In brief

- Moderating but still healthy global growth, coupled with more evidence of disinflationary momentum setting in, prompt certain central banks to begin their rate cut cycles in the past week.

- However, in comparison to the aggressive rate hikes in the last few years, this will likely be a very gradual rate cut cycle for most of the global central banks, especially as we do not see strong foundations for a material easing cycle.

- Further clarity in direction and destination of yields as well as the path of inflation will continue to help alleviate rates volatility, thereby supporting the case for staying invested in fixed income. The opportunity to lock in yields at current levels still look compelling.

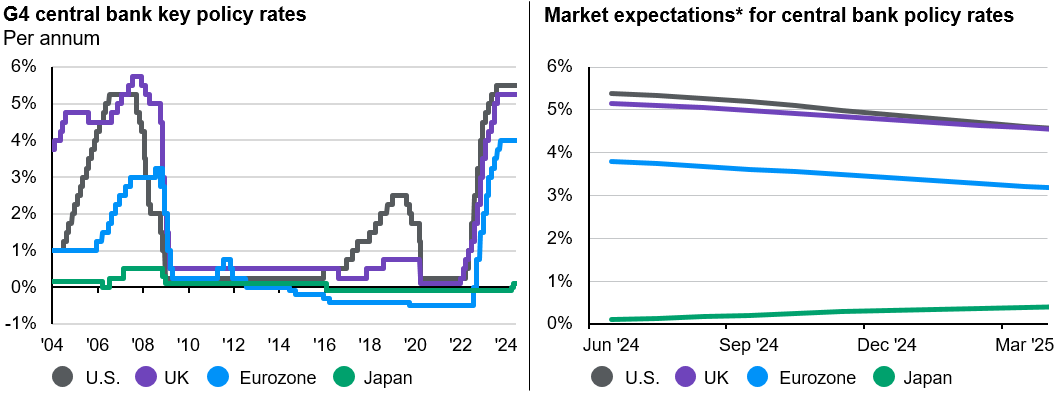

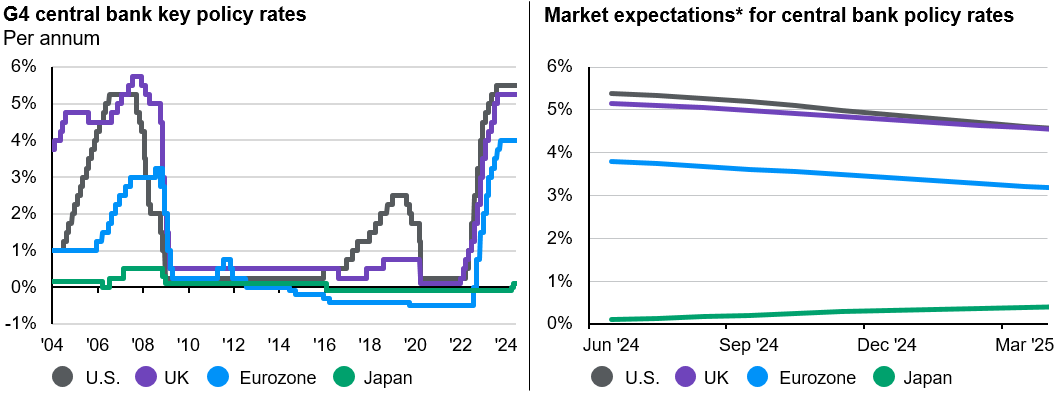

The first week of June marked the start of central bank divergence with several banks taking the first step on their easing paths while the Federal Reserve (Fed) is still expected to remain on hold, probably until the latter part of the year. Even though more central banks are gradually dialing back tight monetary policies, we expect they will continue to adopt a cautious data-dependent approach so as to negate any risk of restocking inflation.

Source: Bank of England, Bank of Japan, European Central Bank, U.S. Federal Reserve, J.P. Morgan Asset Management; (Left) FactSet; (Right) Bloomberg L.P. *Expectations are based on overnight index swap rates. Past performance is not a reliable indicator of current and future results.

Guide to the Markets – Asia. Data reflect most recently available as of 10/06/24.

European Central Bank: jumping ahead of the Fed in cutting

Key central bank focus was the European Central Bank (ECB) meeting on June 6, where they cut 25bps, as widely expected, to take the deposit rate to 3.75%. After nine months of holding rates, the ECB felt that the inflation outlook had improved markedly and so it was appropriate to moderate the degree of restriction. Even though ECB President Christine Lagarde would not commit to future rate cuts at this point, she did highlight that there was a “strong likelihood” that the ECB was entering a “dialing down” phase, i.e. this was not a one and done. While ECB’s hike in inflation forecasts, coupled with a lack of commitment to additional cuts set a rather hawkish tilt, President Lagarde downplayed the recent wage growth strength, suggesting that the “direction and destination” of policy remains clear.

Markets are pricing between one to two additional 25bps rate cuts by year end, and a terminal rate of around 2.5% by mid-2026. Meanwhile, if unit labor costs as well as services inflation slow slightly less quickly than expected, one cut, rather than two, for the rest of this year may be more appropriate. This suggests that the disinflation process is still broadly on track within Europe, but there are indeed labor market related risks to keep an eye on.

Previously the eurozone has only cut rates ahead of the U.S. in the Euro crisis. Even in the most recent hiking cycle, while the Fed took the lead in raising rates starting in March 2022, the ECB started 4 months later. However, this time round, unlike the U.S., the ECB is less concerned about the economy overheating, giving them more comfort to start easing ahead of the Fed. European economies are also more sensitive to rates than the U.S., especially due to the much shorter maturity of European corporate debt vs. the U.S., prompting the ECB to cut rates first rather than risk acting too late. The benefit from lower rates are also comparably higher given eurozone’s higher dependence on bank lending (around 2/3 of corporate debt) compared to the U.S., which is more credit market dependent instead, with only around 1/3 of corporate debt being bank loans. We continue to see ECB’s path to lower rates to be much clearer compared to the U.S. while rate cuts will have a more immediate supportive effect in the eurozone. This also provides a fairly attractive backdrop for European sovereigns, particularly more rate/growth-sensitive peripheral members.

Bank of Canada: first G7 central bank to cut and more is coming

Bank of Canada (BoC) was the first G7 central bank to cut its policy rate target by 25 basis points to 4.75% on June 5, as expected. Recent data suggest continued evidence that underlying inflation is easing and inflation will likely continue to move towards the 2% target. However, risks to the inflation outlook remain and BoC will likely stay data dependent while moving cautiously going forward.

Bank of England: the midsummer cut may be delayed

In the UK, the Bank of England (BoE) faces a slightly more difficult picture, with weak labor participation keeping wage growth, and therefore services inflation, more elevated. In April, headline inflation fell meaningfully to 2.3% year-over-year but services inflation remains high at 5.9%, making any hopes of a June 20 rate cut from the BoE appear premature. In particular, there is a risk that core inflation does stay a bit sticky given the ongoing strength in services inflation and recent acceleration in economic activity. Nonetheless, we continue to expect 1-2 cuts later this year, and UK government bonds do look attractive at these yields.

U.S. Fed: Be patient while keeping options open

At the start of the year, markets were expecting a total of 175 basis points of interest rate cuts. Rate cut expectations have been trimmed significantly since then amid continued evidence of U.S. economic resilience and inflation that has remained sticky. Recent speeches by Fed officials acknowledged the lack of progress on inflation and the desire to maintain the current level of policy rates for longer. The updated dot plot and Summary of Economic Projections, will be released during the June Federal Open Market Committee (FOMC) meeting and market will closely monitor whether FOMC members delayed more of the 2024 rate cuts into 2025. Admittedly, inflation was stronger than expected in the first quarter, but 1Q24 GDP was revised lower while the data in April and May on manufacturing, housing, job openings and personal spending, among others, point to moderating demand. Even April inflation data took a step in the right direction. We continue to believe the rate cut cycle is merely delayed rather than derailed, and should begin later this year.

Bank of Japan: The next move is a hike but not so soon

The Bank of Japan (BoJ) decided on March 19 to exit its negative interest rate policy and hiked policy rates for the first time in over 15 years. Looking ahead, the BoJ will have to delicately balance policy to minimize the domestic growth impact from higher rates or a weaker Japanese yen. We continue to forecast the BoJ to undertake a prolonged hiking cycle, amid further evidence of sustained inflation, while the pace will likely be gradual. BoJ will need to seriously consider reducing its Japan Government Bond purchases to reduce distortions in its government bond market.

Investment Implications

Moderating but still healthy global growth, coupled with more evidence of disinflationary momentum setting in, prompt certain central banks to begin their rate cut cycles in the past week. However, in comparison to the aggressive rate hikes in the last few years, this will likely be a very gradual rate cut cycle for most of the global central banks, especially as we do not see strong foundations for a material easing cycle. Nevertheless, cutting rates should provide some welcome relief to both households and businesses. Further clarity in direction and destination of yields as well as the path of inflation will continue to help alleviate rates volatility, thereby supporting the case for staying invested in fixed income. The opportunity to lock in yields at current levels still look compelling. In particular, developed market government bonds and investment grade corporate debt have the added benefit of providing some cushion against downside surprises or unexpected financial stress.

09ju241106105305