fully invested, especially in that asset class. The time has more than come for investors to consider whether portfolios are appropriately positioned for the rate cutting cycle ahead, especially given portfolio imbalances that may have developed over the past few years.

Over the past month, it has become clear that inflation is no longer the only risk on the Fed’s radar. Confidence in the disinflation progress has increased, with personal consumption expenditures (PCE) inflation now under 3%. However, concerns about downside labor market risks have grown following the softer-than-expected July jobs data. The Fed seems intent on keeping the “soft landing” on track by cutting rates proactively, not reactively. A first rate cut at the September 18 Federal Open Market Committee meeting seems all but certain. The discussion has now shifted to the size and frequency of these cuts, as well as the ultimate destination. If the labor market continues to normalize rather than collapse, rate cuts should be seen as “normalizing” rather than “easing.”

However, investors should recognize that this still means current short-term rates are as good as they are going to get: 3-month Treasury yields are likely coming down from 5.4% today to around 3.5% over the next 18 months. However, if the economy loses more momentum, rates could decline more rapidly and settle at an even lower level. One of the biggest risks for investors in a falling rate environment is reinvestment risk. For fixed income, investors have not missed their opportunity to capture attractive yields, with core bond yields still at 4.4%, but the window is rapidly closing. As witnessed this summer, what is here today can quickly be gone tomorrow: 2-year yields dropped 85 basis points in less than two months.

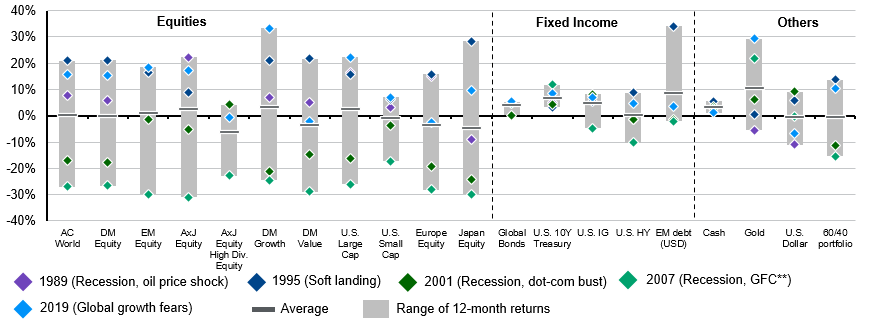

Asset class returns following the start of rate cuts

12 month returns* after the first rate cut following the past five rate hike cycles

Source: FactSet, U.S. Federal Reserve, J.P. Morgan Asset Management. Based on MSCI AC World Index (AC World),MSCI World Index (DM Equity), MSCI Emerging Markets Index (EM Equity), MSCI Asia Pacific ex-Japan Index (AxJEquity), MSCI Asia Pacific ex-Japan High Dividend Yield Index (AxJEquity High Div. Equity), MSCI World Growth Index (DM Growth), MSCI World Value Index (DM Value),S&P 500 Index (U.S. Large Cap), Russell 2000 Index (U.S. Small Cap), MSCI Europe Index (Europe Equity), MSCI Japan Index (Japan Equity), Bloomberg Global Aggregate (Global Bonds), Bloomberg U.S. Treasury Bellwethers 10Y (U.S. 10Y Treasury), Bloomberg U.S. Corporate Investment Grade Index (U.S. IG), Bloomberg U.S. Credit Corporate High Yield (U.S. HY), J.P. Morgan EMBI Global (EM Debt USD), Bloomberg U.S. Treasury Bills 1-3M (Cash), New York Spot price (Gold), U.S. dollar index (U.S. dollar), 60% AC World and 40% Global Bonds (60/40 portfolio). The first rate cuts occurred in Jun ’89, Jul ’95, Jan ’01, Sep ’07, Aug ’19. *Total returns in local currency are used, unless otherwise specified. **GFC stands for global financial crisis. Past performance is not indicative of current or future results.

So, where should investors allocate capital? History can be a useful guide, but not all rate cutting cycles are created equal:

- “Soft landings” (1995, 2019 pre-pandemic): Risk assets, like large-cap equities and emerging market (EM) debt, have done well when rate cutting cycles have coincided with a soft landing. Critically, large-cap stocks have performed better than small-caps, suggesting investors should focus on quality under either economic scenario. Interestingly, developed market growth and value equity returns were similar, suggesting investors should rebalance portfolios from previous winners. Lastly, U.S. treasuries have had positive performance and have outperformed cash on average.

- “Hard landings” (1989, 2001, 2007): When rate cuts coincide with recessions, risk assets have suffered. Within equities, non-U.S. equities have suffered the most, while high dividend indices have tended to fare better. In fixed income, quality has shined, as high yield bonds and EM debt have seen negative returns, while U.S. treasuries have provided very solid returns (helping to diversify portfolios).

Investment Implications

Looking at “soft landings” versus “hard landings” is key when thinking about risk levels and duration. Additionally, investors may want to correct portfolio imbalances that may have developed since the last U.S. rate cutting cycle. This is especially true and time sensitive for core fixed income. The time has come for investors to capitalize on attractive entry points while they are still available.