India’s low correlation with the U.S. and negative correlation with China offer diversification benefits in a portfolio.

In brief

- Fueled by robust economic growth and steady earnings performance, India has drawn substantial investor interest.

- The current ruling party and Prime Minister appear to still enjoy a high level of popularity and are likely to return to power, leading to policy continuity in structural reforms to modernize the economy.

- Equity valuations have risen to a high level. A strong earnings growth outlook and relatively high quality of earnings likely explain some of the valuation premium to historical averages and other equity markets.

- India’s low correlation with the U.S. and negative correlation with China offer diversification benefits in a portfolio. But high valuations mean an active approach.

India: the fastest growing major emerging market

India continues to garner attention as both economic growth and market performance have surprised on the upside. The economic momentum is likely to be sustained, given there are a number of structural trends that will continue to benefit the economy, and in turn, the equity market.

Recent real gross domestic product (GDP) releases have exceeded market expectations. The 4Q calendar year (CY)/3Q fiscal year figure came in at 8.4% year-over-year, driven by strength in investment. Net exports were a drag, but India’s domestic demand strength is enough to withstand weak external demand. Consensus forecasts puts real GDP growth at 7% year-over-year for 2024, the highest among all major emerging markets.

Inflation is still volatile and overly influenced by weather impacted food prices, but it remains within the Reserve Bank of India’s (RBI) target range of 2%-6%. Resilient growth means the RBI can afford to be patient with any policy moves.

Long-term economic support

India’s public and private capex growth is a key target for policymakers. Through structural reforms using digitalization, financialization of its population and making a push to become a manufacturing base, the government aims to modernize India. The government has pivoted away from boosting consumption to encouraging private investment through supply side reforms and improving the business environment. Tax incentives and investment into infrastructure are key areas of focus, while conditions for doing business have improved.

India’s “ease of doing business” index has improved steadily, while manufacturing wages remain relatively low, raising its attractiveness as an alternative to other emerging markets as a manufacturing base and attracting foreign direct investment flows. As a country with a relatively stable political and economic outlook, India’s further integration into the global supply chain appears an effective move.

Policy certainty, but a narrower margin

2024 has been described as the year of elections, and India is no exception, with the poll date for a general election set to start on 19th April, progressing through seven stages over six weeks, with the results announced on 4th June. Up for grabs will be 543 seats in the lower house of the Indian Parliament, the Lok Sabha, for five years. Elections always add an element of uncertainty. The incumbent Prime Minister Narendra Modi and his Bharatiya Janata Party (BJP) led National Democratic Alliance are expected to still retain their majority rather comfortably for a third term, but by a narrower margin. Modi and the BJP retain a high level of popularity across a number of current surveys.

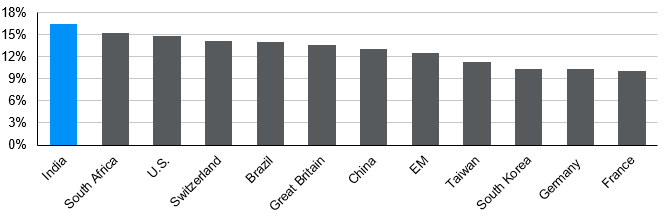

India's quality of earnings leads others

Average return on equity, 1999-2023

Source: FactSet, MSCI, J.P. Morgan Asset Management. EM stands for emerging markets. Data are as of March 15, 2024.

The main opposition party, the Indian National Congress has co-operated with other parties to form the Indian National Development Inclusive Alliance, but at the time of writing, they have yet to put forward a candidate for Prime Minister and are viewed as too fractured to pose a significant challenge. If the expected result occurs, it should mean policy continuity, which would likely calm markets and boost sentiment.

Rich valuations test equity market

Fueled by robust economic growth and steady earnings performance, India has drawn substantial investor interest. After eight consecutive years of market gains, India’s stock market has surged to become the fifth largest in the world, with around USD 4.5trillion in market cap.

While the gains in the U.S. stock market dominated headlines last year, India’s returns were not too far behind. The MSCI India registered a total return of 21.3% in U.S. dollar terms, while the S&P 500 delivered a 26.3% total return. More importantly, unlike the narrow tech-led rally witnessed in the U.S., gains in India have been more broad-based, potentially reassuring investors about the sustainability of market gains.

The equity market has come under pressure more recently given stretched valuations and misses on earnings expectations. In fact, the Securities and Exchange Board of India has proactively taken some steps to address concerns about “froth”, particularly in the small- and mid-caps. Their call to the mutual funds to limit exposure to higher liquidity risk areas of the market contributed to the recent sell-off.

Trading at 22x forward earnings, MSCI India—comprising large- and mid-cap stocks—ranks India as one of the most expensive markets in the world. While historically, India has traded at a premium to other markets; currently, at 1.3 standard deviations above its 10-year average, it appears expensive even relative to its own history. That said, a strong earnings growth outlook and relatively high quality of earnings likely explain some of the valuation premium. Over almost the last quarter of a century, India’s average return on equity has not only been higher than many emerging markets like China, South Korea and Taiwan, but it has also been higher than the U.S. Additionally, the earnings growth outlook has also been relatively robust. With the emerging markets universe registering a decline in earnings growth in 2022 and 2023, India’s double-digit growth stood out. The consensus estimates of 17% earnings growth for CY24, if realized, would mark four straight years of double-digit earnings growth, reflecting consistency in earnings performance.

Nevertheless, rich valuations carry the risk of disappointment. Despite registering a very healthy growth of 22% for CY23, earnings missed the lofty estimates of a 25% growth. Moreover, with headline earnings set to moderate and growth in other emerging markets expected to rebound off of a low base, India’s relative attractiveness might be tested in the short term.

Investment implications

Despite potential near-term headwinds, over the long run, India is poised to benefit from recent structural reforms that unlock its demographic dividend, a high likelihood of political continuity, and the government’s ambitious plans of investing in the digital and physical infrastructure. Furthermore, consistent and high earnings growth by Indian companies further enhances its appeal.

India’s low correlation with the U.S. and negative correlation with China offer diversification benefits in a portfolio. Therefore, in a market like India, which is characterized by high valuations coupled with potentially strong growth, active management is key to realizing potentially better risk-adjusted returns.