In brief

- The Federal Reserve’s (Fed’s) dual-mandate focus has shifted attention to the labor market which appears to be losing steam, stoking fears of a sharper U.S. economic slowdown and triggering a sell-off in risk assets globally.

- Disappointing data could front-load the Fed’s policy action towards the neutral rate, with markets re-pricing for larger cuts at the remaining FOMC meetings this year.

- Portfolios should be well diversified across both equities and fixed income, and remain appropriately balanced across both U.S. and global equities.

The broadening focus of the Federal Open Market Committee (FOMC) last week on the labor market put the spotlight on a slew of labor market data that came through last week. Overall, the signals from the incoming data pointed to a labor market that is losing steam rather quickly, bolstering the case for the central bank to deliver its long-awaited monetary policy cut at its meeting next month, on Sept 17-18. This comes as markets have repriced for larger policy rate cuts in subsequent meetings following the conclusion of the FOMC meeting last week. In recent days, we have witnessed large moves across major indices, with the next few months likely proving to be volatile as markets reassess incoming data for guidance on the timing and magnitude of the policy rate cuts.

Fed’s dual mandate operation

While the Fed held rates steady last week as expected, the Committee notably stated its focus on both its maximum employment and price stability mandate, a departure from previous statements which focused primarily on inflation risks. There were a few adjustments in terms of the description of the labor market in which the Committee had noted that job gains have moderated, and that the unemployment rate has moved up recently, but remains low. Chairman Jerome Powell also highlighted the broadness of recent disinflation, which permits the Fed to be slightly less focused on inflation and more attentive to growth and labor market risks. The incoming data regarding the labor market will be key in guiding the Fed’s reaction function in the coming months.

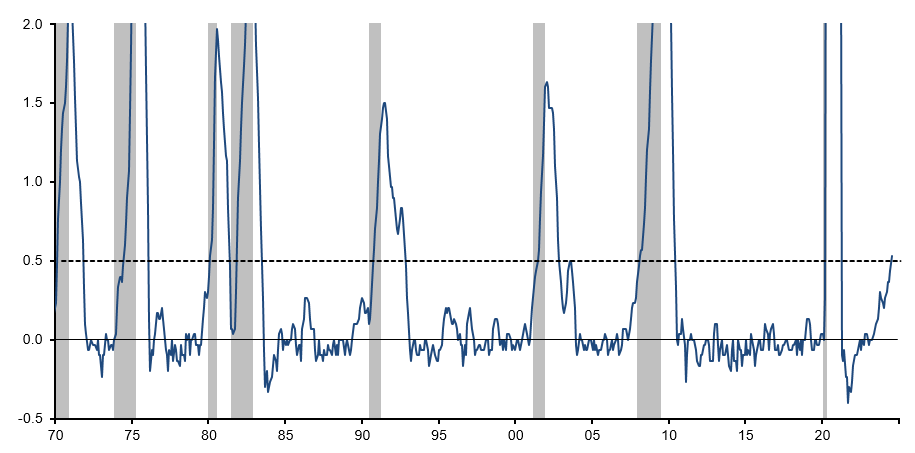

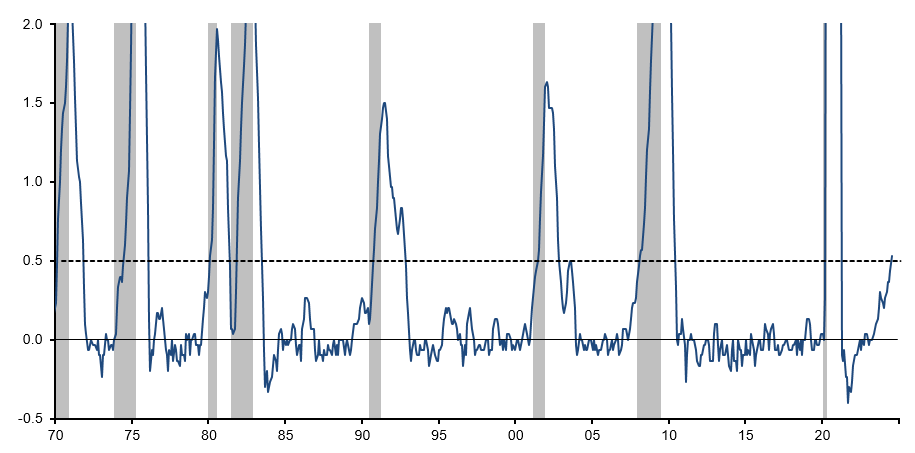

Exhibit 1: U.S. unemployment Sahm rule1

Source: BLS, J.P. Morgan Asset Management. 1. Sahm rule states the economy is entering/about to enter a recession when the 3- months moving average of unemployment rate has risen by at least 0.5%-pt. above the minimum 3-month average seen over the prior 12 months. Shaded region denotes recessionary periods.

Labor pains

Turning to the data, the July jobs report delivered a material disappointment. Taking a step back, the unemployment rate has been useful in providing signals on the proximity to a recession. Thus, July’s 0.2% point uptick in unemployment rate to 4.3% triggered the Sahm Rule1, which states that the economy is entering/about to enter a recession when a three-month moving average of the unemployment rate has risen by at least 0.5% point above the minimum 3-month average seen over the prior 12 months (Exhibit 1). While we had expected a modest rise in the unemployment rate and see the labor market as balanced, a look at history demonstrates the possibility that once the unemployment rate starts to rise, it can do so quickly if the economic cycle deteriorates.

At the same time, non-farm payrolls (NFP) rose by 114K, marking the slowest print in over three years with fairly broad-based signs of weakening across the economy as a few services sectors reported declines in payrolls over the month. Other jobs data last week danced to the same tune as labor cost pressures eased last quarter relative to the start of the year when both the employment cost index (ECI) and unit labor costs (ULC) exhibited some strength. Beyond the labor market data, the manufacturing purchasing managers index (PMI) and ISM surveys pointed to softness in the sector. The upshot is that the manufacturing PMI remains comfortably above its cycle low.

However, it is important to recognize that it is not entirely all bad news on the labor front. Labor force grew by 420K, confirming that the economy is still adding workers despite slowing momentum. In other encouraging news, U.S. productivity rebounded in 2Q24, up 2.7% over a year ago.

Fed’s path to neutral ground

More recently, softer labor market data has been viewed as a market positive as inflation pressures could diminish through the wage channel. With wages contributing less to the inflation outlook, however, negative news on the labor market might be interpreted as bad news for the economy and raise the prospect of the Fed being behind the curve when it comes to easing policy rates.

Unless we get markedly strong economic data, the series of disappointing data prima facie could accelerate the monetary policy easing cycle. It is no surprise that markets are now pricing in a 50 basis points (bps) cut in September. In response to the recent weakness in the economic data, the Fed is likely to front-load policy easing, with further 50 bps cuts in both November and December, to achieve the neutral interest rate and maintain some degree of flexibility.

Japan feeling the heat

Over the last three trading days, TOPIX dropped 20.3%. More notably, the 12% decline on August 5 was the second largest on record, following only that on Black Monday, October 20, 1987. At the time of writing, USD/JPY has fallen close to 9.1% since July 11, when the U.S. released the soft June consumer price index (CPI) print. Carry trades, which arguably have been a key focus, tend to unwind when we witness 1) narrowing interest rate differential and/or 2) increase in FX volatility.

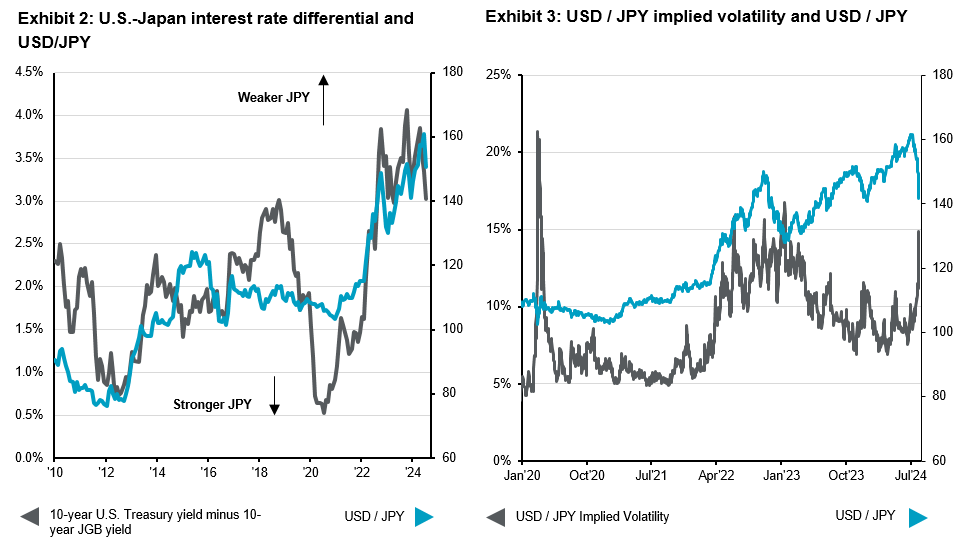

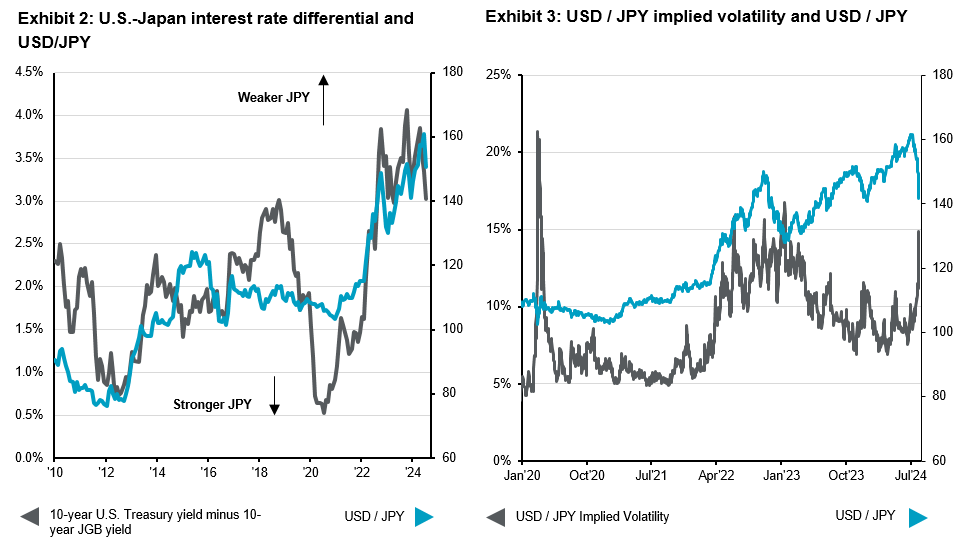

Source: J.P. Morgan Asset Management. (Left) Bank of Japan, FactSet; (Right) Bloomberg.

Guide to the Markets – Asia. Data reflect most recently available as of 05/08/24.

Exhibit 2 illustrates the impact of narrowing interest rate differentials: when interest rate differential narrows, the grey line points downwards, suggesting the difference between 10-year U.S. treasury yield and 10-year Japan government bond yield narrows, thereby leading to a stronger Japanese yen (blue line).

Japanese yen (JPY) shorts peaked for hedge funds when USD/JPY reached 150 (around March this year), but for real money when USD/JPY reached 160 (around June). In June, IMM’s (International monetary market’s) JPY short positions surged i.e. increased JPY selling due to activation of JPY carry trade, which continued amid the possibility that the USD/JPY could aim for 165 JPY as the interest rate gap continued to widen.

The turning point was the release of the U.S. June CPI on July 11 that bolstered the conviction for rate cut expectations by the Fed. Since then, with narrowing interest rate differentials between U.S. and Japan, JPY short positions continued to unwind, impacting overall carry trades globally. Since then, JPY short positions have reduced which contributed to further JPY appreciation.

Meanwhile, Exhibit 3 illustrates the impact of an increase in FX volatility: the implied USD/JPY volatility (grey line) rose due to ongoing geopolitical uncertainties while the investors became risk averse. 1-month implied exchange rate volatility rose to 15.6%, much higher than the year-to-date average of 8.9% and 10-year average of 8.6%. As the market continues to digest the incoming U.S. economic data, the carry unwind may continue while USD/JPY will likely continue to be driven by the outlook for U.S. monetary policy. We also remain cautious about volatility due to uncertainty around political events in Japan and the U.S.

Having said that, Japan’s corporate governance improvements remain a key factor supporting the long-term investment case for Japanese equities. Furthermore, companies could unwind cross-holdings in equities to free up capital and engage in more share buybacks. Meanwhile, further improvement in the macro environment, which we expect in 2H24, will be a key catalyst for sustained Japanese share price gains. At the same time, a stronger JPY may attract international investors who have been put off by the JPY weakness given the hedging costs.

Investment implications

The baseline scenario around U.S. growth remains one characterized by a slowdown rather than a recession. Investors should remain watchful over incoming U.S. labor market data and ensure portfolios are well-diversified to weather the possibility of a greater slowdown. There are a couple of investment implications. Firstly, there is opportunity for investors to add to equities at better valuations in a market that has tended to over extrapolate the weakness in the economy, especially in the event that the data improves. In particular, the focus on quality when it comes to risky assets such as equities should be on the top of the mind for investors. Secondly, in the event of a sharper growth contraction that is met with deeper policy rate cuts by the Fed, investors could extend duration into high-quality bonds which could provide stable returns in the long-term. Thirdly, the imminent monetary policy easing by the Fed could imply the weakening in the U.S. dollar, implying stronger return on non-U.S. stocks. Thus, investors’ portfolios should be allocated across both U.S. and global equities.

09le240608064347