While the focus currently should lean towards quality and defensiveness in large caps, the Federal Reserve cutting rates later this year could be constructive for small caps.

In brief

- Although valuations for small caps are attractive, large caps are less cyclical, more profitable and of higher quality.

- Vulnerability in regional banks remains a key risk to small cap stocks due to its contribution to the small cap index, and more importantly, the potential of pullback in regional bank lending.

- Thus, on the market cap spectrum, we continue to advocate leaning towards quality and large caps.

Large caps or small caps?

After an impressive equity rally in 2023 and new all-time highs to start 2024, investors are evaluating their equity allocations. Small caps got investors’ hopes up in late 2023 and valuations continue to look attractive, but so far this year, small caps have continued to underperform large caps. Where should investors position along the market cap spectrum? To assess the best opportunities by market cap, we evaluate the following criteria:

Valuations: Currently valuations are stretched for large caps, with the current price-to-earnings (P/E) 27% above its 20-year average, while small caps are more in line.

Sector composition: Given index concentration among a narrow set of stocks, large caps are highly tech-oriented. Small caps have the highest relative exposure to financials, consumer discretionary, energy, and health care. If the rally broadens out, small caps could benefit, but if the economy slows those cyclical areas could face headwinds. However, it is not just what sector exposure is, but how compelling the underlying companies are within those sectors, which profitability can help decipher.

Profitability: Although we do not expect a recession, the economy is likely to slow, which could challenge revenues and impact profits, so quality is key. Over 41% of the small cap index is unprofitable, compared to 17.5% in mid cap, and 7.4% in large cap. Profit growth for the S&P 500 is estimated to be 12% in 2024 after tracking slightly down in 2023. Small caps are anticipated to rebound from profit declines of 10% in 2023 to 23% growth in 2024. However, estimates have only been revised down slightly for large caps for 2024, while small caps estimates have already been revised down 9% in the last three months.

Debt service: Interest costs are rising after Fed hikes, but both large and mid-caps have interest coverage ratios, which measure the ability to service their debt, above their 25-year averages, compared to small caps which have dipped below their long-term averages. In addition, higher rates may impact smaller companies sooner than larger companies because nearly half of S&P 500 debt outstanding matures after 2030 compared to 14% of the Russell 2000, and contains just 6% of floating rate debt compared to 38% in the Russell 2000.

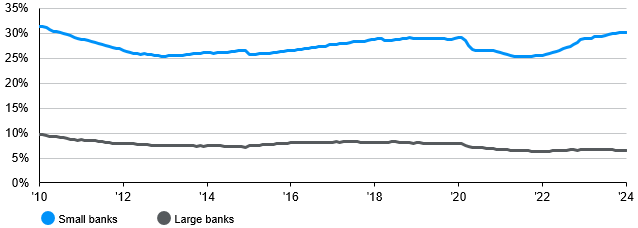

Exhibit 1: Commercial real estate (CRE) loans on small and large U.S. bank* balance sheets

Proportion of total assets, seasonally adjusted

Source: Federal Reserve, Bloomberg, J.P. Morgan Asset Management. *Refers to small and large domestically chartered commercial banks in the U.S. According to Federal Reserve’s definition, large banks are top 25 banks by domestic assets and small banks are those outside top 25. Data is as of February 16, 2024.

Costs: Although wages and input costs have recently slowed or receded, they have reset at higher levels than pre-pandemic. According to the National Federation of Independent Business (NFIB) survey of small businesses, inflation and labor quality continue to be their top concerns. These structurally higher costs tend to be absorbed better by larger companies with more robust balance sheets than smaller companies.

Regional banking sector still faces headwinds

Almost a year after the regional banking stress, concerns over the sector is mounting again, following the earnings announcement by New York Community Bancorp’s (NYCB). NYCB’s earnings came in well below expectations, revealed surprise losses on commercial real estate (CRE) loans and management slashed dividends, sending shares plummeting. There are several idiosyncrasies with NYCB’s case, such as its outsized exposure to New York rent-stabilized housing. Although NYCB’s challenges are company-specific, it also shows that the regional banking sector is still facing headwinds.

From a balance sheet perspective, post-2008, smaller banks have been piling into CRE loans to gain market share, with these loans now taking up 30.2% of small banks’ total loans and leases (vs. 6.5% for large banks). However, with property prices weak, vacancy rates high and refinancing rates significantly higher than rates on maturing loans, Fitch Ratings projected U.S. commercial mortgage-backed securities’ delinquency rate to more than double from 3.5% in 2023 to 8.1% in 2024. To protect against this risk, more regional banks have announced higher charge-offs and loan loss provision. The memory of the March 2023 regional banking stress still lingers as a warning to maintain a strong balance sheet in case panic spreads and a deposit run is triggered.

From a profitability perspective, a few macro headwinds also weigh on regional banks’ earnings and net interest margins. On the asset side, higher funding costs and tighter credit standards have slowed loan growth, suppressing revenue. On the liability side, higher deposit betas pressure banks to maintain high deposit rates to remain competitive, or risk losing assets.

How does this impact small caps?

On one hand, regional banks take up around 8% of the Russell 2000 small cap index (compared to 1% of S&P 500). Financials is the second largest sector in the Russell 2000, representing 16% in weight. On the other hand, regional banks are also an important funding source to the economy. Small banks provide 32% of all outstanding loans and leases held by domestically chartered commercial banks. They are an especially important funding source for small businesses as well, with the latest NFIB survey reporting 69% of small business owners using a small, regional or local bank as their main funding source, as opposed to 17% using a large bank and 14% using a medium-sized bank.

With the aforementioned concentration in CRE loans and profitability headwinds, in addition to higher regulatory hurdles, regional banks may pullback on lending if stress intensifies. At the moment, we don’t see big contagion risks yet. Lower rates and loosening credit conditions could provide important relief as well, but this remains an area of risk to closely monitor this year.

Investment Implications

Going forward, although a broadening out of the U.S. equity rally and favorable valuations could benefit small caps, large caps look more appealing, in terms of balance sheet quality and margins. Large caps are also less vulnerable to a possible weakening of the regional banking sector. The focus currently should lean towards quality and defensiveness, but once the Federal Reserve starts cutting rates and its effect feeds through the economy, the environment will be constructive for small caps.